Building on the Industrial Revolution, the modern sedentary age coupled with abundant cheap food has greatly exacerbated the obesity problem. According to CDC data, 1 in 5 adults in the US and territories could be classified as obese. Even worse, 22 states had obesity rates above 35% in 2022.

Considering the myriad of health issues associated with obesity, this positions the global weight loss market for a high-growth category. According to Dimension Market Research done in January, investors should expect a CAGR of 10.3% as the market size grows from $165.5 billion in 2023 to nearly $399.3 billion by 2032.

New promising drugs may even accelerate that growth. But which pharma companies are positioning to capture that weight loss growth most effectively?

Pfizer

After the controversial vaccine rollouts, many have speculated that Pfizer Inc (NYSE:PFE) will receive a record-breaking fine. So far, Texas and Kansas sued the pharma giant for making false claims and hiding evidence of severe vaccine-related adverse events. Nonetheless, given the broad government support for the rollouts, it is unlikely that a substantial censure is afoot.

For shareholders, this looming narrative had a suppressive effect on PFE stock as the vaccine demand died out. From the all-time high of $55 in December 2021, PFE shares have had a 52-week average of $29.96, aligning with the present price of $28.66 per share.

However, having a diversified portfolio of drugs translates to steady revenue streams. As of Q1 ‘24 earnings, Pfizer expects $58.5 to $61.5 billion in revenue for the full-year 2024, reconfirming the December outlook. For the quarter, the company generated $14.88 billion in revenue, 19% less YoY but beating the forecasted consensus of $14.01 billion.

Pfizer shareholders now expect to see a new windfall from danuglipron, the company’s weight loss solution taken as a once-daily pill. Previously in December, the twice-daily version was discontinued due to adverse effects during the trial.

Danuglipron belongs to the family of GLP-1 agonists, which are now prevalent in the treatment of obesity-related issues, of which diabetes is the main driver. Optimization studies will take place in the second half of 2024 to determine dosing.

But with $2.5 billion invested in internal R&D in Q1 alone, the company has a “robust pipeline of three clinical and several preclinical candidates,” according to Pfizer Chief Scientific Officer Dr. Mikael Dolsten. Considering the frequent dosage potential, Pfizer’s revenue could be greatly boosted.

Novo Nordisk

The Danish multinational pharma company took the obesity market by storm with its main stars, Wegovy and Ozempic. In Q1 earnings, the company reported 24% sales growth, driven by these GLP-1 drugs. So much so that Novo Nordisk A/S (NYSE:NVO) now holds a 34% obesity market share alongside a 55.3% GLP-1 market share.

Wegovy sales increased from DKK 4.5 billion to DKK 9.38 billion from the year-ago quarter. Ozempic for diabetes had a similar success, generating DKK 4.3 billion, a 35% YoY increase. Both drugs rely on semaglutide as an active ingredient.

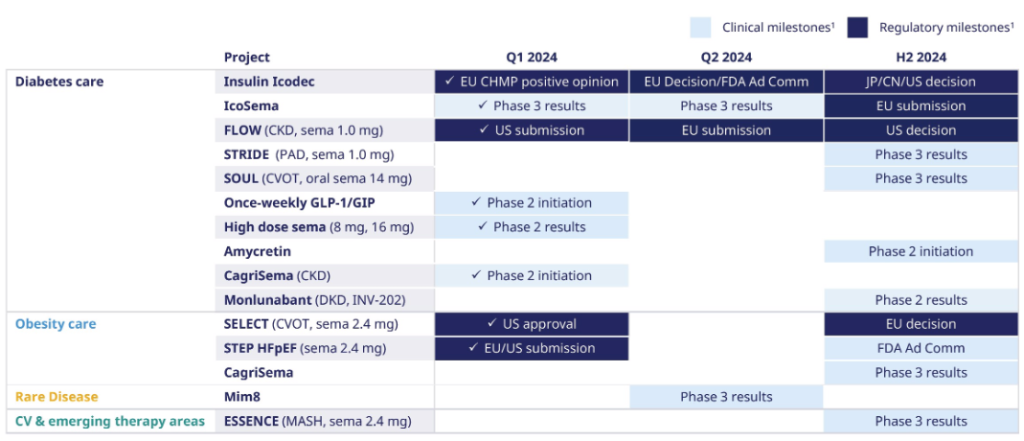

This left the company with a 28% YoY increase of DKK 25.4 billion net profit, or $3.65 billion, enough to become Europe’s most valued company. Looking ahead, Novo Nordisk is heading to increase its obesity/diabetes dominance with multiple drug rollouts.

Presently priced at $142.37 per share, NVO stock is well-above its 52-week average of $111.72, while near its all-time high of $146.91 in June. The price reflects Novo Nordisk market share in the obesity/weight loss arena, in line with Nasdaq’s average price target twelve months ahead at $143.79.

The high ceiling for NVO stock is $166 per share, largely dependent on the company’s competitors and further success in drug rollouts.

Eli Lilly

Headquartered in Indianapolis, Eli Lilly and Company's (NYSE:LLY) call to obesity fame is Trulicity (dulaglutide), having launched in the US in November 2014 as GLP-1 receptor agonist. In September 2020, the FDA approved additional Trulicity doses for type 2 diabetes treatment.

However, Eli Lilly is no stranger to drug rollout success given its iconic Prozac that became synonymous for depression treatment and Iletin as the very first insulin on the market in the 1920s.

Improving on obesity and diabetes treatments, the company now counts on Mounjaro, Zepbound and Jardiance for revenue growth. In Q1 earnings, these drugs were mainly responsible for the quarter’s 26% sales boost of $8.76 billion, delivering a $2.2 billion net income.

The question is whether Eli Lilly’s offering is superior to Novo Nordisk. Both Mounjaro and Zepbound rely on tirzepatide as an active ingredient. In a JAMA study tracking patients’ results from May 2022 to September 2023, the case leans toward Eli Lilly.

Unlike Novo Nordisk’s semaglutide, which resulted in a yearly weight loss of 8.3%, Eli Lilly’s tirzepatide showed much better results at 15.3% weight loss on average. This eventually led to tirzepatide’s approval in China this May.

Although China also approved Novo Nordisk’s Ozempic in 2021 and Wegovy in late June, Novo Nordisk is likely to face a wind down as the patent on semaglutide expires in 2026. At that point, we are likely to see a flood of Chinese generic obesity drugs, a similar pattern that happened with the EV market.

In contrast, Eli Lilly’s patent on tirzepatide in China expires in January 2036. Presently priced at an all-time high of $943, LLY stock is significantly above its 52-week average of $668. It appears that investors expect another Prozac star where a drug becomes a synonym for treatment.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.