- The S&P 500 faces a correction but recent stronger-than-expected GDP data might revive its recovery prospects.

- Despite a muted initial reaction, traders are eyeing if the improved economic data can spark a broader uptrend for the index.

- After strong GDP figures, the focus shifts to upcoming tech earnings and other economic data.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

The S&P 500 has been grappling with a recent correction after lackluster tech earnings, but yesterday’s better-than-expected GDP data could help breathe new life into the index's potential rebound attempt.

Yesterday's GDP data, showing a 2.8% quarter-over-quarter increase, exceeded market expectations and dispelled fears of a recession.

While the index's initial response to the data was muted, traders will be closely watching to see if this economic data can reignite the S&P 500's broader uptrend.

Despite the recent pullback, the index has shown resilience and now with the futures firmly in the green, a potential rebound could be on the horizon.

With the market pricing in multiple rate cuts for the remainder of the year, the focus will shift to upcoming tech earnings and economic data to gauge the market's next direction.

US Economy Shows Strength

Yesterday's strong GDP data supports the scenario of a soft landing for the U.S. economy, with annualized quarter-over-quarter GDP growth coming in higher than expected.

While the Fed is expected to maintain a relatively hawkish stance for now, the growing consensus for the number of rate cuts later this year could boost market sentiment.

The current environment is encouraging for investors. Strong economic growth aligns with the market consensus, which still expects the Federal Reserve to initiate a policy pivot in September, despite a slight decrease in the probability to 88.6%.

Interest rate cuts, aimed at supporting the disinflation process rather than a crisis-ridden economy, are generally positive for stock market indices.

If macroeconomic data continues to be positive, the S&P 500's upward trend should persist, provided major companies maintain positive revenue growth and earnings per share. This trend will be tested next week when major firms such as Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN) and Meta (NASDAQ:META) announce their results.

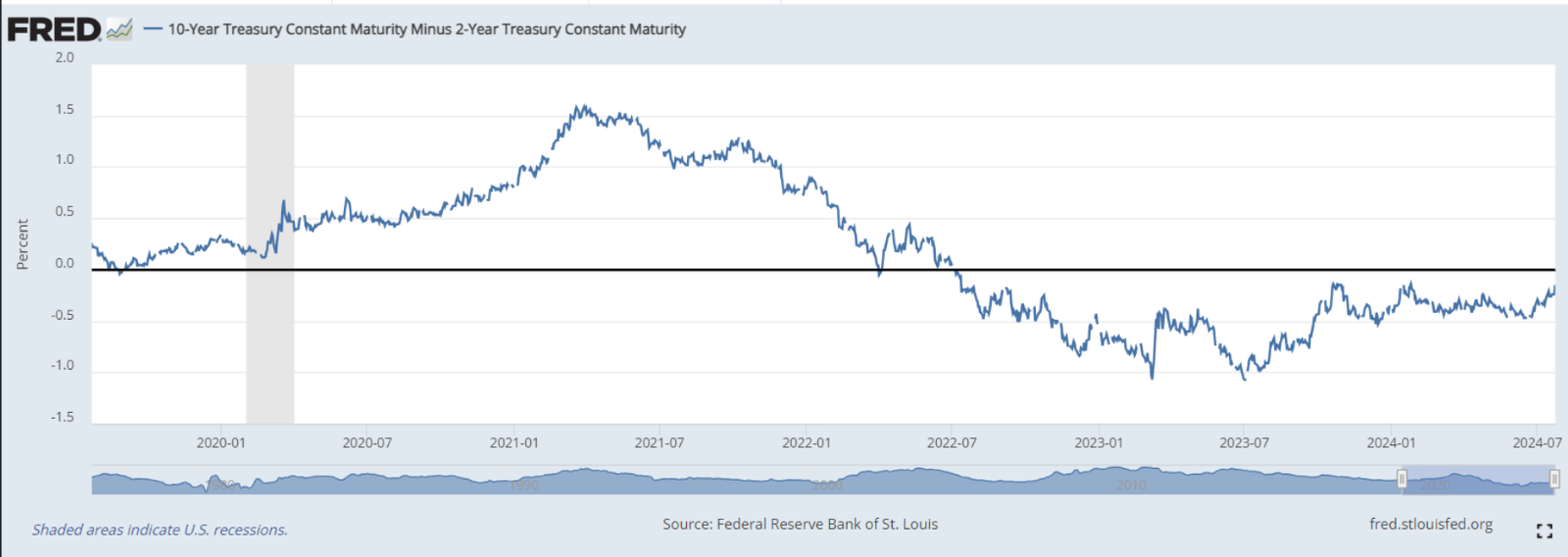

Earlier in 2023, an inverted yield curve signaled a potential recession. However, recent developments suggest that this recession scenario may be unlikely, as the yield curve begins to return to its normal state.

S&P 500: Technical View

Since mid-July, the S&P 500 index has followed a corrective trend, with the initial support target at 5,370 points. If bears manage to break through this support, they could push the index toward the psychological barrier of 5,000 points, encountering additional minor supports along the way.

Conversely, a signal of a rebound would be a rise above the nearest resistance at 5,550 points, confirmed by breaking the local downward trend line. A further breakout above 5,630 could pave the way for new historical highs, surpassing the 5,700-point mark.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.