- Despite a relief rally, US markets fell into the close on Wednesday.

- Bank of Japan’s reassurances have temporarily eased market pressures.

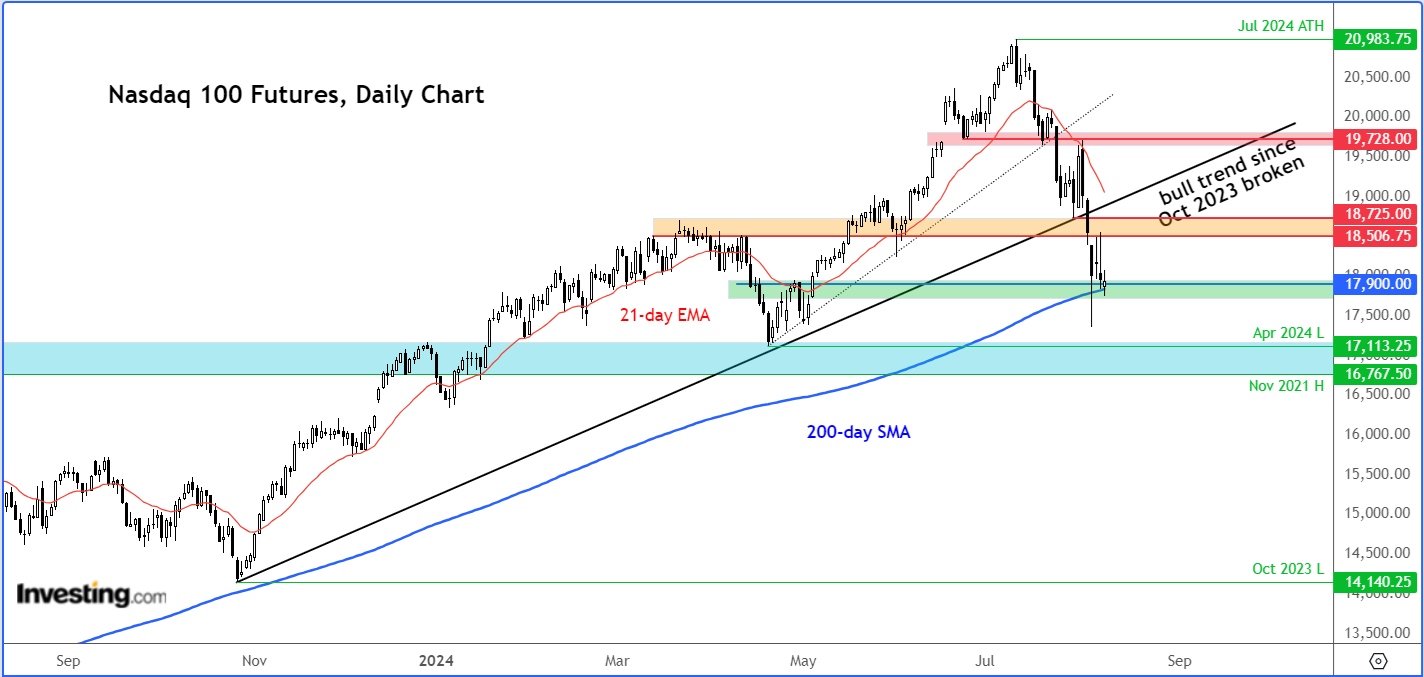

- Nasdaq 100's technical outlook suggests cautious optimism with key support levels in focus.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

US index futures edged higher after wiping out their sharp gains into the close on Wednesday. Similar to Wednesday’s first half of the session, we have seen the Japanese Nikkei 225 stage a recovery, lifting shares in Europe.

Yet, sentiment remains cagey following the recent turmoil, and it remains to be seen whether the markets will make a more lasting comeback this time around in another quiet day for economic news.

Clearly, investors are still wary after recent market upheavals. The sentiment is cautiously bearish, and more signs of a market bottom are needed to reignite bullish enthusiasm, even though there's been a hint of stability in the past couple of days.

The Nasdaq 100 has tested its technically important 200-day moving average over the past couple of days and so far it has held above it.

But now it needs to form a clear bullish signal to re-ignite the bullish momentum, while a close below it could lead to further follow-up technical selling.

Bank of Japan’s Reassurance Eases Market Pressure

The focus has been on Japan and its central bank's actions. Global indexes bounced back on Wednesday following a significant recovery in Japanese stocks after the Bank of Japan (BoJ) reassured markets.

A top BoJ official pushed back against last week’s unexpectedly hawkish stance, and the lack of major bearish news alongside a quiet economic calendar slightly boosted risk appetite.

However, investors remained hesitant to buy the dip, after carefully evaluating the potential impact of the carry trade unwind and the BoJ’s reassurances.

Well, they kind of did buy the dip but were happy to take a profit as the major indexes hit broken support levels, which later turned into resistance and caused the markets to head lower into the close on Wednesday.

Will we see a similar pattern today? Time will tell. But the recent reaction to the BoJ’s policy tightening and weakening US data has overall kept sentiment cautious, with traders waiting for clearer bullish signals, especially with US CPI data due next week.

In case you missed it, it was BoJ Deputy Governor Shinichi Uchida’s comments that provided the relief on Wednesday, suggesting the central bank wouldn't raise rates during market instability and that Japan's monetary policy would adapt if market risk views changed.

This reassurance came after a period of wild market swings, with benchmark indexes plunging on Monday following a weak close last week. Expectations of more aggressive Federal Reserve rate cuts due to weak US economic data failed to provide support as the rapid unwinding of popular yen-funded carry trades had a more significant impact including in US tech stocks and therefore the Nasdaq 100.

Nasdaq 100 Technical Analysis and Trade Ideas

The Nasdaq has now fallen for 5 consecutive weeks. Unsurprisingly, this has pushed momentum indicators like the Relative Strength Index (RSI) to near oversold levels.

This means that at the very least we should expect to see oversold bounces here and there – like we did for example on Wednesday. But with lots of support levels broken, the previous bullish trend on the Nasdaq 100 has been disrupted. Thus, the bulls are now in need of a clear bull signal to ignite a fresh rally.

Until a clear bullish reversal pattern is formed, any short-term recoveries you might see could turn out to be a bull trap. For that reason, it is essential to be more nimble and book profit near broken support levels as they could now turn into resistance.

At the time of writing, the Nasdaq futures chart was testing a critical technical zone between 17,750 to 17,900. This area marks the breakout zone from early May, and where the 200-day moving average comes into play.

While we have seen a few attempts to break below this zone this week, and despite an intraday drop on Monday, the Nasdaq 100 has managed to hold its own above here on a closing basis this week.

Therefore, this has kept the long-term bullish trend still intact, even though the break of trendlines means the short-term trend is no longer bullish. The lack of a closing break below the 200-day MA should keep the bears alert, especially with no new bearish news. However, a close below this range could indicate a deeper correction for the Nasdaq in the coming days.

In terms of resistance, the area around 18,500 to 18,725, which used to be a support area, is now a major upside hurdle. Here, the rally stalled on Wednesday. As a minimum, we will need to see the formation of a key bullish reversal stick around the 200-day average, or a rise back above this 18,500 to 18,725 range to change the current trend back to bullish.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI