Shares of restaurant chains can provide a refuge for long-term investors during market upheavals. Their low-cost meal options, global footprint, and earnings stability are some of the strengths that protect them from the extreme volatility that can affect high-flying growth stocks during uncertain times.

Today, we're looking at two global food chains—Starbucks (NASDAQ:SBUX) and McDonald’s (NYSE:MCD)—to analyze which stock offers a better value as the sell-off in markets deepens amid speculation that the Federal Reserve will tighten monetary policy more aggressively in order to tackle inflation.

1. Starbucks

Since last fall, there's a clear trend showing the specialty coffee maker, known for such beverages as pumpkin spice lattés and cinnamon roll frappuccinos, is losing investors' interest. Its stock, after surging to a record high in mid-July, is down more than 10% during the past six months, underperforming other large restaurant operators. Shares of SBUX closed yesterday at $106.03.

This weakness comes after a remarkable turnaround during the pandemic, when the Seattle-based company suffered a severe blow to its business as COVID-19 spread globally, forcing offices to close and daily customers to stay at home.

As sales gradually return to pre-pandemic levels, Starbucks is now facing new challenges in the shape of escalating prices of commodities and transportation, as well as wage inflation. Many analysts believe these headwinds will keep Starbucks’ margins under pressure and hold back its recovery, especially when it doesn't plan to slow down its investment efforts to capture market share.

As part of the plan to wrest sales from competitors, Starbucks aims to make $2 billion in capital expenditures this year as it aggressively expands, especially in China.

In a recent note, RBC Capital Markets analyst Christopher Carril lowered his outlook for Starbucks stock to ‘perform’ from ‘outperform,’ saying rising cost pressures will have an impact:

“The ongoing investment in its employees is core to SBUX’s operating strategy and principles, and likely the right decision for the business over the long term. We continue to believe this is the case, but given the magnitude of cost pressures in FY22, we see potential for lingering debate around the timing of a return to SBUX’s ongoing target of 18-19% operating margin.”

In a similar note, Oppenheimer analyst Brian Bittner said:

“Our updated analysis suggests EPS forecasts in ’22 and ’23 lack upside levers needed to drive outperformance. While 2022 is a well-telegraphed “investment year,” the Street already underwrites outsized margin and EPS growth in ’23.”

2. McDonald’s

The maker of Big Macs, Egg McMuffins and french fries is proving a much better bet in the ongoing rotation to value stocks and safety. Unlike SBUX, MCD shares rose to a record high last week, after delivering about 25% return last year. McDonald's stock finished on Monday at $264.41.

One reason for this strength is that MCD outperformed most restaurants during the pandemic, helped by its take-out and delivery focus. In addition, a new chicken sandwich, the company’s price hikes and its robust loyalty program, are fueling sales in the US, where the chain has more than 13,000 locations.

The company’s comparable sales expanded 12.7% in the quarter that ended Sept. 30, beating analysts’ estimates by nearly 10%.

Piper Sandler in a recent note upgraded MCD to overweight from neutral, saying the company is in a better position to tackle the challenges posed by the current inflationary environment.

The note said:

“While the cost pressures and operational challenges facing the broader industry are real, we believe McDonald’s is uniquely positioned to leverage its size, scale, operational capabilities and ongoing investments to take share as it leans into the high-level consumer trends highlighted.”

In the note, cited by CNBC.com, Piper Sandler said that it recently surveyed consumers and found a strong desire to return to restaurants, with preferences that pointed to a strong year for McDonald’s.

The note added:

“Our survey highlights a sustained and near-peak preference among consumers for engaging with restaurants via the drive-thru channel. On a cuisine basis, results indicate a steady and persistent demand for hamburger and chicken cuisines.”

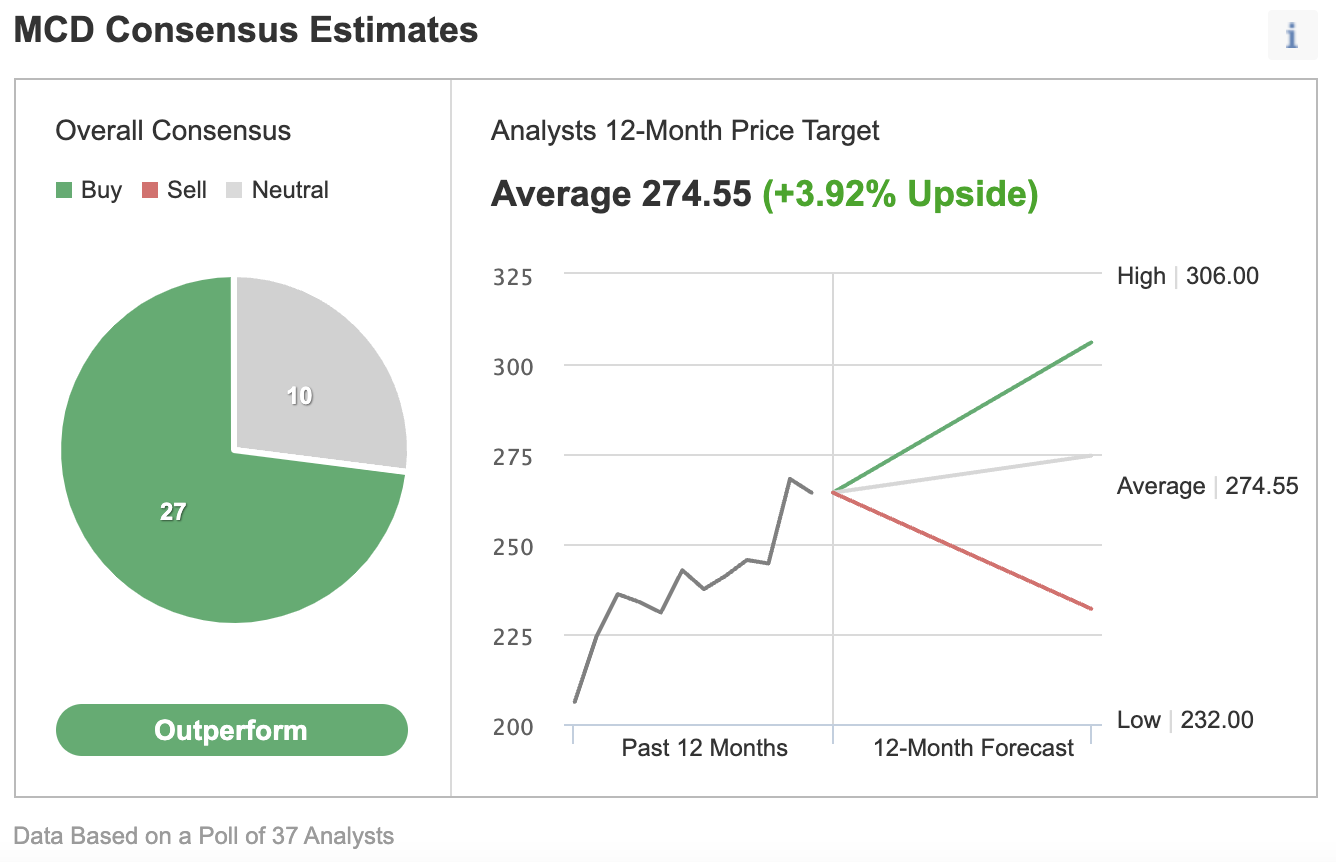

These positive sentiments are also reflected in an Investing.com’s survey of 37 analysts, of which 27 rate MCD as “outperform.”

Chart: Investing.com

The average 12-month price target on the stock is $274.55, an almost 4% upside.

Bottom Line

MCD is faring much better in the current flight to safety than Starbucks.

The preference by investors for the fast-food giant shows its stock will be less impacted by macro events over the coming months as the market grapples with a more hawkish Fed, and restaurant operators continue to face higher inflation, worker shortages and supply/demand imbalances.