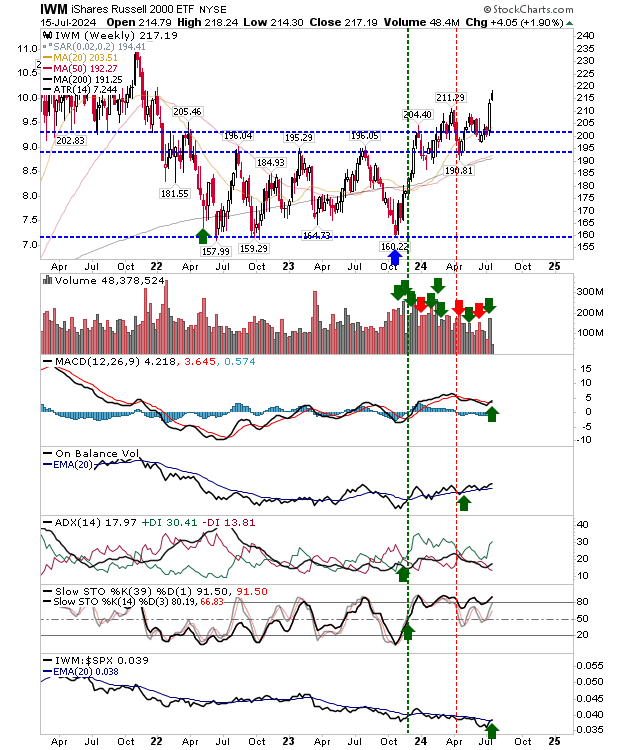

The Russell 2000 (NYSE:IWM) surprised many with a strong session yesterday, building on its positive finish last week. The index shows promising signs of forming a right-hand-side base. Technical indicators remain positive, suggesting potential for relative outperformance against the S&P 500.

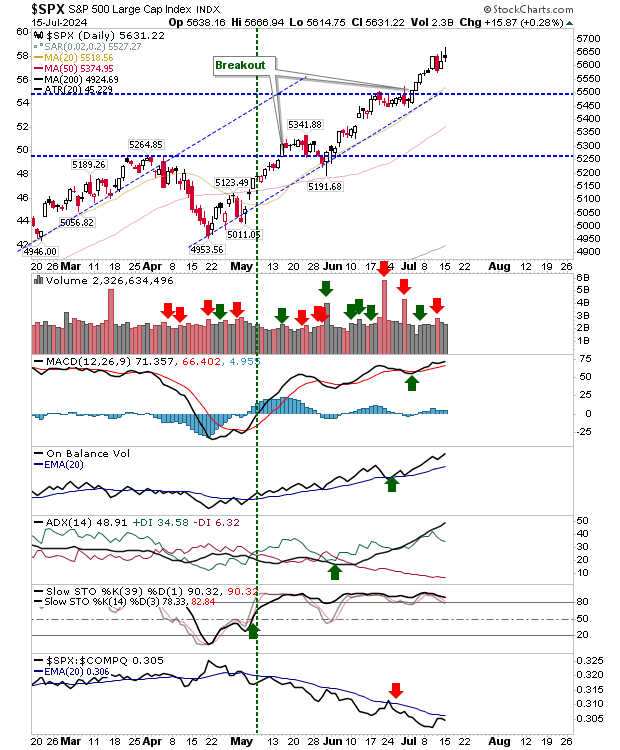

The S&P 500 and Nasdaq both opened with gaps higher, but neither could build on their success. Technicals are net positive, although the S&P 500 is underperforming the Nasdaq. Yesterday's doji has the potential to mark a reversal, a weak pre-market session today would likely confirm it.

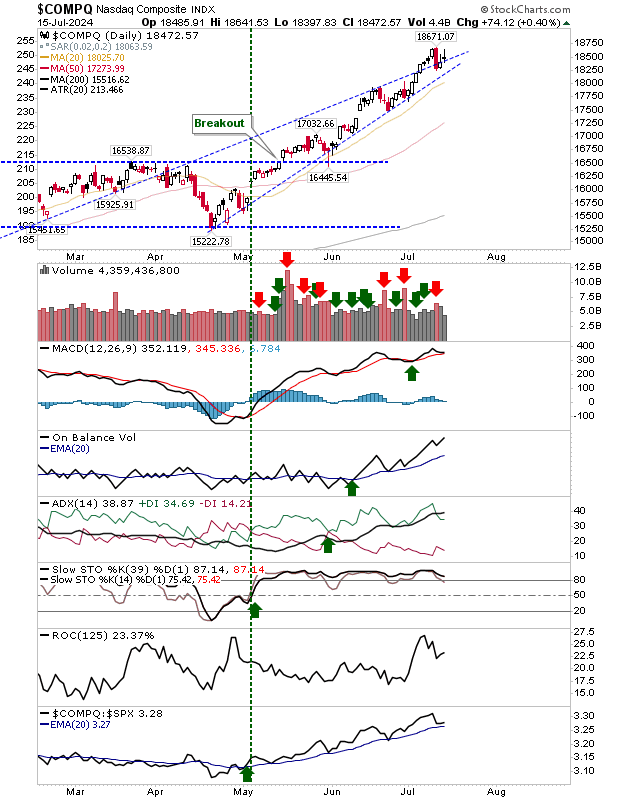

The Nasdaq doji was contained by last Thursday's high, making it a little more vulnerable to a reversal today. As with the S&P 500, if there is a weak pre-market then it could turn into a tough day. A move above 18,670 will break the bearish implications of last Thursday's selling, and yesterday's potential reversal doji.

Watch the premarket for leads. The Russell 2000 is now the bullish one to watch with lots of room for upside, so buying down days will be good for investors. A weak pre-market has the potential to hurt S&P 500 and Nasdaq traders, particularly with money cycling into small-cap stocks. However, if the latter indexes can (EOD) close above yesterday's highs then the reversal potential of these doji is negated.