Last week, the stock markets’ adverse reaction to Friday’s jobs report was to price in a hard landing and to expect a series of federal funds rate (FFR) cuts by the Fed, including a 50-basis-point cut in September. Helping to unnerve investors was that the increase in the unemployment rate might have triggered the Sahm Rule, implying that the jobless rate is about to soar, as it has in the past once the rule was triggered.

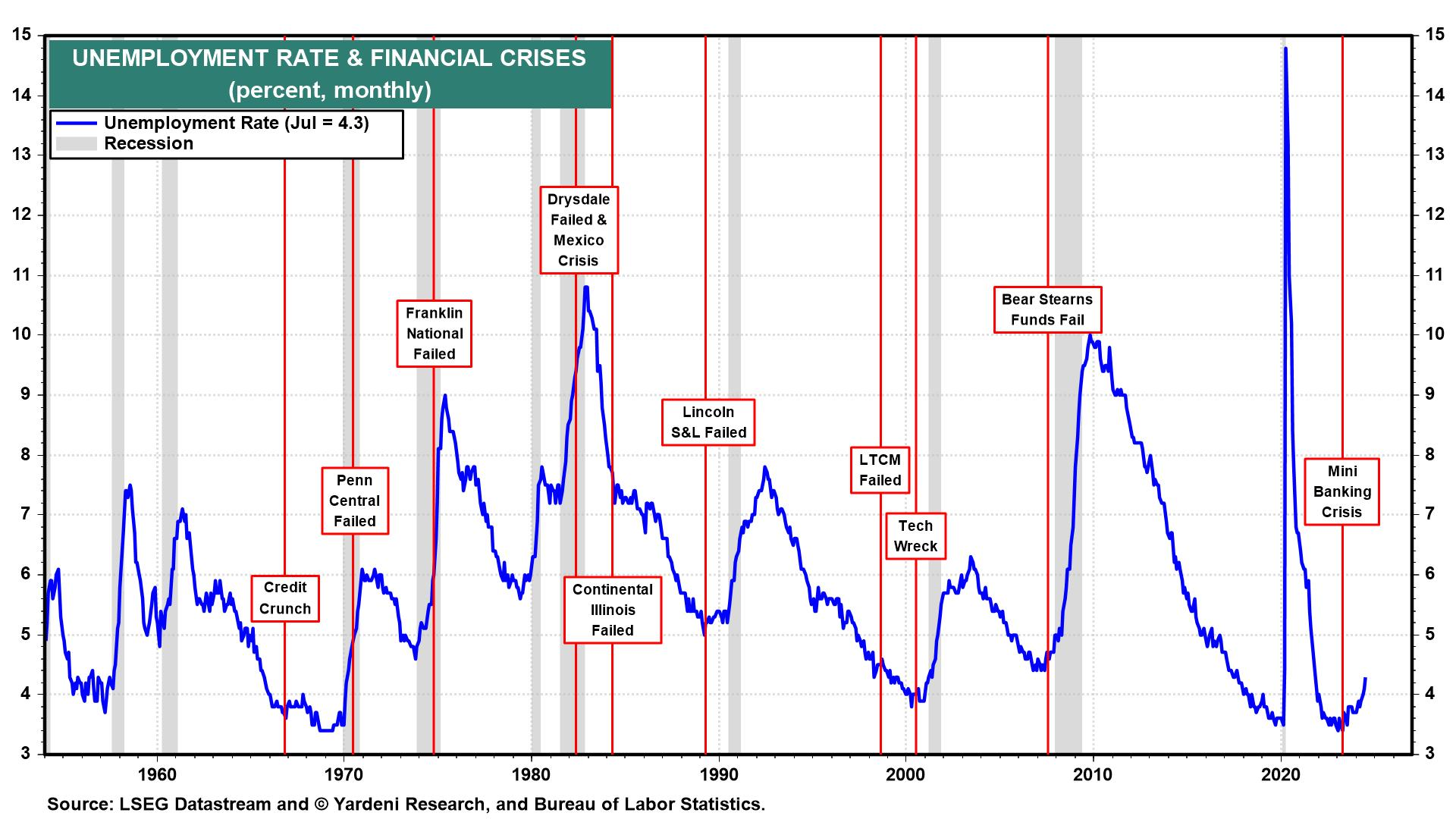

In his presser, Powell dismissed the Sahm Rule as a “statistical regularity.” We agree. We acknowledge that the tightening of monetary policy in the past led to gradually rising unemployment followed by big spikes in the unemployment rates. But those spikes were attributable to financial crises that morphed into credit crunches that forced employers to cut payrolls and consumers to retrench. There was a credit crisis last year, but the Fed averted an economy-wide credit crunch and recession.

Show us a credit crunch, and we’ll agree that the unemployment rate is about to soar as the economy falls into a recession.

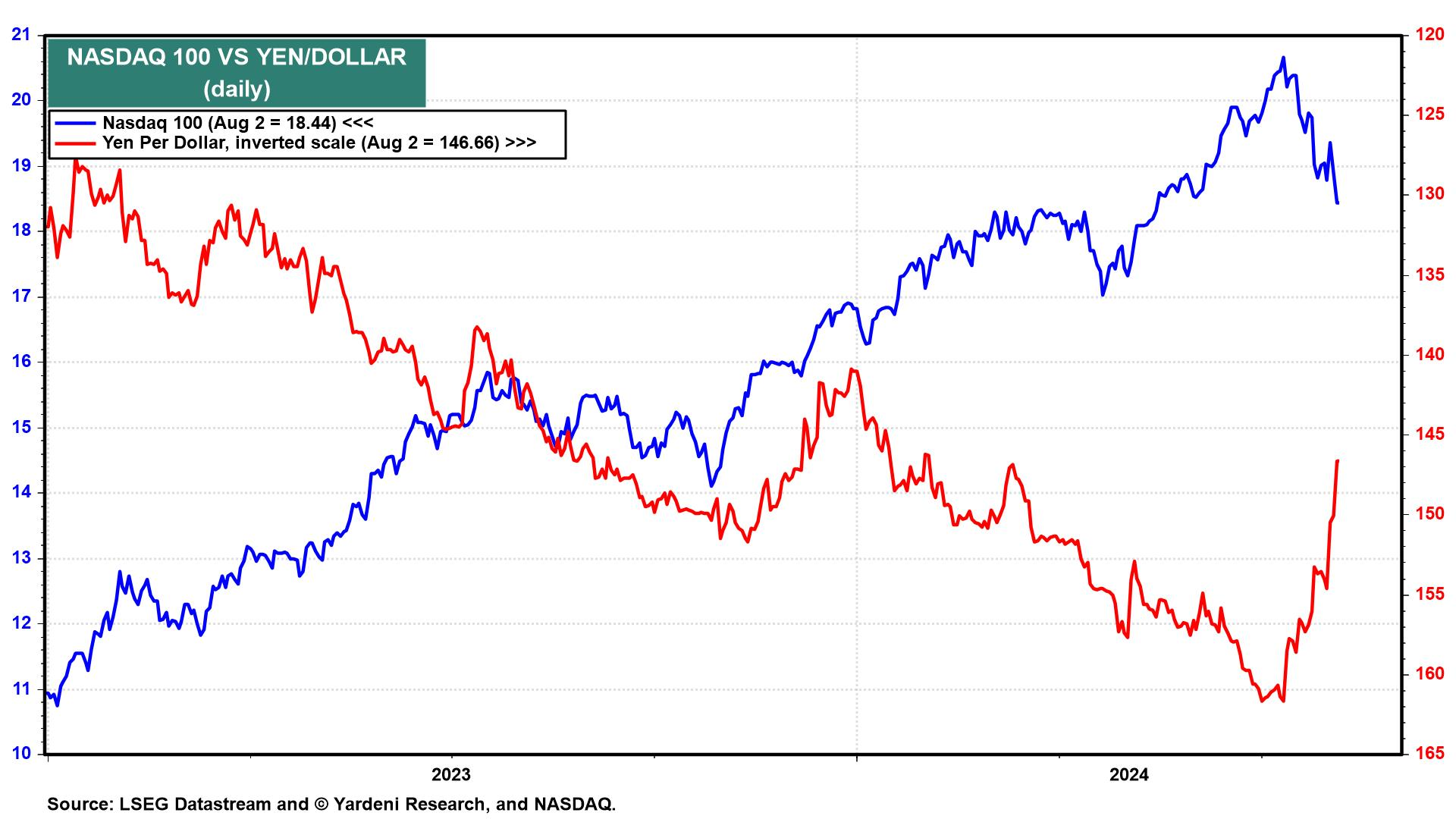

We also believe that Friday’s market selloff was exacerbated by a mad scramble by speculators to cover their carry trades in the Magnificent-7 stocks (Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA)) and other financial assets around the world. The one exception was US Treasury securities, which rallied strongly in reaction to the global financial turmoil. In addition, sentiment was overly bullish in the stock market, making it vulnerable to the tumultuous selloff that occurred on Friday.

The rapid unwind of carry trades injected another dose of volatility into the financial markets. Carry traders borrowing at ultralow rates in Japan effectively short the yen, borrowing and selling it to then buy other currencies of countries with higher interest rates so they can invest in those countries’ assets.

Carry trades have worked out well since global central banks (except for the Bank of Japan) began raising interest rates in 2022, and especially last year as the weakening yen gave the trade extra juice. (The preponderance of carry trades also helped push the yen to weaker than 161.00 to the dollar thanks to all the selling pressure.)

Carry trades are great until they're not. This one started to unravel in the past few weeks after Japan’s Ministry of Finance defended the currency and the BOJ subsequently started to tighten monetary policy. The rising yen forced carry traders to cover their shorts in the yen rapidly and to liquidate their assets that were financed by their carry trades. Many had piled into momentum stocks, including the Magnificent-7 and those in the Nasdaq 100.

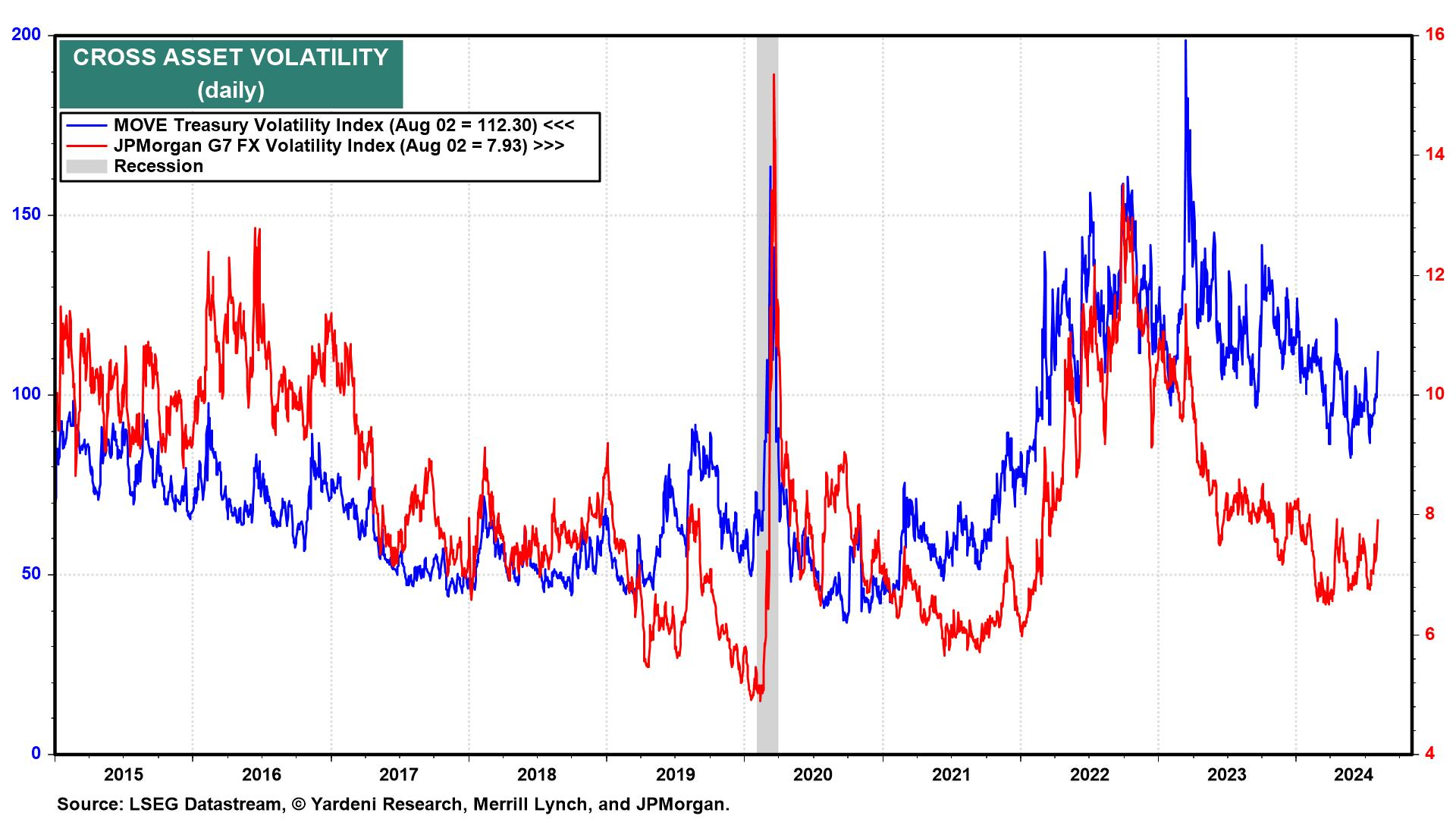

The yen is now trading at 146.50 to the dollar versus more than 161.00 a few weeks ago. The carry trade unwind likely spurred much of the spike in the CBOE Volatility Index (VIX) to above 29 midday Friday, as seen by increased volatility in bonds and currencies.

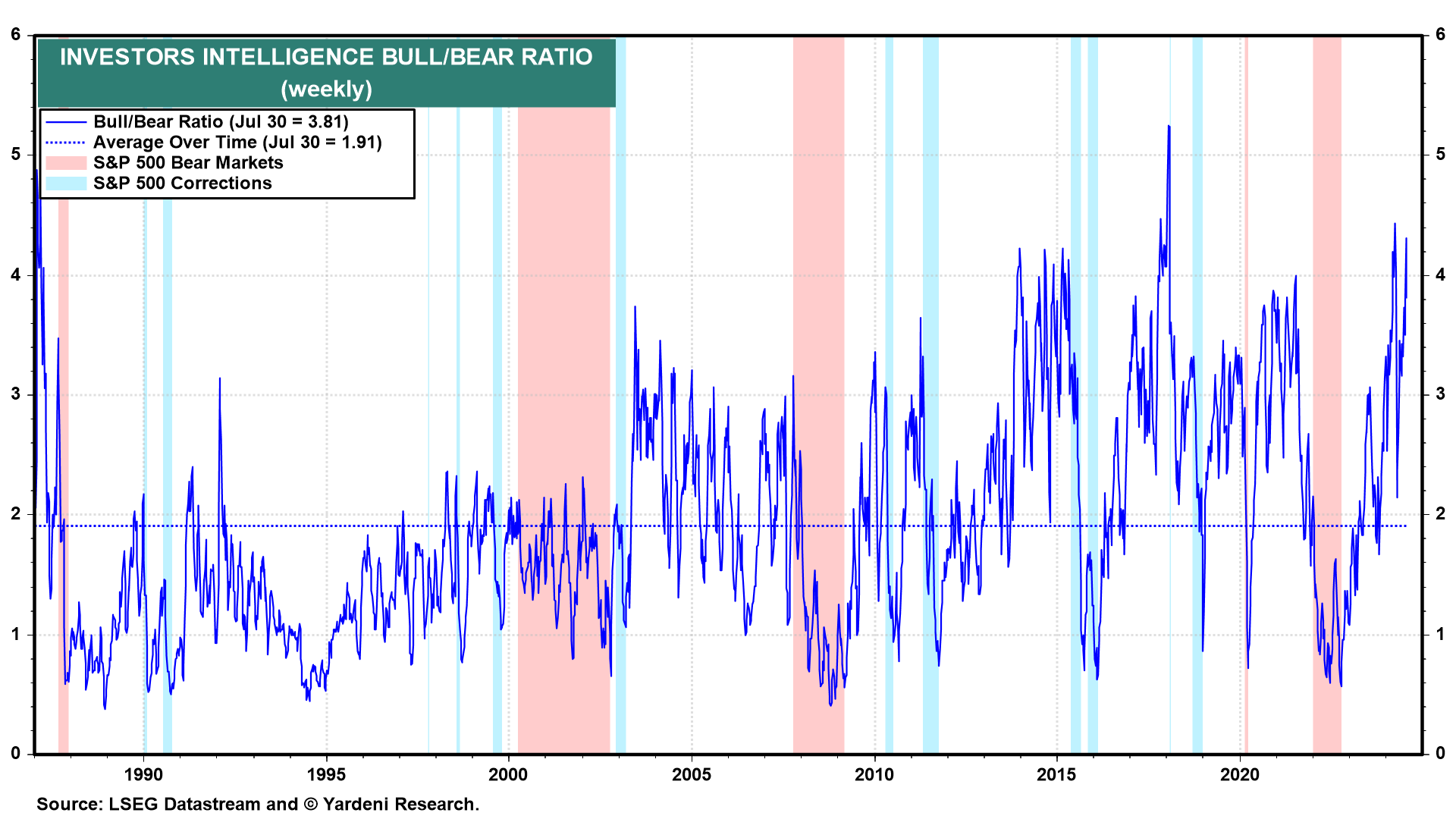

Finally, the Investor Intelligence Bull/Bear Ratio has been around 4.00 for several weeks. The percentage of bears has been hovering around lows only seen a few times since the survey started in 1987, which is a contrarian indicator.