- Some stocks can really test your patience with a prolonged downtrend.

- Holding on to the stock, and seeing your portfolio bleed can be painful.

- Even worse would be selling it right before a turnaround. But this tool can help you avoid exactly that.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

After six months of a nearly straight upward trend in the market, investors have begun preparing for a more volatile environment ahead. Among the several risk factors preying on traders' minds, growing fears of an economic recession in the US have joined a series of disappointing earnings from big tech companies, signaling caution ahead.

In addition, a global carry trade unwind provoked by a Bank of Japan rate hike and growing geopolitical worries added to an already volatile macroeconomic picture ahead of the US presidential election and uncertainty about the pace of the US Federal Reserve's rate cut cycle.

But while those worries are indeed justified, they do not imply that you should sell your positions and run for the hills.

On the contrary, a little volatility can prove a blessing to those able to find the right stocks at the right time.

In fact, after months of a market almost completely overvalued, a general reshuffle trend that has taken hold over the last month has opened new, more exciting opportunities to savvy traders out there.

But just where to find such stocks?

While financial research is a serious, often complicated, game, InvestingPro's flagship Fair Value tool can cut through the noise with the click of a button.

By combining 17+ industry-recognized metrics, it can guide you through every stock in the market with an accurate price target for each one of them. This will allow you to understand with laser-sharp precision whether it is time to buy, hold, or sell a stock.

And the best part? It only costs less than $8 a month using this link.

Sounds too good to be true, right?

Well, not quite. InvestingPro's Fair Value tool has consistently brought tried-and-true results to its users over the years.

Check out these real-world cases below for more on how Fair Value has helped our premium users.

Blackstone: Fair Value Calls the Bottom Near Perfection

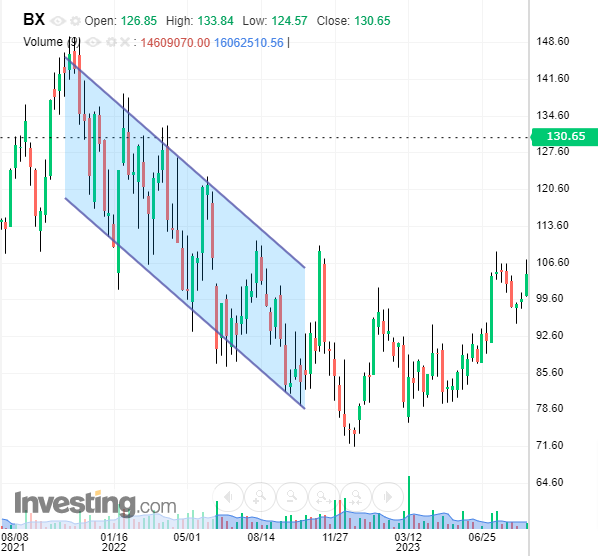

Blackstone (NYSE:BX) stock had been in a persistent downtrend, shedding about 30% from November 2021 to September 2022.

Many investors, frustrated by the prolonged decline, decided to exit their positions, unaware that the stock’s turnaround was just around the corner.

On September 27, 2022, InvestingPro’s fair value tool identified a significant upside potential of 53.4% for Blackstone.

While the stock dipped slightly further after that signal, it wasn’t long before the recovery began. Unfortunately, some of the most impatient investors sold at a loss just before the rebound.

In contrast, InvestingPro subscribers who trusted the Fair Value signal saw impressive gains. Since the call, the stock has surged 57.11%, outperforming the S&P 500 by 12% over the same period.

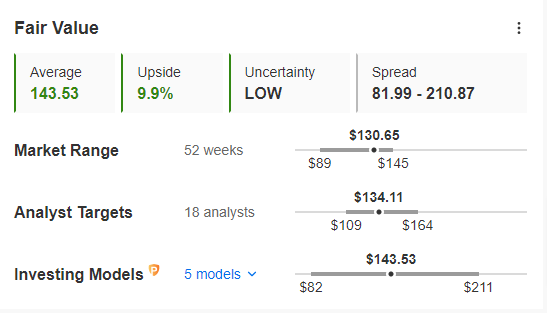

Currently, the Fair Value tool suggests a further 9.9% upside from the stock's current level.

Source: InvestingPro

With earnings set to come out on October 17, 2024, there’s a chance the stock could achieve this additional upside before the results are announced.

Amazon: Trusting Fair Value Paid Off Handsomely

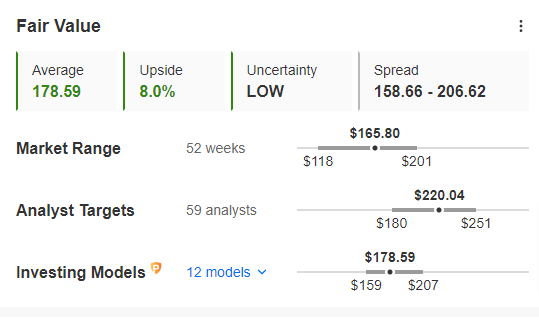

Amazon.com (NASDAQ:AMZN) entered a downtrend on December 21, 2021, and by June 14, 2022, the stock had lost over 38% of its value.

On June 14, 2022, the fair value tool indicated a potential 54.3% upside. Fair enough, the stock did not bottom at that exact moment, as the downward momentum did have some room to run before it did.

Eventually, the turnaround did materialize as the stock found a bottom.

Since reaching its low, Amazon’s stock has surged nearly 60%, significantly outpacing the S&P 500’s 41% gain. This impressive return includes the recent dip following the company's earnings report on August 1.

After the post-earnings decline, the Fair Value tool is suggesting an 8% upside for the stock.

Source: InvestingPro

Bottom Line

Bag-holding a stock or selling it right before the bottom can be a costly mistake.

After the recent correction, many stocks like Blackstone and Amazon have ended a period of downtrend and become ripe for a turnaround.

With tools like Fair Value at one's disposal, there can be no excuses to be booking hefty losses in stocks that are about to turn higher.

So, what are you waiting for? Make better-informed decisions now.

Use InvestingPro today for less than $8 a month as a part of our summer sale and discover stocks that could be ripe for a turnaround!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest and is not intended to incentivize asset purchases in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and associated risk remains with the investor.