Stocks got a major boost last Friday afternoon as implied volatility dropped sharply in the final hours of the day, aided by a large end-of-month $4+ billion buy imbalance for the closing cross. Imbalanced data starts to build at 2 PM ET, and that’s when the run-up in the S&P 500 began. The size of the buy imbalance was likely driven by end-of-month factors.

Additionally, the events in the Oval Office on Friday sent the VIX 1-day to an intraday high of 22. At that point, it was clear that implied volatility was elevated, and the likelihood of continuing to rise on Friday—and more importantly, dropping sharply on Monday—was very high.

Adding to that a negative gamma environment, it seemed inevitable that we would see a “rip-your-face-off” rally. The chances of that continuing into Monday also seemed high, at least at the start of the day. By 10 AM on Monday, IV should have mostly reset. Of course, I had reviewed all of this earlier in the day in a member video, though I wasn’t able to pinpoint the exact start time.

The rally was strictly a mechanical result of very favorable circumstances—I’m not sure at this point that it was anything more than that.

In the meantime, this week will bring a lot of economic data—not just soft survey data. The big reports will come at the end of the week, with the jobs report likely carrying the most weight. Based on estimates of 153K jobs created and an expected 4% unemployment rate, it’s tough to argue that the economy is in dire shape. Even the ISM Manufacturing report due on Monday is expected to show expansion for the second month.

However, due to soft survey data, the 10-year rate fell sharply back to 4.2% on Friday—indeed not what I expected. It now sits at the 50% retracement level, a significant spot. The next support level wouldn’t come until 4.06%, at the 61.8% retracement level. It seems to me that the odds of a bounce this week are quite high, which is what I would expect.

I just don’t see a recession or major slowdown at this point, and fortunately—or unfortunately—I’ve been doing this long enough not to base my opinion on just one or two surveys.

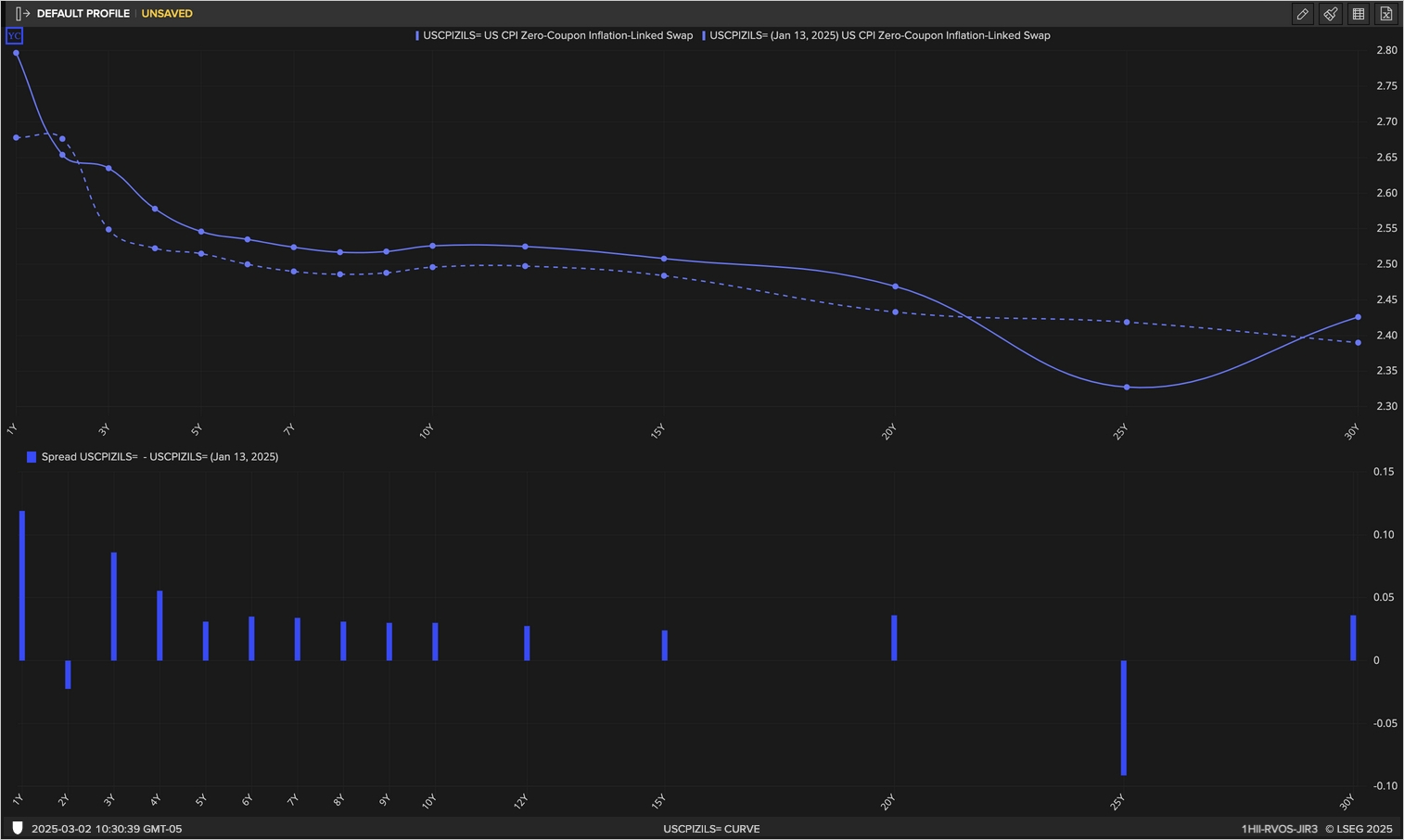

Certainly, when looking at inflation swaps across the curve, we are not seeing a major change. While Treasury rates have declined since January 15, the day the 10-year peaked, inflation swaps are higher, and some significantly so. Even the 5-year and 10-year swaps have risen, reflecting an inflation outlook and a growth outlook. We may be finally entering stagflation, but until we see hard evidence, it remains a possibility rather than a reality.

Anyway, it will be a long week, capped off with the jobs report and, later that morning, Jay Powell. It will be interesting to see what Powell says about inflation expectations, as several data points now suggest those expectations are no longer well-anchored.