- Reports Q4 FY2022 results on Wednesday, Feb. 16, after the close

- Revenue expectation: $7.41 billion

- EPS expectation: $1.22

Investors will likely see another blockbuster earnings release from NVIDIA (NASDAQ:NVDA) tomorrow. The California-based semiconductor giant averaged about 57% revenue growth over the last eight quarters and should maintain momentum backed by solid demand for graphics processors and rising semiconductor prices.

After beating expectations on every earnings report since 2019, the bar is undoubtedly high for NVIDIA. However, analysts are projecting per share growth of almost 60% year-over-year—in line with the company's track record of producing explosive growth.

Despite the positive outlook, NVDA stock has been under intense selling pressure during the past 10 weeks, losing about 28% of its value from its late November peak and 19.4% on the year.

The latest sign of weakness came last Friday when the stock dropped 7% amid speculation that the Federal Reserve will be more aggressive in tightening its monetary policy. On Monday, the stock rebounded slightly, gaining 1.3% to close at $242.67.

In addition to the broader market environment that's been hostile for growth stocks, NVIDIA failed to close a $40 billion deal to acquire British chip-design specialist ARM. The deal was blocked by global regulators amid antitrust concerns, leaving a $1.36 billion charge against earnings in the first fiscal quarter of 2023 linked to the deal's termination.

Long-Term Prospects

Short-term headwinds have failed to hurt analysts' faith in the company's long-term growth prospects. Another strong report from NVDA could shift the focus back to fundamentals, as companies from mobile-phone makers to car producers continue struggling to source enough chips for their products.

In a recent note to clients, Citibank said it sees several positive catalysts for the chipmaker in 2022, including a strong holiday gaming season, solid data center demand trends, and gaming/networking supply improvements in the second half this year.

NVIDIA provides critical components required for all the sector's high-growth technologies, including cloud computing, artificial intelligence, robotic automation, mobile computing, the internet of things, and crypto mining.

UBS reiterated its buy rating on NVDA last week, saying it's bullish heading into earnings. Its note added:

"Despite ongoing supply constraints, we expect strong results with revenue guided ~$7.4B or maybe slightly higher as gaming should remain better-than-seasonal due to ongoing channel fill and data center continues to grow >60% YoY before comps there start to become more challenging later this year."

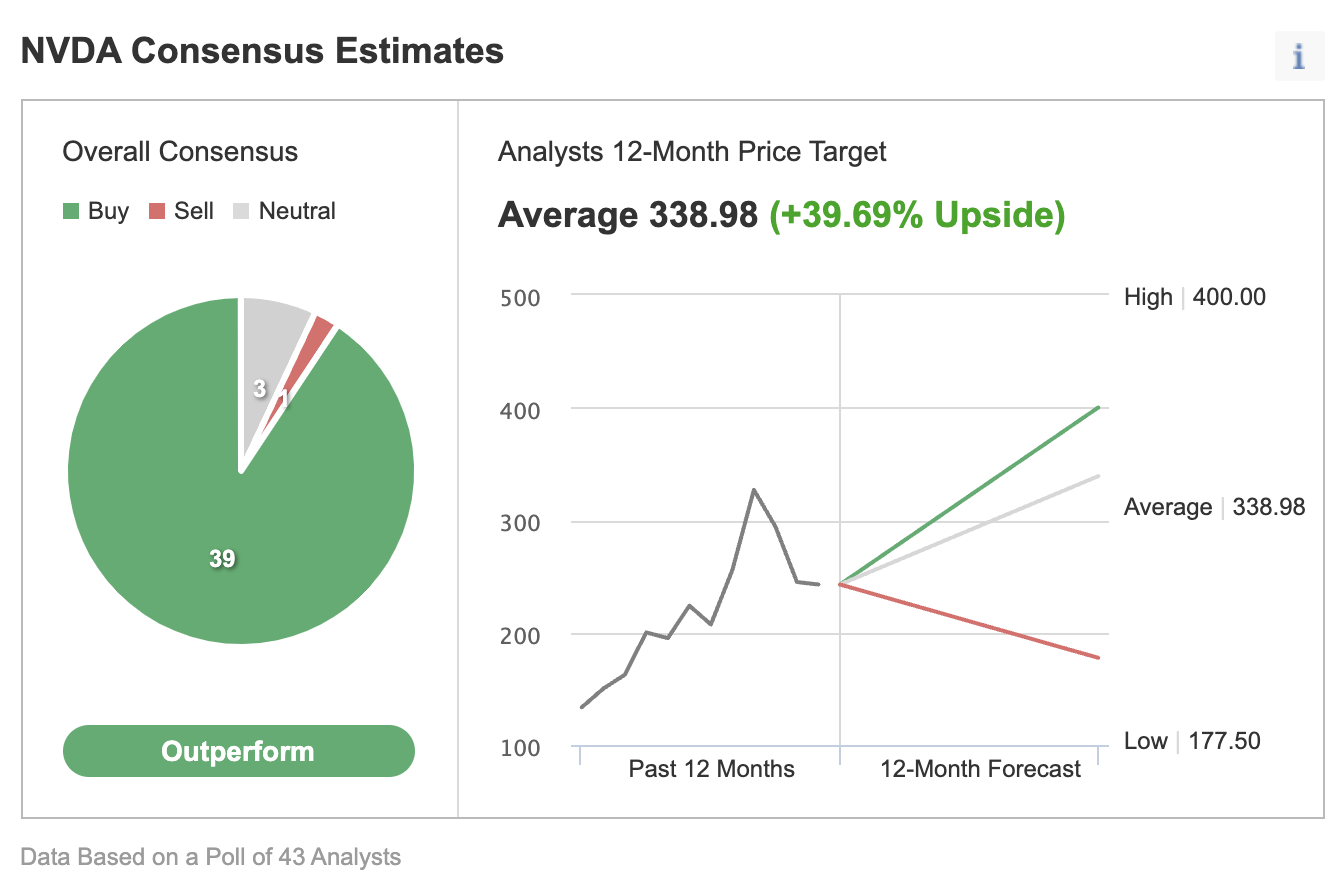

In a poll of 43 analysts conducted by Investing.com, 39 gave the stock an "outperform" rating with a consensus 12-month price target of $338.98, implying a 39.6% upside potential from the current market price.

Source: Investing.com

Bottom Line

NVIDIA will likely produce yet another impressive earnings report, showing the company's unique mix of growth and profitability. This growth momentum should provide long-term investors a good reason to buy NVDA stock, especially in more attractive levels after recent weakness.