Federal Reserve Chairman Jerome Powell, speaking at a conference on Tuesday, gave the doves most of what they wanted to hear. Although he said more evidence was needed to rationalize cutting interest rates, his overall message favored expectations that policy easing is on the near-term horizon.

“We’ve made quite a bit of progress and in bringing inflation back down to our target,” Powell advised at a central banking forum in Portugal. “The last [inflation] reading and the one before it to a lesser extent, suggest that we are getting back on the disinflationary path. We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

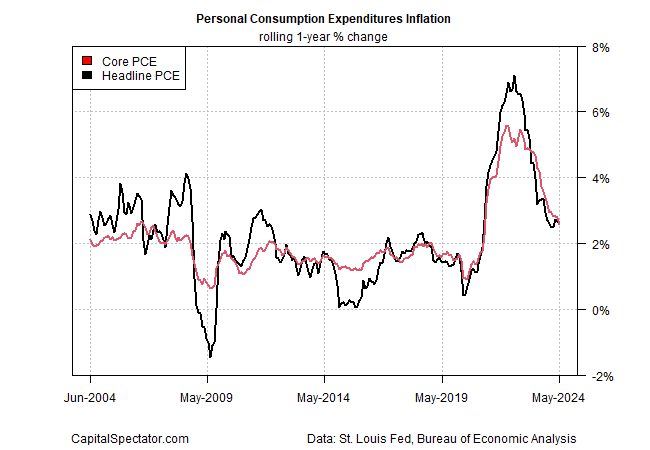

The “progress” includes Friday’s news that the core reading of Fed’s preferred inflation measure eased in year-over-year terms in May to 2.6% — its softest pace in more than three years, based on the Personal Consumption Expenditures Price Index. Reaching the Fed’s 2% inflation target, in other words, appears to be on the near-term horizon.

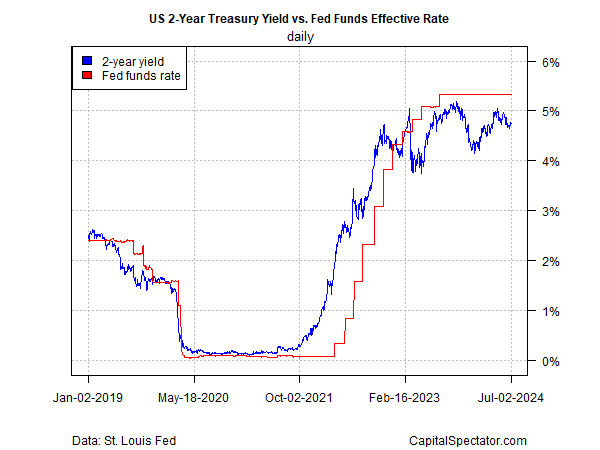

The policy-sensitive 2-year Treasury yield continues to trade in a tight range, ending yesterday’s session (June 2) at 4.75%. But that’s well below the ~5% mark that was briefly reached in April, which suggests that investor sentiment remains moderately confident that the Fed will soon cut its current 5.25%-to-5.50% target rate.

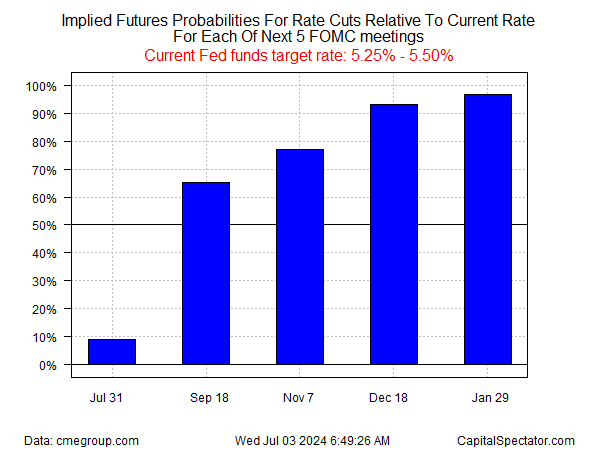

The Fed funds futures market is pricing in a moderate probability that the central bank will soon begin easing policy, perhaps as early as the Sep. 18 FOMC meeting. The current estimate reflects a roughly 65% probability that the central bank will announce a rate cut in two months.

The timing of the rate cuts is a key factor, Powell noted.

“We’re well aware that if we go too soon, that we can undo the good work we’ve done. If we do it too late, we could unnecessarily undermine the recovery and the expansion.”

The next update on inflation that will test whether disinflationary progress is continuing arrives on July 11, with the release of consumer prices for June.