I recently returned from NVIDIA’s GTC AI Conference in San Jose, California. This year’s event was completely sold out, with an estimated 20,000 investors, engineers and business leaders in attendance. CEO Jensen Huang likes to call the annual get-together the “Super Bowl of AI,” and after seeing his keynote, I understand why.

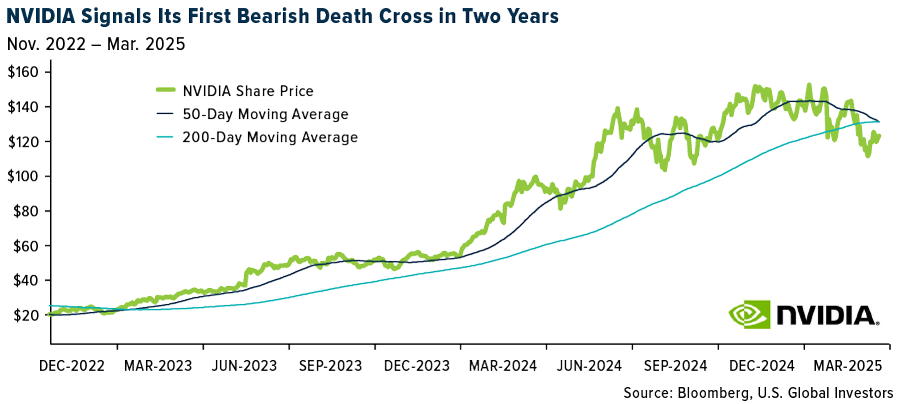

Despite NVIDIA Corporation (NASDAQ:NVDA)’s stock flashing a bearish “death cross”—its 50-day moving average slipped below the 200-day moving average for the first time since January 2023—the energy at the conference was electrifying. Every major industry was represented, from health care to defense, signaling that artificial intelligence (AI) is expanding at a white-knuckle clip. During his approximately two-hour presentation (and he didn’t use notes!), Huang described a future where AI agents will transform entire industries, making businesses more efficient, aerospace and defense more advanced and markets more intelligent.

During his approximately two-hour presentation (and he didn’t use notes!), Huang described a future where AI agents will transform entire industries, making businesses more efficient, aerospace and defense more advanced and markets more intelligent.

In other words, if you thought ChatGPT was impressive, you haven’t seen anything yet.

AI Agents: The Next (LON:NXT) Industrial Revolution?

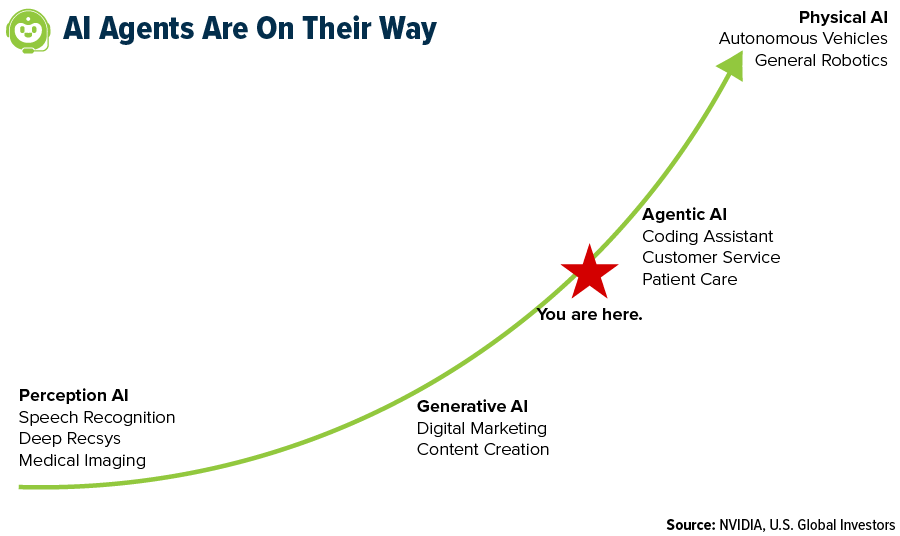

Huang spoke extensively about “agentic AI,” or AI that doesn’t just retrieve data but perceives, reasons and acts on your behalf.

In his example, AI agents “can go to a website, interpret words and videos, maybe even play a video, learn from it, understand it—and then use that new knowledge to complete its task.”

To understand this better, imagine you work on Wall Street. An AI agent could scan earnings reports, build models and execute trades faster than a human could. In health care, AI agents will be able to diagnose diseases, assist in surgeries and manage hospital logistics—all with limited human supervision.

Perhaps the biggest impact will be in aerospace and defense. Huang made a bold prediction: “Everything that moves will be autonomous.”

This suggests a future with AI-powered drones, cybersecurity defense systems, battlefield robots and much more. The U.S. military is already testing AI systems that can independently identify threats and make tactical, split-second decisions in real-time.

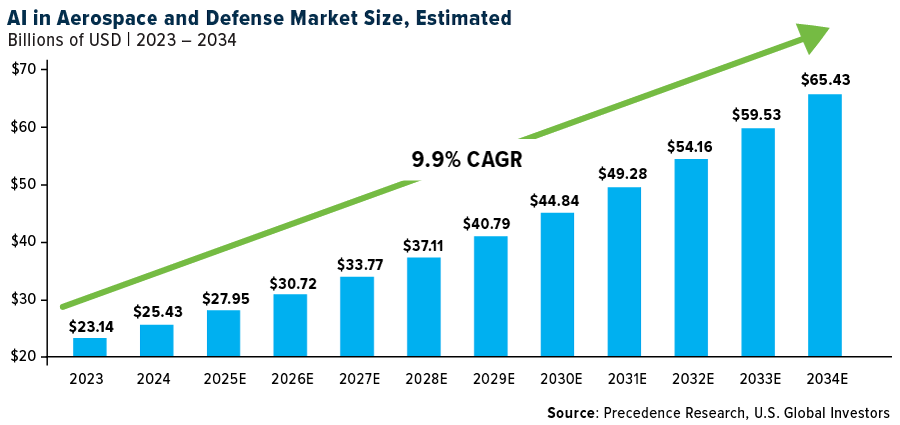

As I shared with you last month, the global AI market in aerospace and defense is projected to surge from approximately $28 billion today to $65 billion by 2034, according to one research firm. That’s a solid 9.91% compound annual growth rate (CAGR). North America alone represents $10.43 billion of this market, and it’s growing even faster at 10.02% annually.

Trump's Pro-AI Policies and NVIDIA's Strategic Shift

Under President Trump's administration, there’s been a concerted effort to boost American leadership in AI. One such initiative is the Stargate Project, a collaborative venture involving OpenAI, SoftBank (TYO:9984), Oracle (NYSE:ORCL) and MGX, which aims to invest up to $500 billion in AI infrastructure across the U.S. by 2029.

Aligning with this vision, NVIDIA has unveiled plans to invest hundreds of billions of dollars in U.S.-based manufacturing over the next four years. The move seeks to reduce reliance on Asian supply chains, particularly in light of tariff uncertainties.

Speaking to the Financial Times last week, Huang remarked that, over the next four years, NVIDIA will buy “probably half a trillion dollars’ worth of electronics in total.” He added that he can see the company “manufacturing several hundred billion of it here in the U.S.”

A Bearish “Death Cross”

Even with all the excitement, NVIDIA’s stock has formed a death cross, a technical pattern that typically signals near-term weakness.

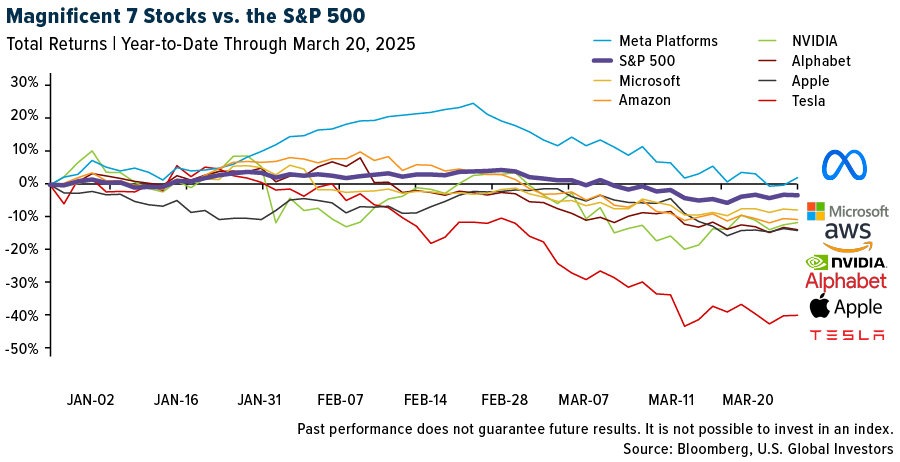

But let’s put things in perspective. After meteoric runs in 2023 (when it was up 238%) and 2024 (up 171%), some consolidation is natural, if history is any guide. Also, every Magnificent 7 stock, except Facebook-parent Meta Platforms (NASDAQ:META), is underperforming the S&P 500 year-to-date.

I believe these dips can present buying opportunities. NVIDIA’s fundamentals remain incredibly strong. In the fourth quarter of 2024, the company reported record revenue of $39.3 billion and record data center revenue of $35.6 billion. It also reported record full-year revenue of $130.5, more than double the amount generated just a year earlier.

The AI Agent Boom is Just Beginning

Sitting in the audience at NVIDIA’s GTC Conference, I could feel the same energy that surrounded the dot-com boom, the rise of mobile computing and the emergence of cloud technology.

Despite near-term market fluctuations, the investment case for AI remains rock solid. It’s clear to me that companies that build AI, use AI or enable AI infrastructure will shape the global economy in the decades to come.

*****

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024): NVIDIA Corp (NASDAQ:NVDA)., Microsoft Corp (NASDAQ:MSFT)., Alphabet (NASDAQ:GOOGL) Inc., Tesla (NASDAQ:TSLA) Inc.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.