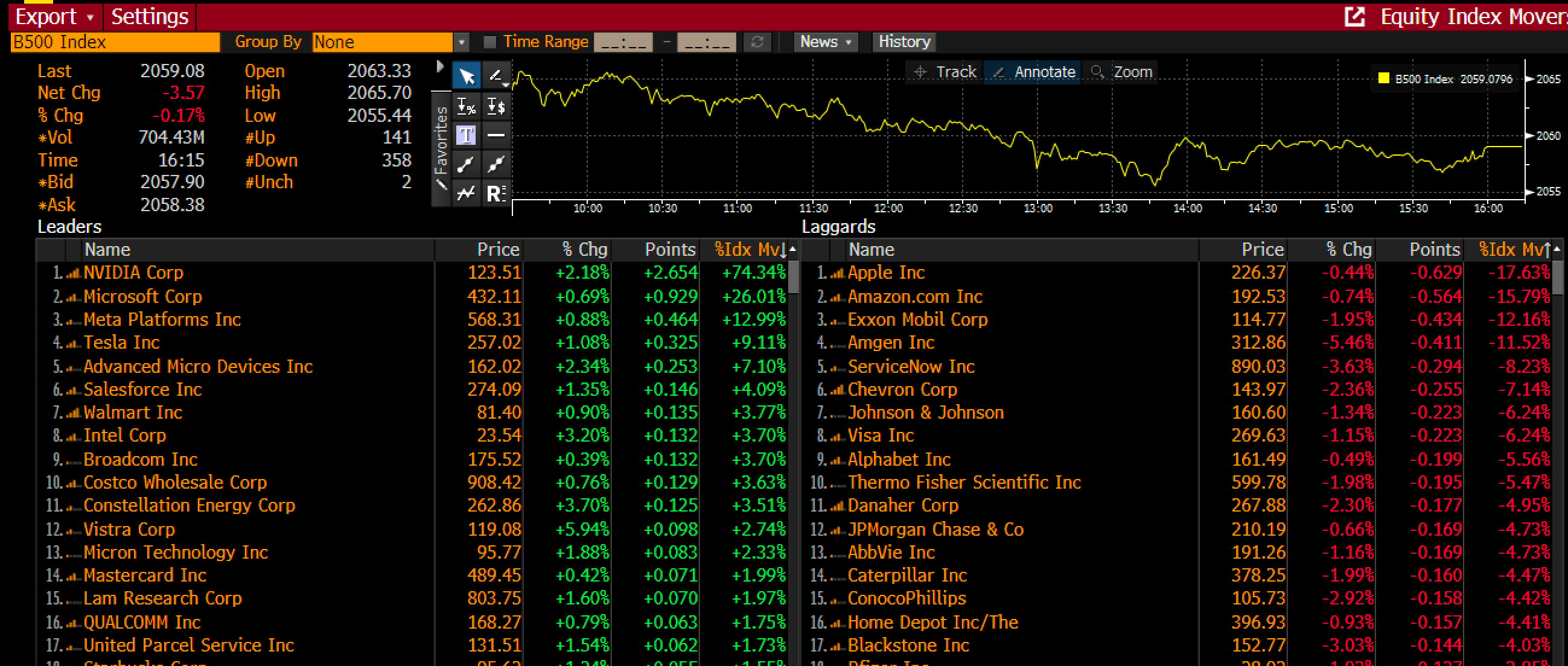

Despite the S&P 500 closing flat yesterday, it was a reasonably weak session overall. Within the index, only 132 stocks advanced, while 368 declined. The Bloomberg 500 indicates that the “Troubling Three” stocks did all the heavy lifting yesterday.

(BLOOMBERG)

Despite the S&P 500 Equal Weight Index declining by approximately 70 basis points yesterday and the small-cap IWM ETF falling by almost 1.6%, there seems to be persistent optimism around the sector.

However, when examining a chart of the IWM, it doesn’t appear to be signaling an upward trend, so it’s unclear where this optimism is coming from.

What S&P 500 Needs to Break Free From Range

At this point, the S&P 500 appears to be stuck in a range, likely because the JPMorgan collar has a call at the 5,750 strike that was sold at the end of the June quarter.

This means market makers are, in theory, long the calls and need to hedge the position by being short futures.

As the notional value of the calls decays, market makers need to cover their short positions, and to do that they buy back the S&P 500. This action is somewhat supportive of the market because we are so close to that strike price.

At the same time, market makers have to short more futures every time the index climbs. This position will be closed out on September 30, and a new position will be rolled over on that day. This is creating this position of being stuck, at least for now.

Interestingly, the notional delta value seems relatively insignificant at just $10 billion. I believe that all it would take is one good day of substantial volume to break this range.

(BLOOMBERG)

But S&P 500 e-mini futures were light yesterday at under a million contracts.

Steepening to Spark Nasdaq 100 Correction?

Meanwhile, the 10/2 spread continues to steepen, climbing to a positive 23 basis points yesterday. So far, the Nasdaq 100 hasn’t seemed to mind too much, trading relatively flat.

Historically, over the last two years, when we see the yield curve steepening, it tends to lead to more of a correction in the Nasdaq 100, and at least over the past few days, that has yet to be the case.

The Nasdaq has gone more sideways for sure, but I would have expected more movement at this point.

Micron (NASDAQ:MU) reported results that came in a little ok, but with solid guidance. It was a tough call for Micron because they needed solid guidance, which they managed to deliver.

The way the stock was positioned favored shares falling, given that the stock needed to get over $103 for it to be in a zone where it could rally further.

Much to their credit, they reported solid guidance, and the stock cleared that high watermark at $103, so there’s not much more you can say there.

What happens if that $103 region comes back into play for some reason? The unwind could be something to watch. We have to wait and see because we simply do not know how it trades in the regular session.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.