It was news a few days ago that Snap Inc (NYSE:SNAP), a social networking technology company, lost 45% in a single stock market session.

This followed a profit warning from the social media company that showed hard times for a once booming industry, triggering a collapse of the entire sector.

The Social Network Industry

Is the social networking technology industry really destined to go the way of the Nifty-Fifty or the dotcoms?

I would like to start with a quote from Massimo Ruggero of the TV series 'Devils'; "Data is the new oil, but oil sooner or later runs out, data does not..."

Now, these companies, in addition to having countless users, possess billions and billions of data, and information.

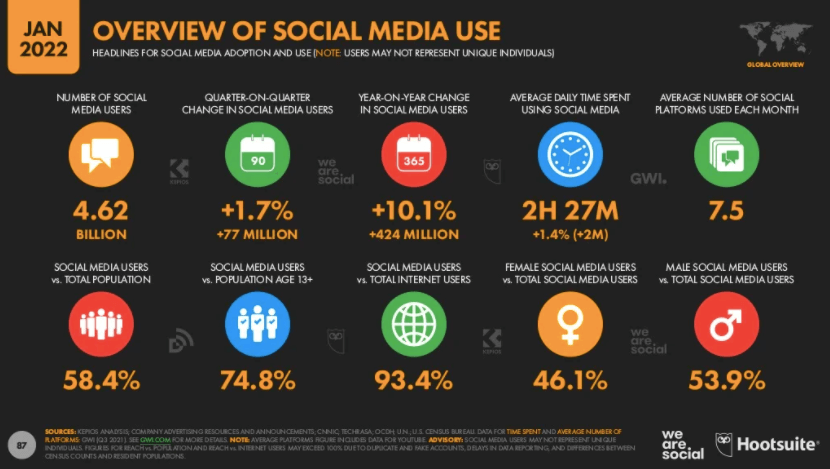

As we can see from the screenshot below, as many as 4.62 billion people are social network users. Moreover, the new generations are digital natives, so being registered in some kind of social network is now almost as normal as having a health card.

.

Which to bet on?

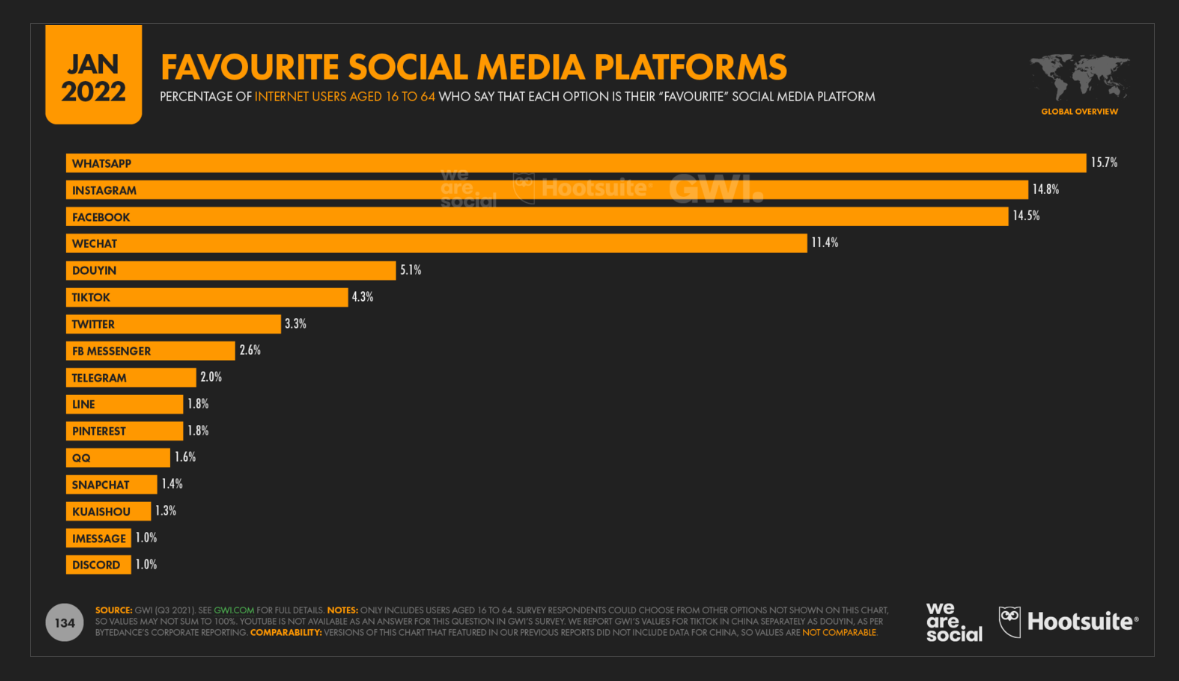

According to a recent analysis by GWI.com, we see that the most widely used platforms in the world are still owned by Meta Platforms Inc (NASDAQ:FB), followed by WeChat in the fourth position. Therefore, if we were to evaluate companies according to 'market share', Meta Platforms Inc dominates, not surprisingly it is also the largest company in terms of market capitalisation.

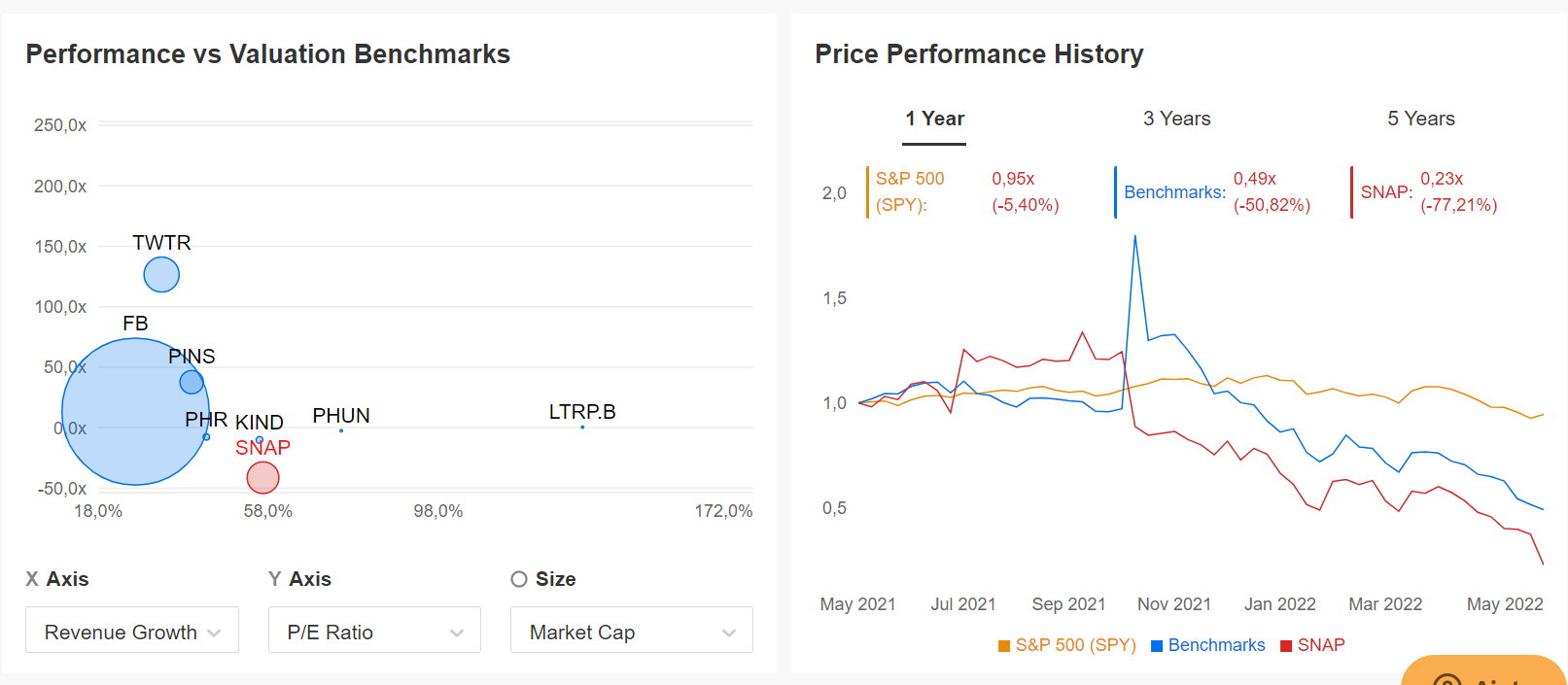

If, on the other hand, we analyse the valuations with our InvestingPRO tool, Twitter Inc (NYSE:TWTR) currently seems to be the most overvalued (pending an understanding of Musk's intentions). If we then consider that many of these companies are still loss-making (Snap Inc for several years) we realise that the business itself does not offer many choices, i.e. the only company truly able to grow structurally and make a profit to date is almost exclusively Meta Platforms Inc.

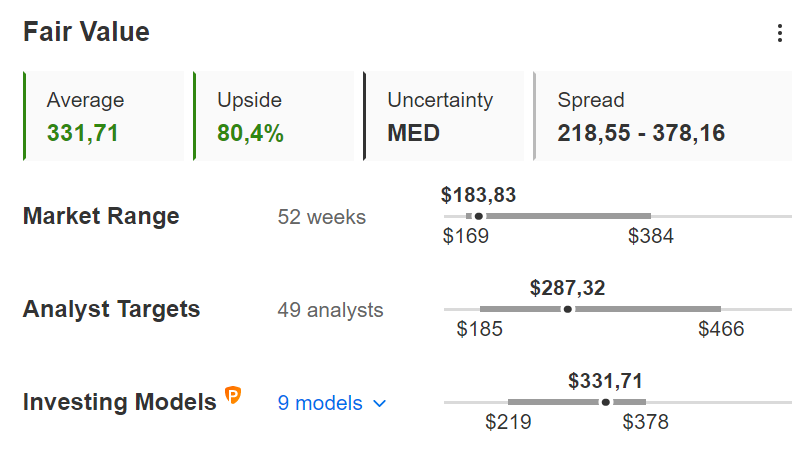

Speaking of Meta Platforms Inc, the stock (which is currently in one of my portfolios) has a potential discount of 80% to its fair value (so the margin is there), and even if we want to be more conservative, the multiples have fallen in just a few months with a P/E of 13.3 and a P/S of 4.29, definitely very good valuations.

Until next time!

***

If you find my analyses useful, and would like to receive updates when I publish them in real time, click on the FOLLOW button on my profile!

"This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any type of asset, is valued from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with you."