We have seen this before - a rally of a few weeks tops off with a reversal candlestick, but the next day, the rally continues.

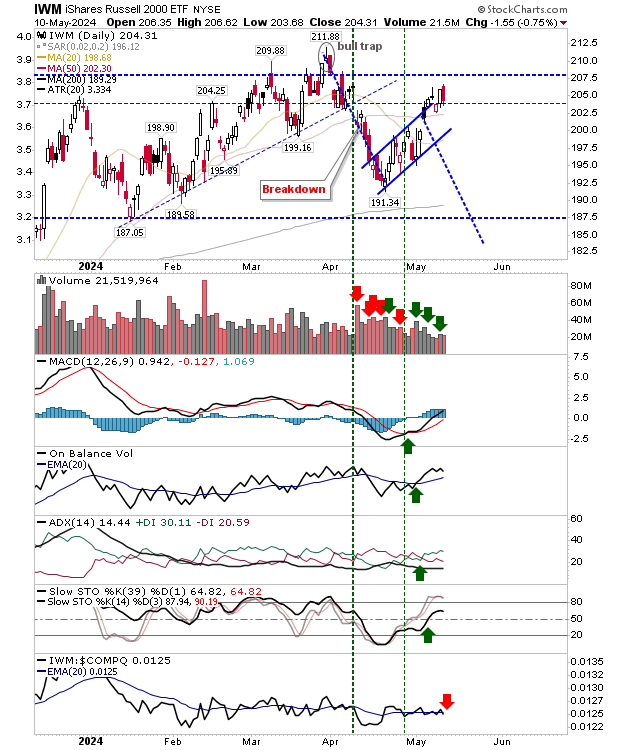

Things were perhaps a little more bearish for the Russell 2000 (IWM), than the S&P and Nasdaq. However, with all indices pressuring resistance of bearish flags - to the point these flags may no longer be considered bearish - it's still more likely we will see challenges of March highs before we see any retest of April lows.

For the Russell 2000 ($IWM), there was a 'bearish cloud cover' candlestick to finsh Friday's trading. The index is still above its 20-day (50-day and 200-day) MA, and is running along the top of its 'bear flag' in what could be viewed as a resumption of its rally. Volume has dropped across the flag pattern, as is typical, but if the next uptick in volume coincides with buying then it won't be long before the March 'bull trap' is challenged.

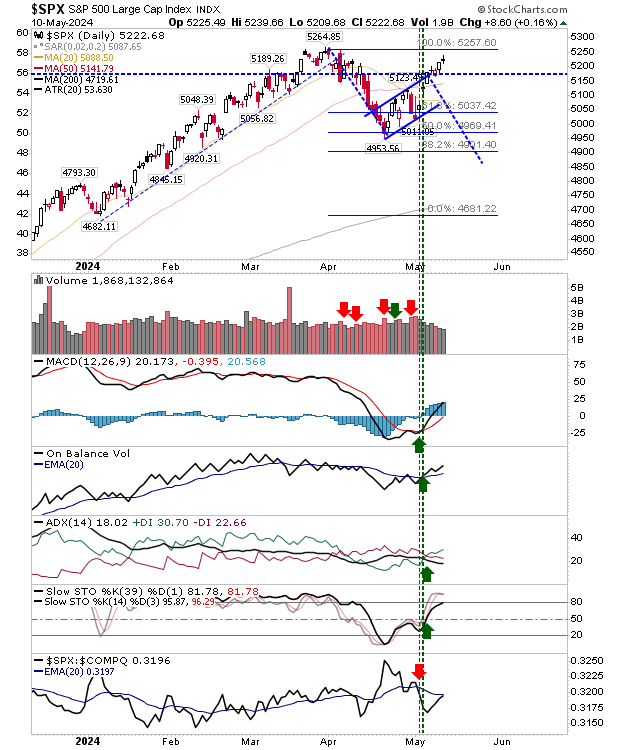

The S&P 500 closed Friday with yet another narrow-range-day doji, following on from a similar doji on Tuesday. Tuesday's doji didn't linger long in the memory, so precedent states Fridays should last there just as long. We are very close to new all-time highs, and with technicals net bullish but not overbought, there is a good chance we will see these highs tested this week.

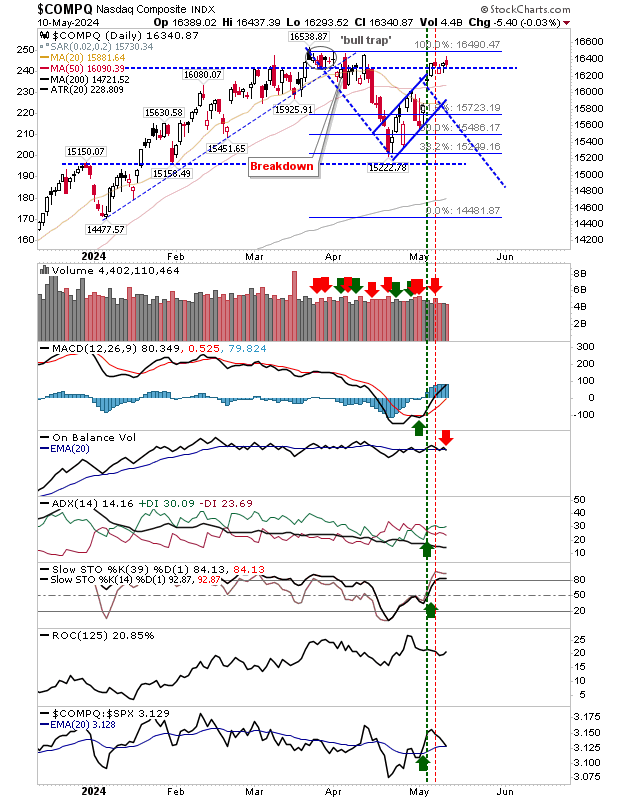

The Nasdaq has already started the process of challenging the March 'bull trap'. The past week has seen tight trading around the 16,300 level, and one good day will probably be enough to generate the new all-time high this index seems to be pushing towards. There was a 'sell' signal in On-Balance-Volume that needs to be watched, but this didn't come with any confirmed distribution on Friday.

Heading into this week there is cause for optimism. At worst, we are likely looking at an extension into a summer trading range that at least keep things positive into the latter part of the year (and whatever nightmare the US election brings).

If things were to go really bad, I would find it hard to see losses below 2023 lows, so any discount should be viewed as an investment opportunity for member stocks in lead indices (or index ETFs).