Stock prices and bond yields dipped while oil prices jumped yesterday. In Washington, a senior White House official said the US is actively preparing to defend Israel against another direct missile attack by Iran.

The official added that such an attack would carry severe consequences for Iran, which is under pressure to retaliate for recent Israeli military actions against Hezbollah, its proxy in Lebanon.

The markets' initial reactions moderated by early afternoon after what seems to have been a limited strike on Israel by Iran with no serious casualties.

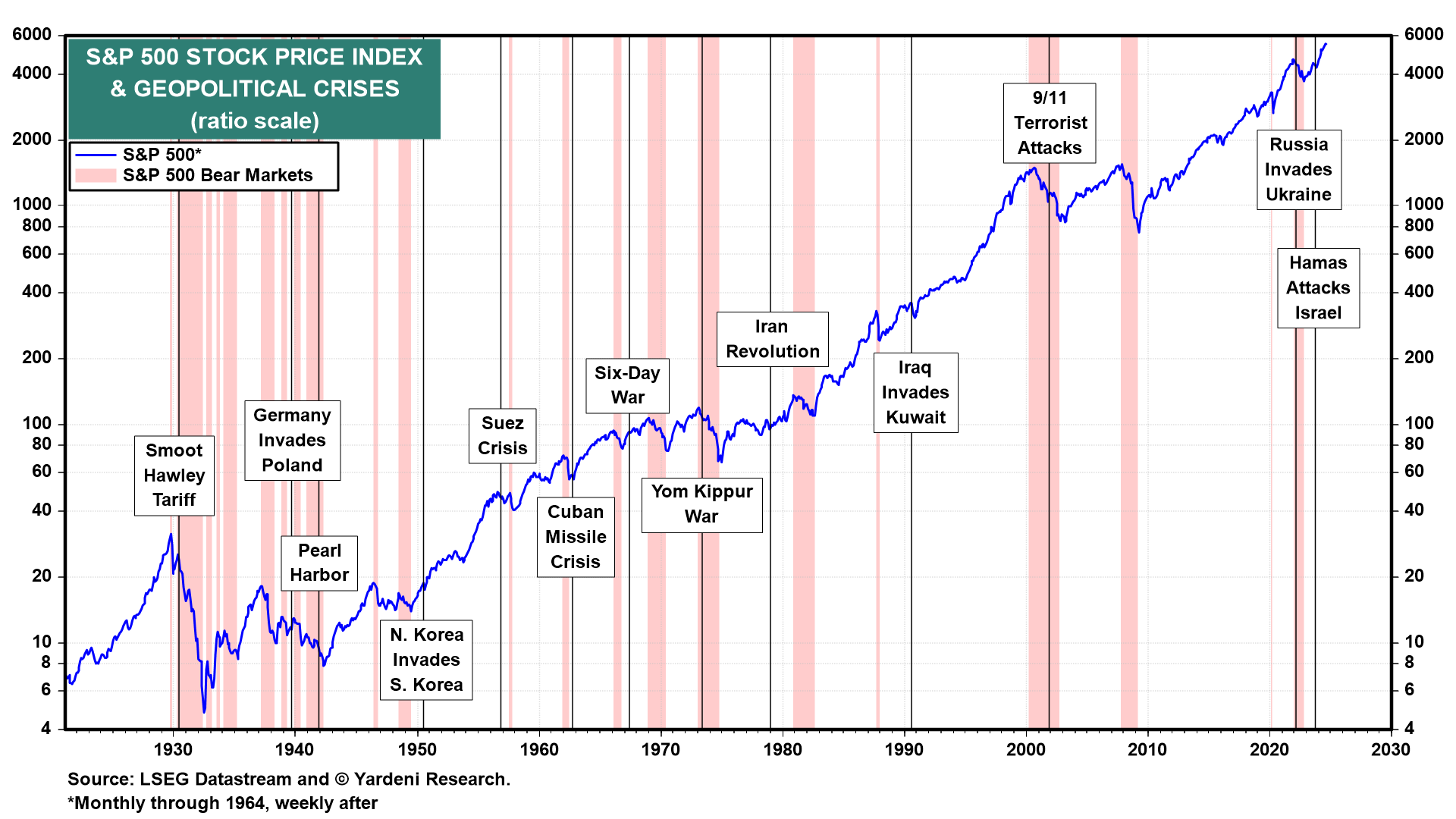

A widening Middle East war has been our number one risk scenario over the past year for the bull market in stocks.

For now, we are sticking with our subjective probabilities: 50% Roaring 2020s, 30% 1990s-style meltup, and 20% reprise of geopolitical turmoil reminiscent of the 1970s.

As we've often noted in the past, geopolitically induced selloffs in the S&P 500 tend to be buying opportunities (chart).

Meanwhile, here in the US, yesterday's economic indicators were mostly unsurprisingly benign.

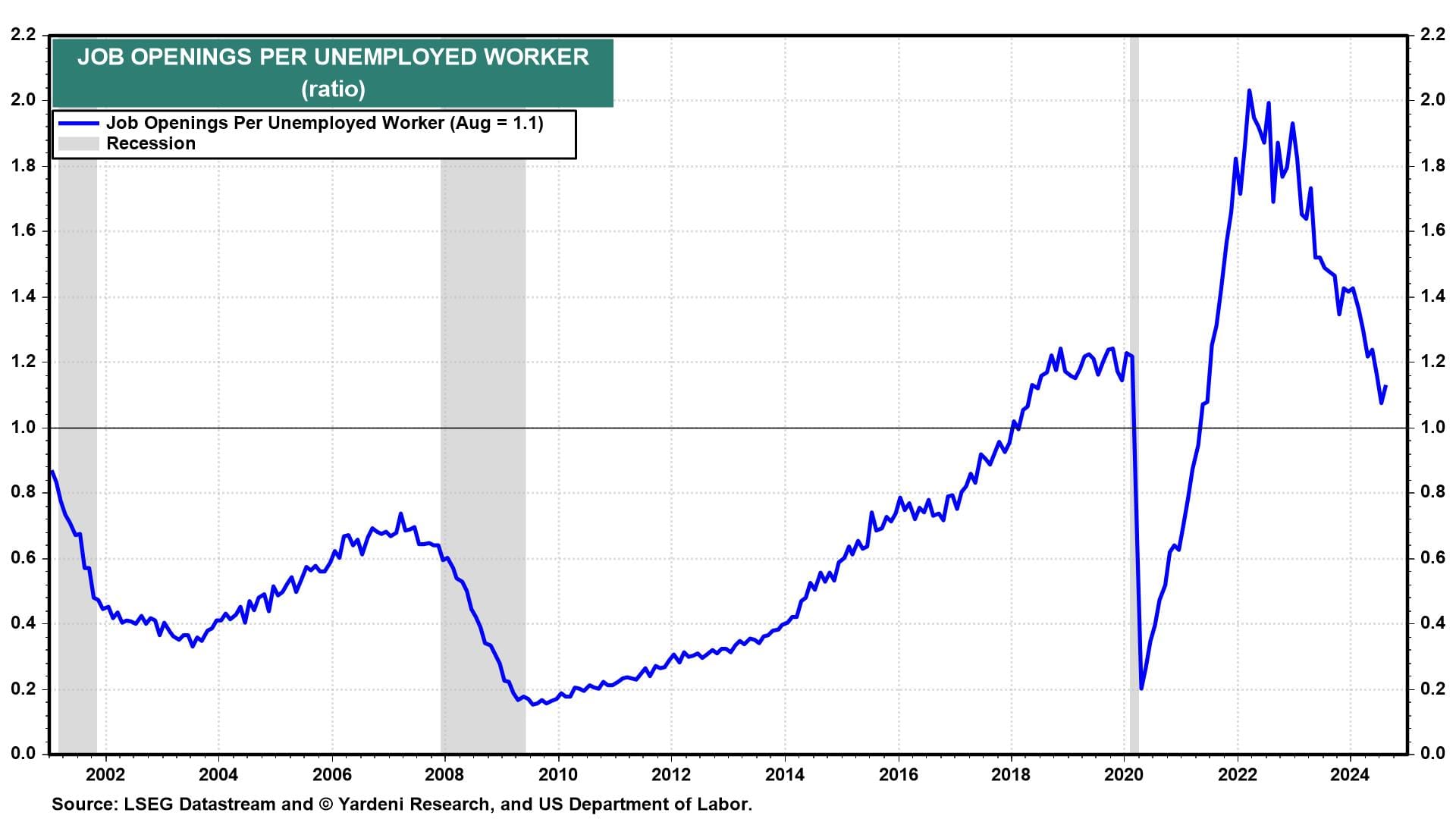

Job openings ticked up in August, while quits fell. The national M-PMI remained weak in September. Construction spending unexpectedly fell in August amid a sharp drop in outlays on single-family housing projects.

The day before yesterday, Fed Chair Jerome Powell suggested that two more 25bps rate cuts could occur over the rest of this year.

He also acknowledged that upward revisions in personal income last week meant that there is no need for the Fed to rush cutting rates. That's been our position all year. Here's our quick take on yesterday's data:

Labor Market Remains in Good Shape

The hires and quits rates both fell, as expected based on the decline in the "jobs plentiful" series from The Conference Board's consumer confidence survey.

The latest data align with our view that currently unemployed workers are increasingly struggling to find jobs due to skill mismatches rather than decreased demand for labor.

On a "skills-adjusted" basis, the economy is at full employment.

Stock selloffs triggered by geopolitical events have historically presented buying opportunities, and for now, the underlying economic indicators remain stable.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI