This post was written exclusively for Investing.com

Volatility has surged in recent days as fears over the coronavirus have taken hold of the equity market. The VIX surged to as high as 37 on Feb. 27, as stocks plunged in value. However, options traders are betting the rising volatility levels begin to fall in the weeks ahead. Some of the traders have been unwinding previous bets, while others appear to be making new bets.

It could spell good news for stocks too if options traders are betting that volatility subsides. It may not indicate that a bottom has been reached in the equity market, but it does suggest that perhaps the wild and sharp price movements may settle down.

Betting On A Reversal

The VIX options that expire on March 18 saw a sharp drop in the number of open call contracts at the 25 strike price on Feb. 27. The open contracts fell by around 61,000 to around 272,000. According to the options data provided by Trade Alert, the calls traded on the BID for approximately $3.40 per contract. Given that the calls traded on the bid and the open interest fell, it is an indication that the contracts were sold.

Additionally, open interest levels for the June 17 30 calls rose by 39,000 contracts. Despite the rising open interest, the contracts traded on the bid for $0.70 per contract, indicating they were sold. In this case, it is an indication that a trader is betting that the value of VIX is not above 30 by the expiration date.

Finally, the open interest levels for the 20 put options that expire on March 18 rose by roughly 21,000 contracts on Feb. 27. These puts traded on the ASK for around $1.50 per contract, an indication they were bought. As a result, the VIX would need to fall below 18.50 for the buyer of the calls to earn a profit.

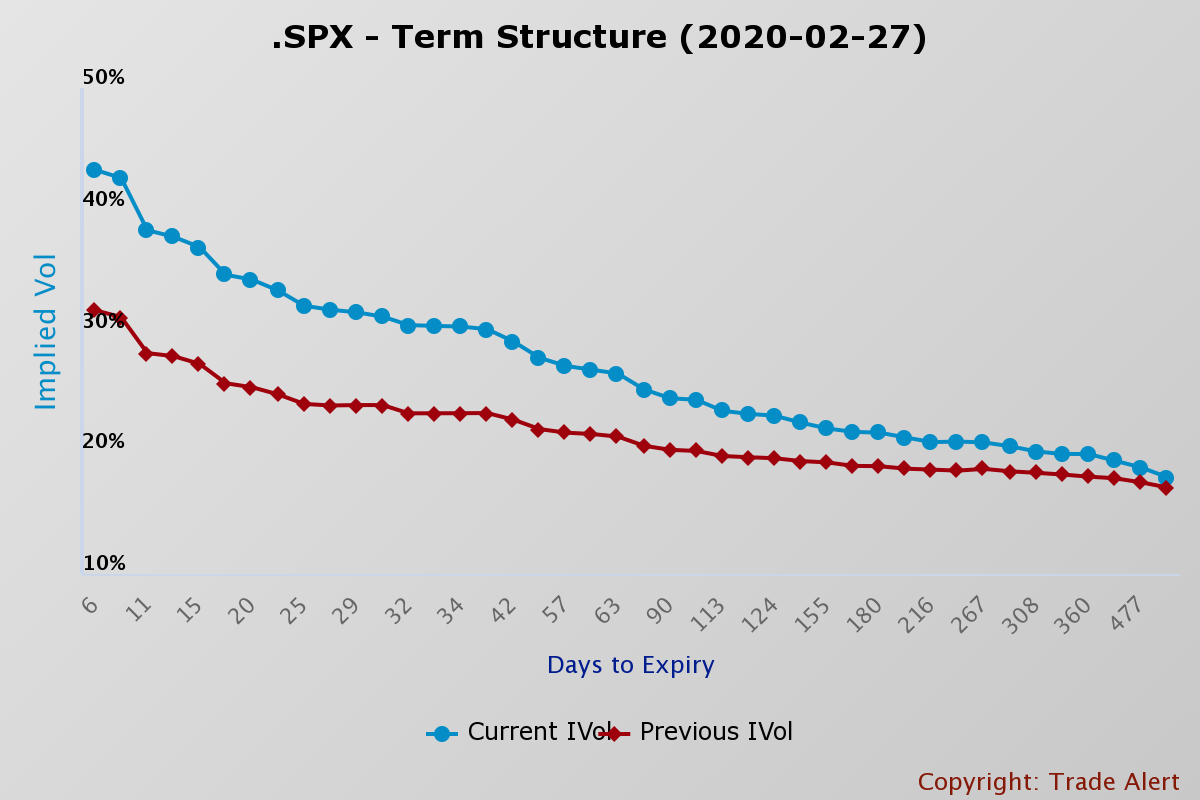

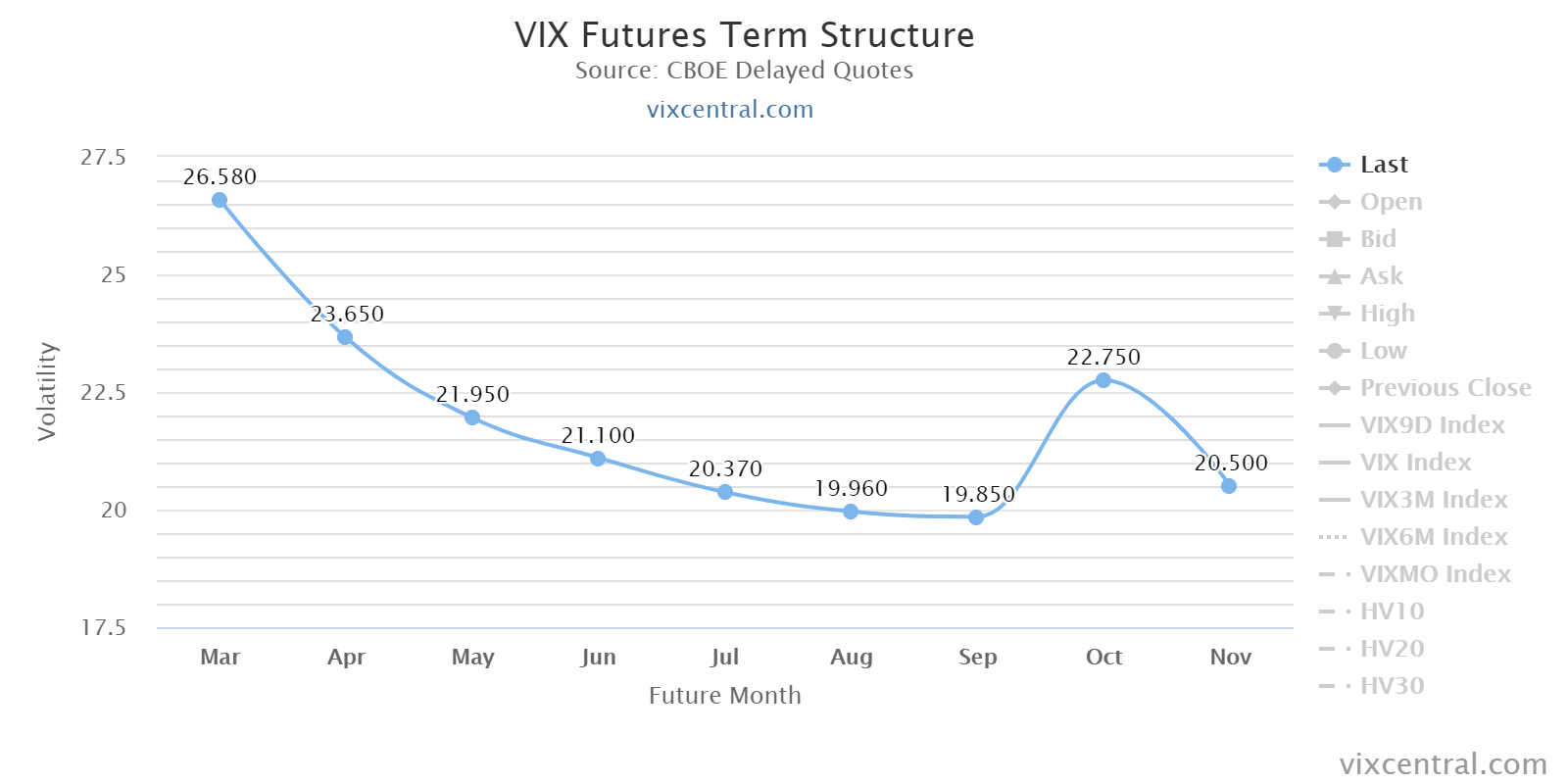

Backwardation

There are also signs that volatility levels may begin to decline are now being priced into the market. The implied volatility term structure for the S&P 500 is now in backwardation, which means that the current implied volatility will be lower in the future than it is currently.

The VIX itself is in backwardation too, with values for the VIX expected to fall from 32 currently to around 23 over the next 30 days.

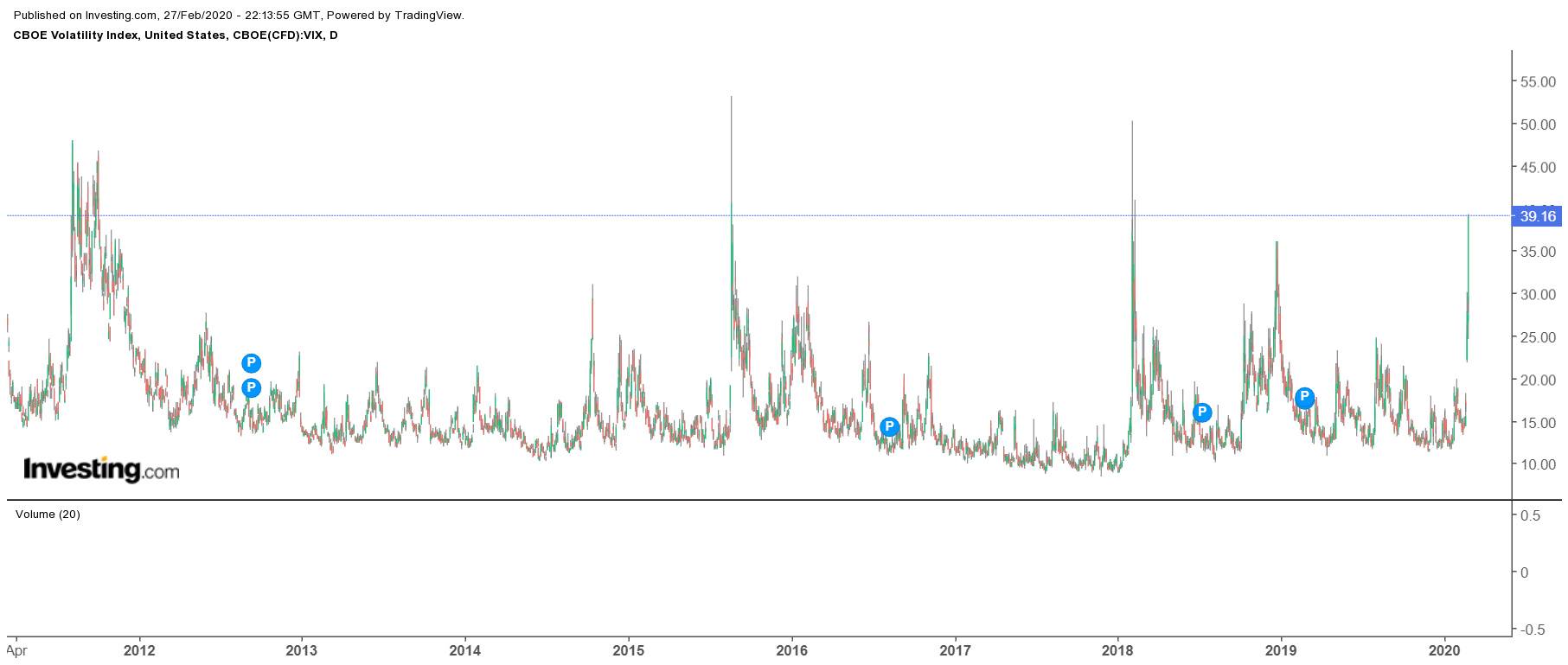

Over 30

Historically, when the VIX increases to levels above 30, it typically results in volatility levels declining in the weeks that follow. It isn’t likely that this time will be much different and if that is the case, it seems logical that traders are betting that the volatility subsides in the weeks ahead.

If that volatility does begin to subside and the VIX does begin to fall in value, it would indicate that the equity market should start to settle down and perhaps even start to push higher once again. After all, time does help to heal.