Though a rising interest rate environment adversely affects fixed-rate bond investments, the defining attributes of floating rate debt, incoming generation and low price sensitivity, have proven beneficial at this point in time.

The defining attributes of fixed income investments are their low-risk nature and the surety of income they provide, however, ‘low risk’ is not ‘no risk,’ as all investments are prone to experience adverse periods of performance. As global economies begin increasing interest rates to combat inflation, bond prices are declining, but their yield generation is increasing. So, what opportunities reside within this new rate environment for fixed income investors.

Looking Across the Fixed Income Spectrum

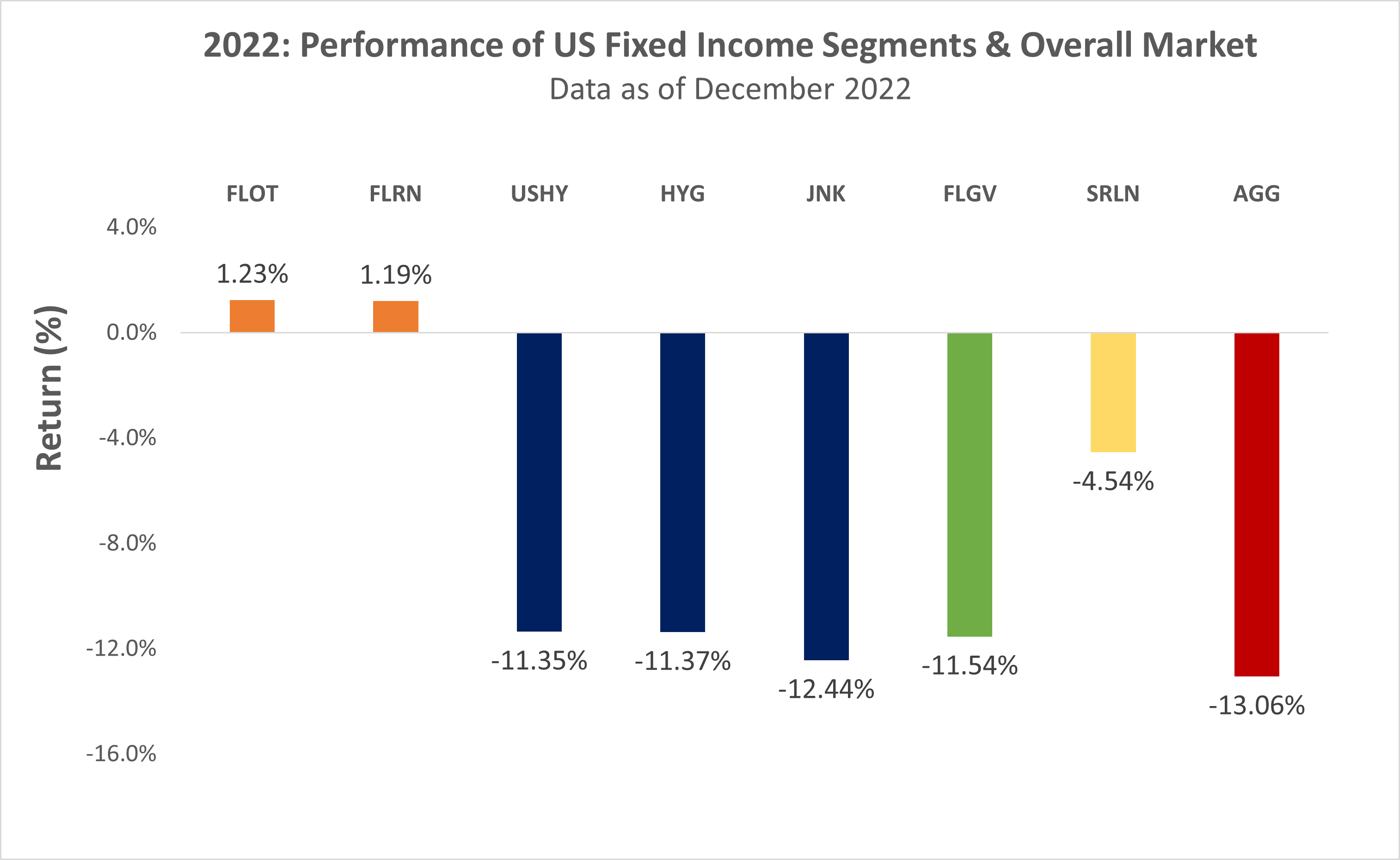

The concept of diversification is often spoken about in regards to equity portfolio construction, but it is also a key consideration in creating a comprehensive bond portfolio; as all fixed income segments do not perform in a similar manner. Looking across the US fixed income spectrum of 2022, almost all segments underperformed, the lone exception being floating rate loans.

Category: Floating Rate Debt

- FLOT: iShares Floating Rate Bond ETF | 2022 Annual Return: 1.23%

- FLRN: SPDR Bloomberg Investment Grade Floating Rate ETF| 2022 Annual Return: 1.19%

Category: High Yield Debt - USHY: iShares Broad USD High Yield Corporate Bond ETF | 2022 Annual Return: -11.35%

- HYG: iShares iBoxx $ High Yield Corporate Bond ETF | 2022 Annual Return: -11.37%

- JNK: SPDR Bloomberg High Yield Bond ETF | 2022 Annual Return: -12.44%

Category: Treasury - FLGV: Franklin US Treasury Bond ETF | 2022 Annual Return: -11.54%

Category: Bank Loan - SRLN: SPDR Blackstone (NYSE:BX) Senior Loan ETF | 2022 Annual Return: -4.54%

Category: US Aggregate - iShares Core US Aggregate Bond ETF | 2022 Annual Return: -13.06%

The Case for Investing in Floating Rate Debt

Floating rate debt can play an important role in a diversified portfolio, due to its ability to generate a relatively high level of income, while also having low price sensitivity to interest changes. As the name suggests, floating rate instruments are tied to a short-term benchmark rate that adjusts periodically over time. In the current rising rate environment, the income generated from floating rate debt contributes to the overall return performance of a portfolio.

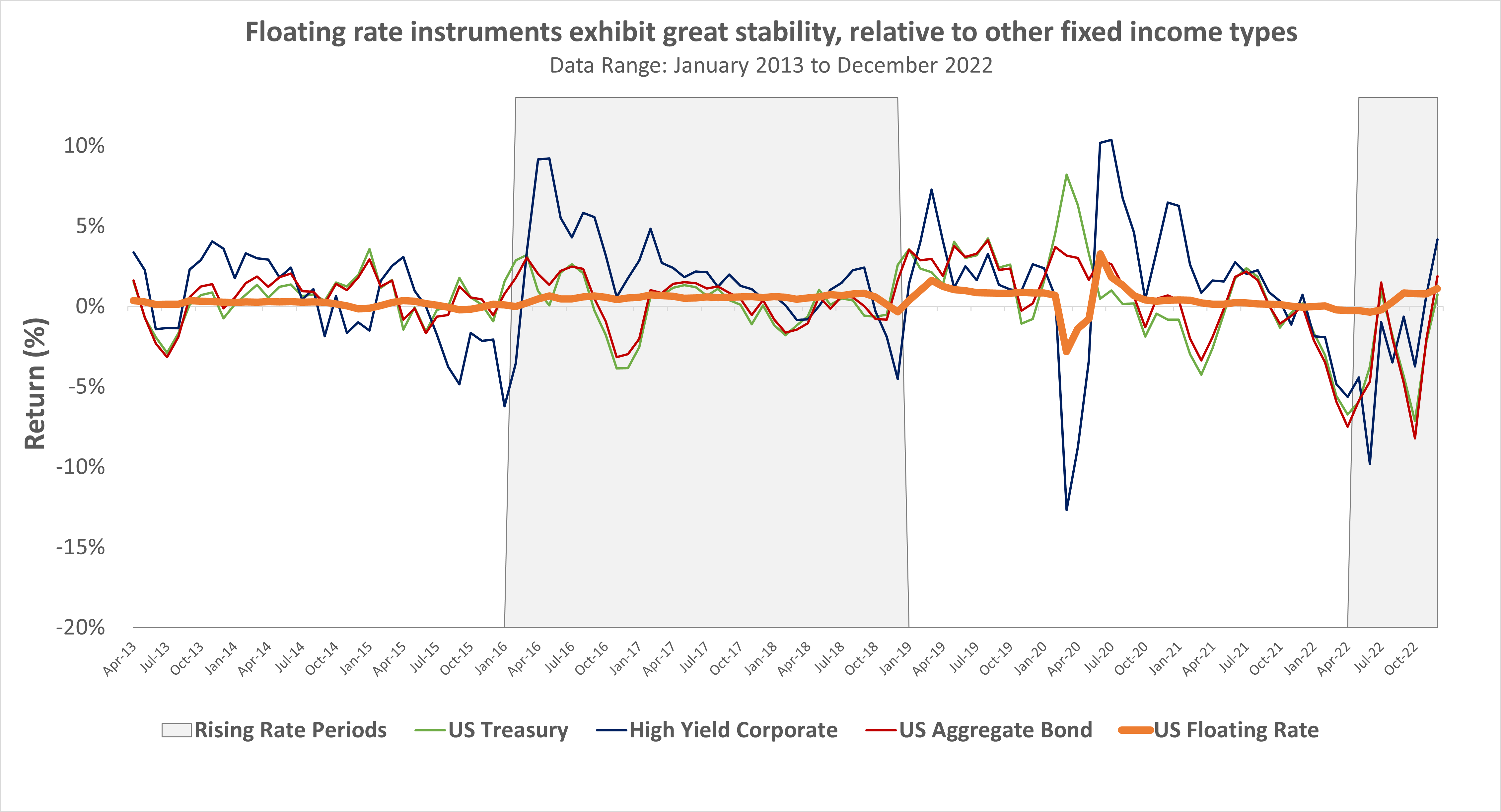

Beyond its income-generating capabilities, floating rate debt can be a stabilizing component within one’s portfolio. Given the inverse relationship between prices and yields of fixed-rate bonds, as market interest rates rise, a low fixed coupon rate may no longer be attractive—the price will generally fall to make its yield more in line with market interest rates. But floating rate instruments don’t suffer from this dynamic - because their coupons adjust with market interest rates, their prices don't need to, making them very stable.

In comparing the return profile of the US floating rate index, relative to other bond segments and the aggregate bond market, floating rate debt instruments have exhibited a less volatile investment profile over time, regardless of the interest rate environment. Please note, the rising rate periods indicated on the chart was determined by reporting done by the World Economic Forum on the historical pacing of US Federal Reserve interest rate increases.

For bond investors, as the Federal Reserve continues to raise rates, floating rate debt should be considered an ideal bond segment to allocate towards, due to its low interest rate sensitivity. Floating rate debt allows investors to maintain exposure to the bond market, rewarding them with higher income payments, rather than trying to time the market and waiting for the perfect time to invest in bonds.

For investors interested in gaining exposure to floating rate debt, the iShares Floating Rate Bond ETF (NYSE:FLOT) and SPDR Bloomberg Investment Grade Floating Rate ETF (NYSE:FLRN) are two passively managed investment offerings that provide direct exposure to the floating rate bond market. For bond investors seeking to mitigate interest rate risk in a portfolio, and gain some upside in a rising rate environment, these two solutions are worth consideration for one’s portfolio.

***

This content was originally published by our partners at ETF Central.