The spring thaw is slowly setting in on the United States as temperatures get warmer. Europe’s energy crisis also feels less urgent two weeks into the Ukraine invasion. The combined effect: Lower US natural gas prices despite healthy storage drawdowns and LNG demand at home.

Gas futures on New York’s Henry Hub fell for a third straight day on Wednesday, heading for a near double-digit weekly loss at the time of writing as day-to-day weather forecast changes discount the strength of the remaining cold in March.

Wednesday’s shift in temperature removed some five billion cubic feet (bcf) of projected demand over the next two weeks, adding to Tuesday’s disappearance of 35 bcf, according to those in the know.

In the meantime, plummeting European gas prices are adding to the Henry Hub’s weight as shorts exploit the cross-border relationship between the two markets which have become increasingly connected in sentiment since the Ukraine invasion.

Monday’s 4% capitulation on the US side came after Chancellor Olaf Scholz assured that Germany would not impose any ban on Russian gas imports. His statement caused TTF Gas Futures in the Netherlands—Europe’s premier exchange—to plunge from $68 to $50 as some of the fear premium built into the market over the security of the bloc’s energy supplies vanished.

Houston-based energy consultancy Gelber & Associates on Wednesday emailed its clients with exposure to natural gas to caution them that upside risk still remained on TTF; although much of its future movement will likely depend on the geopolitical actions of key Russian and European players versus weather shifts.

“While the Henry Hub’s upside exposure to European pricing remains capped due to the limits of American export capacity, downside exposure is a very different beast,” Gelber’s analyst Dan Myers said in the email, seen by Investing.com.

Myers added:

“Falling European prices have the potential to still impact American markets to some degree as incremental European price shifts downward will affect American LNG capacity utilization more so than incremental price shifts upward.”

“It appears likely that short-term Henry Hub price weakness may continue to occur, as the market prices in lowering domestic March natural gas demand, as well as higher expected gas production down the curve from elevated oil pricing.”

US oil’s West Texas Intermediate benchmark jumped 26% for the week ended Mar. 4 in response to the sweeping sanctions by the West on Russia that analysts said will indirectly hit Moscow’s crude exports. WTI continued to rise early this week to 14-year highs above $130 a barrel before tumbling double-digits on Wednesday in the first sharp decline since the outbreak of the war in Ukraine.

Gelber’s caution came ahead of the weekly storage update on natural gas due on Thursday from the US Energy Information Administration.

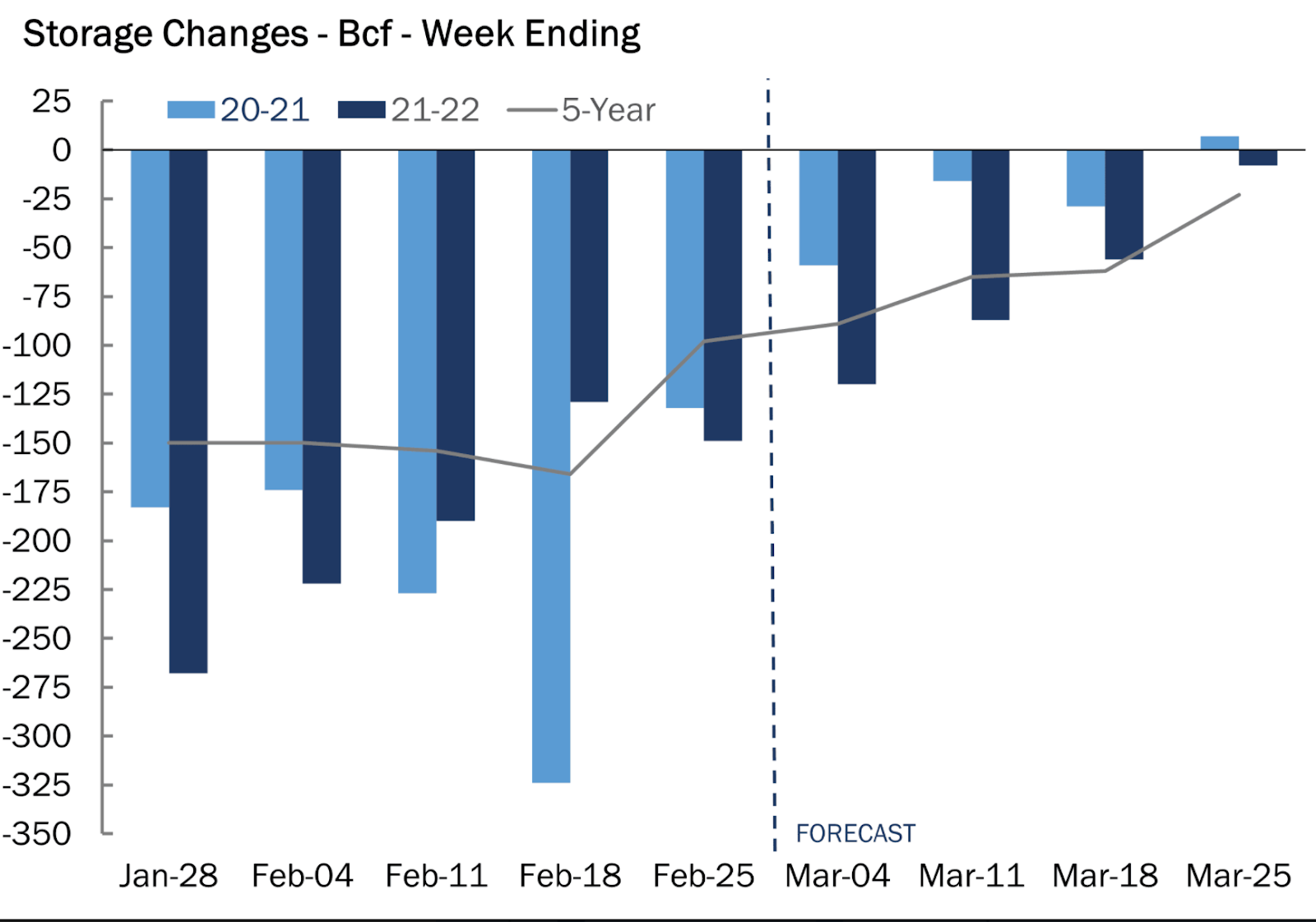

Source: Gelber & Associates

Analysts tracked by Investing.com expect a drawdown of 117 bcf for the week ended Mar. 4, compared with the withdrawal of 59 bcf during the same week a year ago and a five-year (2017-2021) average withdrawal of 89 bcf.

It would be the ninth week in a row where weekly gas burns by utilities had exceeded 100 bcf, with four of those weeks turning in drawdowns in excess of 200 bcf.

In the prior week to Feb. 25, utilities withdrew 123 bcf of gas from storage.

If analysts' consensus forecast is on target, the withdrawal during the week ended Mar. 4 would cut inventories to 1.526 trillion cubic feet (tcf), about 15.6% lower than the five-year average and 15.2% below the same week a year ago.

Last week’s weather was milder-than-normal with 146 heating degree days (HDDs), compared with a 30-year normal of 154 HDDs for the period, according to data from Refinitiv.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

Gelber’s Myers said storage withdrawals are expected to diminish in size as colder weather abates through the end of March.

“The first injection of the year could very well occur as early as Mar. 25 in the event that weather forecasts continue to lighten,” he wrote in his email.

Rystad Energy’s Vice President for gas markets Sindre Knutsson held a similar view.

“The market is now looking ahead to the end of the winter season. Forecasts point to comfortably above normal temperatures,” Knutsson said in comments carried by industry portal naturalgasintel.com.

Bespoke Weather Services said US supplies were sufficient for domestic needs, and with the market headed into the spring shoulder season, heating demand was all but certain to taper quickly.

“We have finally seen the natural gas market decouple from the moves in the rest of the energy complex, something we feel should have happened sooner, but it is always difficult to predict that kind of timing when you have major news headlines impacting all markets,” Bespoke said in comments.

According to Refinitiv data, the amount of gas flowing to US liquefied natural gas export plants rose to 12.59 bcf per day (bcfd) so far in March from 12.43 bcfd in February and a record 12.44 bcfd in January.

The United States is exporting record amounts of LNG as global gas prices trade 12 times higher to US futures amid the Russia-Ukraine conflict.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.