- Reports fiscal Q3 2022 results on Monday, Mar. 21, after the close

- Revenue expectation: $10.63 billion

- EPS expectation: $0.71

Of late, the world’s largest sportswear company, Nike (NYSE:NKE), has been offering investors an interesting risk-reward proposition. While sales in China, its second-largest market, continue to suffer due to COVID restrictions, robust spending in North America is offsetting that loss.

When the maker of Air Jordan and Air Force 1 sneakers reports its latest quarterly earnings later today, the regional dichotomy will be the primary story reflected in the Beaverton, Oregon-based company's numbers. Sales in the company’s fiscal 2022 third quarter will likely be flat when compared with the same period a year ago, while earnings per share will drop $0.71 from $0.9 a year ago, according to analysts’ consensus forecast.

Due to lingering production issues in Asia and slowing demand, Nike reported about a 20% decline in its sales there during the second quarter. Sales in North America, however, surged about 12% during the same period.

The outlook for sales in China will likely remain grim in the short run as COVID-19 infections in the country jumped the most in recent days since the early days of the pandemic, and cities across the Asian nation responded with additional curbs and lockdowns.

These concerns have diminished Nike’s investment appeal this year, sending its stock down more than 21% so far in 2022. Shares closed on Friday at $131.24.

Still, despite this challenging environment, the bull case for Nike stock continues to remain strong. The expectation for the footwear and accessories giant is that given soaring consumer demand and the company’s successful e-commerce push, NKE stock will rebound, delivering hefty returns to long-term investors.

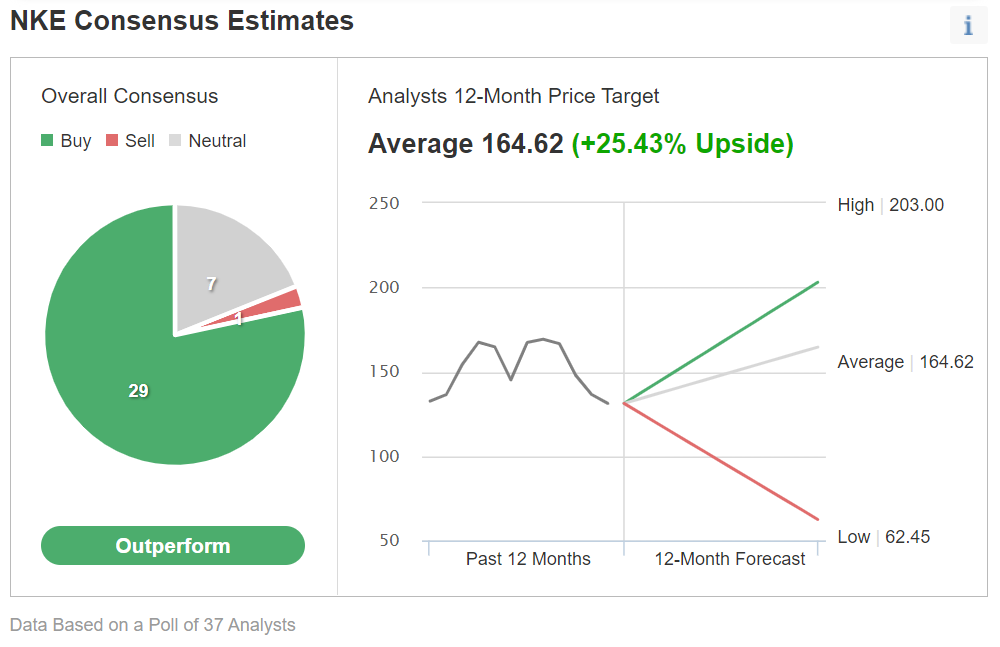

Bearing that out, among 37 analysts polled by Investing.com, 29 gave NKE an outperform rating.

Chart: Investing.com

As well, the analysts' 12-month consensus price target for the stock of $164.62 implies a 25% upside.

'Best Equipped To Navigate Macro Challenges'

Credit Suisse, while reiterating Nike as outperform, said in a recent note:

“Once FY23 numbers are de-risked, we think valuation relative to the peer group can start to expand again — and believe Nike is the best equipped name in our coverage to navigate the current macro challenges.”

Similarly, Baird also designated Nike stock as outperform, saying in a note of its own:

“While NKE was a lower-conviction Outperform-rated idea entering 2022, we believe sentiment increasingly embeds global macro concerns. We expect NKE to deliver in-line or better FQ3 results and to express a positive view of category demand.”

One of the biggest drivers of Nike’s long-term growth is the company's accelerated shift to e-tail selling. It has created a direct-to-consumer business that's not just efficient but also responsible for improving the enterprise's profit margins. Nike’s direct-to-consumer business boosted its revenue 9% in Q2 to $4.7 billion. This division now accounts for about 40% of its total sales.

Bottom Line

Nike's business will continue to face challenges in the short run as demand remains weak in Asia due to the pandemic. But this weakness, in our view, is temporary as the global appeal of Nike's brands remains strong as does its excellent execution capabilities. Any post-earnings weakness in the stock should be considered a buying opportunity.