Since early September, we have been tracking an Elliott Wave Principle (EWP) correction in a five-wave sequence lower.

“…to ideally $4270+/-10, respectively. The latter target zone is also where green W-c equals the length of green W-a, measured from the green W-b (September 4) high. A typical c=a relationship. Moreover, it is also where the (red) 76.40% extension of red W-i resides (see Figure 1 below)."

We have followed up on that prognostication every other week, and two weeks ago (see here) we found that our primary expectations for lower prices in a five-wave sequence came to fruition, albeit with the usual aberrations that cannot be foreseen.

Back then, we found:

"…the SPX must move above at least … $4324 high to strongly suggest the red W-iv low is in place and the rally to $4800 has started. However, if the index drops below last week's low, we must shift our focus. Namely below the previous week's low, especially $4165, will bring the current alternate EWP count, green W-4, 5 red W-iii of black W-1 of blue W-C, back to the forefront."

Fast forward, and the index rallied to as high as $4393 only to break below that "last week's low" at $4216 yesterday. Hence, our primary expectation was wrong, and we must re-assess to understand why because all we can do is "anticipate, monitor, and adjust".

Besides, the EWP is interpretive, and although it is based on a limited set of price-based rules and -patterns, no human is infallible, so we all make mistakes sometimes. Allow me to explain.

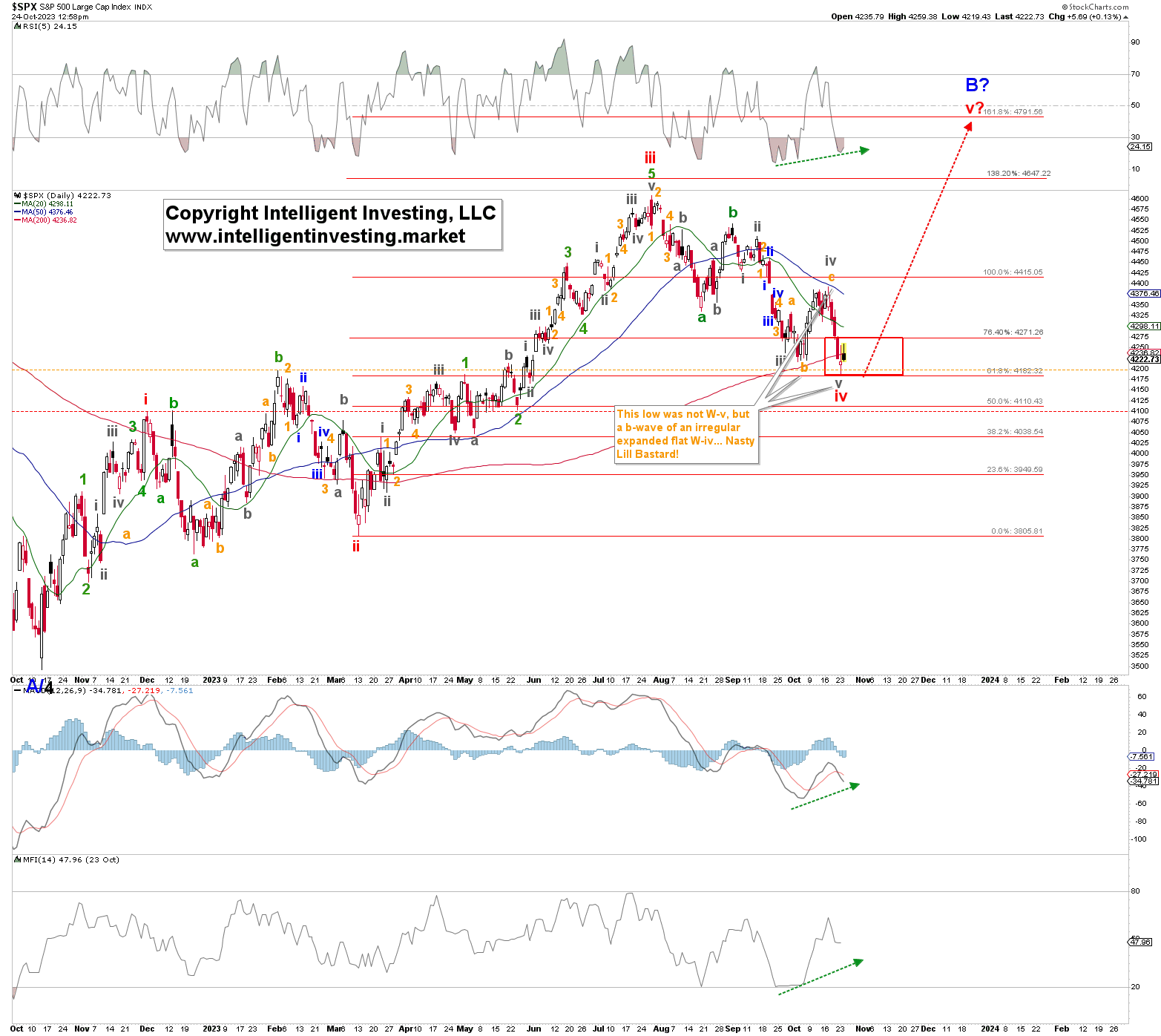

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Since the September 27 grey W-iii low, the index completed what now counts best as an irregular expanded flat grey W-iv, a 3-3-5 correction. See Figure 2 below. The critical part here is the rally from the September 27 low to the September 29 high and then the decline into the October 3 low: see the orange box. The two-day rally was clearly only three (blue) waves, corrective, and thus assigned the W-iv label (iv).

Moreover, the subsequent decline made a lower low, strongly suggesting that it was grey W-v (v). However, that decline was somewhat ambiguous, though assigned as an ending diagonal, which is overlapping (more about that below). The subsequent rally from October 3 to October 17 was in five waves, adding weight to the notion the more significant (red) W-iv correction was completed in early October.

However, yesterday's lower low renders that assessment incorrect, and instead, since the September 27 low, the market most likely went through a larger grey W-iv as an irregular (W-b > W-a) expanded (W-c > Wb) flat pattern: 3-3-5. It was a tricky pattern that certainly fooled us, but we figured it out, making us better going forward.

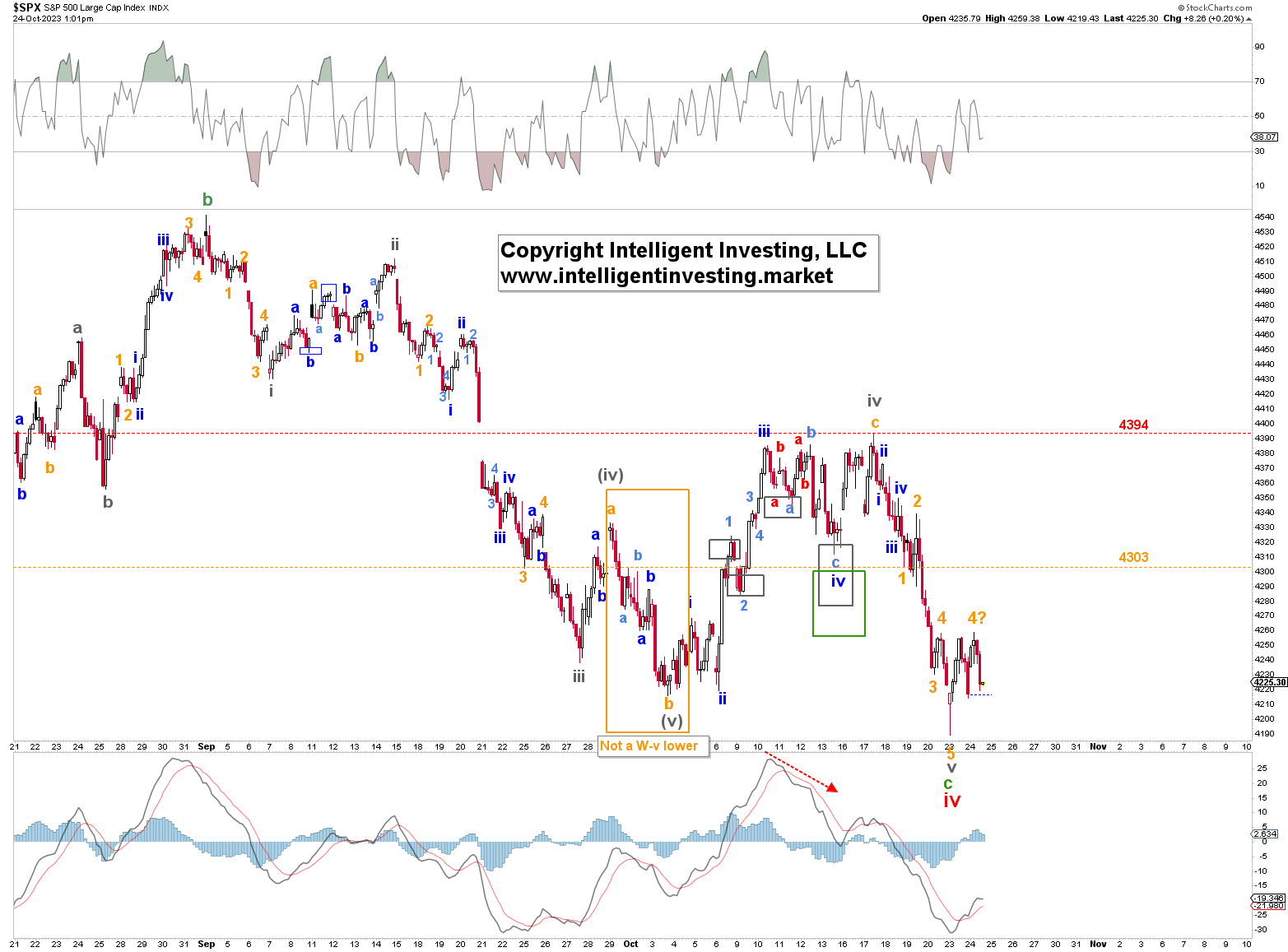

Figure 2. Hourly SPX chart with detailed EWP count and technical indicators

Thus, we have now been able to assess where we went wrong, and based on that analysis, we find that the Bulls have one last chance to reach $4800, as long as $4100 is not breached. Before we go there, please note that one of the most significant and powerful aspects of the EWP is that it provides market context and objective parameters to that context, something that few, if any, other methodologies can do.

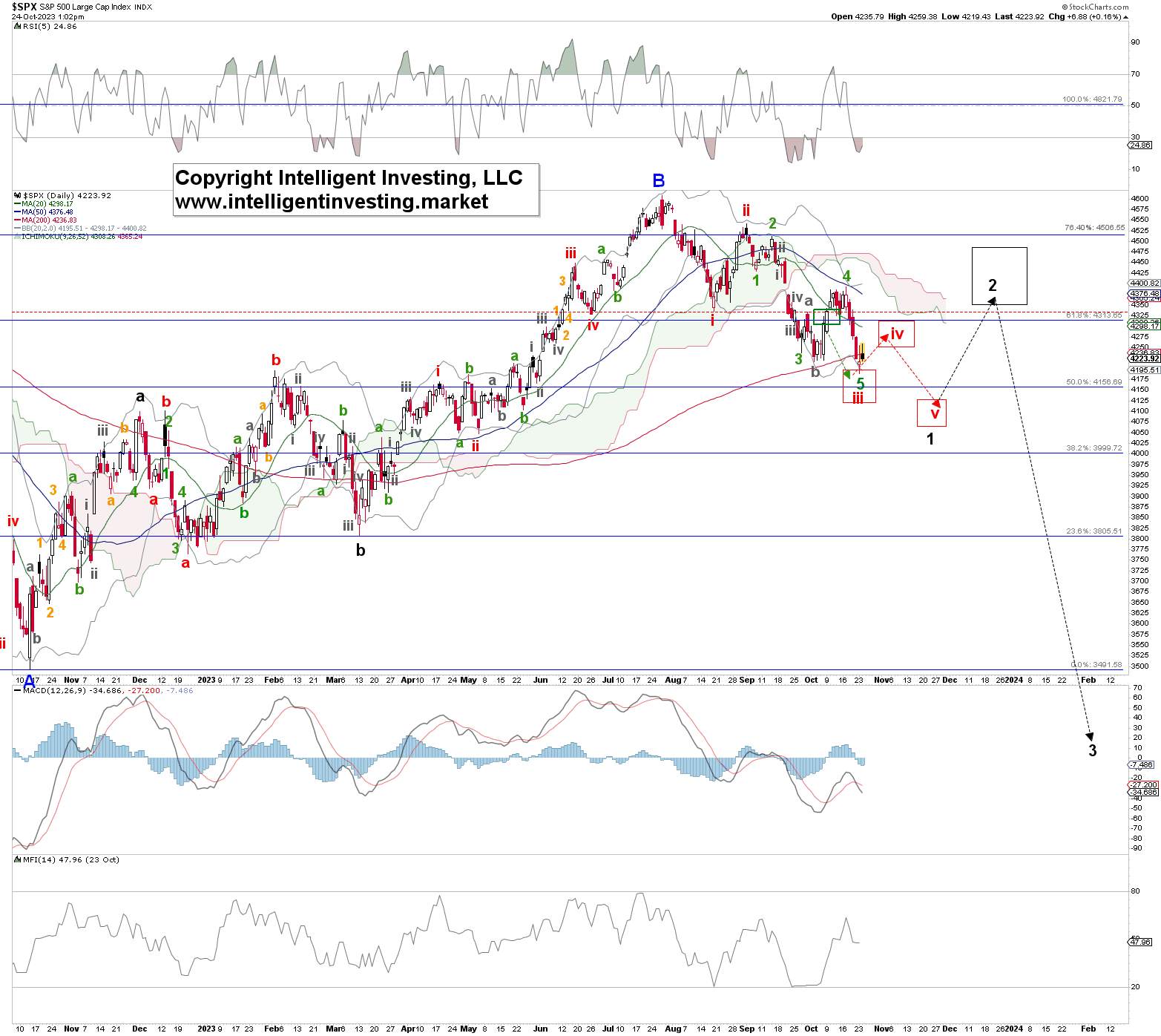

A corrective pullback in the EWP analysis always takes shape as an a-b-c structure, wherein the W-a comprises three or five waves, whereas the c-wave encompasses primarily five waves. Therefore, because the initial decline from the July $4607 high into the August $4335 low counts best as three waves, it suggests this is an a-b-c corrective pullback. Hence, we labeled that low as green W-a. Moreover, it sets the index up for a rally to ideally $4800 when the pullback completes.

Since an initial three-wave move often means a correction, probability strongly suggests the current pullback is "merely" a correction. Hence, we must favor this scenario. However, only one (!) type of pattern can start as a three-wave move and will still complete a full five waves: the "dreaded" diagonal. They are much less common and thus not favored. But it must be accounted for; we shared it with you last time. See Figure 3 below.

Figure 3. Daily SPX chart with detailed EWP count and technical indicators

Thus, although the index has not yet moved below the more critical $4165 level, it moved below the early October low, increasing the odds this pattern is at play, and for as long as the index is unable to move at least above $4303 and especially $4335 (the early August low: red dotted horizontal line) we must keep it on our radar. Even more than before.

Unfortunately, most people approach market analysis from the perspective of "tell me what the market is going to do with all certainty right now," aka the "so you are telling me it can go up or down" crowd. But that's a simplistic, naïve, and often amateurish mindset, as anyone who has experience in the stock markets knows that is impossible because financial markets are non-linear, complex environments.

Moreover, if we all knew that, then the markets wouldn't function, and Wall Street wouldn't have to hire armies of highly educated analysts and A.I.-programmers to try to be successful in the stock markets.

Thus, the stock market Bulls are currently living on the edge, and it will not take much to tip things in favor of the Bears.