- Financial heavyweights gear up to reveal Q4 results, setting the tone for 2025.

- Analysts highlight strong growth potential, with Wells Fargo and BlackRock leading forecasts.

- High-interest rates and M&A activity could drive further gains for the banking sector.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

The stage is set for the Q4 earnings season, as U.S. financial heavyweights prepare to unveil their fourth-quarter results. JPMorgan (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Goldman Sachs (NYSE:GS), and BlackRock (NYSE:BLK) will release their numbers on Wednesday, with Bank of America (NYSE:BAC) and Morgan Stanley (NYSE:MS) following on Thursday.

According to FactSet estimates, earnings for the S&P 500 are projected to rise 12% year-over-year, marking the fastest growth since 2021. Much of this success hinges on financial giants delivering strong performances, fueled by a robust banking sector.

Banks Leading From the Front

Financial stocks surged 28% in 2024, outpacing the broader S&P 500’s 23.3% gain. Analysts expect this momentum to carry into earnings, with industry profits projected to climb nearly 40% in the fourth quarter. These tailwinds could position banks to soar even higher in 2025, provided macroeconomic conditions hold steady.

Banks have enjoyed a significant advantage from the high-interest-rate environment. Moneyfarm analysts point out that net interest margins—the difference between what banks earn on loans and pay on deposits—have expanded, boosting profitability.

But interest rates aren’t the only factor sparking optimism. Experts see additional catalysts, including a potential uptick in mergers and acquisitions, a revival of IPOs, loosened regulations, and attractive valuations. "Although still undervalued, the sector could present compelling investment opportunities in 2025 if the economy remains stable," Moneyfarm suggests.

Optimism Dominates Analysts’ Forecasts

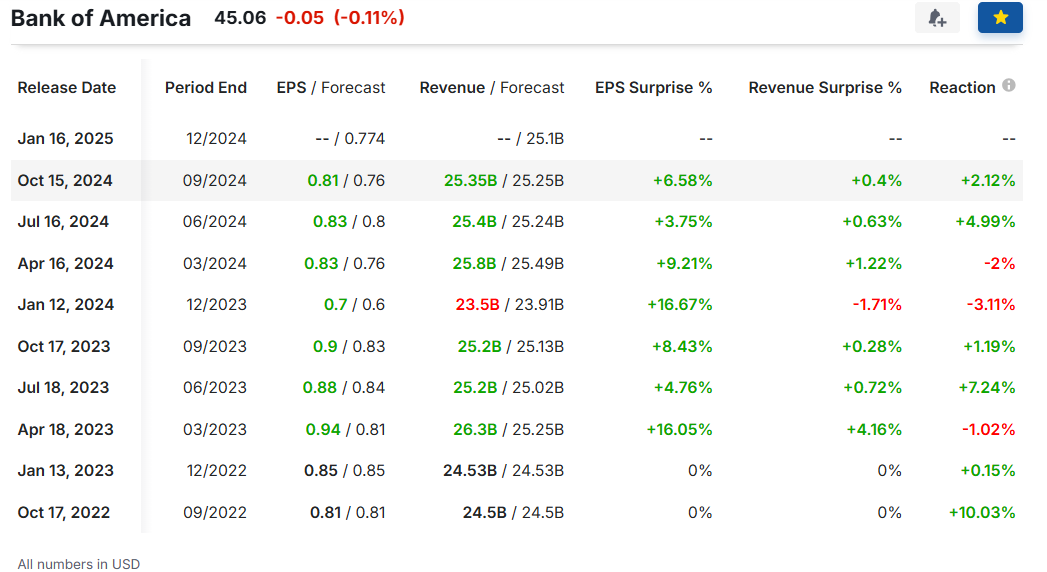

Earnings projections for major banks have improved for six out of seven players over the past 90 days. Even Bank of America, which saw estimates dip slightly, is expected to report year-over-year earnings growth. This confidence underlines the belief that U.S. banks are well-positioned to benefit from a strong close to 2024.

Source: InvestingPro

After a banner year for financial stocks, a decline in interest rates could pressure margins, increasing the likelihood of market corrections if earnings fall short of expectations.

Which Bank Stock Is Poised for the Biggest Growth in 2025?

As markets anticipate strong results, the question remains: Which big bank is primed for the most growth in the year ahead?

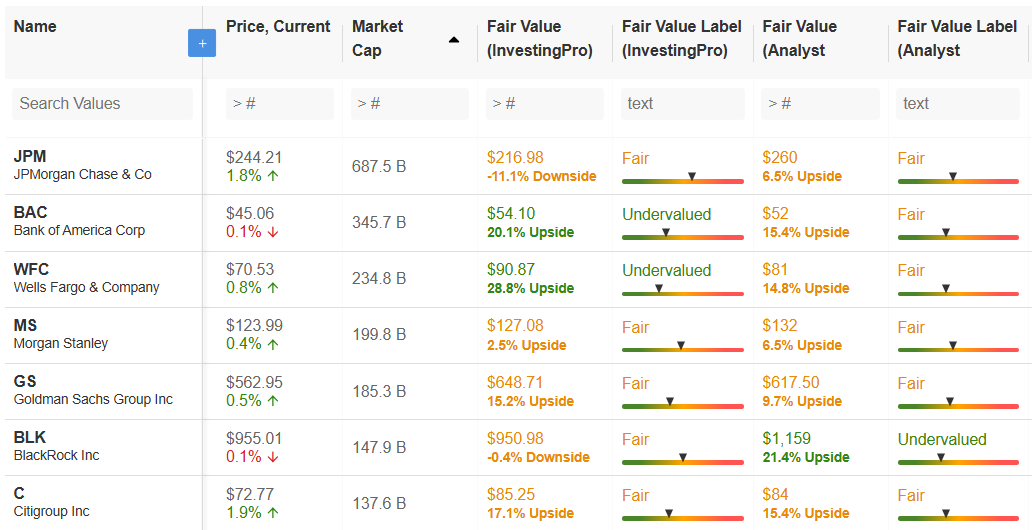

InvestingPro data highlights BlackRock as the top contender, with analysts forecasting a 21.4% potential price increase.

Source: InvestingPro

Citigroup and Bank of America follow closely, each with a 15.4% upside. When considering fair value, Wells Fargo stands out with an estimated 28.8% growth potential, while Bank of America and Citigroup also show promise.

Investors will be watching this week’s earnings reports closely, as they could set the tone for financial stocks in 2025. While the sector offers enticing opportunities, staying alert to economic shifts and earnings surprises will be crucial for navigating what lies ahead.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.