- Reports Q2 2022 results on Friday, July 22, before the open

- Revenue Expectation: $6.27B; EPS Expectation: $0.3987

- Global demand-led capital spending will drive an exceptional multi-year growth cycle

The world’s largest oil-field services company, Schlumberger (NYSE:SLB), appears to be in a sweet spot. With oil prices hovering around $100 and global equipment shortages persisting, sales are surging back to pre-pandemic levels while profit margins keep displaying a healthy trend.

According to analysts’ consensus forecast, when Houston and Paris-based Schlumberger reports its latest quarterly earnings on Friday, its sales may jump 11% to $6.27 billion from the same period a year ago.

As oil producers worldwide scramble to increase outputs in a bid to ease tight supplies, following the Russian invasion of Ukraine and subsequent Western sanctions on Russian energy, Schlumberger has been gearing up for growth.

SLB plans to boost spending by 18% to $2 billion this year, targeting North American oil explorers who should dominate activity in the first half of the year, followed by international growth in the final six months.

Chief Executive Officer Olivier Le Peuch believes global demand-led capital spending will drive an exceptional multi-year growth cycle. He said in a statement in April:

“The dislocation of supply flows from Russia will result in increased global investment across geographies and the entire energy value chain to ensure the diversification and security of the world’s energy supply.”

Schlumberger operates in more than 120 countries, supplying the energy industry’s most comprehensive range of products and services, from exploration through production. Indeed, its last quarterly results served as a bellwether for the energy business, given the company’s regional reach and insight into drillers’ plans.

Stock Is Down 30%

Despite the surging demand for its services, Schlumberger stock has shed more than 30% of its value during the past six weeks amid heightened fear that a recession could trigger a sharp decline in energy demand. Its stock traded at $33.73 at the time of writing, sharply lower than this year’s high of $49.83.

In addition to macro uncertainties, Schlumberger’s high exposure to Russia is another risk factor keeping investors on the sidelines. The company said in April that it is suspending future investment in Russia, a market representing about 5% of its total sales.

Despite these uncertainties, the current risk/reward proposition favors Schlumberger stock after the recent pullback. With the highly tight global supplies, no producer is sitting idle, and continuing equipment shortages mean SLB and its peers have significant pricing power.

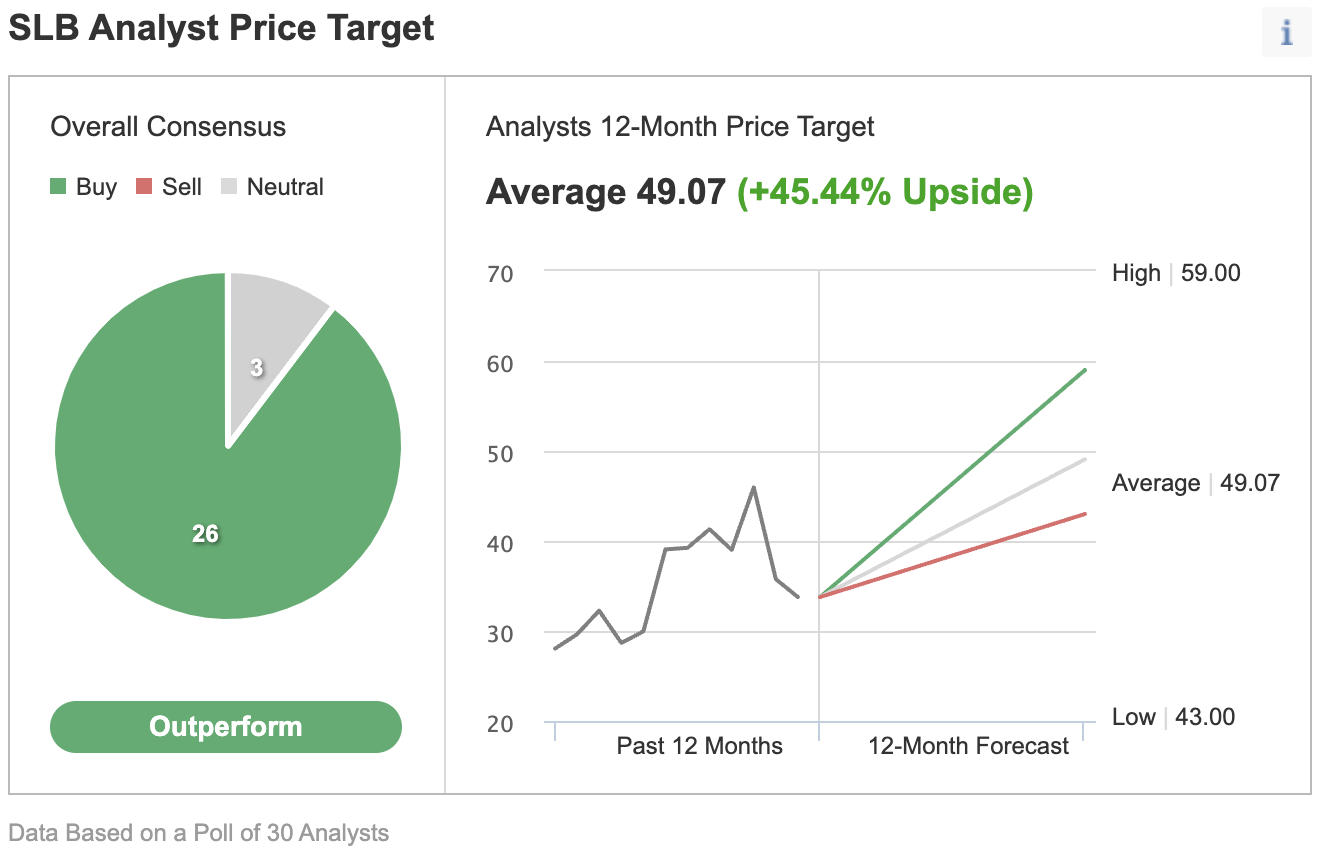

In an Investing.com poll of 30 analysts, 26 rated Schlumberger a buy, implying a 45.44% upside potential.

Source: Investing.com

Halliburton's (NYSE:HAL) Chief Executive Officer Jeff Miller told analysts during a conference call today:

“Oil- and gas-market fundamentals still strongly support the multi-year energy upcycle. Post-pandemic economic expansion, energy-security requirements, and population growth will continue to drive demand.”

Bottom Line

After going through massive restructuring since the pandemic-driven slump in energy markets, Schlumberger is a much slimmer and more efficient company that should continue to benefit from the favorable conditions for companies that provide tools to producers. The company’s incoming earnings report is likely to prove that point.