It took a little longer than thought, but the first big Nor'easter of 2021 is finally here. And so is the return of $3 natural gas.

After several missed storm forecasts, the weekend’s blizzard along the Atlantic shoreline, dumping nearly 3 feet of snow in the most affected spot—Newton in New Jersey—proved the event gas bulls had awaited since the cold season began with the Sept. 21 fall.

Typically, January would be the month when winter begins peaking, resulting in a surge of demand for gas-fired heating. But this year’s opening to the winter cycle was inconsistent at best.

In fact, colder patches were experienced in October and November, when gas futures on the New York Mercantile Exchange’s Henry Hub breached the key $3 per mmBtu, or million metric British thermal units, mark for the first time since January 2019.

After November, for a while, it barely felt like winter had arrived, with a Christmas that was one of the warmest in years.

But Sunday’s Nor’easter spun the gas market on its head, sending Henry Hub’s front-month March contract to $3.005 by Tuesday.

Freezing Conditions Expected To Linger

Gelber & Associates, a Houston-based consultancy that advises on risk-taking in natural gas, told its clients in an email circulated on Tuesday that pressure upward of $2.80 was expected to be retained as freezing conditions linger for now.

Week-to-date, Henry Hub’s March contract was already up more than 10%, with the spot price pushing at near $2.90 by 2:00 AM ET (07:00 GMT) Wednesday, in Asian trading.

Gelber adds:

“The extension of cooler weather forecasts today underscores the weather volatility’s current capacity to drive rising demand for natural gas.”

“Nearly 75-80 Bcf of natural gas demand is expected to have been added as a result, magnified by much of the additional cold falling during the week. The forward curve continues to shift along with March, adding a few cents through the end of next winter.”

Concurrently, Thursday’s weekly reading of US natural gas storage by the Energy Information Administration is likely to show a drawdown of 136 bcf, or billion cubic feet, for the week ended Jan. 29, according to a poll of industry analysts tracked by Investing.com.

Eight Straight Triple-Digit Draw Forecast

If accurate, it would be the eighth straight weekly gas storage drawdown in the triple digits, triggered by the addition of 36 HDDs, or heating degree days from cooler shifts in not only the US Northeast, but also the Midwest and South Central.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

Aside from a spike in gas burns for heating, an inordinate amount of the fuel was also being used for power burns, Gelber said, adding:

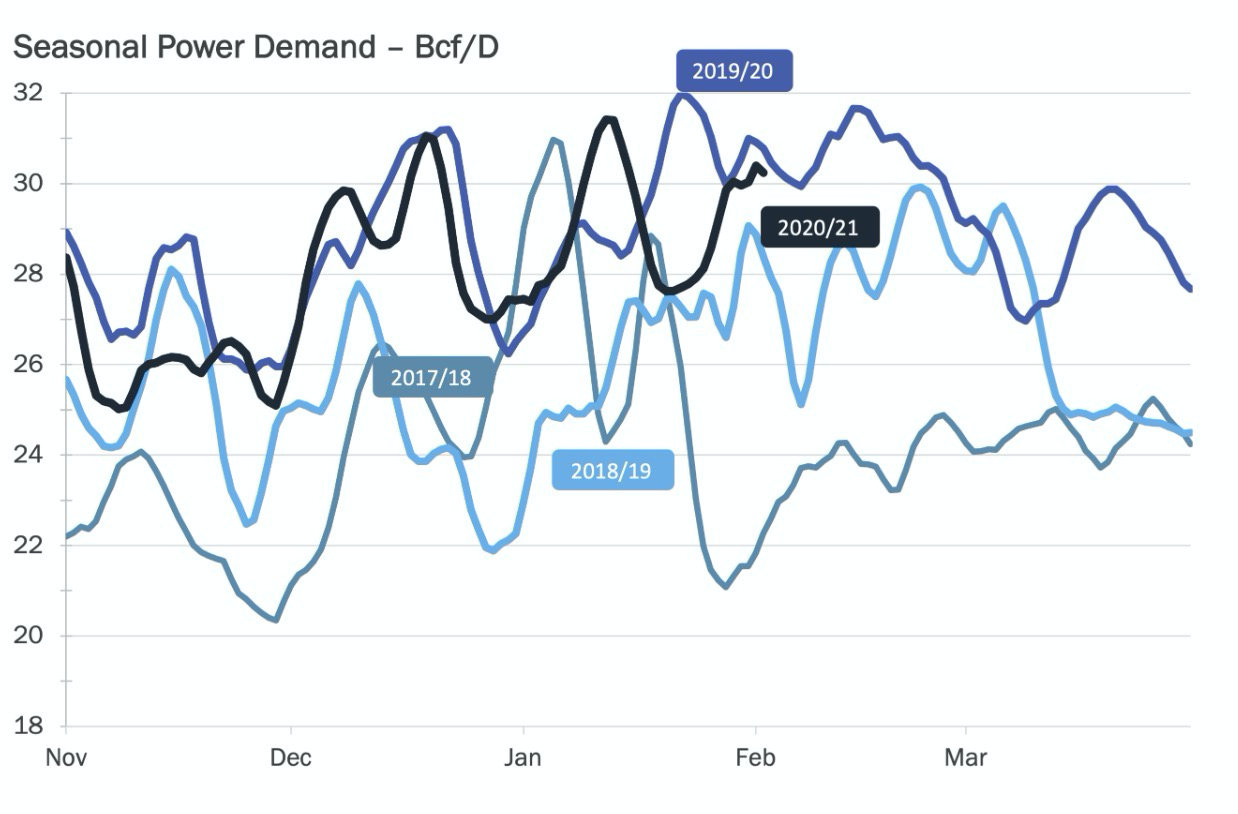

“Current seasonal power demand is gearing up to breach 2019/20 levels, reaching near 30.2 bcf per day to start February.”

“This represents a near 2.8 bcf per day increase over the last week, coinciding with the dramatic turnaround in weather forecasts and gas prices.”

Source: Gelber & Associates

Source: Gelber & Associates

Scott Shelton, energy futures broker at ICAP in Durham, North Carolina, pinned the outsized draws on lower US production, and even lower imports of gas from Canada. He said demand was still manageable for now, it is “expected to rip soon” as weather models turn even colder.

Explaining the phenomenon, naturalgasintel.com said in a blog that weather models made huge changes to the colder side over the weekend and on Tuesday, continued updates added demand to the 15-day outlook.

The European model gained 23 HDDs for Saturday (Feb. 6) through Feb. 16. The midday American Global Forecast System, meanwhile, added 5 HDDs, with the model showing a frigid pattern across much of the northern half of the country during that time period, including bouts of subfreezing air into Texas and the South, according to NatGasWeather. It added:

“With the supply/demand balance already tight, the natural gas markets have been impatiently waiting for sustained winter cold to arrive, and this is the first time the past two winters it’s likely to finally come through.”

The blog, however, noted that it was still unclear how long the cold spell could last, adding:

“Signs point to a frosty pattern more or less continuing through the middle of February. As long as frigid air is able to hold over Western Canada, it would provide an opportunity to release and push into the northern United States at times, though there could be some milder breaks.”

“Essentially, if there were to be a milder break around Feb. 15, it might only be brief before another cold shot arrives.”

Overall, both the latest GFS and European models are “impressively cold” beginning Saturday through Feb. 15, with widespread lows ranging from the minus 20s to the 20s across the northern half of the United States.

Gas Daily Technical Outlook Now at 'Strong Buy'

On the pricing front, Investing.com’s Daily Technical Outlook on Henry Hub’s front-month has turned into a “Strong Buy” from a mere “Buy” in the previous week.

Should the contract extend its bullish trend, as it’s expected to, a three-tier Fibonacci resistance is forecast, first at $2.961, then $3.007 and later at $3.081.

In the unlikely event the market reverses, then a three-stage Fibonacci support is expected to form, first at $2.813, then $2.767 and later at $2.693.

In any case, the pivot point between the two is $2.887.

As with all technical projections, we urge you to follow the calls but temper them with fundamentals—and moderation—whenever possible.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. He does not own or hold a position in the commodities or securities he writes about.