- Investors are facing a critical moment, navigating a strong bull market that turned 2 recently.

Balancing continued gains with preparation for potential pullbacks is key to managing this market phase.

Strategic diversification and patience can help investors weather future volatility.

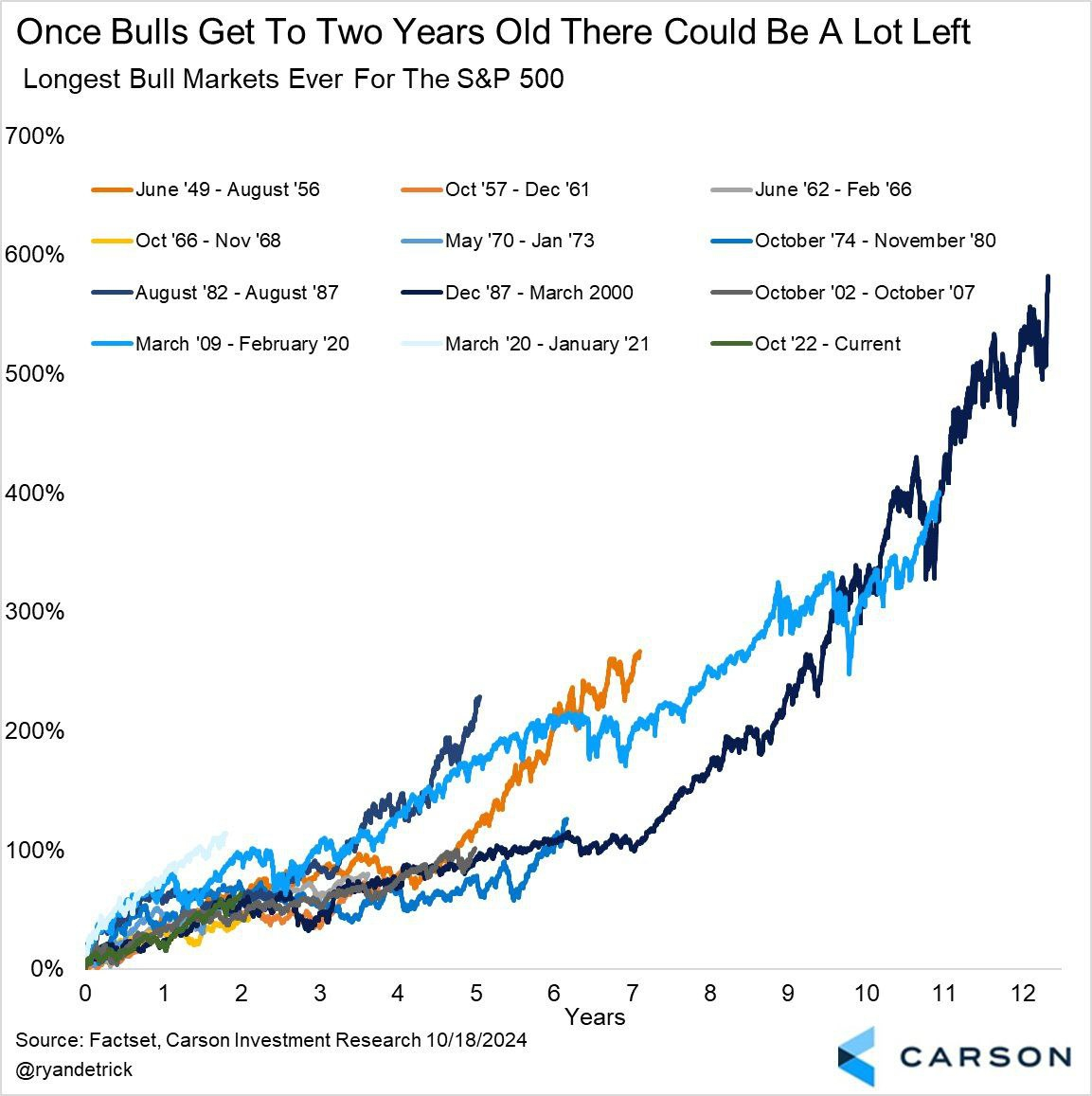

After two years of strong gains in the S&P 500 since the October 2022 low, the bull market shows no signs of slowing down.

Both 2023 and 2024 have been remarkably positive, and even bonds, though limited, have started offering modest returns to investors.

But with markets riding high, the question on everyone’s mind is: how do we navigate this phase?

At recent events I’ve attended, I’ve spoken with numerous investors, and the same dilemma keeps popping up—how should we manage this current market phase?

While I don’t have a crystal ball, I want to share how I’m approaching this unique period.

What History Tells Us About Bull Markets

Let’s start with a look at the bigger picture. Historically, bull markets have often lasted for years, even when valuations seem stretched.

We’ve seen similar periods where uptrends continued for extended periods with only brief interruptions. Yet, while this may feel like an endless party for some, experienced investors know that rising prices also signal a time to increase caution.

Why? As valuations climb, expected future returns fall. It’s essential to remember that what’s already happened is in the rearview mirror—future gains are what matter now.

So, the big question:

How Should You Act During Such a Phase?

In my view, the key is balance. On one hand, continue taking advantage of the market’s strength. On the other, prepare for potential pullbacks and deeper declines.

It’s a tricky task, but trying to “sit it out” until a drop may not be the best strategy. Inflation erodes savings, and anyone who tried waiting in 2023 would still be on the sidelines. Long-term investors who stay in the market generally fare better.

The "time in the market" principle remains crucial—trying to perfectly time your exit and re-entry is notoriously difficult.

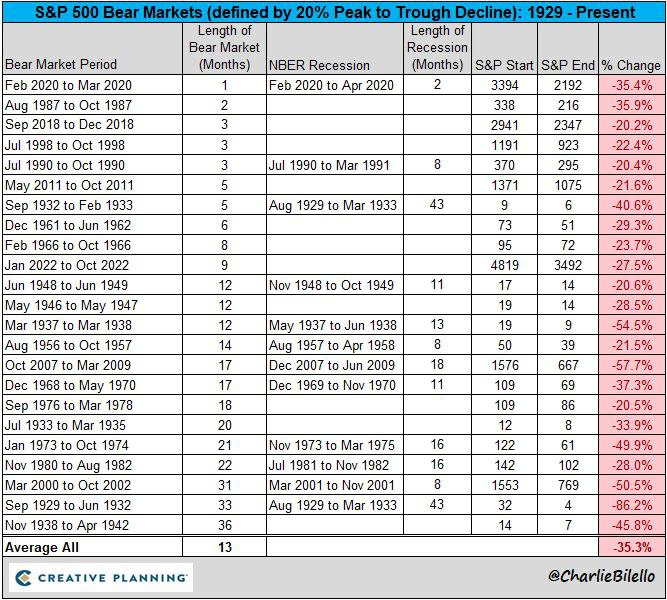

However, staying invested means being prepared to ride out the inevitable market dips, which could be as deep as 20%, 30%, or even 40% in extreme cases.

Those with a long horizon of 15-20 years may choose to do nothing and weather the storm, relying more on their behavior than on technical maneuvers.

For others, diversification is the key. Even Warren Buffett has been gradually shifting toward short-term government bonds, a move I’m also making to a lesser degree.

This strategy allows us to capture attractive yields while keeping some skin in the equities game, ready to pivot back if markets turn.

Geographical diversification or sector shifts—perhaps reducing tech exposure in favor of more defensive plays—are other ways to manage risk while staying in the market.

In the end, the options are there. It’s up to each investor to define their process and choose how to proceed.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.