This week won’t have the excitement of the past week, but it could be one of those weeks that catch us by surprise, too. Earnings season is still rolling forward, although 230 out of the 500 companies in the S&P 500 have reported results.

So we aren’t quite at the back half of earnings season, but let’s say that all of the big companies have now reported, and it only really leaves Nvidia (NASDAQ:NVDA) still out there, which won’t come until February 21.

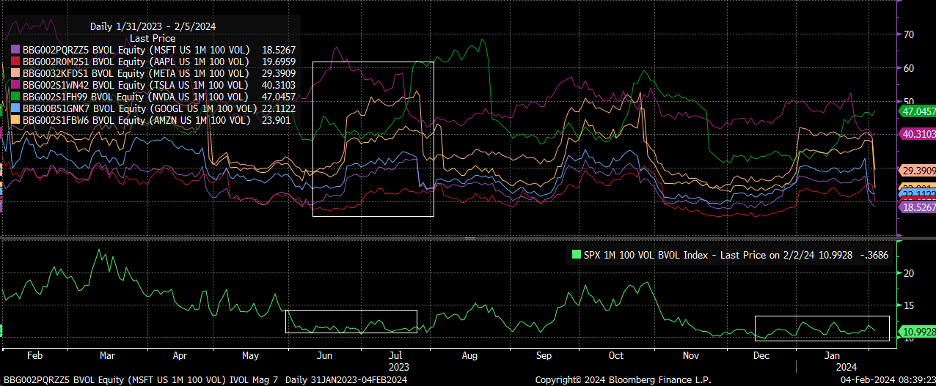

As theorized, the implied volatility for 6 of the seven stocks in the Mag7 has now fallen sharply, and while Nvidia’s will, it won’t be until after the company reports results.

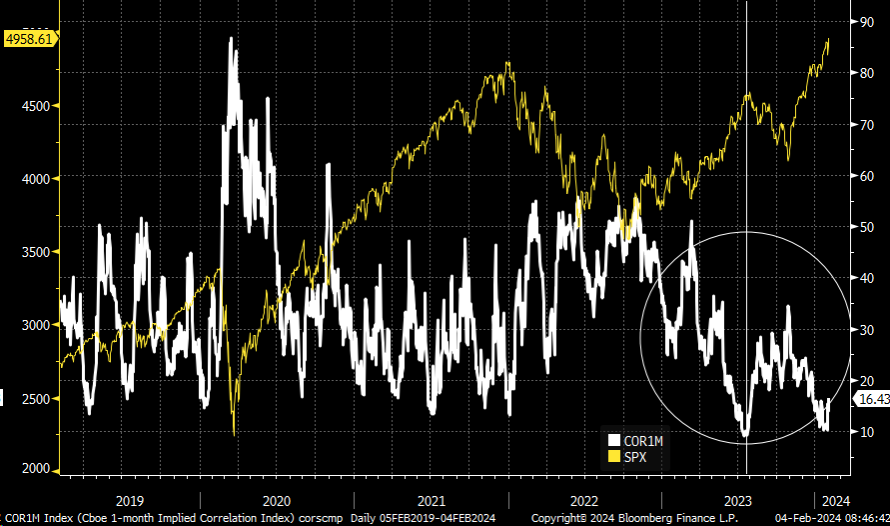

Therefore, in theory, the implied correlation indexes should continue to rise now that the implied volatility has reset and the implied volatility of the S&P 500 and the components of the index begin to trade as one.

As the theory goes, as the implied correlation index goes higher, we should see the S&P 500 come down as the volatility dispersion trade unwinds, and the constant volatility supply we have seen suppressing the VIX is unwound until one month before the start of the next earnings season in late March.

It is a theory because nothing in this market is guaranteed to work, and something could upset or delay the apple cart. Still, at least to this point, things have played out as expected, and I believe it shall continue to play out.

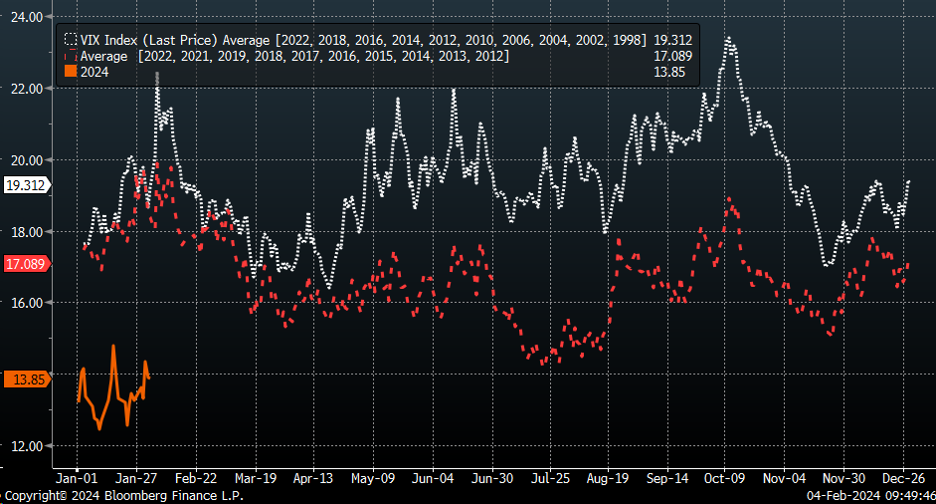

I guess the one point of reference here is that, typically, this is a time of the year when the implied volatility of the S&P 500 rises. Given that, this year is a Presidential election year, and 3 of the biggest stock market sell-offs in modern times were in the Presidential election years 2000, 2008, and 2020.

I will add that 2012 and 2016 were no picnics either. Still, one can see that over the past ten years, excluding 2020, and every even year, excluding 2000, 2008, and 2020 in the VIX, we tend to see a rise in the implied volatility of the broader market. I also excluded 2023 from the averages.

We also see that there is a rather large notable increase in the VIX from mid-August to mid-October and notably higher in even years, and perhaps that is because elections, in general, happen in even years, whether it be Preseidental or just general elections, that can sway the balance of power in Congress.

Currently, the VIX is extremely low versus the historical average of the past 10-year ex-2020, and extremely low versus even years, ex-2000,08, and 2020. Given that the volatility dispersion trade is behind, I could make a fairly strong case that the suppression of volatility is now behind us for a time and is due to peak around March and possibly into March Opex.

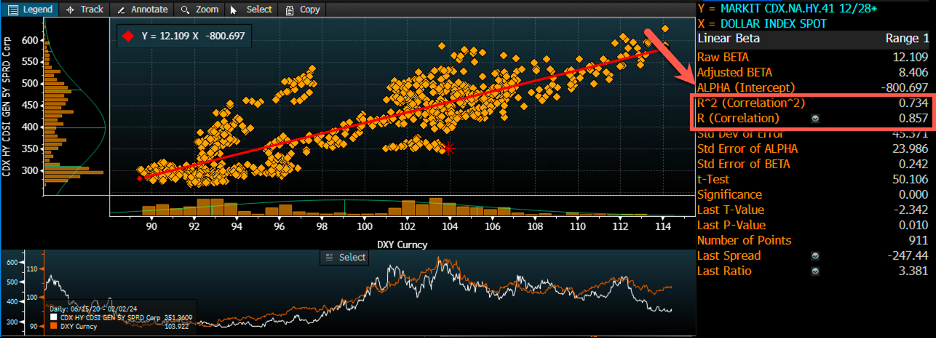

Additionally, Friday’s strong job report helped the dollar break out firmly and push above resistance at the 103.50 level, which it has struggled at for some time. This will put the next level of resistance for the dollar index around the 104.25 level.

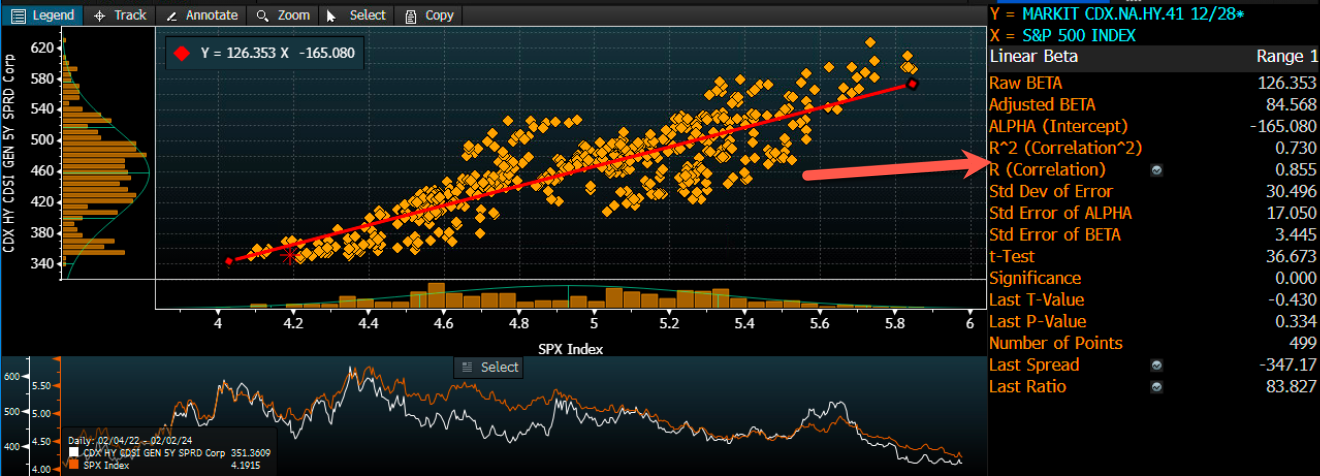

Generally speaking, we care about changes in the value of the dollar index because of its effects on things like financial conditions and high-yield credit spread, which are highly correlated over the years. So, a strong dollar should lead to higher credit spreads.

Higher credit spreads should lead to a higher S&P 500 earnings yield, which means a lower PE ratio for the S&P 500 and lower prices.

All in all, many moving pieces and parts have had to come together since the start of the year to get us to this point, making things challenging from a broader macro standpoint.

While the messaging around the timing of these things coming together is impossible, the idea behind my work and how I go about presenting is meant to be in a story form, slowly bringing all of the bits and pieces together over time until we get to what should be the start of the next chapter.

If I have read things correctly, we have probably read the final paragraphs of the chapter. I think we are about to close the chapter on the October rally and see financial conditions tighten and volatility rise and I still have not ruled out a return to 4,100 on the S&P, as farfetched as they may sound.

Of course, I could be wrong, and I am willing to live with that because part of market prognostication means being wrong; it is just shifting those odds in your favor as best as possible.

YouTube Video –