- Intel and Nvidia are examples of two extremes

- One stock has gone parabolic, while the other one has been in a strong downtrend

- Let's take a closer look at both cases using InvestingPro tools.

Intel (NASDAQ:INTC) is -58% or so from pre-bear market 2022 highs with a market cap of $120.1 billion.

Nvidia (NASDAQ:NVDA), on the other hand, is +15% from highs, also called "the new Tesla," or "the new Apple," with a market cap of $963 billion (the stock is up approximately 6% pre-market, giving it a $1 trillion dollar valuation at the time of writing this article).

Intel Corporation and Nvidia both operate in related sectors, focusing on different aspects of technology.

Intel's segments include Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Mobileye, Non-Volatile Memory Solutions Group (NSG), and Programmable Solutions Group (PSG). The CCG segment is dedicated to PC experimentation, while the DCG segment develops platforms for computing, storage, and networking. The IOTG segment focuses on high-performance computing platforms for various industries, and the Mobileye segment provides driver assistance and autonomous driving solutions. The NSG segment offers memory and storage products, and the PSG segment specializes in programmable semiconductors.

Nvidia, meanwhile, specializes in PC graphics, GPUs, and AI. Its two segments are GPU and Tegra Processor. The GPU product brands cater to different markets, such as gaming, design, AI, and cloud-based visual data processing. The Tegra brand combines GPUs and multi-core CPUs in a single chip, targeting mobile devices, robots, drones, and cars. NVIDIA's platforms are designed for gaming, professional visualization, data centers, and automotive applications, including AI supercomputers, automotive computing platforms, and cloud gaming services.

Multiples Comparision

To avoid being caught off guard, it's crucial to ask ourselves not only about a company's performance and growth potential but, more importantly:

- How reliable is the growth in the medium term?

- How much do current valuations already discount this growth?

So let's look at the valuations:

- P/Earnings: Intel (negative), Nvidia (201 X)

- P/Sales: Intel (2.1X), Nvidia (37X)

- P/Book: Intel (1.2X), Nvidia (39.3X)

Acknowledging potential hazards is crucial. Nvidia's high valuations indicate significant risk for those who buy now.

Certainly, in the short term, market narratives can have a significant impact on stock prices, potentially driving them even higher.

However, fundamentals eventually ground the stock post critical thinking. While those who bought the stock a few years ago may have benefited, those considering buying into the market now must ask themselves a simple question:

At what valuations will there still be willing buyers for this stock?

It's important to always keep in mind what truly propels the growth of a strong stock: earnings primarily and dividends to a lesser extent. There's also a third factor, often referred to as speculative, which involves valuations and P/E ratios that fluctuate periodically.

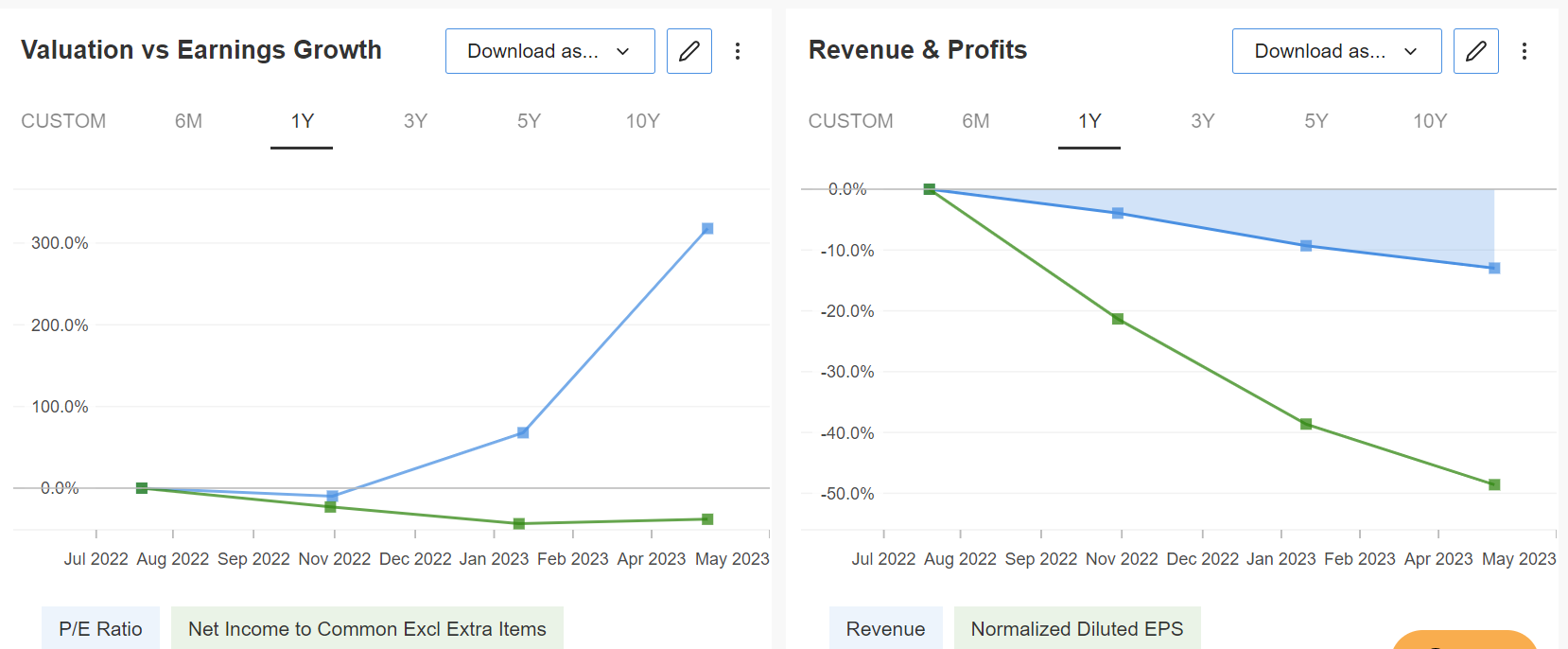

Using InvestingPro, let's look at the relationship between these factors.

Readers can conduct the same analysis for every major name in the market just by signing up through this link.

Source: InvestingPro

What is driving the stock to new highs is narrative and speculation, not growth.

Sure, the future prospects (on paper for now) are encouraging, but the problem here is that they are largely priced into current values. And what if, for some reason, the estimates are not negative but simply lower than the markets expect?

In the case of Intel, recent earnings have resulted in the stock heading lower, but that is not necessarily a buying opportunity.

But, taking a contrarian perspective, we can consider the potential impact on the stock if the results turn out to be better than expected following the significant drop.

Price Targets

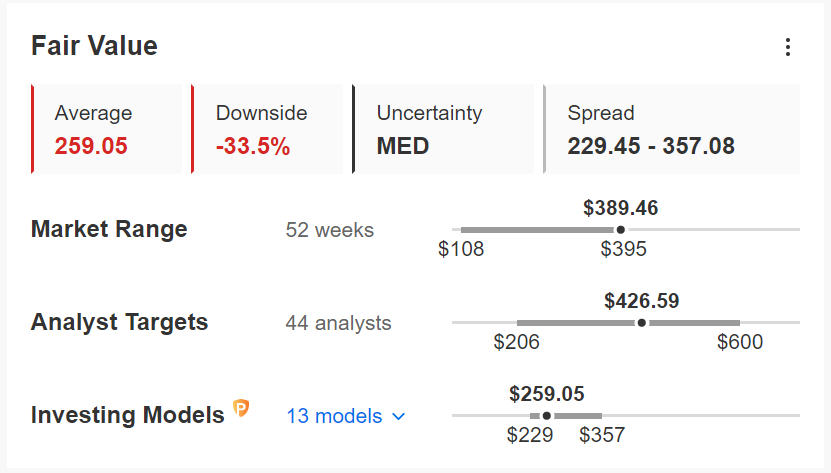

I want to emphasize that many analysts, who often lack proper analysis and simply follow market momentum, have set an average target price of $426 for Nvidia.

They do this in the hope that the masses will continue to flock to the stock and then claim credit if the stock rallies.

However, this does not reflect Nvidia's true intrinsic value. Instead, I would exercise caution and trust InvestingPro's mathematical models, which estimate a value of around $259 (-33% from current levels), making me more cautious yet confident.

Source: InvestingPro

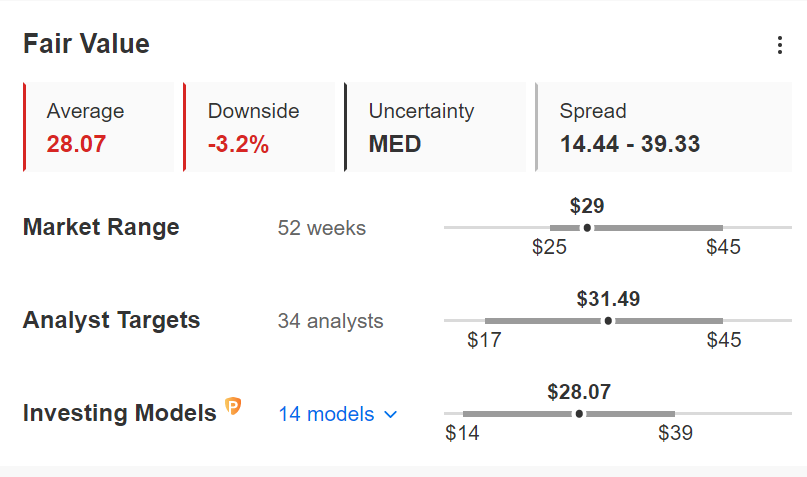

For Intel Corporation, analysts and mathematical models align quite well with the current price.

Source: InvestingPro

While I acknowledge that the positive momentum for Nvidia may continue to drive its stock higher, it's important to remember that an unwarranted rise often leads to a more significant and abrupt decline.

On the other hand, Intel is facing challenges in its business and is working towards a recovery. If there is no positive turnaround in its financials, it's likely that the majority of the negative expectations are already factored into the stock price.

Conversely, there is potential for positive surprises in this case.

However, personally, I do not own shares in either of these companies. I prefer to avoid investments that are widely discussed and popular among the masses.

InvestingPro tools assist savvy investors to analyze stocks, as I did in this article. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.