- May CPI was ugly, PPI not much better

- Fed hikes but remains far behind inflationary curve

- Stocks not plunging; but eroding

- VIX edges higher without spiking

- Rising rates only small part of bearish problem

Stocks have had a rough time in 2022, with the NASDAQ Composite, S&P 500 and Dow Jones Industrial Average posting substantial losses since Dec. 31.

After years of low interest rates and inflation below the Federal Reserve’s 2% target, consumer and other prices have soared. The Fed and U.S. Treasury called increasing inflation a “transitory” event throughout most of 2021, blaming rising prices on pandemic-triggered supply-chain bottlenecks. While policymakers have now acknowledged they were wrong, the central bank and government officials have not taken responsibility for inflation.

In 2020, artificially low interest rates and quantitative easing created a liquidity tidal wave. Government policies to stimulate the economy during the pandemic were unprecedented. While necessary, the policies were haphazard, lasted far too long, and planted inflationary seeds that sprouted during the second half of 2020, bloomed in 2021, and spread like wildfire in 2022.

Rising CPI and PPI data and a declining bond market sent warning signals. The first major war in Europe since the Second World War and a bifurcation between nuclear powers only exacerbate inflationary pressures.

Stocks rallied while interest rates were low, but the markets now face a landscape where rates will chase inflation on the upside. Capital is flowing from equities to fixed-income investments, and the prospects for the stock market look ugly in June 2022.

May CPI Was Ugly, PPI Not Much Better

The May U.S. Consumer Price Index came in hot as a pistol, with the highest reading since December 1981. The CPI rose 8.6% from the previous year, with the core reading up 6%. Both were higher than the market had expected. The Producer Price Index rose 10.8%, continuing the streak of double-digit increases.

Surging food, gas, and energy prices underpinned inflation as they filter through to the core reading, impacting prices of all goods and services. Rising inflation has been a call to action for the world’s central banks. The European Central Bank recently said it would lift interest rates out of negative territory, but inflation will continue to cause real interest rates to remain below zero as inflation erodes the euro’s value. The same goes for the U.S. central bank, which began increasing rates and tightening monetary policy before the ECB.

Fed Hikes But Remains Far Behind Inflationary Curve

On Wednesday, June 15, the Federal Reserve increased the short-term Fed Funds Rate by 75 basis points to a range of 1.50% to 1.75%. The central bank had not boosted the rate by three-quarters of a percent since 1994. The Fed considers the core CPI reading the most reliable inflation data because food and energy prices are highly volatile. At a core reading of 6%, the bottom end of the Fed Funds band is one-quarter of the Fed’s favorite inflation metric.

The core measure could be a mirage in the current environment because of the significant increases in food and energy prices due to the war in Ukraine that has changed the nature of these markets. The war creates a supply-side problem for the economy. The central bank’s tools tend to be effective on demand-side economic dynamics.

The bottom line is that at a 1.50%-1.75% short-term interest rate, the central bank is far behind the inflationary curve, which can only exacerbate the economic condition.

Stocks Not Plunging, Rather Eroding

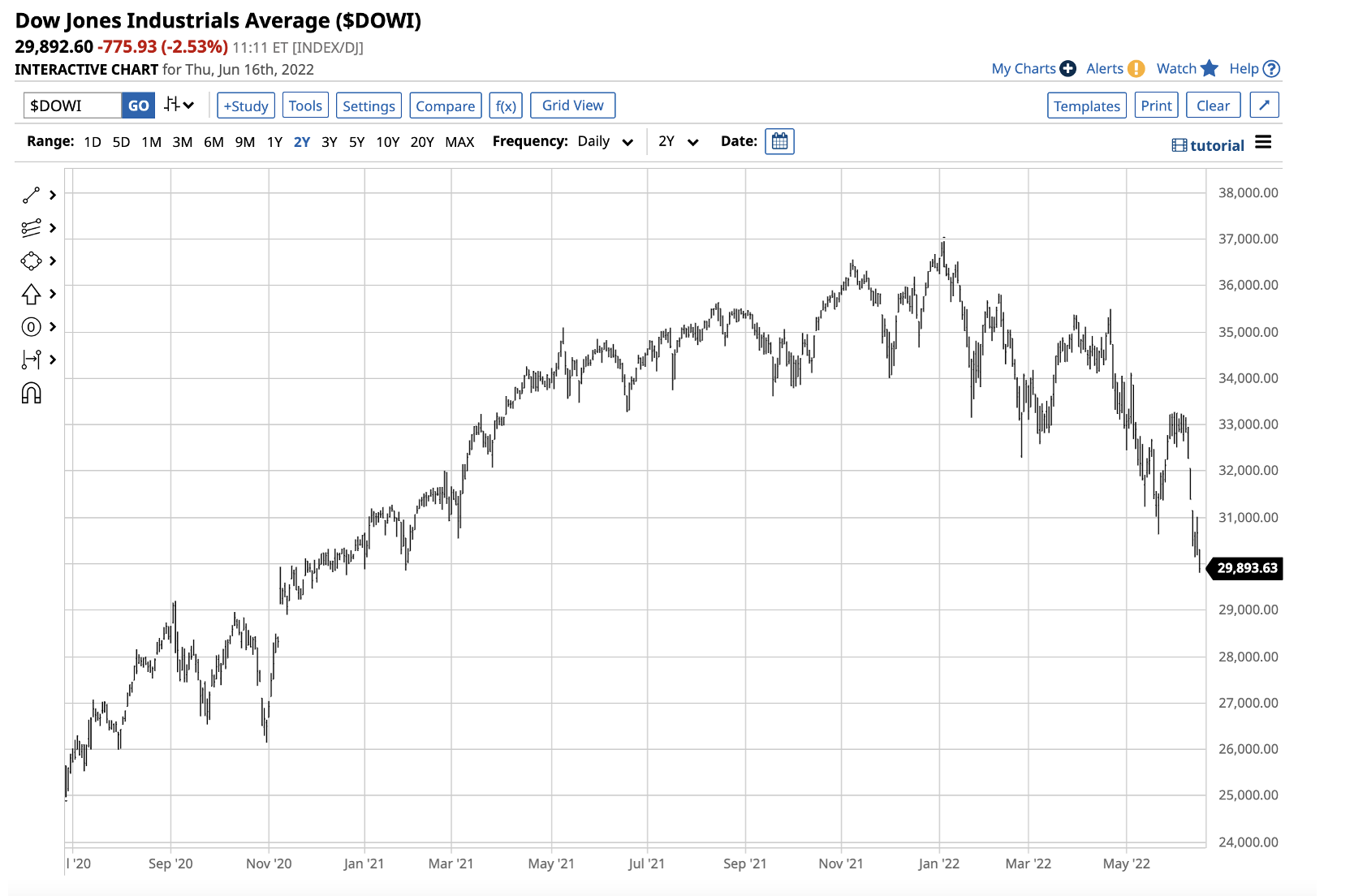

The leading stock market indices have made lower highs and lower lows in 2022. The downside pressure began to intensify in mid-June.

Source: Barchart

The chart shows the S&P 500, the most diversified U.S. stock market index, reached a record high of 4,818.62 on Jan. 4. At 3,675 on June 20, the index corrected 24%, with the selling picking up downside steam after the latest CPI data.

Source: Barchart

The technology-heavy NASDAQ Composite peaked earlier than the S&P 500, reaching a record high of 16,212.23 on Nov. 22, 2021. The NASDAQ was at 10,798 on June 20, 33.3% below the November record peak, as the tech stock index lost one-third of its value.

Source: Barchart

The DJIA may be the best performing index, but it dropped from 36,952.65 on Jan. 5, to 29,889 on June 20, a 19.1% decrease. Stocks were eroding over the past months, but the selling picked up steam following the latest inflation data and the Fed rate hike.

Meanwhile, the September U.S.30-Year Treasury Bond futures fell to a low of 131-01 on June 16, the lowest level since January 2014. Thirty-year conventional mortgage rates were below 3% at the end of 2021 and were above 6% in mid-June 2020. A $300,000 mortgage cost more than $750 above the expense only six months ago.

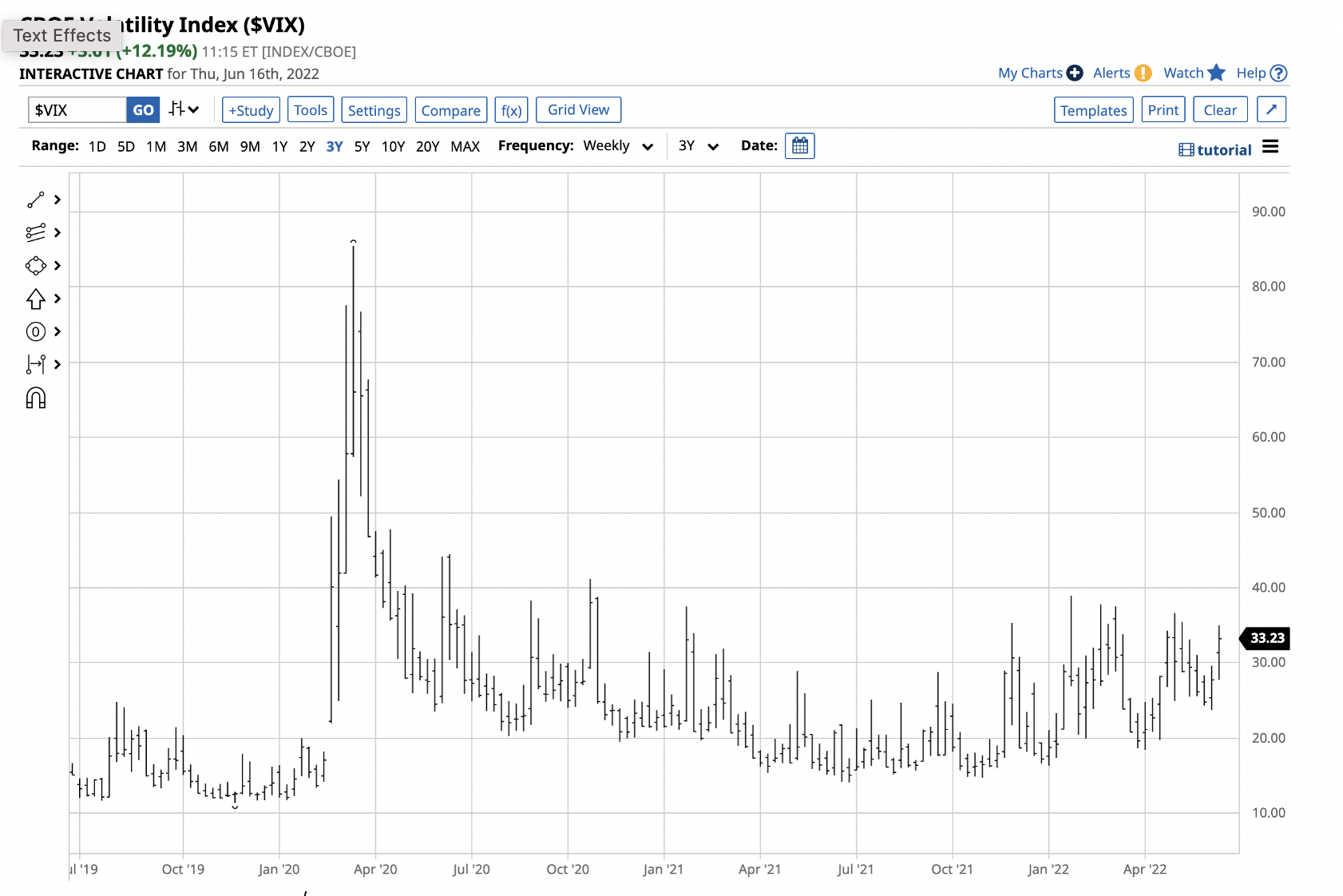

VIX Edges Higher But Does Not Spike

In the past, bearish stock market trends have typically ended after an ugly period of capitulation where many market participants run for the exits. Before the latest CPI data, the stock market had been eroding.

The VIX index reflects the implied volatility of S&P 500 stocks. Implied volatility is the primary determinate of put and call option prices, and options are price insurance. The VIX tends to increase when stocks decline as market participants protect portfolios with price insurance.

While the base level of the VIX has moved higher over the past months, the index has not spiked higher, which means the stock market has not experienced wholesale capitulation.

Source: Barchart

The chart shows the stock market’s March 2020 capitulation led to a spike to the 85.47 level in the VIX index. At 30.36 on June 20, the volatility index was elevated but not at a level that indicates the stock market is anywhere near a capitulation bottom.

Rising Rates Only Small Part Of Bearish Problem

The Fed and other central banks are in a challenging position as they face supply-side inflation and only have demand-side tools at their disposal. Moreover, falling stocks and GDP in Q1 increase the odds of a recession while inflation continues to push prices higher. Stagflation is a horrible economic beast.

Rising rates are weighing on the stock market, but the war in Europe, tensions between the world’s nuclear powers, and U.S. mid-term elections with the world’s leading economy divided along political lines have stoked significant uncertainty in markets across all asset classes.

The decline in the stock and bond markets has not signaled any capitulation, which could be the most bearish factor facing the markets. The VIX in the 30+ range does not indicate market participants are panicking.

Rising rates are just one issue facing the U.S. stock market in mid-June 2022. The bear is likely to continue to guide stocks until the market can establish what could be a blow-off low. The most bearish pattern in stocks could be a continuation of whack-a-mole conditions, where new lows lead to rip-your-face-off rallies that give way to lower lows.

Be careful in the stock market, as increased interest rates are one of many problems confronting equities in mid-2022.