- A wedge pattern in gold is threatening to break higher

- The long-term trend remains bullish - Economics and politics support a rising gold price

- Gold miners offer leverage to the gold price

- Newmont Corporation is a leading gold producer

- Levels to watch in NEM shares

Gold was the first commodity to reach a new record high as the worldwide COVID-19 pandemic caused a flood of central bank liquidity and a tsunami of government stimulus.

In 2021 and 2022, consumer and producer price indices rose to the highest level in over four decades as inflation erodes fiat currency’s pricing power.

In 2022, copper, palladium, lumber, and a host of other commodities reached new record highs, and others moved to the highest prices in years. Gold experienced an inside year in 2021, as the price did not trade above or below the 2020 high and low.

Gold is a hybrid as it is a metal and has a long history as a currency, making the yellow metal unique. Jewelry demand tends to absorb a substantial percentage of annual production.

Meanwhile, central banks and governments own the precious metal and hold it as an integral part of their foreign currency reserves.

The official sectors’ classification of gold validates its role in the global financial system, and they have been net buyers over the past years. After all, while governments can issue legal tender to their heart’s content, they can only increase the gold supply by extracting more metal from the earth’s crust.

Newmont Goldcorp (NYSE:NEM) is a leading gold producer. NEM shares move higher or lower with the metal’s price.

A wedge pattern in gold is threatening to break higher

From a technical perspective, gold has been digesting the move to the August 2020 record high at $2,063 and consolidating over the past eighteen months. After reaching the all-time peak, the price corrected to a low of $1,673.30 per ounce in March 2021, an 18.9% decline. After reaching the March 2021 bottom, the price continued to make lower highs, but it also settled into a pattern of higher lows.

Source: CQG

The weekly chart highlights the wedge formation of lower highs and lower lows, narrowing the trading range in the gold futures since the 2020 high. In 2020, gold traded in a $612.10 range, and in 2021, it narrowed to $289.20. So far this year, the trading band from low to high has been $129.30 per ounce.

Nearby gold futures traded to a high of $1,908.10 on the nearby COMEX futures contract on Feb. 21. The price moved over the first technical resistance level at the mid-November 2021 $1,879.50 high.

The next target is the June 2021 $1,916.20 high, which would confirm a technical breakout in the gold futures market. A confirmed move above the resistance could cause a flood of technical and trend-following buying as market participants load up on the precious yellow metal. An end to consolidation and digestion could send gold to new all-time highs as fundamentals support higher prices.

The long-term trend remains bullish - Economics and politics support a rising gold price

The gold bull market began over two decades ago when the Bank of England auctioned one-half of the UK’s gold reserves. The sales pushed the price lower and set the stage for the rally that took gold’s price to over eight times the price at the lows in August 2020.

Source: CQG

The quarterly chart highlights gold’s bull market that began in 1999. Technical support sits far below the current level at the July 2018 $1,161.40 low, with the March 2021 $1,673.30 a shorter-term support level. At $1,900 per ounce at the end of last week, gold was only $163 below the August 2020 record high and $226.70 above the March 2021 low.

Technical indicators have turned positive on gold, and fundamentals support a higher price. The situation in Ukraine that could lead to war is bullish for gold. There has not been a war in Europe in over three-quarters of a century. The geopolitical landscape remains tense. Simultaneously, China continues to move towards reunification with Taiwan, which makes the geopolitical landscape dangerous on two fronts, in Europe and Asia.

January CPI at 7.5%, with the core reading, excluding food and energy at 6.0%, and PPI at 9.7%, tell us that inflation is raging. The economic condition is at the highest level in over four decades. Gold is a geopolitical and inflation barometer, and the current environment could cause a rally to new record highs over the coming weeks and months.

The technical and fundamental alignment creates a potent bullish cocktail for the precious metal.

Gold miners offer leverage to the gold price

Gold mining companies extract the metal from the earth’s crust, and they invest substantial capital in mining projects, creating leverage to the gold price. Gold mining shares tend to outperform the metal on the upside and underperform when gold’s price declines.

The leading gold mining companies offer leverage for investors. However, they do not experience time decay as they remain in business during corrections and bearish trends. Unlike many leveraged ETF, ETN, and derivative products, the top gold mining companies offer the best of both worlds; leverage without theta.

Newmont is a leading gold producer

Newmont is a gold producer that also produces copper, silver, zinc, and lead as they exist in gold ores. The company owns producing mines in North and South America, Australia, and Africa. China is the world’s leading gold-producing country, accounting for around 11% of the total global production in 2020. In North America, NEM is the leader.

Source: The Visual Capitalist

The chart highlights NEM’s position as the leading North American gold mining company. At $67.67 per share, NEM had a market cap of over $53.96 billion and trades an average of over 7.5 million shares each day. NEM pays shareholders a $2.20 dividend, translating to a 3.25% yield.

Source: Yahoo Finance

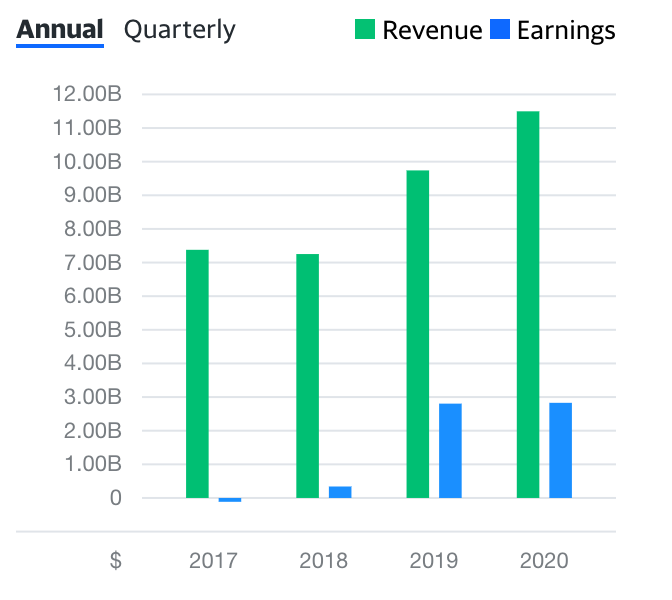

The chart shows NEM’s positive trend in revenues and earnings.

Levels to watch in NEM shares

NEM shares have been making higher highs since the 1980s.

Source: Barchart

As the chart illustrates, technical support sits at the December 2021 $52.60 low with resistance at the May 2021 $75.31 high.

In 2020, nearby COMEX gold futures rallied from the March $1,450.90 low to the August $2,063 high, a 42.2% rise. Over the same period, NEM shares rose from $33.00 to $72.22 or 118.8%, as the leading gold-producing company delivered over double the percentage gain as the gold futures market.

If gold is heading for new and higher peaks, NEM’s production will push the stock to new levels on the upside. Aside from capital appreciation, the over 3% dividend is attractive as holding gold involves opportunity costs and offers investors no yield. At the same time, NEM pays them while they wait for capital appreciation.

Leverage, yield, and a breakout in gold are compelling reasons to consider adding NEM to a portfolio in the current economic and geopolitical climate.