Colder weather, fit for winter, is finally arriving in the United States, ending an unseasonably balmy December. But bulls in natural gas will likely have to contend with something else first: a rather bearish storage report for last week as demand for heating remained under par.

The inventory report for the week to Dec. 17, which the Energy Information Administration will release at 10:30 AM ET (15:30 GMT), and will likely be “an extremely bearish one, as storage will deviate somewhat significantly from the five-year average,” said Dan Myers, analyst at the Gelber & Associates gas market consultancy in Houston.

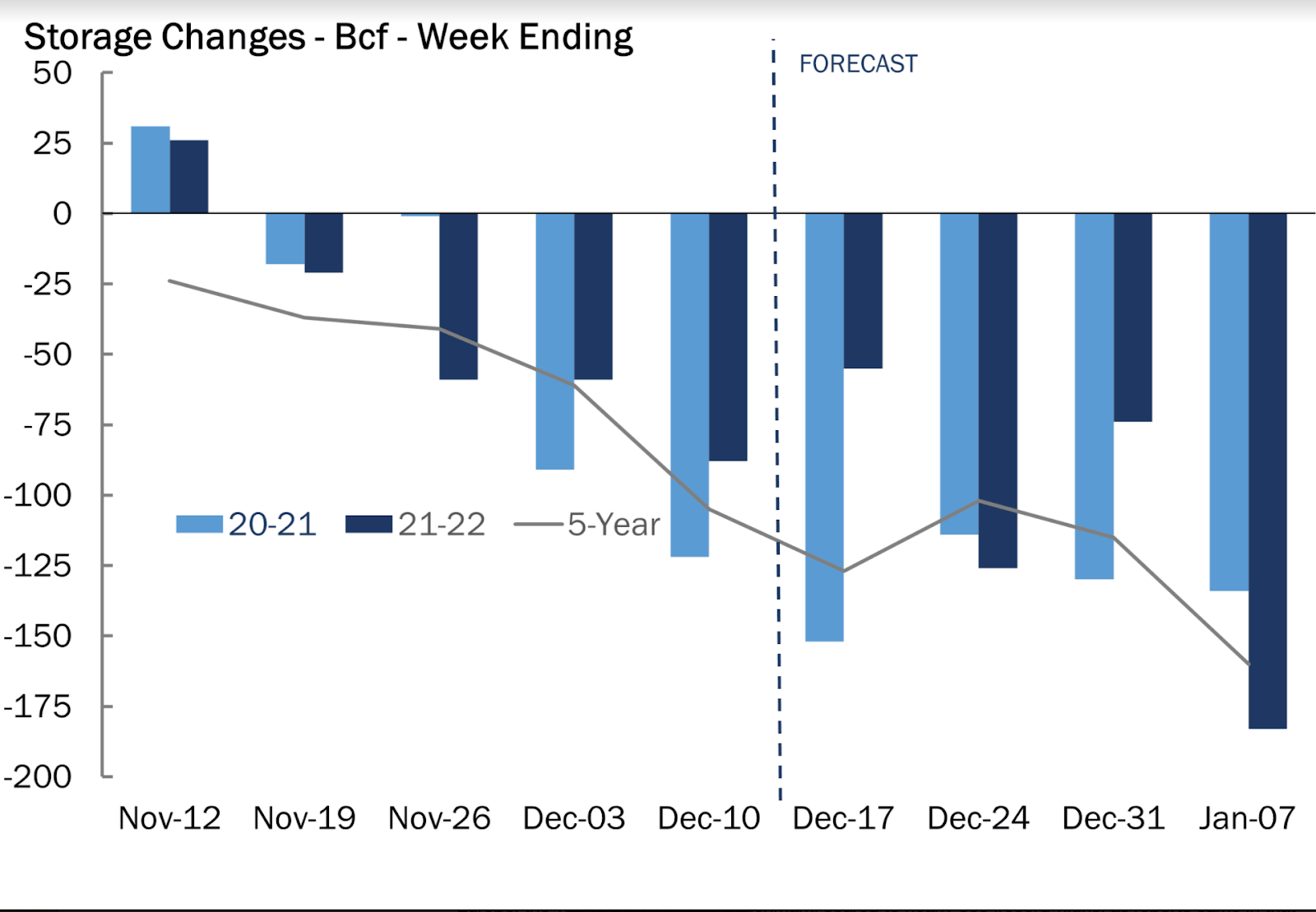

In the previous week to Dec. 10, the EIA reported a draw of 88 billion cubic feet (bcf), from storage. That compared with a withdrawal of 118 bcf during the same week a year ago and a five-year (2016-2020) average drawdown of 114 bcf.

This time, Gelber expects a 55 bcf withdrawal against a five-year average of 153 bcf. A consensus of analysts tracked by Investing.com have a similar forecast at 56 bcf.

“This deviation from the five-year is a testament to the weakness of weather temperatures in early December, which has the potential to become the second warmest December on record since the 1950s,” Myers wrote in an email to Gelber & Associates that was sighted by Investing.com.

“While mild weather is the dominant driver behind the lower storage withdrawal, lower week-over-week exports as well as higher gas generation are both expected to play a role in bringing the withdrawal number lower past those predicted by purely-weather based models,” he added.

Source: Gelber & Associates

Whatever the market’s concerns are on the supposed bearish storage report, they were not reflected in Thursday’s early trading of gas futures on New York’s Henry Hub. The exchange’s spot contract jumped 2.8% at Wednesday’s settlement, rising for a third day in a row after back-to-back gains of 1% and 4% in two previous sessions.

The combined gains have positioned Henry Hub futures for their first weekly gain in four at the close of Thursday’s trade as US markets end a truncated week before Friday’s observed holiday for Christmas, which falls on Saturday. If trades hold steady through Thursday’s close, then gas futures could finish the week up 5% after a net plunge of 27% over the prior three weeks mainly due to balmy weather.

While some places in the US are still expected to show record high temperatures over the next week or so, prospects of colder weather have been a tease for natural gas prices that have been repeatedly knocked down in recent weeks by balmy December patterns, observed industry news portal naturalgasintel.com.

“Though there are still discrepancies between the weather models, even the warmer Global Forecast System forecasts the frosty air spreading out of the northern Plains across the northern part of the country Jan. 1-5,” the portal added.

NatGasWeather said in a forecast carried by the same portal that the European Center model was expected to be much colder. A slight north/south shift over the Americas could bring to the United States bitterly cold winds from South Canada, resulting in what could be a substantial price response. “To our view, it’s important the EC doesn’t back off on cold Jan. 1-5, or it could disappoint,” the forecaster added.

Bespoke Weather Services told naturalgasintel.com that the risk of at least some of the stronger cold up in Canada spreading farther east still existed.

Patterns in tropical forcing mechanisms are still supportive of colder weather into early January, according to the forecaster. At the same time, the upcoming pattern could bring enough cold into the Rockies/Plains to warrant freeze-off concerns, it added.

“Nothing like last February, mind you, as there is no super cold plunge into Texas, but could still be notable,” Bespoke said.

All things considered, the forecaster sees upside risks to prices, even after the rallying of the last couple of days. This could take place if not the rest of this week, then certainly into next week’s contract expiration, especially if colder risks hold on or get stronger as the pattern in the first half of January becomes clearer, it said.

“Obviously, a big flip back warm would invalidate this idea, but that is not something we favor as of right now,” Bespoke added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.