- Companies will be announcing dividends for last year in the coming weeks/months.

- In this piece, we'll take a look at three stocks with the highest dividends.

- Not only do these companies pay high dividends, they tend to deliver them on a consistent basis.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

At the start of the new year, companies typically convene General Meetings where the dividend payments to shareholders are often determined.

Companies usually opt to distribute profits to investors on a quarterly or annual basis.

The past year witnessed a consistent trend of regular dividend payments that have grown gradually.

In today's analysis, we'll focus on three companies distinguished by their regular dividend payments and a high dividend yield ratio, comparing last year's data against the S&P 500 average.

The upcoming weeks also coincide with the period for the release of financial statements for the last quarter of 2023.

Altria Stands Out With the Highest Dividends

Beginning with Altria (NYSE:MO), a holding company encompassing entities under the Philip Morris (NYSE:PM) brand within the tobacco industry.

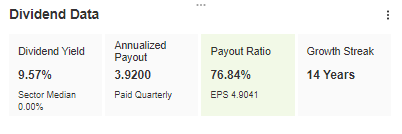

Among these companies, Altria stands out with the highest dividend yield, reaching 9.75% last year.

Source: InvestingPro

In the context of dividends, the main thing to note is the amount of free cash flow generated, which currently stands at just under $5.9 billion.

Such a stock should easily cover the need to pay out a portion of profit to shareholders without the need to deviate from the positive path set in recent years.

The vast majority of the company's revenue comes from smoking products, yes, however, smoke-free products are starting to become increasingly important. This sector is expected to grow 35% by 2028, according to company estimates.

Verizon Stock Rebounds From Long-Term Lows

Another company to watch out for is Verizon Communications (NYSE:VZ), which is a major player in the US market for broad-based telecommunications services.

The company boasts of paying dividends continuously for the past 19 years with a dividend yield of 6.77% last year with a dividend payout ratio of 52.50%.

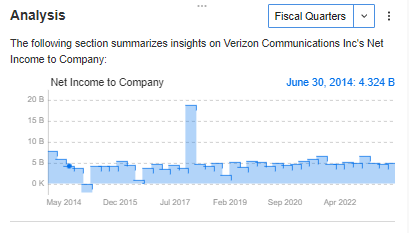

What is peculiar is that the company has maintained a stable level of net income for almost the entire last decade, which is a good prognosis when it comes to regular profit payments over the long term.

Source: InvestingPro

From a charting perspective, the stock has rebounded from long-term lows, which were set just above the $30 per share level, the lowest since 2010.

A breakout of the $43 per share resistance level, which opens the way for an attack on the $50 region, will be key to maintaining momentum and continuing the northward movement.

Comerica Has Been Paying Dividends for More Than 50 Years

Comerica (NYSE:CMA) is an established brand in the financial services market with under 400 branches mainly in the southern states of the US.

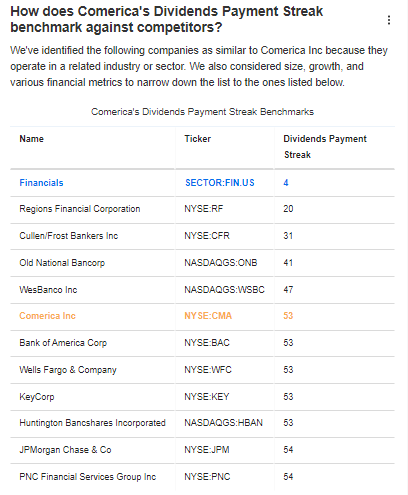

What is striking when examining the details of the dividend payment is that it has been consistently paid for the past 53 years, placing the company at the forefront of the financial sector.

Source: InevstingPro

Comercia also looks attractive considering the underlying metrics with a dividend yield at the top of 5.33%.

However, one has to be particularly careful when considering buying it, as the company will announce its financial report as early as Friday, which is preceded by 12 downward revisions with only 2 upward.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.