This article was written exclusively for Investing.com

The Fed minutes came and went. Investors seemed to be under the impression there were no surprises, at least based on the initial rally in the equity market during those final 2 hours of trading on Feb. 17. But the minutes may have been more hawkish than they seemed, as bond markets seemed to pick up on something that sent nominal rates down and inflation expectations down with them.

While the odds for a 50 basis point rate hike may be less following the minutes, the more significant question is, does it matter? Because the minutes seemed to make it clear, the Fed will be raising rates and is currently planning to reduce the size of its balance sheet.

Taking The Fed Seriously

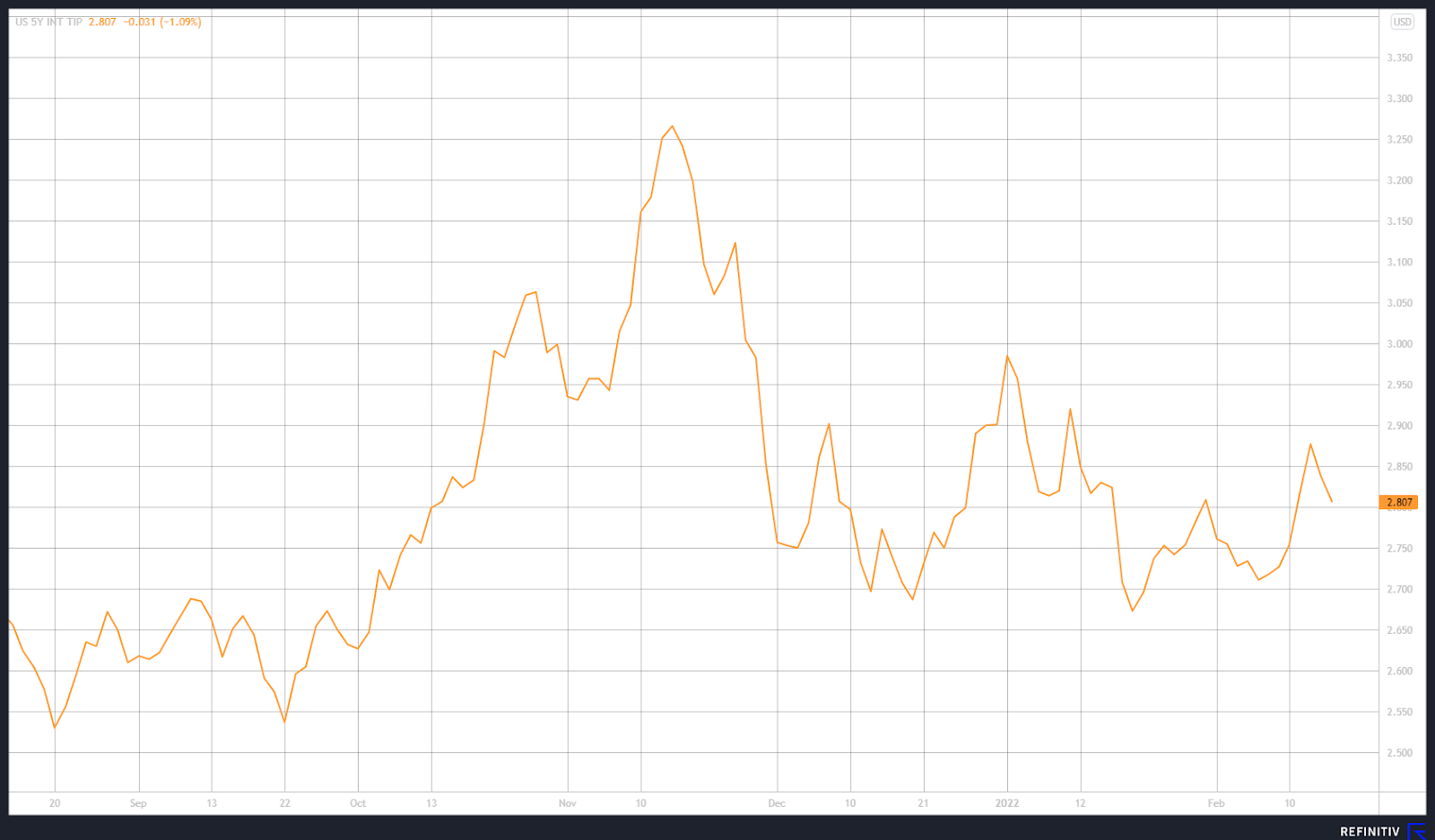

Following the Fed minutes, inflation expectations began to crumble after steadily rising following the hotter than expected consumer price index (CPI) on Feb. 10. Following the CPI report, the 5-Year TIP breakeven inflation expectations repriced higher, climbing to 2.78% from 2.72%. Those expectations continued to rise, hitting nearly 2.91% by Feb. 15. That was the highest the inflation reading had reached since early January.

While those expectations had started to come down already, they took a notable drop following the minutes, sliding to roughly 2.79% from 2.86%. The steep decline may indicate that the bond market thinks the Fed is very serious about raising rates and shrinking the balance sheet to combat inflation.

Killing Growth In The Process?

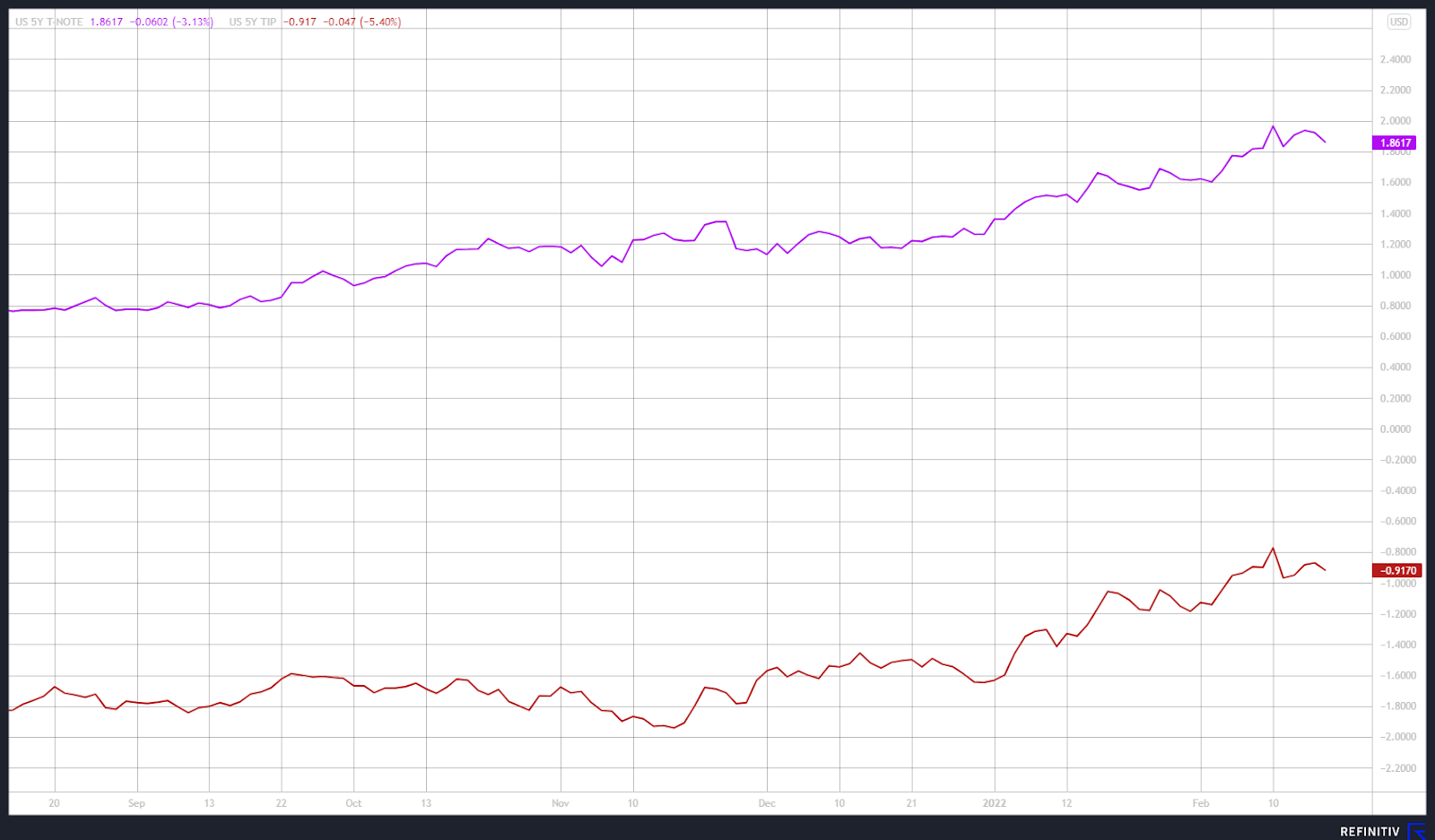

While it tells us that the market takes the minutes seriously, how those inflation expectations are falling may be more telling, with nominal rates dragging those expectations lower. It could signal inflation expectations are falling because investors believe the Fed will overtighten, slowing economic growth dramatically.

If inflation expectations fall due to concerns of the Fed overtightening and the economy slowing, it would likely push the yield curve to continue to flatten, with front-end rates rising faster than the back.

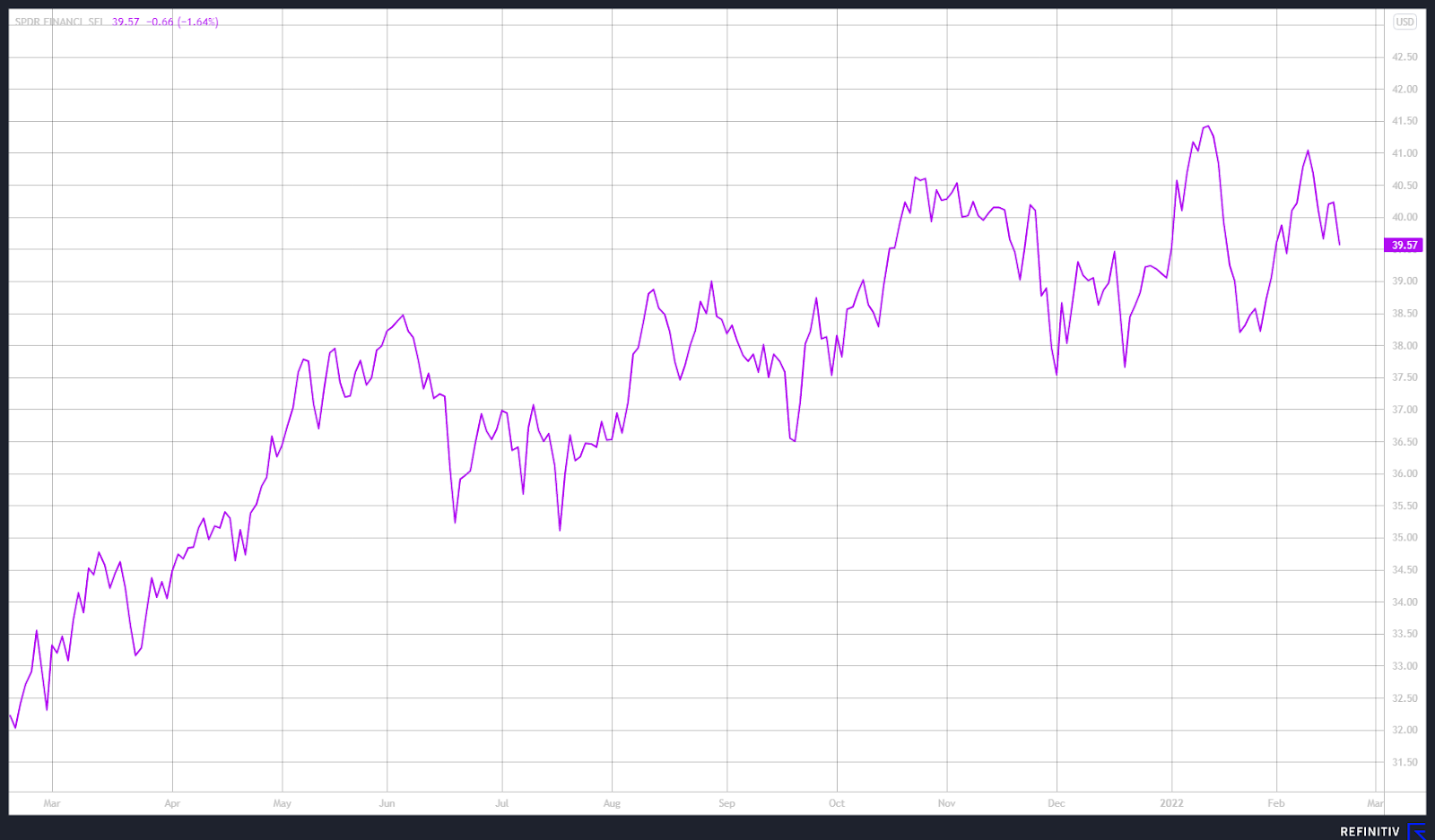

While banks could be one group to benefit from rising rates, it would likely be offset by worries of weaker economic growth and a flatter yield curve. So it would actually make the banks one group of stocks that would perform poorly if that becomes the consensus mindset among investors.

Searching For Clues

It makes being aware of how the market interprets the future of Fed monetary policy critical, not just for bank stocks but for all stocks. If the perception begins to turn more towards the Fed overtightening, causing a very severe economic slowdown, it would likely weigh heavily on stocks overall. Based on the current Atlanta Fed GDPNow forecast, first-quarter growth is only tracking at 1.3%. The Fed can't afford to slow the economy too much without risking a potential recession.

The next few weeks heading into the Mar. 16 FOMC meeting will be critical to digest the market's thinking. If inflation expectations continue to fall, led lower by nominal rates, and bank stocks struggle, it would be a pretty clear indication that the market is getting very worried about the Fed killing off the entire economy in the process of reining in inflation.