After rebounding nearly 10% from four-week price lows hit in mid-October, the natural gas market is faced again with the prospect of an unseasonably large storage build that could weigh on prices. But will bulls buck the trend and send the market the other way?

If there’s one thing the gas market has taught us this year, it is to expect the unexpected.

From inclement weather (think the Texas winter storm and Hurricane Ida), to production snags (fewer equipment and employees at all major oil and gas drilling services after the pandemic), to Henry Hub prices themselves (swinging 30% just last week), few things surprise gas traders anymore.

Thus, Wednesday’s consensus among analysts that gas in storage rose by 63 billion cubic feet (bcf) last week due to milder-than-normal weather could be treated as just another anomaly by those with an abundantly positive outlook on the market.

This is especially so after Wednesday’s rally of almost 7% on the Henry Hub—which incidentally, came after Tuesday’s near 5% rise—as traders focused on forecasts for increased heating needs as well as the roaring demand for exports of liquefied natural gas (LNG) amid tight global balances for the fuel.

Early Wednesday, weather data trended milder for the upcoming weekend through the middle of next week.

But it shifted to slightly cooler for the Nov. 15-18 time frame, forecaster NatGasWeather said in an outlook carried by industry portal naturalgasintel.com.

With global gas supplies lighter than in past years and consumption running higher, demand for US exports was also holding strong, the portal noted.

While uneven from one day to the next, LNG feed gas volumes have hovered close to 2021 highs of around 11 bcf so far this month, providing support for futures. A global economic rebound from the depths of the coronavirus, combined with extreme weather this year, has fueled robust demand for natural gas across Europe and Asia.

While these provided a fundamental backstop to the market, the volatility in gas prices in recent weeks has surprised even veteran traders who haven’t seen such swings in years. Prices have repeatedly approached seven-year highs before recoiling on the notion that they had gone up too much and too fast with little merit.

“Trading natural gas these days just about makes lumberjacking look safe,” analysts at the Schork Report observed in a commentary carried by naturalgasintel.com.

Source: Gelber & Associates

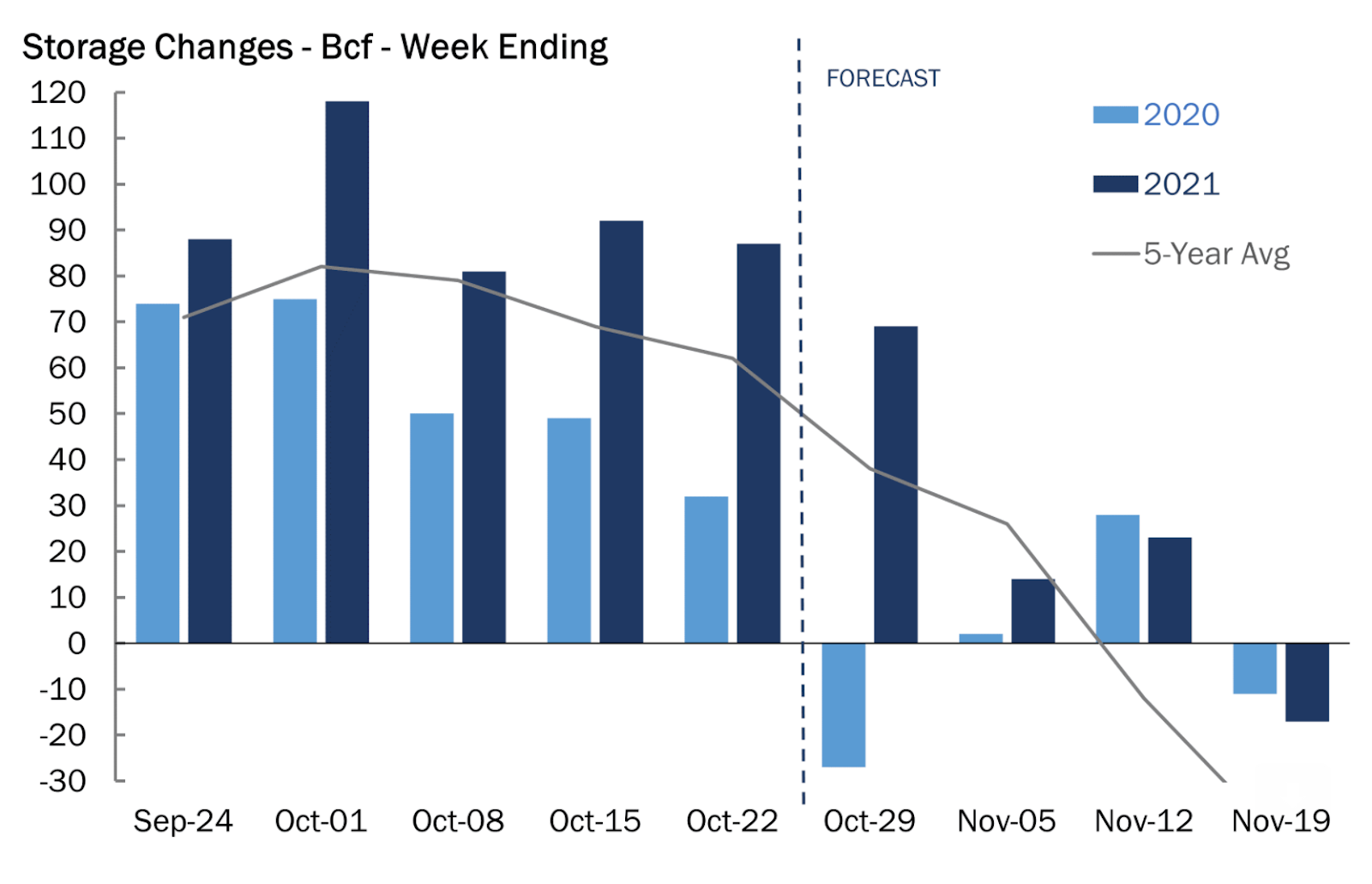

The 63-bcf storage injection estimated for last week would be in contrast to the 27-bcf withdrawal seen during the same week a year ago and the five-year (2016-2020) average increase of 38 bcf.

In the prior week to Oct. 22, utilities injected 87 bcf of gas into storage, which was the seventh week in a row that utilities stockpiled more gas than usual.

If analysts are on target with their 63-bcf build, total inventories in storage would rise to 3.611 tcf, or trillion cubic feet. That would still be 2.7% below the five-year average and 8% below the same week a year ago.

The US Energy Information Administration issues its weekly update on gas inventories at 10:30 AM ET (14:30 GMT) each Thursday.

The weather last week was milder than normal with 77 TDDs, or total degree days, compared with the 30-year average of 88 TDDs for the period.

TDDs, used to estimate demand to heat or cool homes and businesses, measure the number of degrees a day's average temperature is below or above 65 degrees Fahrenheit (18 degrees Celsius).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.