So much for that. It took one day to erase nearly a week’s worth of gains. An almost 6% rally in the S&P 500 was gone in less than 7 hours.

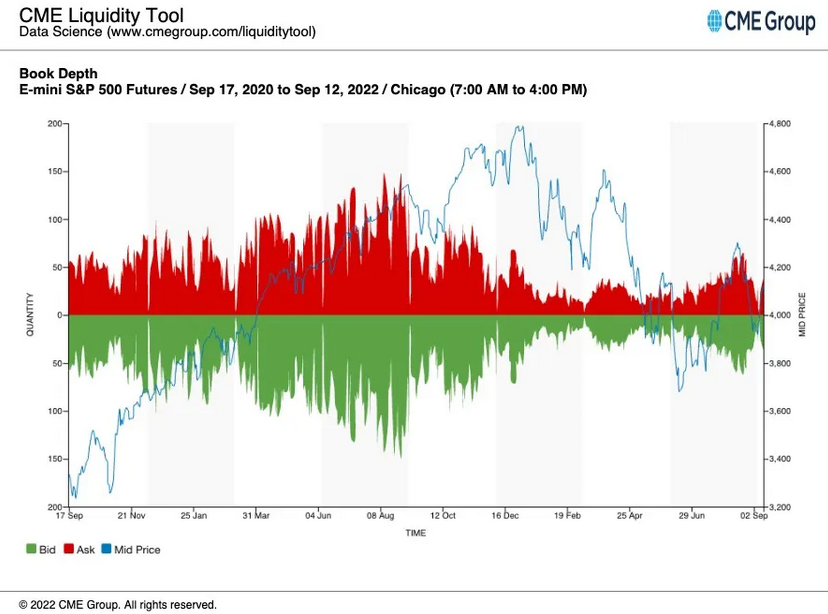

This market moves with incredible speed, and we can thank illiquid market conditions coupled with systematic flows that appear to be nothing more than pure momentum chasers.

CPI

It seemed like all of Wall Street thought CPI would be a miss. The only ones that seemed to have gotten it right were the Cleveland Fed. They have a history of getting it right, while the rest of Wall Street focused on falling gasoline prices. It turns out that a 10% drop in gasoline didn’t even help, because CPI still managed to rise 0.1% m/m, which was 20 bps higher than estimates. Imagine the disaster that would have followed had gasoline not been down 10%.

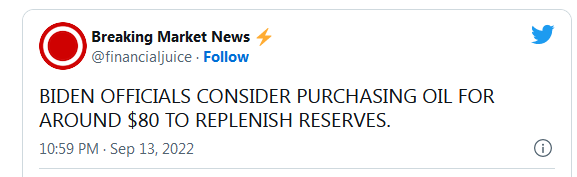

Now, what if oil starts to rise, especially now that it seems:

That nearly turned oil around instantly. You know why, if oil prices start going up and gasoline with it.

Inflation

What is very clear from yesterday’s CPI is that sticky inflation is not going anywhere except up in a straight line. So let’s be honest here: the type of inflation we care about is the type that gets stuck, and the Atlanta Fed’s data suggest inflation is nowhere near a peak.

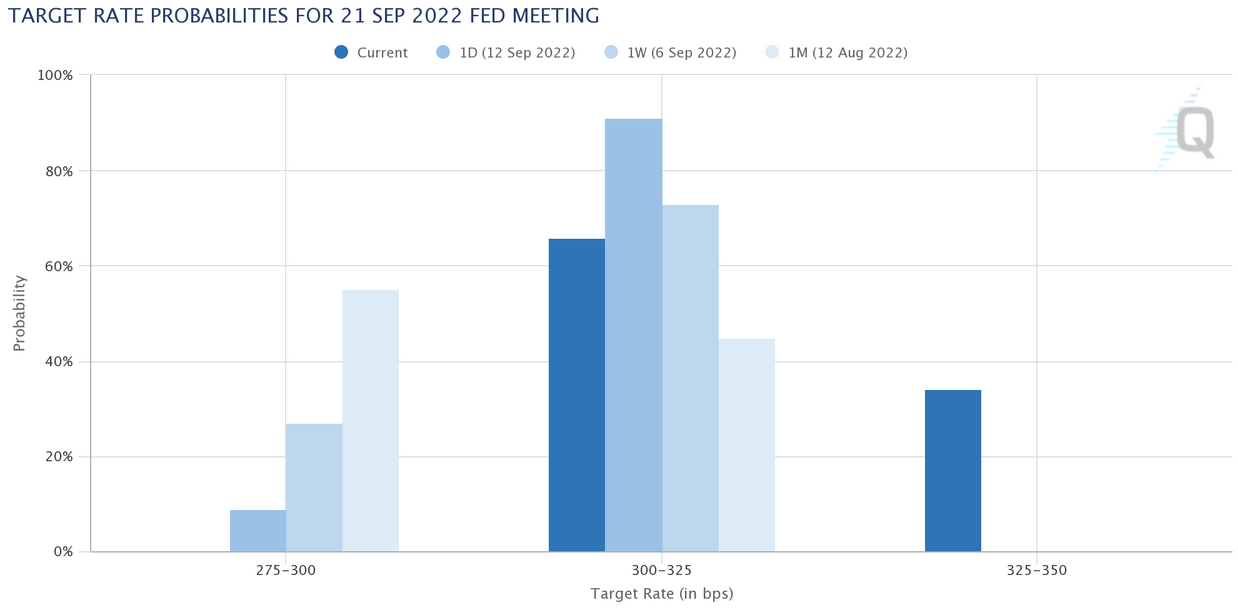

I nearly forgot to mention that the market now sees the odds of a 75 bps hike at 66% and a 100 bps rate hike at 34%.

That sent the 2-year higher by 17 bps to finish at 3.75%, a massive move.

S&P 500

The result is absolute carnage, with the S&P 500 trading around 3,930 and erasing everything over the last couple of days, a 4.3% drop. Worse, the drop yesterday appears to be an impulse wave three down, and once 3,900 breaks, there is a good chance that the ascending broadening wedge I pointed out over the weekend comes alive and drives the market back to the lows, if not to new lows.

NVIDIA

NVIDIA (NASDAQ:NVDA) was crushed yesterday and made a new cycle low, plunging right through support around $134. At this point, the next stop for NVIDIA may not come until $115. It seems hard to believe, but look at how far it has fallen since those horrible results.

Costco

Costco (NASDAQ:COST) appears to have a Head And Shoulders pattern within a Head And Shoulders pattern. The smaller head and should patterns, if it plays out and falls below the neckline around $509, could lead to a drop of an additional 10%.

Apple

Apple (NASDAQ:AAPL) was smashed yesterday after Monday’s big move higher. The stock gave everything back to where it started on Sept. 8. If $151 comes into play, it will be a significant level to watch and needs to hold to avoid a share drop to around $140.