- MetLife shares shot up early in 2021 with bond yields

- The shares have languished since early May

- The Wall Street consensus outlook is bullish with expected 12-month return of 20%

- The market-implied outlook is bullish, with moderate volatility

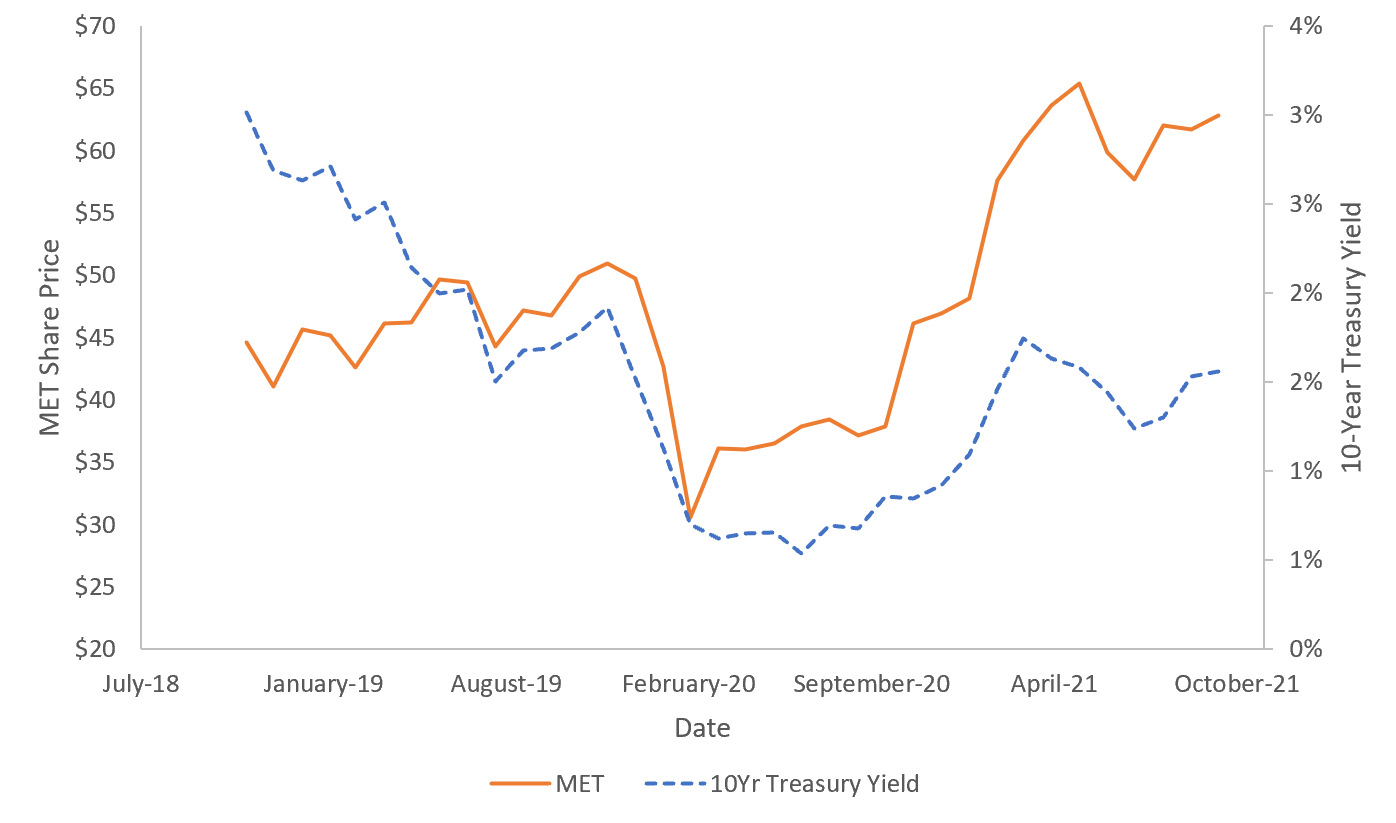

MetLife (NYSE:MET) posted substantial gains early in 2021 as interest rates rose, but the stock has languished since early May. The trailing 12-month price return is 38.5% but the shares are 6.3% below the YTD high close of $67.16 on May 7. Although the financial services giant reported Q3 earnings on Nov. 3, beating expectations, the shares have fallen since then.

Source: Investing.com

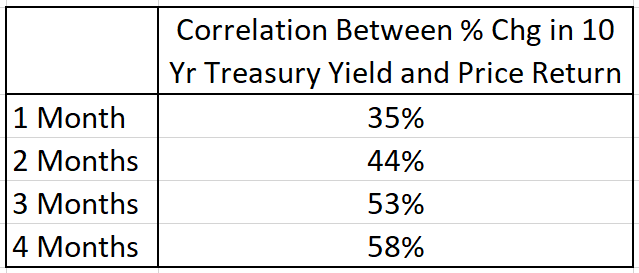

There is a strong correlation between price return on MET and bond yields since MET went public in early 2000. The correlation between 1-month price return on MET and the 1-month percentage change in 10-year Treasury yield is 35%. Looking at rolling multi-month periods, the correlation gets even stronger. For rolling 4-month periods, the correlation rises to 58%.

Source: Author’s calculations using historical data Yahoo! Finance)

The correlation between bond yields, interest rates, and performance of life insurers is well understood. Rising rates are favorable for life insurers and vice versa. To a large extent, investing in life insurance companies is a bet on interest rates. The changes in MET over the past two years track the 10-year Treasury yield quite closely.

Source: Author, using data from Yahoo! Finance

I last wrote about MET on Apr. 27, 2021 and I assigned a neutral rating. In the almost 7 months since, the share price has fallen 1.14%, as compared to a 12.72% gain for the S&P 500. In coming up with my rating for MET, I relied on two forms of consensus outlooks.

The first was the Wall Street consensus outlook. In late April, the Wall Street consensus rating was bullish but the 12-month consensus price target was about 3.5% above the share price at that time. The second consensus outlook that I looked at, the market-implied outlook, is calculated from options prices and reflects the aggregate view of buyers and sellers of options.

The market-implied outlook in late April, looking out to January 2022, was neutral with a slight bearish tilt. Both forms of consensus outlooks reflect market participants’ beliefs about future interest rates and I consider these aggregated views to be better than what I could come up with on my own.

The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the strike price) over the period from today until the option expires. By analysing prices of call and put options at a range of strikes, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook.

With almost 7 months since my last analysis, during which MET has badly lagged the broader market, I have updated the market-implied outlook and the comparison to the Wall Street consensus outlook for MET.

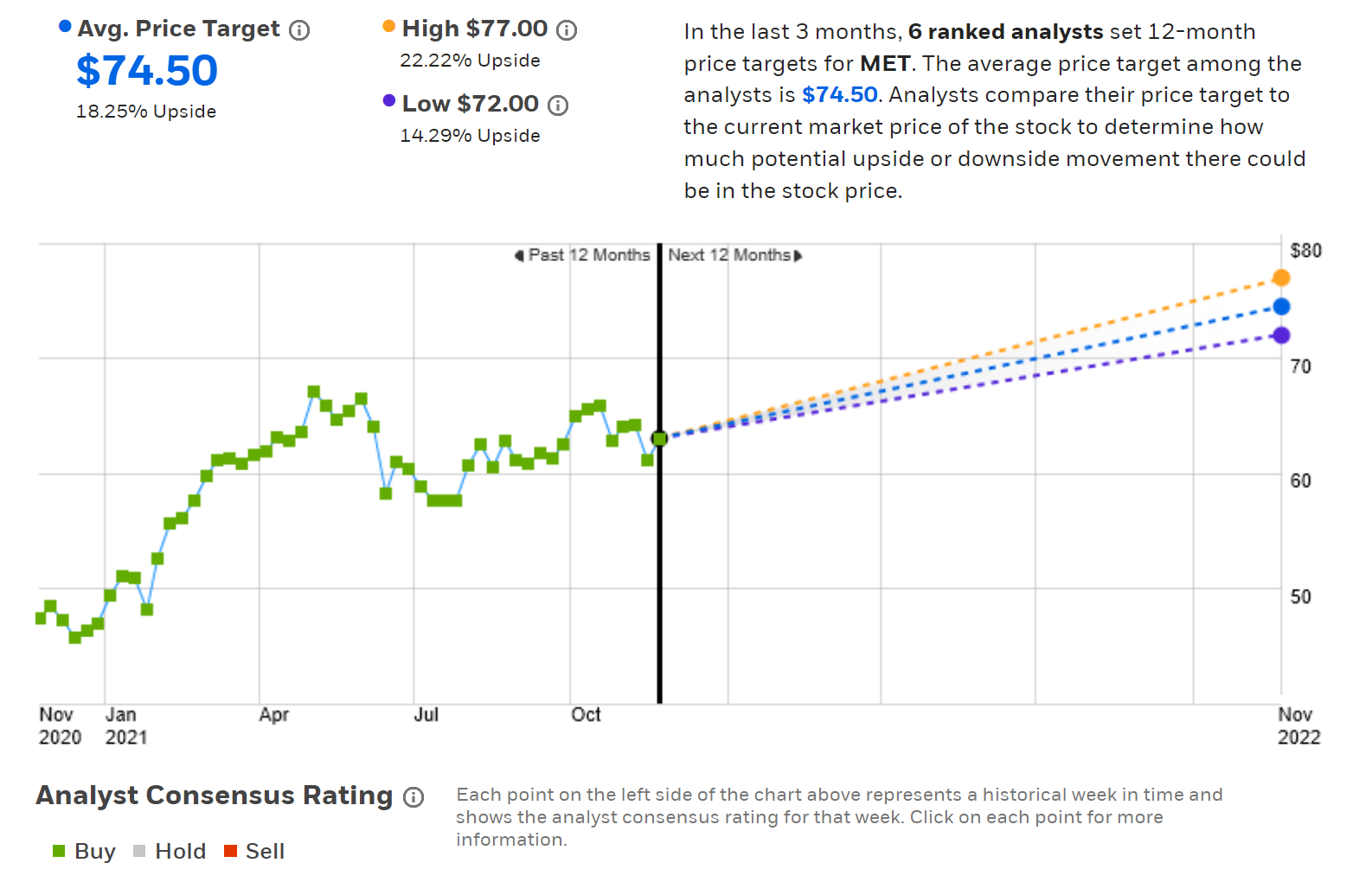

Wall Street Analyst Consensus Outlook for MET

E-Trade calculates the Wall Street consensus outlook for MET using ratings and price targets from 6 ranked analysts who have published their views over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 18.25% above the current share price.

The individual analyst price targets exhibit an unusually low level of spread. The lowest price target is 14.29% above the current price. All six of the analysts assign a buy rating to MET.

When I analyzed MET in late April, E-Trade’s calculation of the Wall Street consensus had a bullish rating and the 12-month price target was $65.30, 3.86% above the share price at that time.

Source: E-Trade

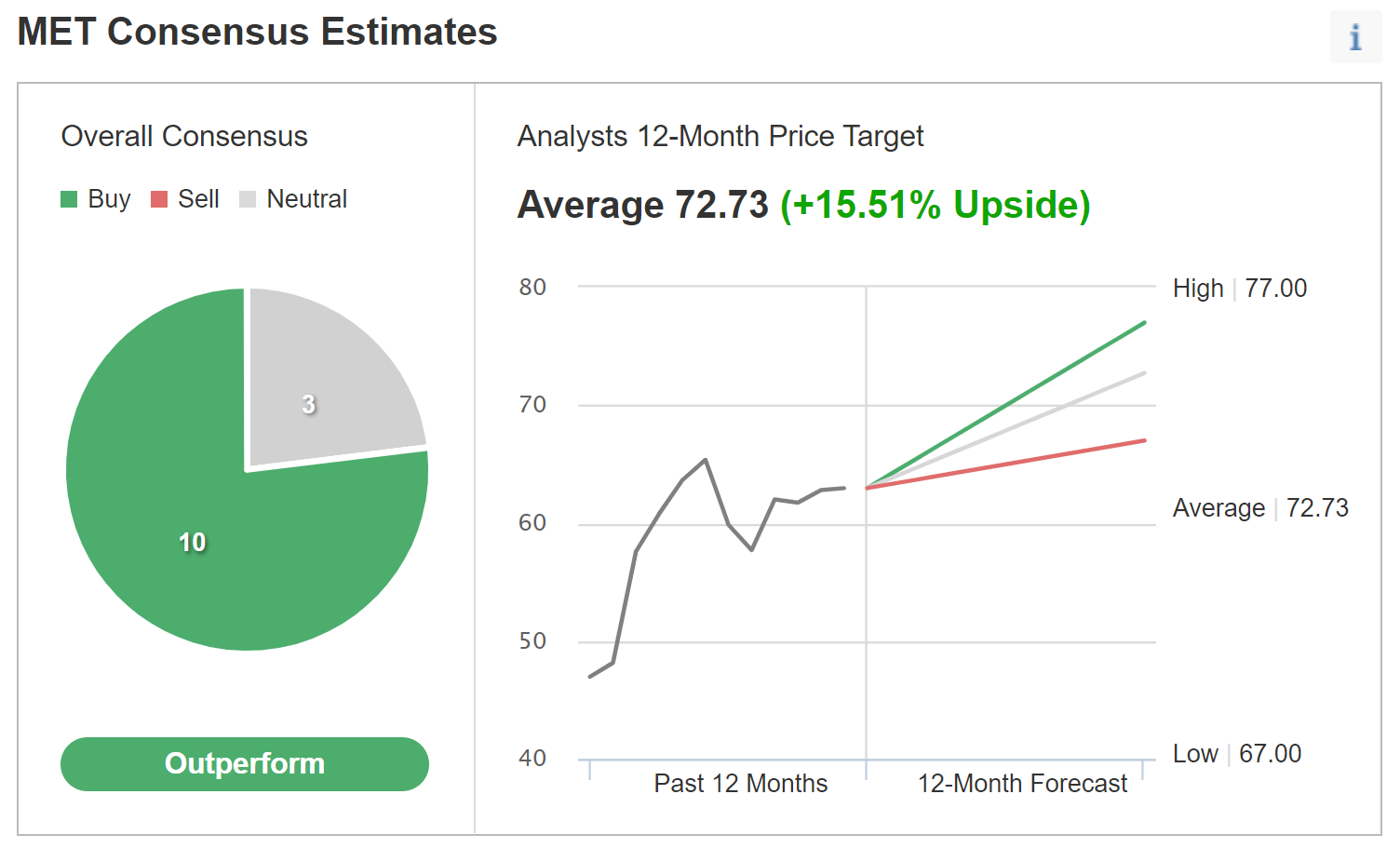

Investing.com calculates the Wall Street consensus by aggregating ratings and 12-month price targets from 13 analysts. The consensus rating is bullish and the consensus 12-month price target is 15.5% above the current share price. Of the 13 analysts, 10 assign a buy rating and 3 assign a hold rating.

Source: Investing.com

The Wall Street consensus outlook for MET has improved substantially since my last analysis in late April, with an expected 12-month price gain of 16.9% (averaging the E-Trade and Investing.com values). Combined with the estimated forward dividend yield of 3.14%, the expected total return for the next 12 months is 20%.

Market-Implied Outlook for MET

I have analyzed call and put options at a range of strike prices, all expiring on Jan. 21, 2022, to generate the market-implied outlook for the 2-month period from now until that date. I have also calculated the market-implied outlooks for the next 3.9 months (from options expiring on Mar. 18, 2022) and the next 6.8 months (using options that expire on June 17, 2022).

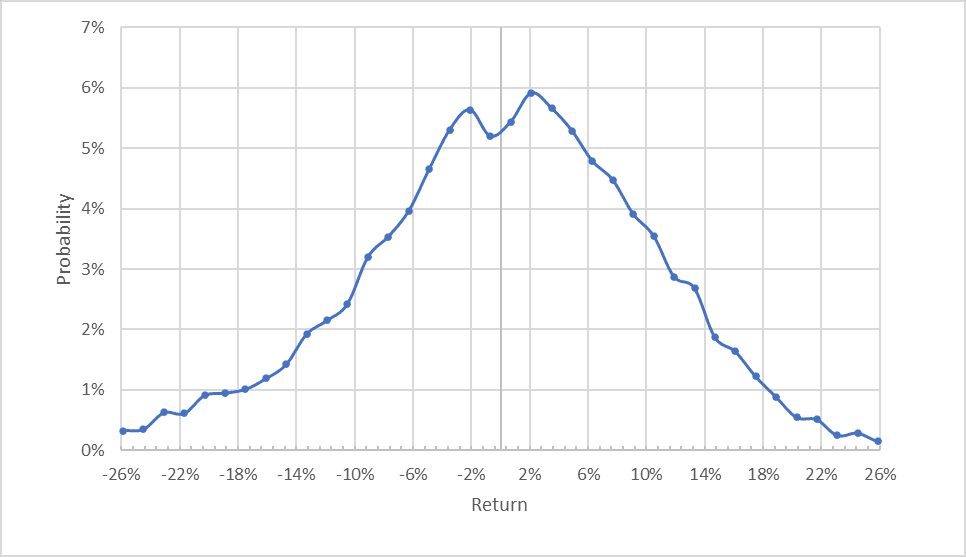

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade.

The outlook for the next 2 months has generally comparable probabilities for positive and negative returns, although the maximum probability is slightly tilted to favor positive returns. The annualized volatility calculated from this distribution is 28.5%.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

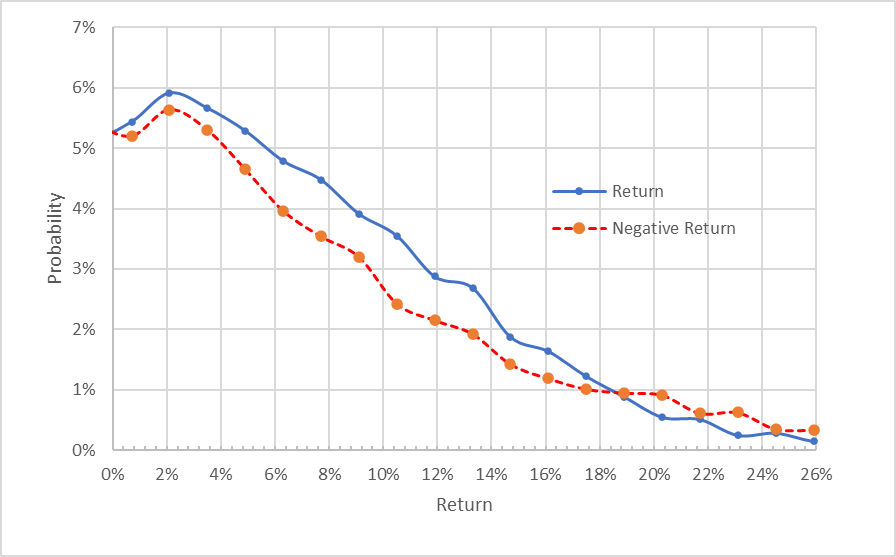

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

This view shows that the probabilities of positive returns are consistently higher than for negative returns for a wide range of the most-probable outcomes (the solid blue line is above the dashed red line over the left ⅔ of the chart. This is a bullish indicator.

Theory suggests that the market-implied outlook tends to be negatively biased (assigning too high a probability to negative returns) because investors, in aggregate, are risk averse and thus tend to overpay for put options. There is no way to rigorously measure or correct for this bias, but considering this tendency, the outlook for the next 2 months looks even more bullish.

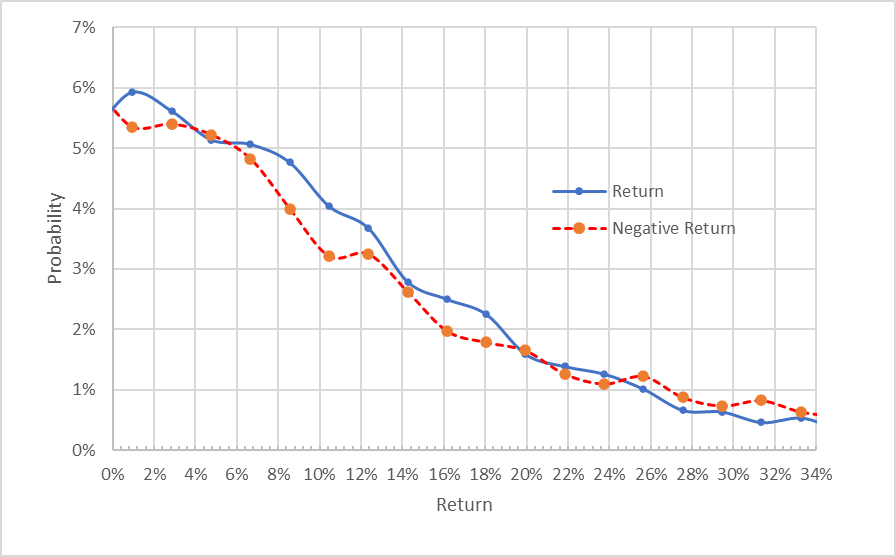

The outlook for the next 3.9 months is also slightly bullish, with the probabilities of positive returns consistently greater than, or at least equal to, the probabilities for negative returns for the most-probable outcomes. The annualized volatility calculated from this outlook is 29.0%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

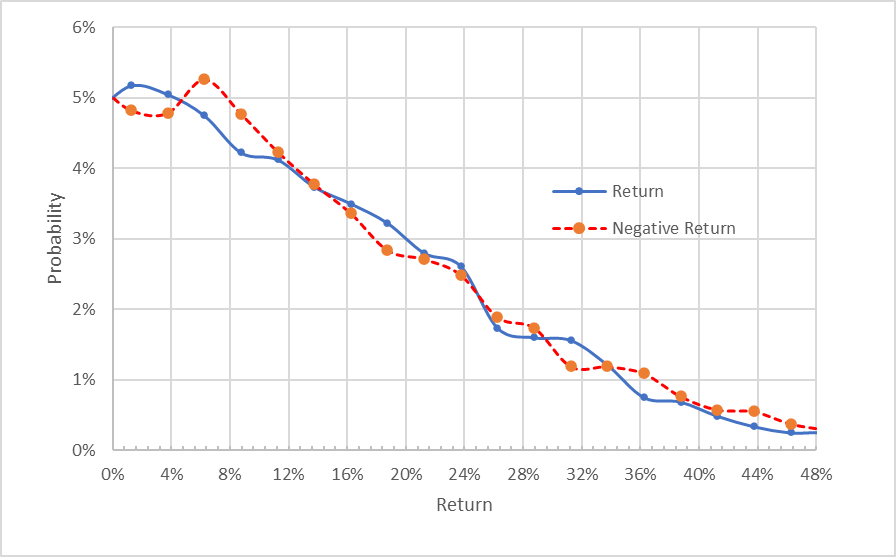

The 6.8-month outlook, from now until June 17, 2022, does not favor positive or negative returns. There are ranges of outcomes with higher probabilities of positive returns and others with higher probabilities of negative returns, but the variability looks like noise. Because of the expected negative bias in the market-implied outlook, this view to the middle of 2022 looks slightly bullish. The annualized volatility calculated from this outlook is 30.3%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlooks tell a consistent story, with a bullish outlook to early 2022, diminishing in strength towards the middle of the year. The options trading volume is quite low for the June options, so I put less weight on the outlook. The expected volatility for MET is quite stable, with an average value of around 29%.

Summary

MET shares peaked in early May and have lacked direction since, consistent with interest rates and bond yields. MET delivered solid results in Q3, but the shares have fallen since that report. The Wall Street consensus outlook was bullish in late April and continues to be bullish, but the consensus 12-month price target has risen, such that the expected total return for MET over the next year is 20%.

The market-implied outlook for MET in late April, looking out to January 2022, was neutral. Today, the outlook to early 2022 is bullish, becoming more neutral by the middle of the year. As a rule of thumb for a buy, I want to see an expected 12-month return that is at least half the expected (annualized) volatility.

The expected 12-month return from the Wall Street consensus is 20% and the expected volatility from the market-implied outlook is 29%, so MET exceeds this threshold. While MET’s returns are sensitive to interest rates and predicting rates is fraught with uncertainty, I am upgrading MET to a bullish rating.