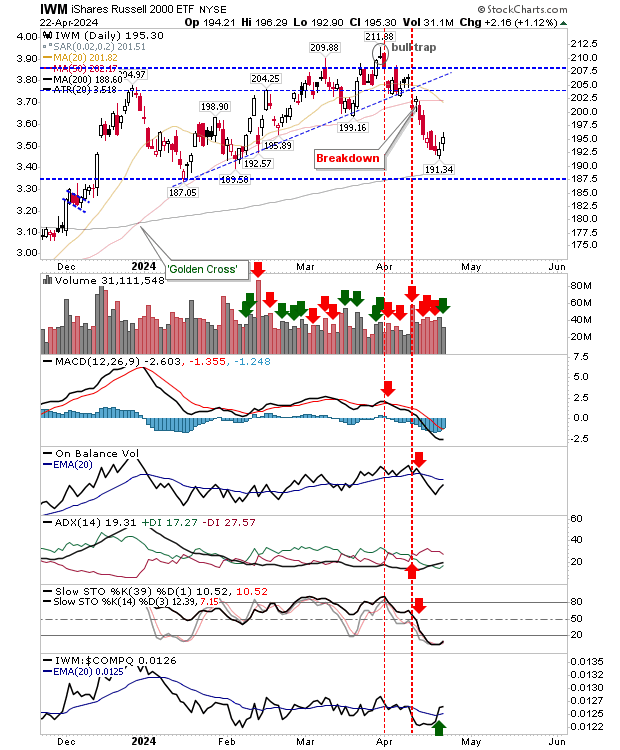

The Russell 2000 (IWM) has been guiding towards this, but the positive reaction in the Nasdaq and S&P 500 following Friday's gains in the Small Caps index is not enough to suggest a swing low is in place for these indexes. For starters, buying volume was light and momentum remained firmly oversold.

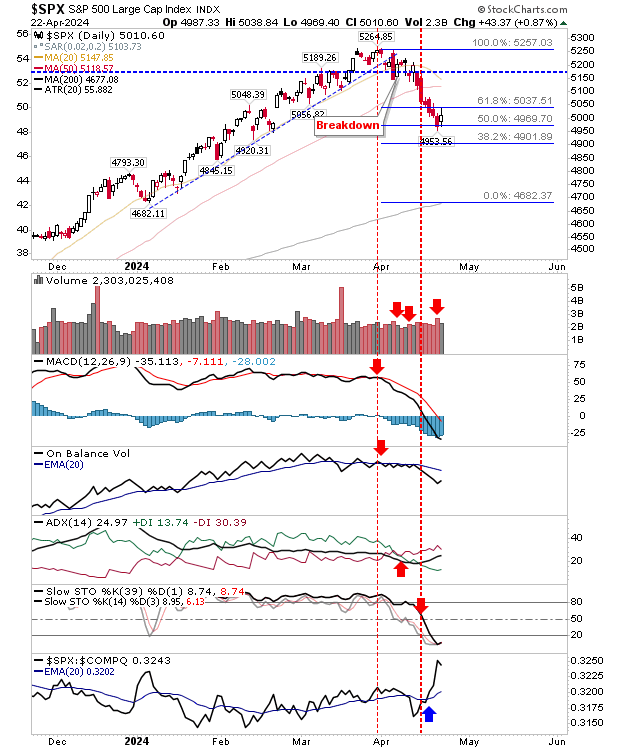

The S&P 500 did offer an opportunity at the 50% Fib retracement, and Fib zones give the best indication the decline has found a sustainable low, or at the very least, not one prone to further panic selling.

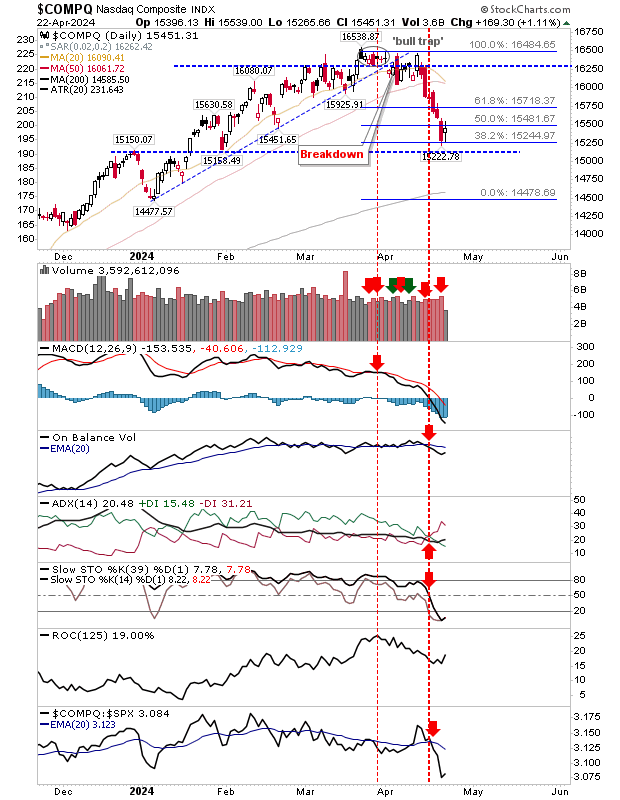

The Nasdaq has taken a bigger hit over the last few weeks than the S&P 500. Relative performance has moved sharply away from the index and only the potential bullish harami offers a scenario more bullish than the S&P 500.

The index is sitting on the 38.2% retracement line in what amounts to a perfect test. If there is a bounce here, look for it to stall at the 20-day MA.

The Russell 2000 ($IWM) posted a second day of gains but buying volume was well down on Friday's accumulation. The buying was insufficient to improve the technical picture, which remains net bearish.

Buyers have started to defend markets at current levels, offering the chance for markets to shape a bounce back to resistance, and then, either extend in a sideways market or launch a fresh rally to new highs for all indexes.