- Q2 earnings season has proved much better than what many expected

- Retail sector might see volatility this week as consumer companies issue results

- XRT ETF almost 50% off November 2021 peak, recently broke out from downtrend

Earnings season still has one final hurdle. Many big-name retailers report second quarter results this week, and the bar might be a bit higher now that more than 90% of S&P 500 firms issued results.

According to Raymond James using FactSet data, the EPS beat rate has been 74%, while total earnings growth for the quarter is near 7%. Those are much better figures than many pundits had feared considering the economy was in technical contraction during the first half.

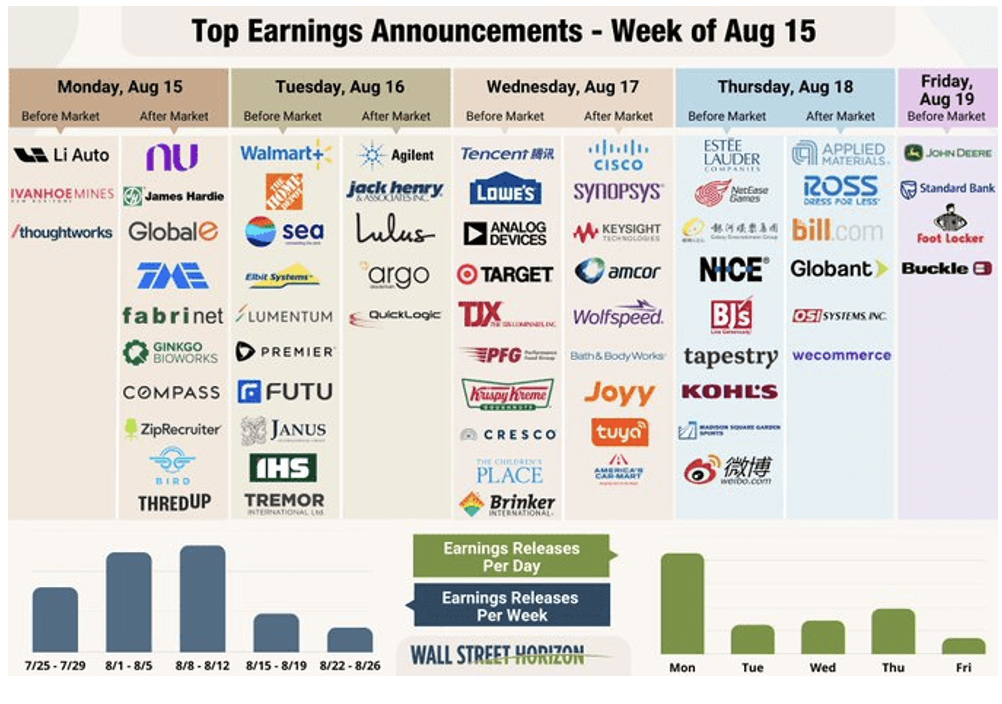

Walmart (NYSE:WMT) and Home Depot (NYSE:HD) get the party started today with their results, followed by Target (NYSE:TGT), Lowe’s (NYSE:LOW) and TJX Companies (NYSE:TJX) on Wednesday.

Kohl's (NYSE:KSS) and Ross Stores (NASDAQ:ROST) profit numbers hit the tape Thursday. Finally, Foot Locker (NYSE:FL) and The Buckle (NYSE:BKE) wrap things up Friday, according to data from Wall Street Horizon.

Source: Wall Street Horizon

When analyzing retail, I like to check out price action with one popular ETF. The SPDR® S&P Retail ETF (NYSE:XRT) is an equal-weight product that tracks the S&P Retail Select Industry Index. It consists of several sub-industries across the market-cap spectrum.

So, while a handful of large-cap companies report this week, the fund is moved just as much by smaller players (like Buckle). XRT has 100 total holdings and pays a 2.15% dividend yield, according to SSGA. Interestingly, after Carvana (NYSE:CVNA) shares surged more than 120% in the last month, it is an outsized position in the fund.

The retail ETF trades at just 9.4 times last year’s earnings, per SSGA, with a forward P/E ratio of 10.23. With an expected EPS growth rate of almost 17% over the coming years, the valuation looks good. Morningstar classifies XRT as a small-cap value fund, with 77% of assets in its consumer cyclical category.

Technically, XRT has broken above an important downtrend line dating back to last November, when so many consumer and tech stocks peaked. Also consider that small- and mid-cap equities petered out about that time, too.

The ETF established a bullish base in the $58-to-$60 range from late May through late July (shortly after Walmart and Target issued their horrendous Q1 profit numbers). Volume declined through that period, which is not uncommon when a stock or fund consolidates.

Since then, XRT is up in 10 of the past 13 sessions, but volume has not been tremendous. I think shares can rally up to the January-through-April range—that congestion zone could prove problematic, though. Still, a bit more upside might be seen.

Source: Investing.com

Bottom Line

Expect the retail industry to move this week as we get the latest read on the consumer. The equally-weighted XRT ETF has broken out from its downtrend, so the momentum is with the bulls after a 45% drubbing from November 2021 to the low in May. Fireworks might begin today with Walmart, which previously issued a negative profit warning, providing its quarterly numbers.