- ProPicks, an AI-powered investment tool, consistently outperforms benchmarks like the S&P 500 with meticulously analyzed high-performing stocks, offering refined long-term investment strategies.

- With six robust strategies, ProPicks caters to diverse investor preferences, ensuring superior performance through continuous updates and evaluations.

- Subscribe now for up to a 60% discount during the Extended Cyber Monday Sale to access ProPicks' exclusive strategies, backed by advanced AI models trained on 25 years of investment data.

Embrace the future of stock selection with ProPicks, your gateway to streamlined AI-powered investment decision-making!

ProPicks introduces a handpicked list of high-performing stocks meticulously analyzed and validated by advanced AI models, consistently outshining major benchmarks like the S&P 500.

No longer just for institutional investors and hedge funds, this cutting-edge product offers a wide spectrum of long-term investment strategies, continuously refined to showcase only the most promising opportunities. Each strategy undergoes rigorous evaluations against current market changes to ensure unwavering reliability and performance.

At the heart of ProPicks lie AI models rigorously trained on over 100 financial metrics, incorporating a wealth of 25 years' worth of investment data. Powered by Google Vertex AI, these models operate with unparalleled speed and precision, sifting through vast company datasets to pinpoint stocks poised to outperform the major indices.

Perhaps ProPicks' biggest strength lies in its ability to eliminate emotional biases from stock selection while dynamically adapting to market shifts. Employing machine learning, combined with AI synergy, it evaluates tens of thousands of companies and identifies stocks with the potential to flourish across diverse market conditions.

Offering strategies tailored to different investor preferences and risk appetites, ProPicks caters to a wide range of investment styles. Typically, each strategy is updated on a monthly basis to ensure that you know what to potentially buy, and when to potentially buy it.

ProPicks is available to all InvestingPro subscribers.

Not yet a Pro user? Subscribe now for an up to 60% discount for limited time only as part of our Extended Cyber Monday Sale!

As a token of appreciation, readers of this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code PP_OA1, and a similar discount of 10% on the bi-yearly Pro+ plan by using coupon code PP_OA2 at checkout!

Let's explore the six robust strategies ProPicks offers:

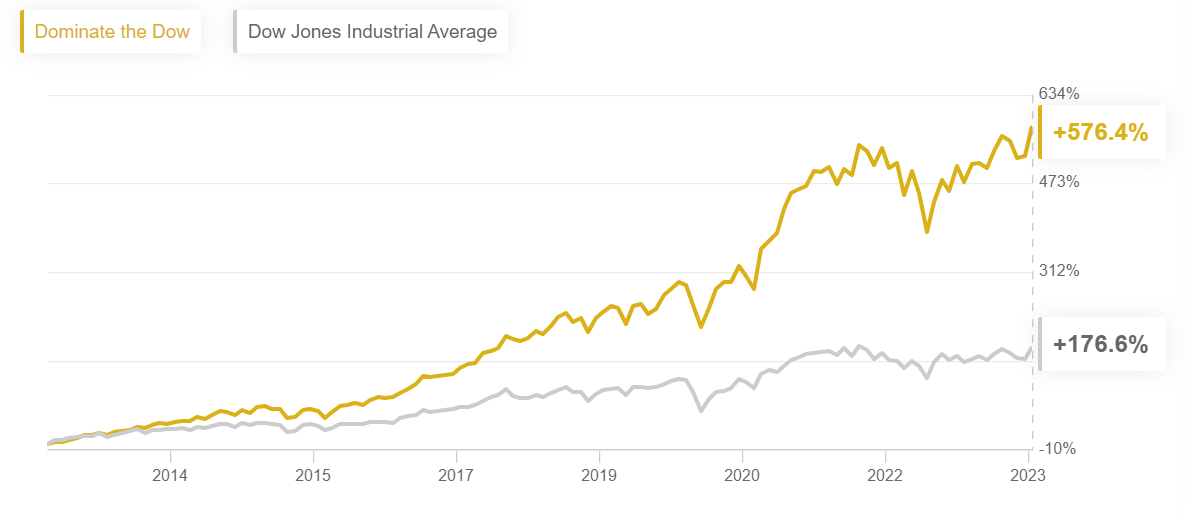

1. Dominate the Dow

Focused on top-tier companies within the Dow Jones Industrial Average, ProPicks’ AI-driven 'Dominate the Dow' strategy is methodically tailored for industry-leading companies boasting solid fundamentals and a consistent history of annual growth.

Source: InvestingPro

Known for their stability, market leadership, and high growth potential, this strategy identifies the top 10 blue-chip stocks within the Dow 30 that present the most compelling investment opportunities.

The historical back-test of 'Dominate the Dow' serves as a testament to the strategy's performance over time, beating its benchmark index by nearly 400% over the last decade, with an annualized return of 19.1%.

Source: InvestingPro

Some of the key stocks that made the cut this month include JPMorgan Chase (NYSE:JPM), Nike (NYSE:NKE), Boeing (NYSE:BA), Caterpillar (NYSE:CAT), and American Express (NYSE:AXP).

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

Regularly updated and charted against changes in market trends, these blue-chip winners more than earn their reputation as industry leaders.

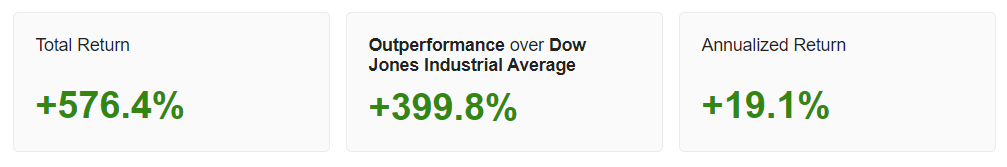

2. Beat the S&P 500

True to its name, the ProPicks ‘Beat the S&P 500’ strategy uses sophisticated AI models to carefully analyze financial data from the entire pool of 500 stocks within the S&P 500. Its primary aim is to pinpoint the top 20 standout names showing the greatest potential for outperformance each month.

Source: InvestingPro

Using AI, our models evaluate every stock based on critical performance benchmarks - such as valuation ratios, momentum metrics, and overall company health - and then charts them against evolving market dynamics in real time.

Historical data shows that the ‘Beat the S&P 500’ strategy would have outperformed the benchmark index by a whopping 670.7% in the past decade, providing an annualized return of 23.4% during that time period.

Source: InvestingPro

Among the selected stocks this month are Booking Holdings (NASDAQ:BKNG), Lam Research (NASDAQ:LRCX), Palo Alto Networks (NASDAQ:PANW), Synopsys (NASDAQ:SNPS), Cigna (NYSE:CI), and KLA Corporation (NASDAQ:KLAC).

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

Consistently monitored and tracked in accordance with market shifts, these high-quality names undeniably validate their status as industry frontrunners.

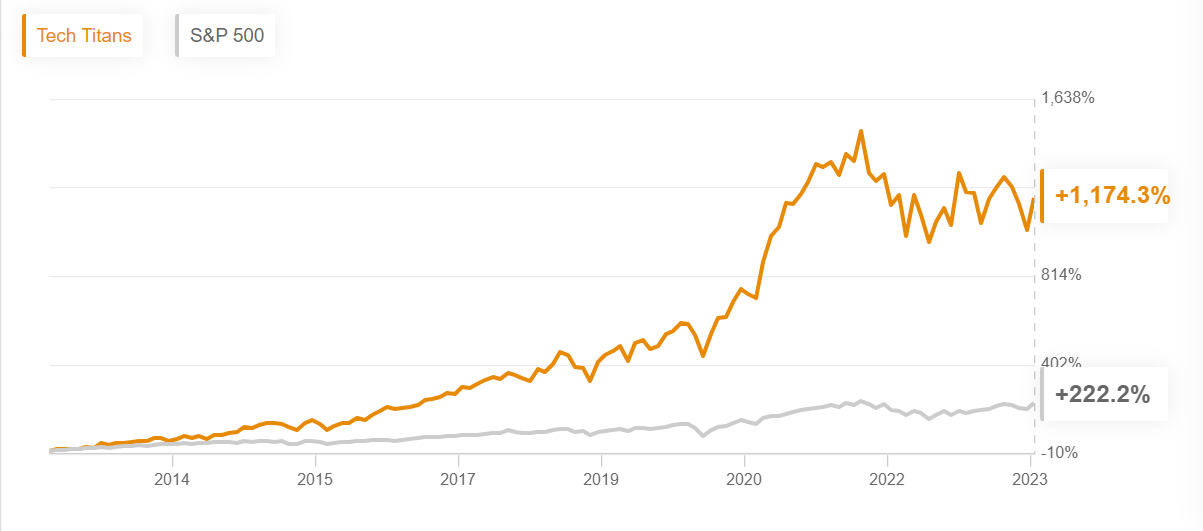

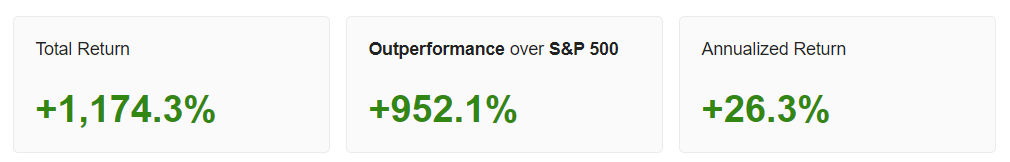

3. Tech Titans

Highlighting 15 tech companies at the forefront of innovation, the ‘Tech Titans’ strategy presents a unique opportunity to ride the tech wave with a carefully selected group of proven tech winners.

Source: InvestingPro

Already established with a sizeable market cap, this strategy includes current industry leaders and rapidly emerging businesses - each with impressive metrics and innovations.

Historical analysis reveals the ‘Tech Titans’ strategy's remarkable track record, blowing past the benchmark index by an astounding 952% over the past decade, resulting in an annualized return of 26.3% within that period.

Source: InvestingPro

Included in the tech-focused strategy’s portfolio this month are Applovin (NASDAQ:APP), Extreme Networks (NASDAQ:EXTR), Nutanix (NASDAQ:NTNX), and Microstrategy (NASDAQ:MSTR).

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

As we’ve witnessed this year, the tech industry moves quick. This is why ProPicks’ AI algorithms constantly monitor and update every pick accordingly every month.

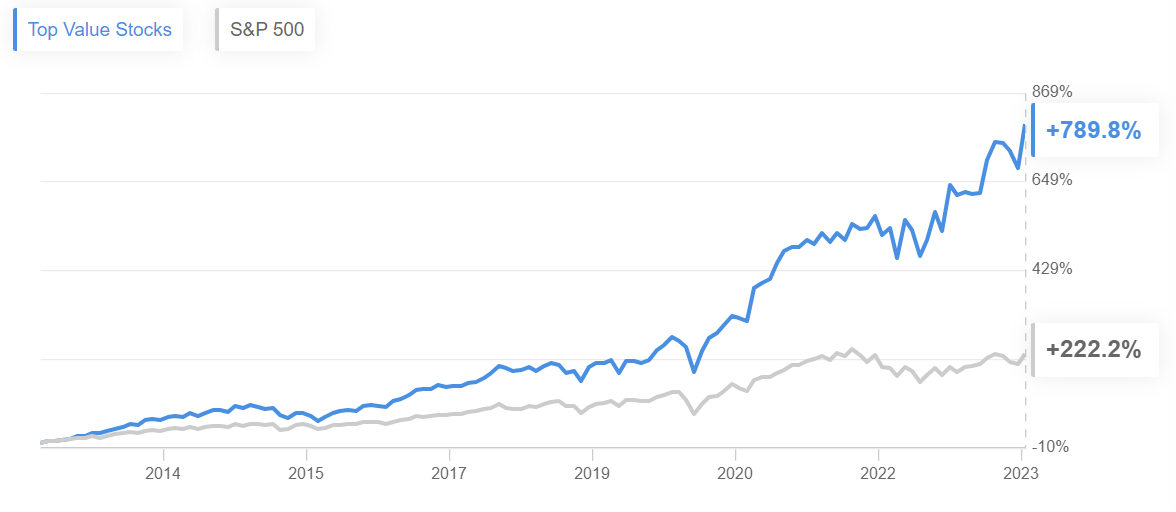

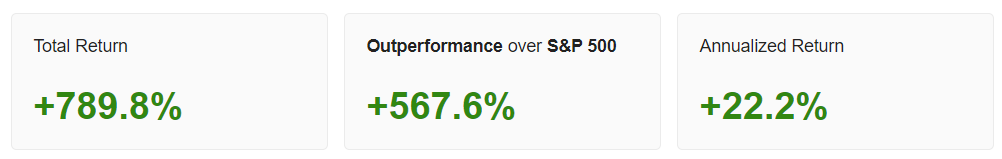

4. Top Value Stocks

As the name implies, the ‘Top Value Stocks’ strategy focuses on companies with attractive price-to-earnings (P/E) ratios that are potential bargains. Our groundbreaking models utilize AI to identify up to 20 undervalued stocks with strong upside potential, each with solid earnings that are primed for growth.

Source: InvestingPro

The ‘Top Value Stocks’ strategy continuously evaluates individual stocks, taking into account essential performance indicators such as valuation ratios, momentum metrics, and overall company well-being, and aligning them with real-time shifts in the market.

Looking back, the value-focused ProPicks strategy has shown an exceptional history, exceeding the benchmark index by a staggering 568% over the previous decade. That translates to a notable annualized return of 22.2% in that timeframe.

Source: InvestingPro

In addition to Cisco (NASDAQ:CSCO), and Qualcomm (NASDAQ:QCOM), some of the value stocks that meet the rigorous criteria are Applied Materials (NASDAQ:AMAT), Booking Holdings, Bristol-Myers Squibb (NYSE:BMY), and Keysight Technologies (NYSE:KEYS).

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

It should be noted that these companies are currently trading lower than their perceived intrinsic value - which means they're also a potentially huge bargain.

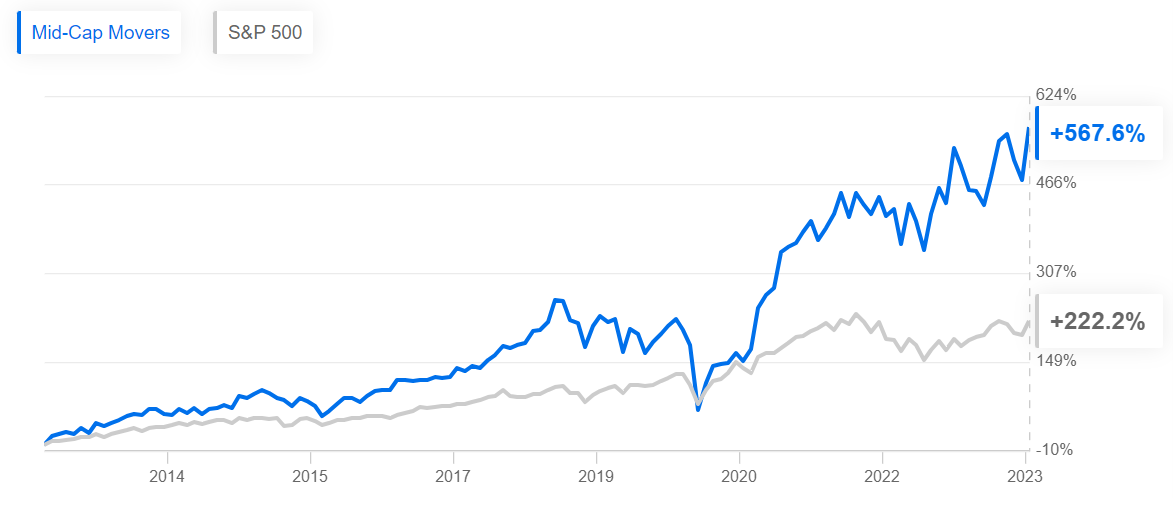

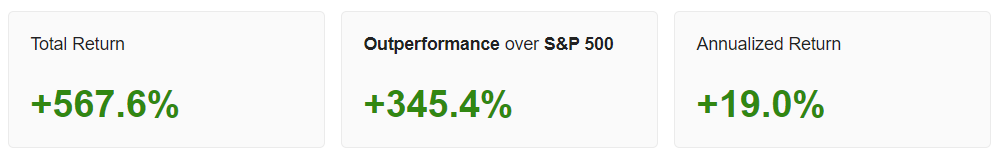

5. Mid-Cap Movers

Renowned for generating superior overall returns, the ‘Mid-Cap Movers’ strategy focuses on standout mid-cap stocks which have been thoroughly identified by our state-of-the-art AI technology.

Source: InvestingPro

Not too big, but not too small, each of the 20 mid-sized companies to successfully pass the strategy’s selection criteria are viewed as the foremost entities in their respective domains and are poised for significant growth. As such, the ‘Mid-Cap Movers’ strategy offers investors a blend of stability and potential for exponential growth.

Through historical analysis, the ‘Mid-Cap Movers’ strategy has showcased an outstanding past performance, beating the benchmark index by a remarkable 345% over the last decade, and achieving an annualized return of 19% within that timeframe.

Source: InvestingPro

Included within the set of chosen mid-cap stocks this month are Wayfair (NYSE:W), Caesars Entertainment (NASDAQ:CZR), Zions Bancorporation (NASDAQ:ZION), Victoria's Secret (NYSE:VSCO), and Halozyme Therapeutics (NASDAQ:HALO).

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

Normally, combing through the entire stock market for mid-cap standouts like this would be a full-time job. But with ProPicks’ advanced AI tools, evaluated monthly against market changes, it's now as simple as ever.

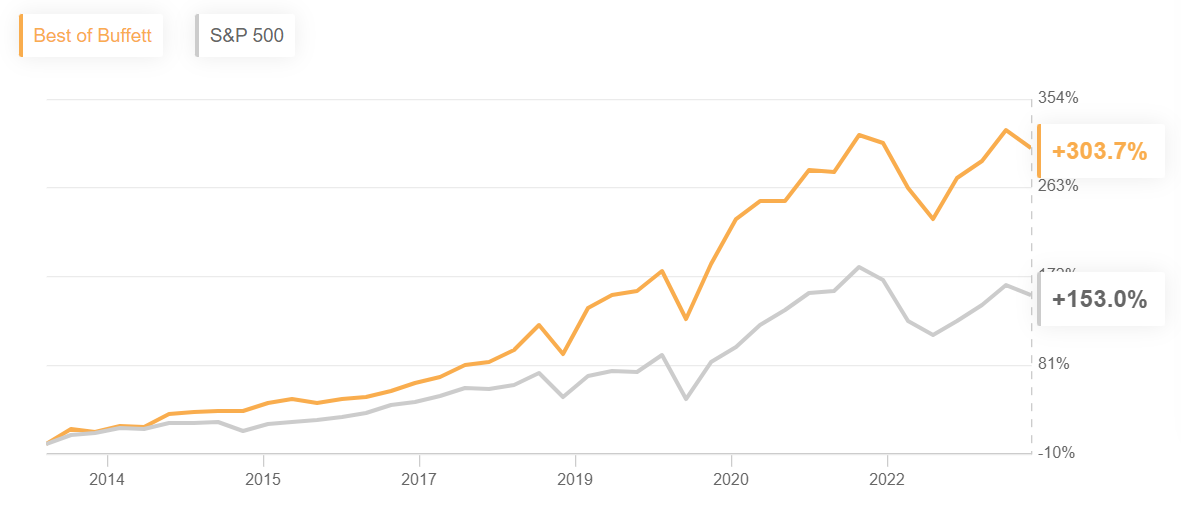

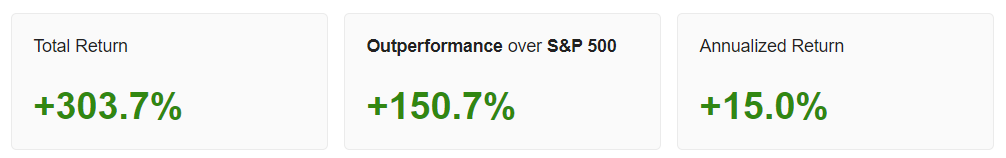

6. Best of Buffett

Not just for beating the indices, the ‘Best of Buffett’ strategy allows you to track the moves made by the Oracle of Omaha himself, Mr. Warren Buffett. Our state-of-the-art AI models have analyzed every stock in Buffett's renowned portfolio and determined the top 15 stars from an already stellar group.

Source: InvestingPro

Leveraging our cutting-edge AI tools, ProPicks isolates the cream of the crop within Buffett’s portfolio to identify the winning stocks that resonate with investors aiming to emulate his success.

Examining historical data unveils the remarkable performance of the ‘Best of Buffett’ strategy, surpassing the benchmark index by an astounding 150% over the past decade. Followers of this strategy would have enjoyed an annualized return of 15% every year since 2013.

'

'

Source: InvestingPro

Procter & Gamble (NYSE:PG), Visa (NYSE:V), and Moody's Corporation (NYSE:MCO) meet the specified conditions and make up the roster of qualifying stocks this quarter.

Subscribe now for an up to 60% discount and see all the ProPicks from our six strategies!

It is worth mentioning that these selections are evaluated and updated on a quarterly basis, aligning with Buffett's disclosed 13F holdings, to ensure up-to-date accuracy and relevance.

InvestingPro subscribers will receive periodic updates on the status of their ProPicks.

Not yet a Pro user? Subscribe now for an up to 60% discount for limited time only as part of our Extended Cyber Monday Sale!

Readers of this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code PP_OA1, and a similar discount of 10% on the bi-yearly Pro+ plan by using coupon code PP_OA2 at checkout!

***

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.