- Mercado Libre is a leader in the e-commerce and financial services sectors in Latin America

- The company's outlook is positive thanks to reduced recession expectations and its foray into the financial sector

- $10 billion in net revenue achieved back in 2022 indicates strong financial health and positive prospects for the stock

Mercado Libre (NASDAQ:MELI), a renowned name in Latin American e-commerce and financial services, has not only gained global recognition but also fiercely competes with industry giants like Amazon (NASDAQ:AMZN) and Alibaba (NYSE:BABA).

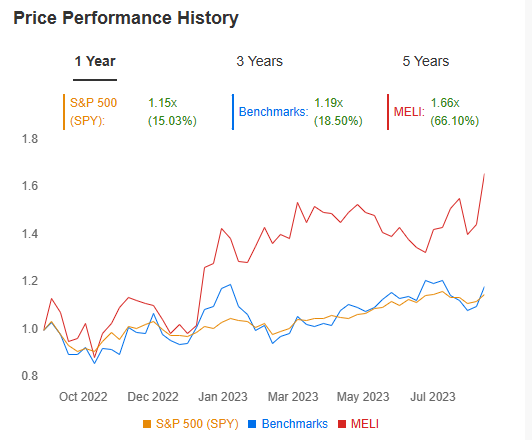

Founded in Argentina in 1999, the company's meteoric rise was aided by the lockdowns during the pandemic. Its Nasdaq-listed stock surged from approximately $700 in February 2020 to over $1420 presently, peaking above $1900 in 2021.

Source: InvestingPro

In Brazil, its BDR (Brazilian Depositary Receipt) is valued at R$58.25 and has touched nearly R$90 at its peak. With reduced expectations of a recession in the US and Europe for 2024, the commerce and retail sector is expected to gain momentum.

Leveraging InvestingPro's tools, we delve into whether Mercado Libre's stocks present a risk or opportunity for investors at this juncture.

MercadoLibre: A Regional Powerhouse

While the e-commerce sector was already robust before 2019, the pandemic supercharged its growth. Companies like Amazon and Alibaba have become integral to many people's lives, just like Mercado Libre, particularly within its Latin American sphere of influence. With over 40 million active users across 18 countries, Mercado Libre has diversified far beyond traditional e-commerce.

One of its key offerings beyond the marketplace is Mercado Pago. This venture into the payments sector has transformed Mercado Libre into a full-fledged fintech company with its own digital bank, credit card services, and traditional payment terminals catering to businesses of all sizes. The company also excels in logistics, aiming for swifter deliveries compared to its rivals, even establishing new distribution centers to facilitate same-day deliveries in major urban areas.

In addition to these ventures, Mercado Libre actively engages customers with exclusive experiences such as a loyalty points club, operational for several years. The company has also ventured into the streaming market with its new Meli+ subscription service, offering subscribers benefits like free shipping and scheduled deliveries.

Favorable Economic Outlook

While the world still anticipates a recession in 2024, particularly in the United States and the European Union, the Federal Reserve (Fed) and the European Central Bank (ECB) have revised their projections downward. This change bodes well for the commerce sector as a whole, and Mercado Libre, as a non-essential consumption segment, is poised to benefit.

Moreover, Mercado Libre's concentration on Latin America is a notable advantage. Even if the US and EU encounter a recession, emerging markets are likely to be less affected. In such a scenario, Mercado Libre maintains an edge over competitors with heavy market penetration in the affected regions, including China's Alibaba.

The company is capitalizing on this competitive advantage by diversifying into new segments, as mentioned earlier, while continually enhancing user experience. Its subscription service aims to be a premier offering in the region, and an affiliate program is set to bolster sales through content creators. Alongside the subscription, Mercado Libre is entering the lucrative streaming market with Mercado Play, a free platform offering users access to movies, series, and more, driven by Mercado Ads, the company's advertising unit.

Strong Financial Standing

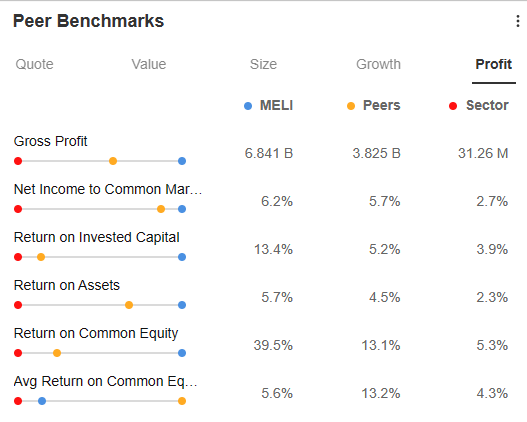

With a net revenue of $10.5 billion back in 2022, Mercado Libre is well-positioned for future growth. The company also exhibits impressive financial metrics, including a current Free Cash Flow of over $4 billion, a Return on Equity (ROE) of 39.5%, and a Gross Margin of 48.4%, indicative of operational efficiency.

Fair Value, Financial Health, and Peer Comparison

To determine whether Mercado Libre's stock represents a risk or opportunity for medium-term investors, we can utilize InvestingPro's tools.

In terms of fair value, Mercado Libre's Nasdaq-listed stock is currently trading above fair value. Priced at $1421.64, it stands 12.5% above the fair value of $1243.82, calculated from 12 valuation models ranging from $775.67 (Price-to-Book Value multiples) to $1694 (Enterprise Value-to-Revenue multiples).

Source: InvestingPro

The company's financial health is robust, with a score of 3.40 (B). This is attributed to strong performance in categories such as Growth, Price Momentum, and Profit, all receiving a score of 4. Key indicators like Accumulated Revenue Growth, Cash Flow Growth, Return on Invested Capital, and Net Profit contribute to these high scores. While the Cash Flow assessment is average (3), the Relative Value is slightly below (2) due to metrics such as a low Earnings Yield.

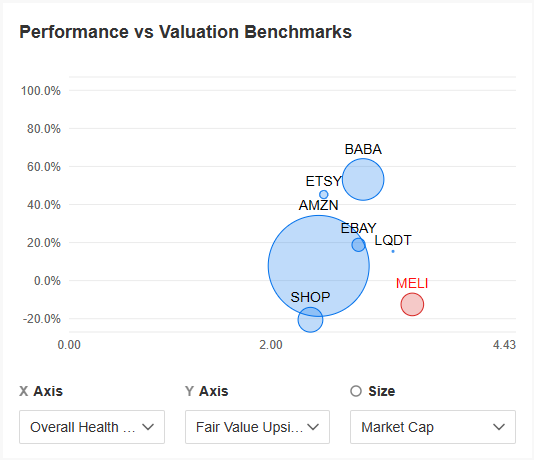

In a peer comparison within the sector, including major companies like Amazon, Etsy (NASDAQ:ETSY), eBay (NASDAQ:EBAY), Alibaba, Shopify (NYSE:SHOP), and Liquidity, Mercado Libre stands out with the highest financial health score of 3.40 (B). Only Liquidity receives a B rating (3.21), while others are rated C, ranging from 2.39 to 2.91 (higher values indicate better financial health).

Source: InvestingPro

Regarding fair value, Mercado Libre is overvalued, expecting an -11.0% over the next 12 months. The situation is similar to Shopify's, which is expected to perform at -20.6%. The remaining companies displayed in the chart are above undervalued, ranging from +7.7% (Amazon) to +53.2% (Alibaba).

Source: InvestingPro

Bottom Line

Mercado Libre possesses the elements required to continue its dominance in the Latin American e-commerce and financial services sector. Its diversification, focus on user experience, and positive outlook in the economic landscape enable it to compete effectively against giants from the US, Europe, and China.

With strong financial health and a recent track record of outperformance, there are compelling reasons to consider its potential as a promising opportunity for long-term investors.

***

Disclaimer: This article is for information purposes only; it is not intended to encourage the purchase of assets in any way, and does not constitute a solicitation, offer, recommendation, opinion, advice or investment recommendation. We remind you that all assets are considered from different angles and are extremely risky, so that the investment decision and the associated risk are specific to the investor.