- Earnings reports are coming in thick and fast as the reporting season kicks off.

- This can present a volatile period for stocks but also create lucrative opportunities for savvy investors.

- In this article, we will look at three tech giants poised to exceed market expectations in their upcoming reports.

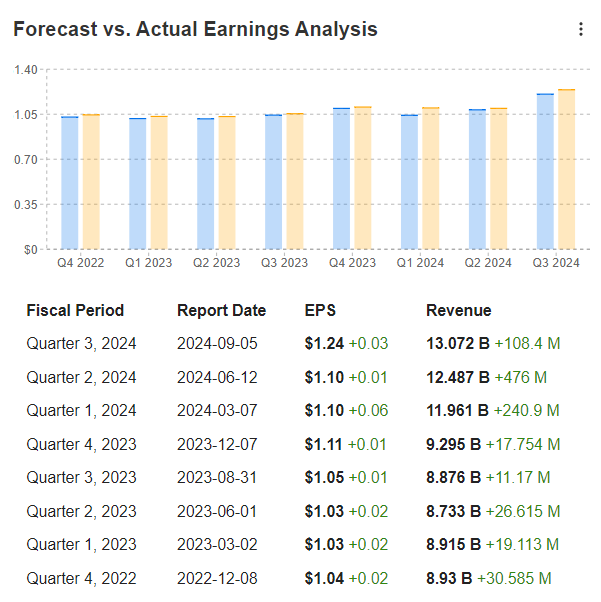

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Stocks often show increased fluctuations, leaving investors vulnerable to volatility, especially amid economic uncertainties and geopolitical tensions.

However, while the risks are greater, these big moves can present big profit opportunities for investors.

Thus, it is prudent to identify stocks that, based on their performance in recent months and analysts' projections, are positioned to outperform consensus estimates.

3 Big Tech Ready to Surprise Markets

Narrowing our focus to megacap companies, a few well-known firms have consistently surpassed earnings and revenue forecasts over recent quarters. Based on analysts' forecasts, these firms present significant opportunities to surprise again.

These companies share characteristics of steady growth and robust earnings forecasts, with all three operating in the technology sector.

1. Nvidia

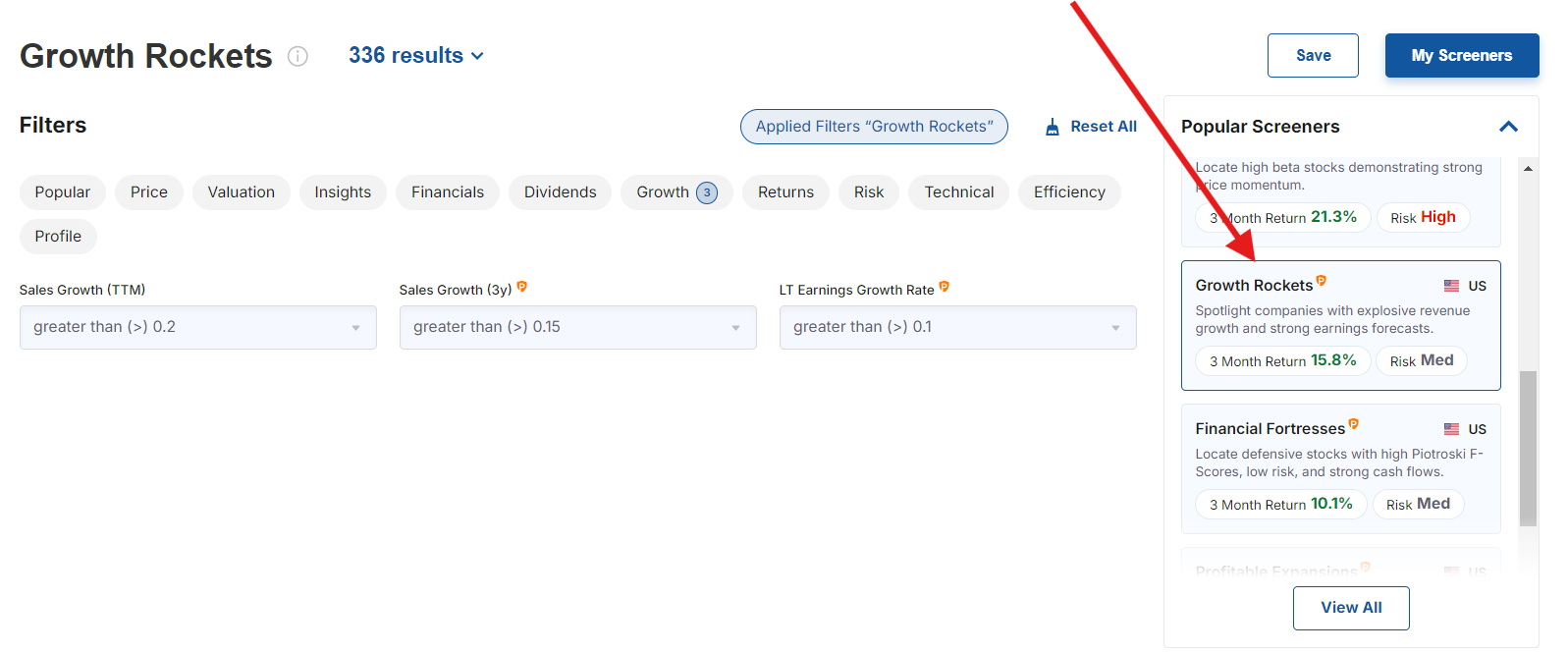

First is NVIDIA (NASDAQ:NVDA). After experiencing summer volatility, the semiconductor stock has regained its growth trajectory, gaining over 18% in the stock market since mid-September. Nvidia has a remarkable record, beating expectations for seven consecutive quarters.

Source: InvestingPro

The question remains: Is there still potential for this positive streak to continue?

According to the latest analyst evaluations, the answer appears affirmative.

Source: InvestingPro

Over the past 12 months, brokers have increased their expectations for the chip giant's earnings per share (EPS) for the upcoming quarter by 67.9%, rising from $0.44 to $0.74 per share. The company, led by Jensen Huang, will report its third-quarter earnings on November 14.

2. Meta Platforms

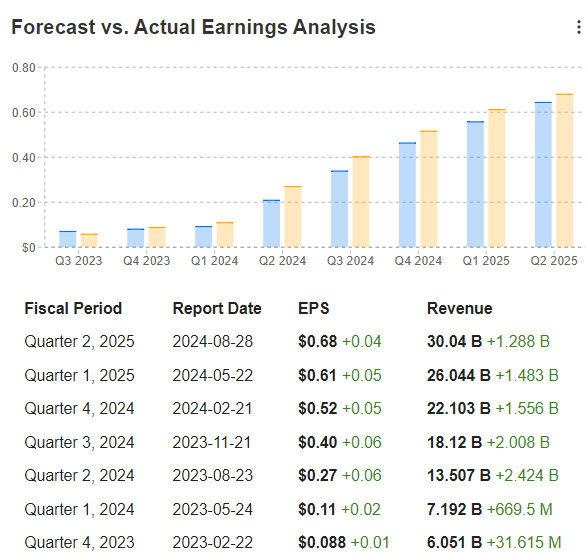

The second megacap to consider is Meta Platforms (NASDAQ:META).

The leader in social networking has delivered six consecutive above-expected results, enhancing the wealth of founder and primary shareholder Mark Zuckerberg, who has climbed to second place among the world’s richest individuals according to Forbes, surpassing Amazon's (NASDAQ:AMZN) CEO Jeff Bezos.

Source: InvestingPro

Meta's stock has appreciated over 80% in the past year, and the upcoming quarterly report could further bolster its performance.

Source: InvestingPro

In the last 12 months, brokers have raised EPS expectations for this quarter by 26.7%, from $4.17 to $5.28 per share. The company, which owns Facebook and Instagram, will announce its Q3 earnings on October 23.

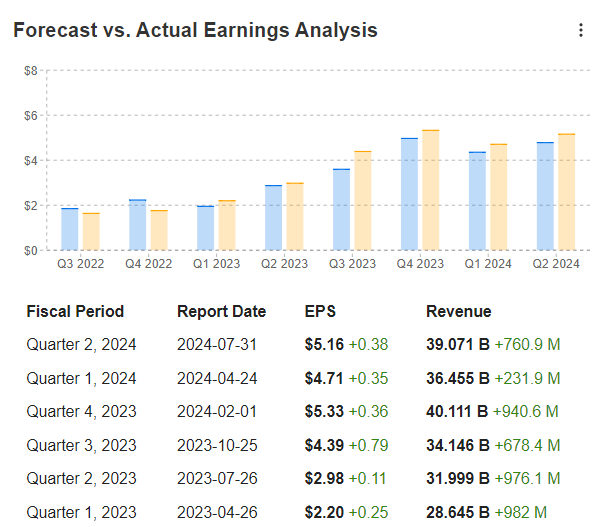

3. Broadcom

Lastly, Broadcom (NASDAQ:AVGO) stands out for its ability to outperform the market. Surging demand for AI has driven this top industry performer’s share price to more than double in 12 months, with last quarter's revenues soaring by 47% year-over-year.

Source: InvestingPro

Analysts are optimistic that Broadcom will surprise the markets once more, as indicated by 20 upward revisions to its third-quarter EPS over the past 90 days.

Source: InvestingPro

Since last year, brokers have increased EPS expectations for this quarter by 14.9%, from $1.21 to $1.39 per share. In this case, we will have to wait until December 5 to see if the results indeed exceed expectations when the company announces its Q3 results.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.