Stocks finished lower yesterday, following more hawkish-than-expected projections from the Fed for 2024 and 2025. The Fed anticipates rates to be at 5.1% by the end of 2024, signaling just 50 basis points of rate cuts next year.

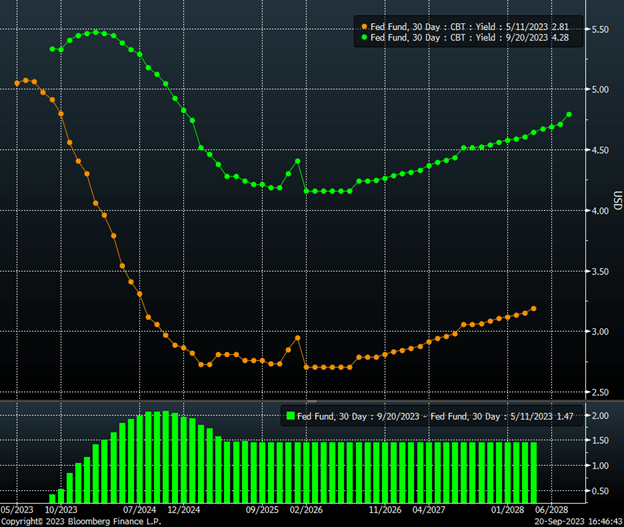

This is a significant departure from market expectations in mid-May. At that time, the December 2024 Fed Funds Rates were trading at 2.86%.

Those same Fed Funds Rates are trading at 4.8% and are likely to continue rising towards the Fed’s target of 5.1% over time, which is more than a 200 bps difference.

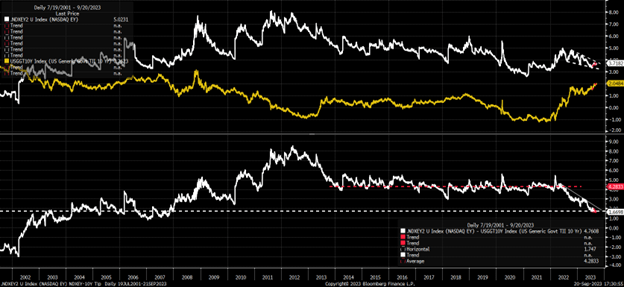

This is crucial to note: as real rates began to rise in mid-May, the Nasdaq earnings yield declined, causing the two measures to converge. The equity market had been betting on many rate cuts in 2024 and a corresponding decline in real yields.

This turned out to be a misguided bet. For months, the Fed has been signaling that its policy would be “higher for longer.”

It indicated that rate cuts were not on the horizon anytime soon. If there were to be any rate cuts, they would merely be adjustments for lower inflation, while real rates would remain restrictive.

On May 11, the spread between the Nasdaq’s earnings yield and the 10-year Real yield was 2.7%; now, that spread has narrowed to just 1.7%, a difference of 100 basis points.

While this may not sound significant, consider that the earnings yield of the Nasdaq would need to increase to 4.7% from its current 3.7% to return to that May 11 spread.

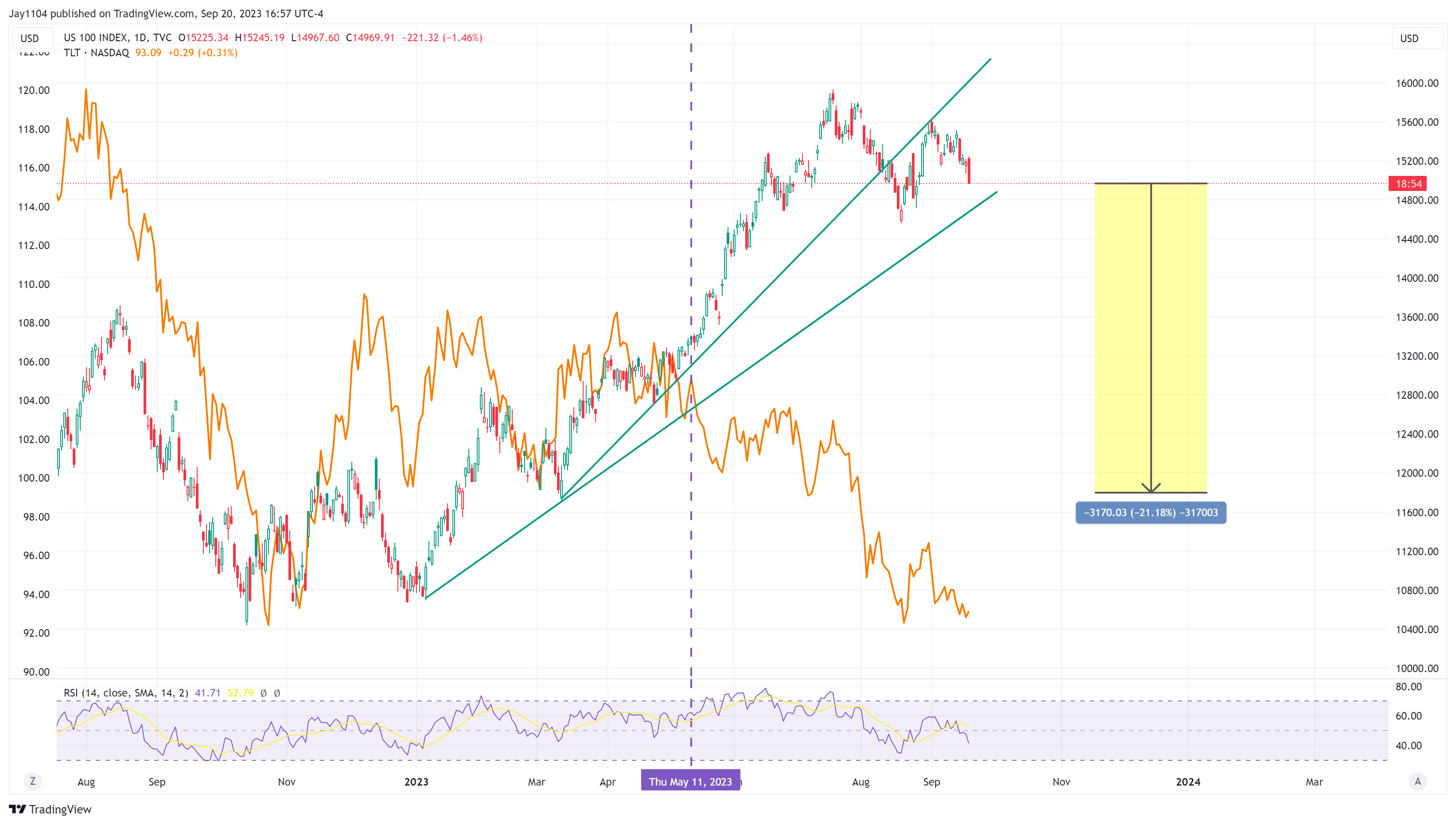

This would require the Nasdaq’s P/E ratio to fall from its current 27.0 to 21.3, representing a drop of 21.1%. Such a decrease would bring the index back to its lows from March 13.

The equity market appears to have made an incorrect bet on the direction of interest rates. If rates continue to rise, it’s logical to expect that the earnings yield of the Nasdaq will need to increase correspondingly, leading to a lower valuation multiple.

Additionally, Powell stated twice yesterday that the neutral interest rate could be higher than initially anticipated, suggesting that rates may need to rise more than once in the future.

His comments during the press conference made it clear that there is no fixed rate plan; I would interpret that as the Fed will react to each new piece of data as it comes in and ultimately has no clue what comes next.

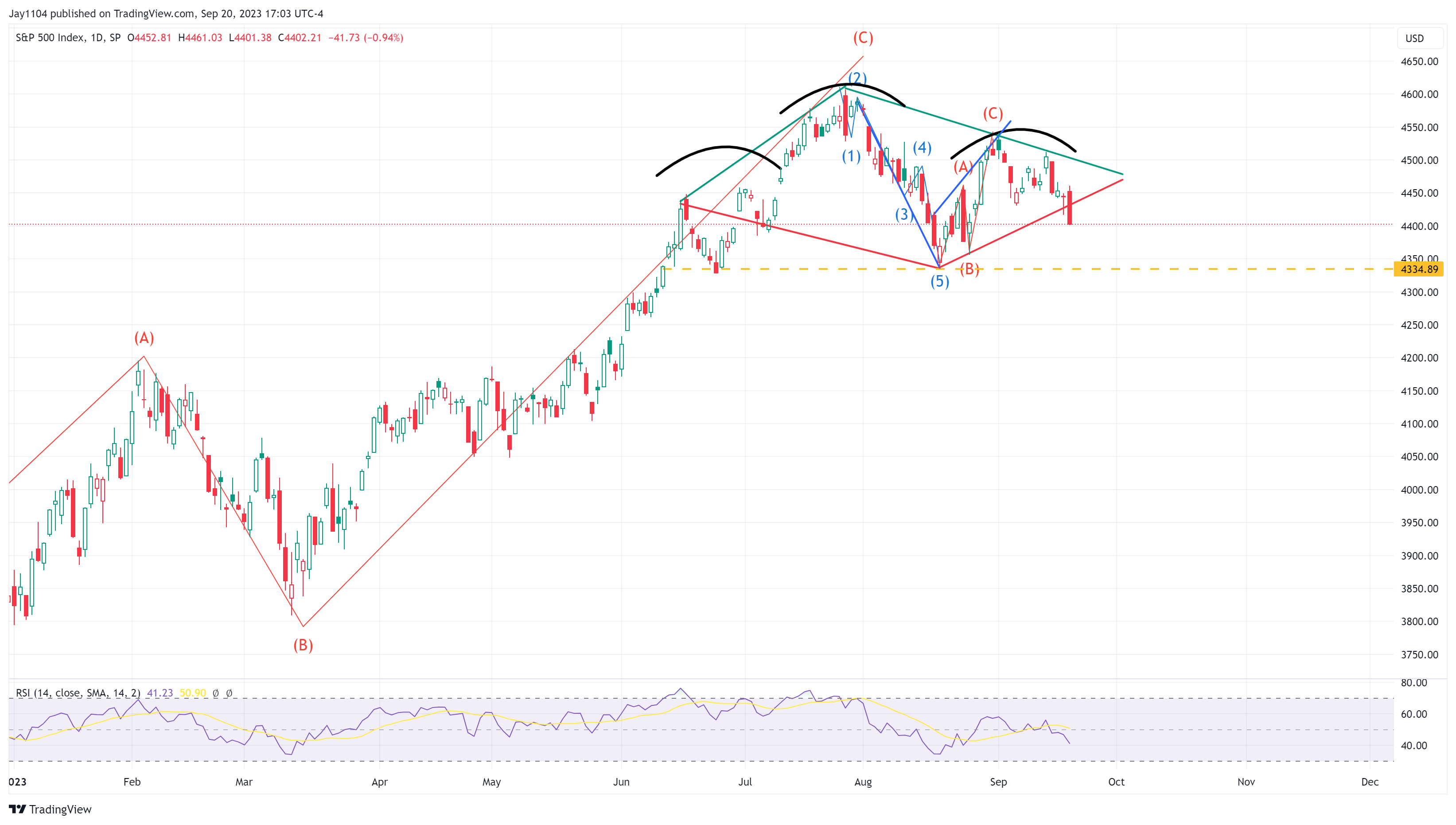

S&P 500: More Downside in the Offing?

From a technical analysis standpoint, it appears that the diamond pattern on the S&P 500 has broken. If this is the case, we could see the index reach 4,330 rather quickly.

Should the 4,330 level break, it would also likely signify that the neckline of the head and shoulders pattern has been breached, pointing to further downside potential.

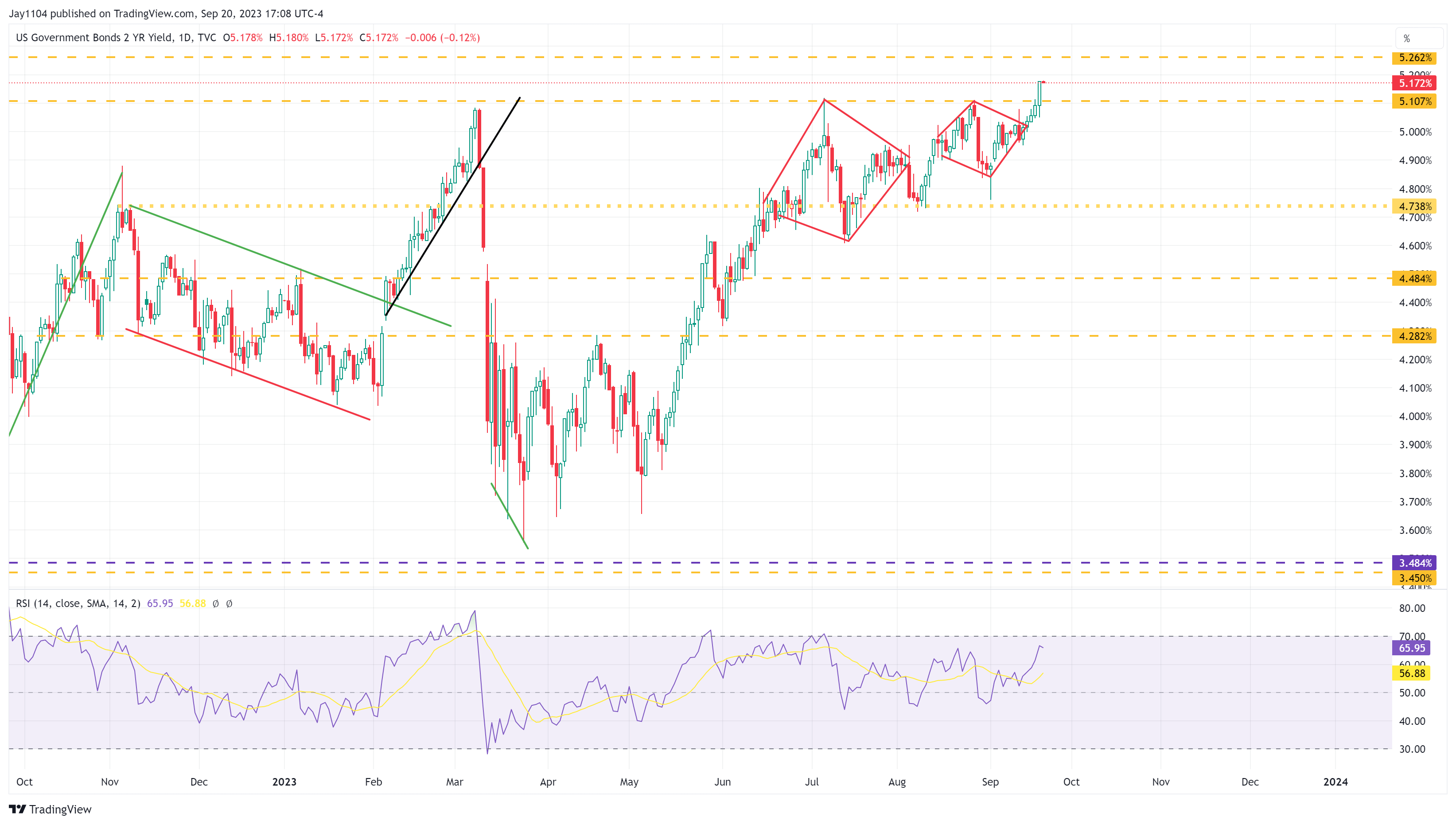

US Bond Yields Breakout

Meanwhile, the 10-year real yield saw a notable breakout today, clearing both resistance levels and ending a month-long period of consolidation.

Meanwhile, the 2-year rate also experienced a breakout, clearing a nearly six-month-long period of consolidation at 5.1%. It appears poised to run up to 5.25%, which is now only eight basis points away, after closing at 5.17%.

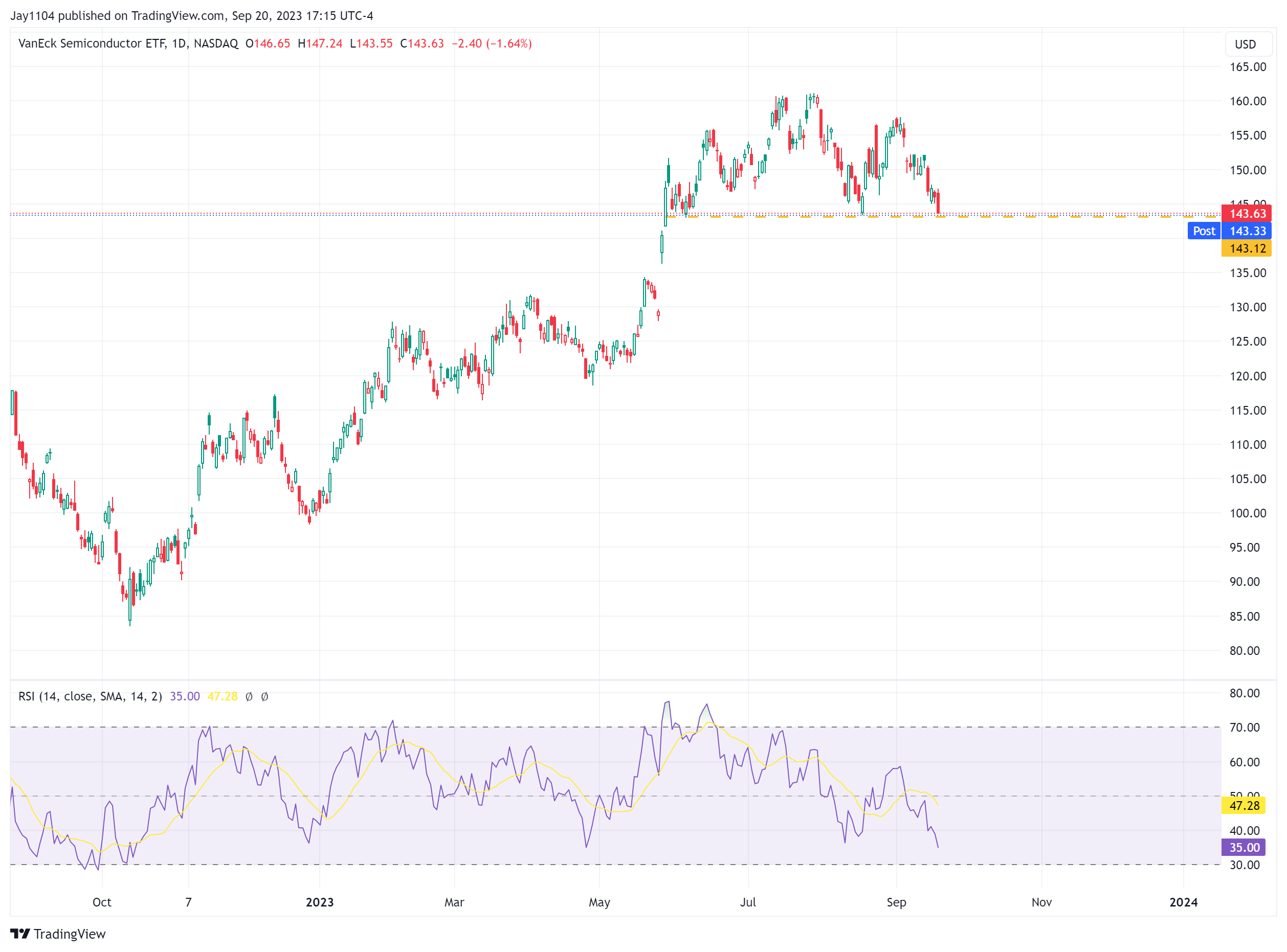

Semiconductors Test Critical Support

The VanEck Semiconductor ETF (NASDAQ:SMH), focused on semiconductors, is currently sitting at a critical support level of $143.50. There are significant unfilled gaps down to $129. The $143.50 level is an important threshold; a break below it would signal a bearish turn for the ETF.

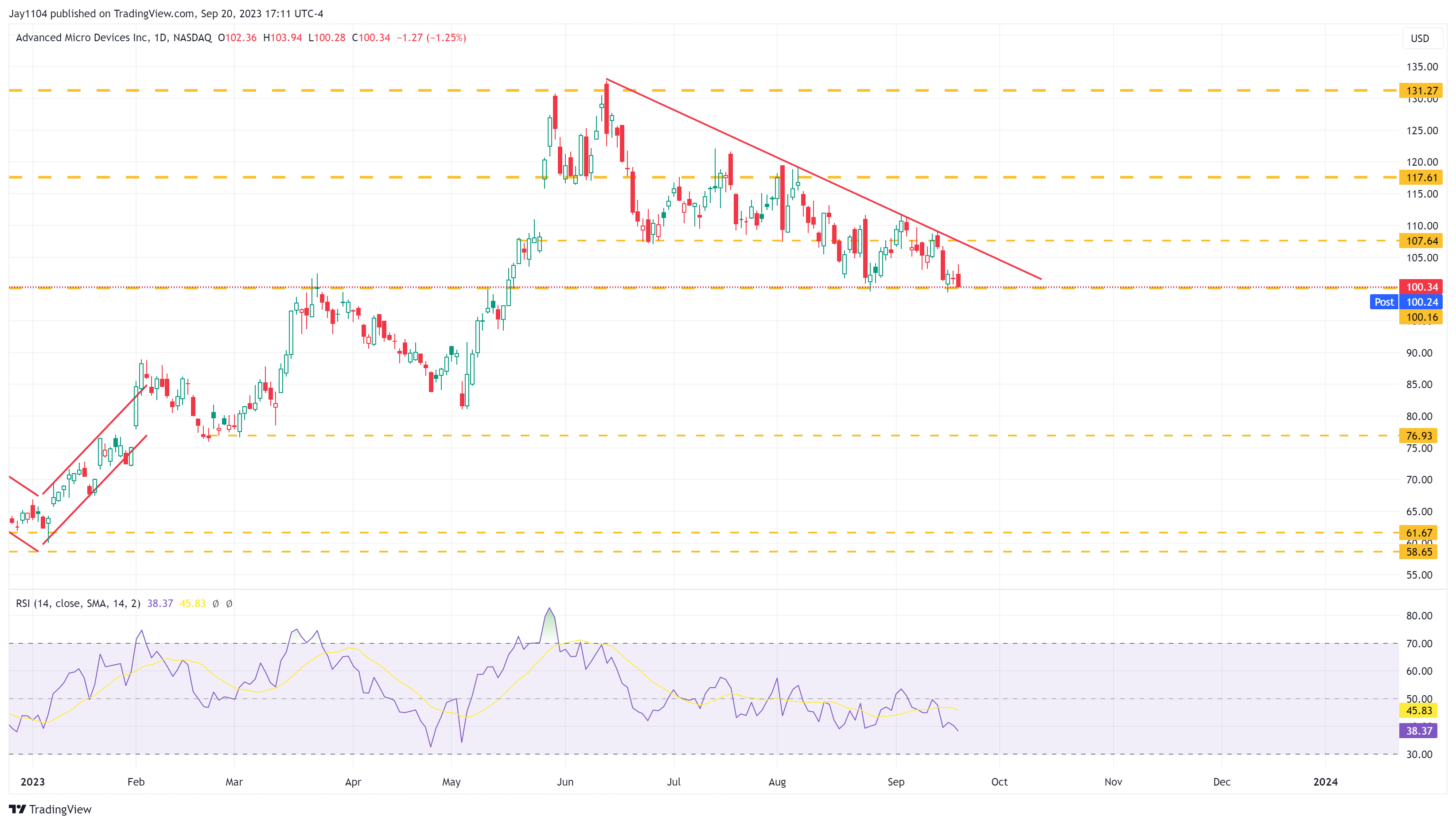

Meanwhile, Advanced Micro Devices (NASDAQ:AMD) looks weak and sits on support at $100. A break of support probably leads to a decline to around $93 and maybe as low as $81.

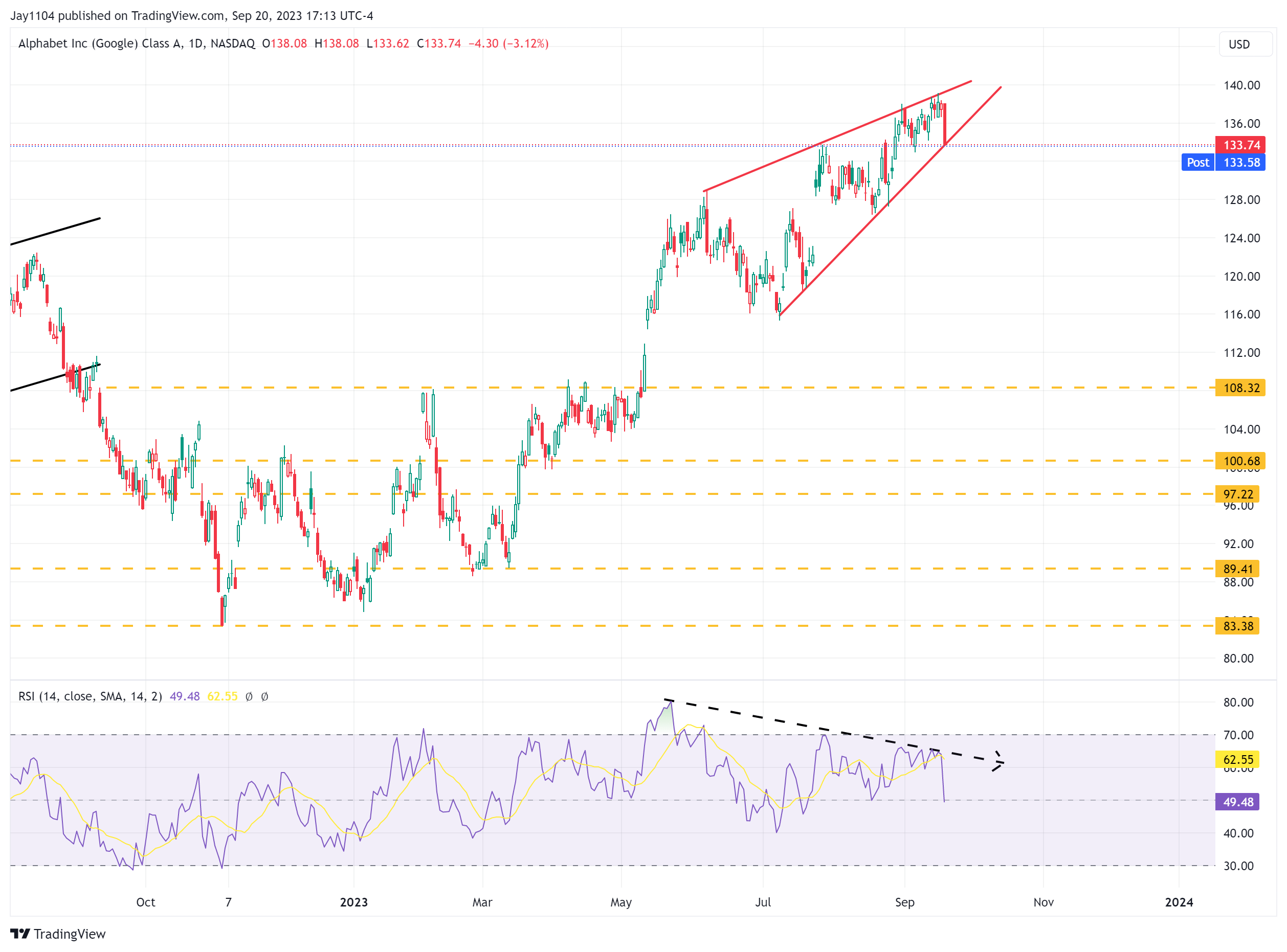

What's Next for Alphabet Stock?

Meanwhile, Alphabet (Nasdaq:GOOGL) appears to have a rising wedge pattern that has formed and a giant gap that was never filled at $122, as well as another one at $111 and a downward-sloping RSI.