The Nasdaq and S&P 500 are doing all the leg work, closing near highs, while the Russell 2000 (IWM) has taken hit after hit as it slips deeper inside its trading range.

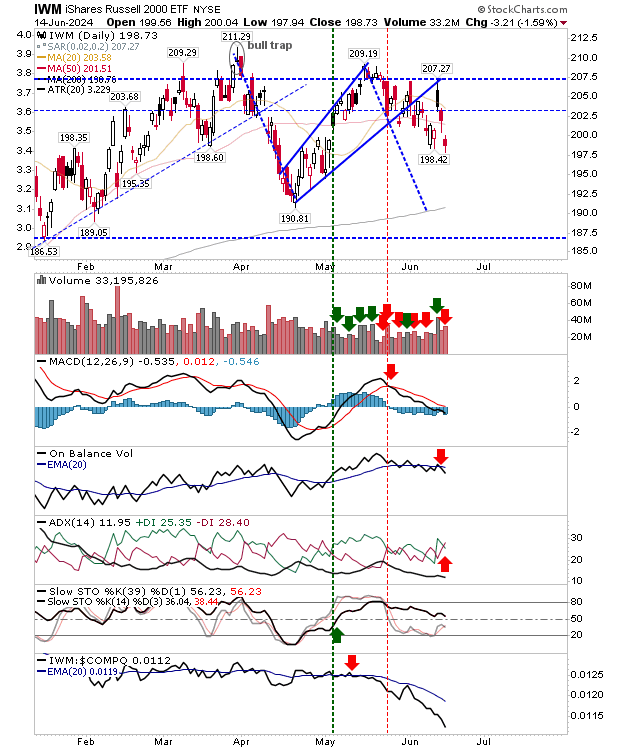

The Russell 2000 ($IWM) is holding the bullish mid-line of stochastics, which is perhaps the best that can be said about it. Other technicals are bearish, including an upcoming bearish cross of the trigger lines below the zero line. The volume also climbed to register as distribution.

But despite this, an index trading inside a range can make many such moves without impacting the larger picture; what we want is either a challenge of the March 'bull trap' or a positive test of the 200-day MA. It would take a decisive loss of the 200-day MA to suggest a larger bearish turn was in the making.

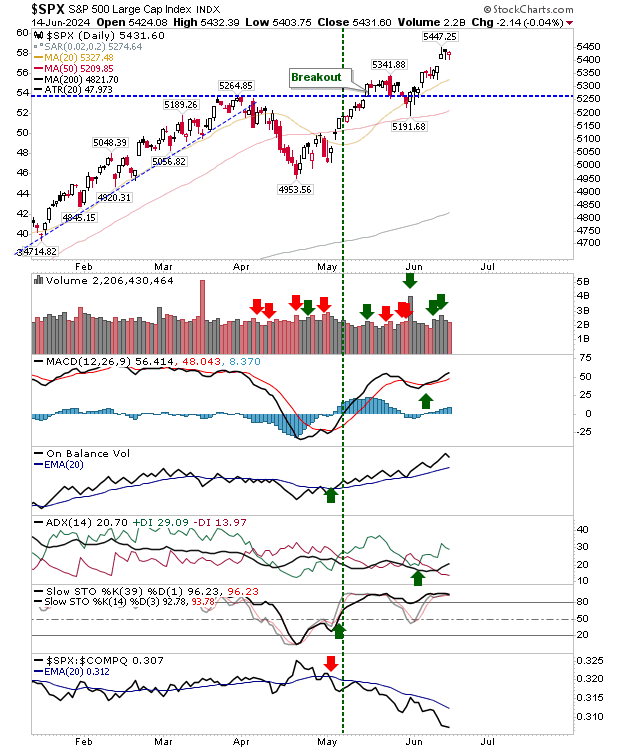

The S&P 500 is a modicum of bullish respect. A small loss, but a likely intact 'measuring gap'. If this proves true, look for a move to 5,560 in the current advance. Technicals are net bullish and only the sharp relative loss against the Nasdaq goes against it.

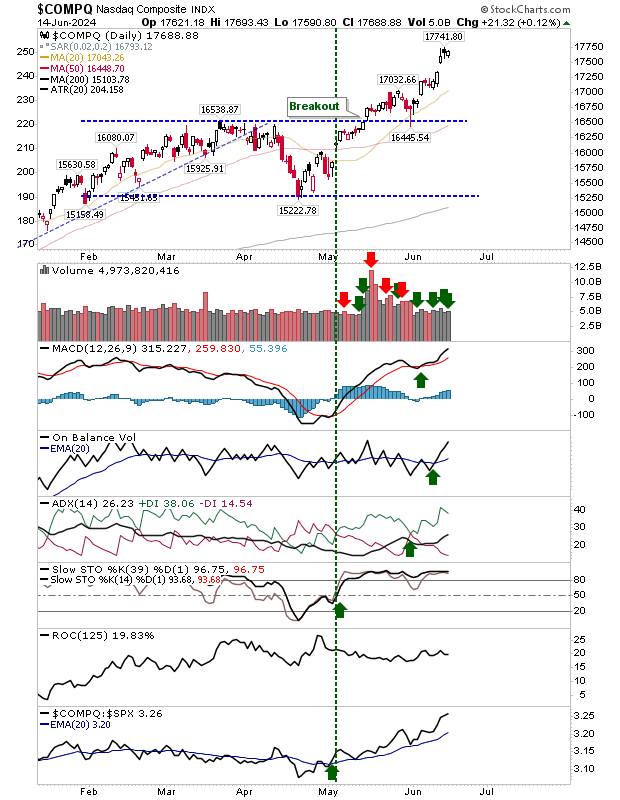

The Nasdaq is the real winner. It was able to close on a new high off the back of strong technicals and significant outperformance relative to peer indices. It too has a 'measuring gap' to work with, opening up for a target of 18,000.

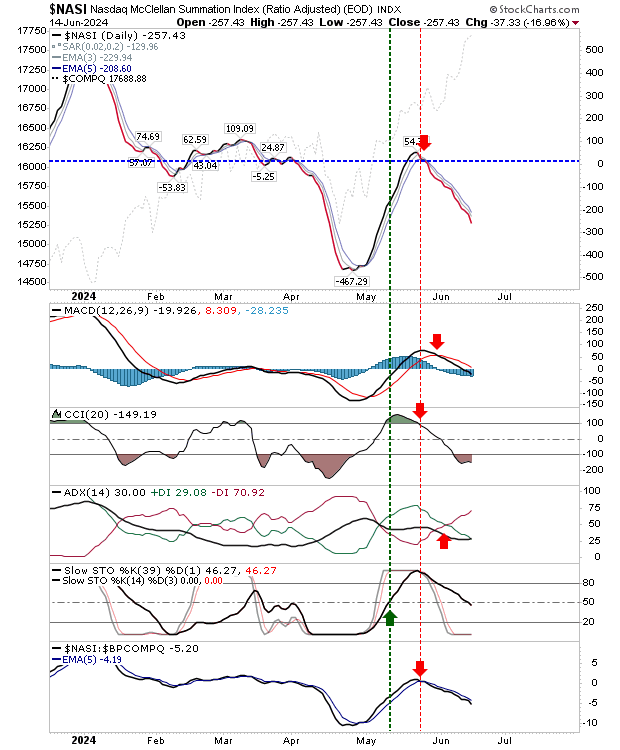

One breadth metric to watch is the Nasdaq Summation Index ($NASI). It's engaged in a significant divergence against is parent index. This is somewhat concerning as the Nasdaq is likely to catch up with it soon, but if the breadth metric reaches -500 or lower, then a significant bottom will be in place.

It's hard to see the Nasdaq holding on with breadth on the wane, but if the next round of losses can stay relatively tight, then it could soon offer a strong bottom built on the back of oversold breadth. We have a bull market for both the S&P 500 and Nasdaq - only the Russell 2000 ($IWM) is disappointing.