As the US election approaches tomorrow, history shows little long-term S&P 500 impact from election outcomes, while global economic forces like SNB profits and ChatGPT’s energy demands drive market dynamics.

On the eve of the US election, it’s worth remembering the following chart. In the long run, electing one candidate over another has had little impact on the S&P 500 index.

Whether the occupant of the White House is Republican (in red) or Democrat (in blue), the S&P 500 has continued its steady upward trend.

Source: Ritholtz

Meanwhile, US Debt Costs Are Surging

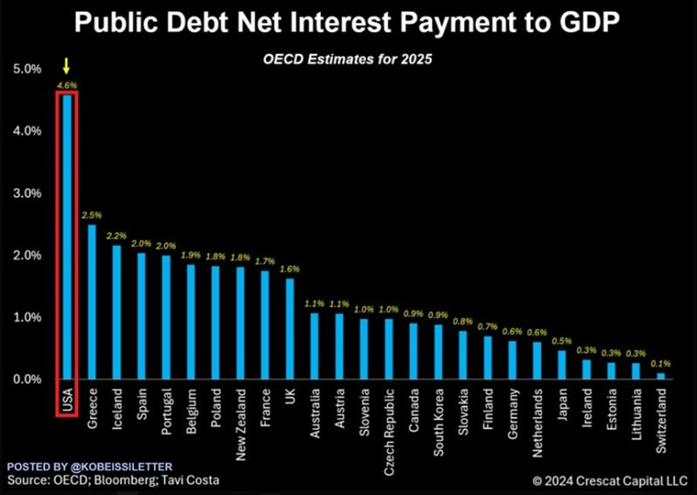

The outlook for US public debt is worsening, as net interest payments as a percentage of GDP are projected to reach a record 4.6% next year.

This would represent more than double the levels during World War II and exceed the historic peaks reached in the 1990s.

This figure is also far higher than net interest as a percentage of GDP across all 38 OECD countries.

In countries where interest costs are relatively high, like Greece, Ireland, Spain, and Portugal, interest/GDP ratios are expected to be half of the US level.

To make matters worse, these projections expect a decline in interest rates over the coming year.

Source: The Kobeissi Letter, OECD, Tavi Costa

US Military Spending Accounts for Over 50% of Global Defense Spending

Despite its flaws, the dollar is not collapsing and remains the world’s reserve currency and by far the dominant currency as a medium of exchange.

Why? 1) The US share of global GDP remains high (25% as of today); 2) People continue to trust US law; 3) The quality of US assets; 4) The US is a net exporter of oil and liquefied natural gas; 5) The US accounts for over 50% of global defense spending.

Questions: 1) Will the new administration reduce military spending? 2) Can the US afford all this spending?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI