-

Spotting undervalued stocks amid bull markets is a crucial skill for investors seeking strong returns.

-

Tools like InvestingPro’s Fair Value can help find opportunities hidden beneath market highs.

-

From industrial giants to auto leaders, data-driven insights uncover the value others might miss.

- Get ready for massive savings on InvestingPro this Black Friday! Access premium market data and supercharge your research at a discount. Don't miss out - click here to save 55%!

Against the backdrop of a second Trump mandate in the US, the prospect of more Fed rate cuts, improving prospects in China, and a global economy that refuses to turn lower in spite of all predictions at the start of the year, one thing is certain: Risk-on sentiment has seldom been higher in the stock market.

While that has so far proven highly positive for the bulls, as global markets notched the best week of an already amazing year last week, it also significantly increases the overall risk-reward proposition when holding stocks.

Certainly, that doesn't imply that you should just take your profits and run for the hills - although hoarding some cash might in fact be a good idea at this point (just look at what Buffett has been doing).

However, what it does imply is that having a better understanding of the actual value of the stocks in your portfolio has become more important than ever before.

As savvy investors know, allocating your investments to assets that offer a greater upside and a smaller downside potential will often prove the difference between having a great and an average year when the tides eventually turn.

Moreover, despite the market being at such frothy heights, there are arguably several bargains out there. In fact, you may be surprised to learn that, amid last week's rally, the index that gained the most was the highly undervalued Russell 2000, which jumped a massive 8.6%.

But how do you spot these stocks? Well, that’s where InvestingPro’s Fair Value tool will prove a game-changer.

With just one click, you can access over 17 industry-standard metrics for every stock on the market, providing accurate price targets to help guide your next move.

And now, as part of our Black Friday sale, you can tap into this tool at a 55% discount.

But don't just take our word for it - let's have a look at the success stories through real-world examples, which we will discuss in detail below.

1. 3M Company – Market Shunned the Stock, Fair Value Identified a 47.26% Discount

Legal woes can sink a stock, but 3M's (NYSE:MMM) story took a surprising turn when market watchers spotted an undervalued gem beneath the headlines.

In 2022 3M Company faced mounting legal troubles and the industrial giant’s stock plummeted. Few investors wanted to touch the St. Paul, Minnesota-based company, which was grappling with a slew of high-profile lawsuits, including an $850 million settlement in 2018 for contaminating water and natural resources in its hometown.

The intense market pessimism and cascading liabilities dragged 3M’s stock down 32% for the year, causing frustration and panic among investors and damaging the company’s reputation.

As legal liabilities loomed, 3M’s valuation dropped significantly, with the constant flow of lawsuits casting doubt on its future stability. Yet, at this low point, Fair Value (FV)—a data-driven valuation tool—saw a compelling opportunity.

FV identified a substantial 47.26% discount on 3M's fair value, suggesting that the company’s fundamentals were still intact despite the negative sentiment weighing down the stock.

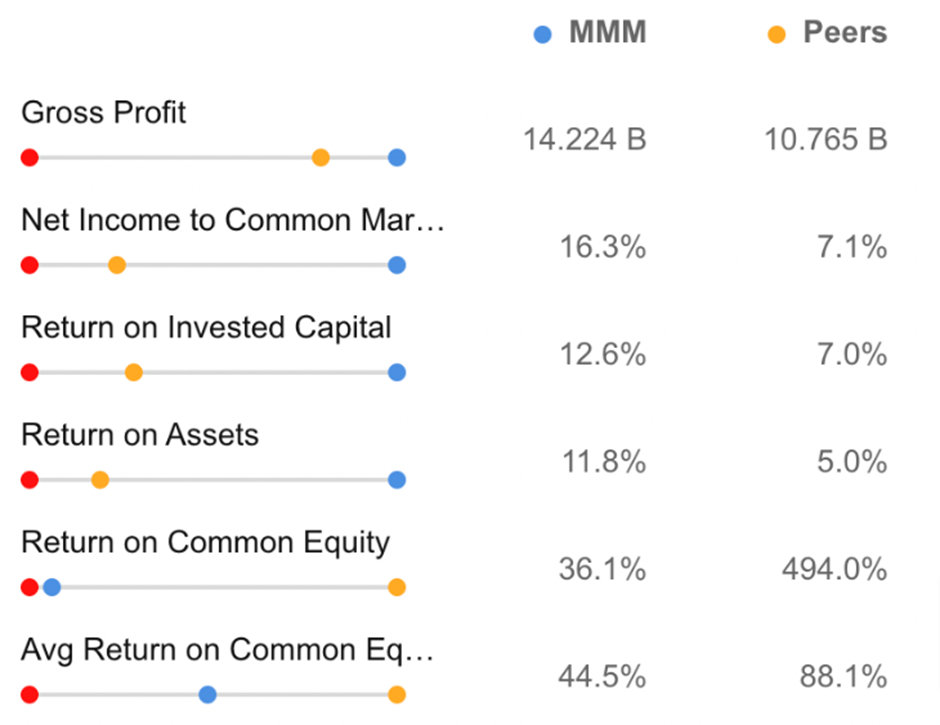

Examining 3M’s financials validated FV’s insight. The company remained an industry leader, showing strength in gross profit, net income margins, return on invested capital, and return on assets compared to peers.

Source: InvestingPro

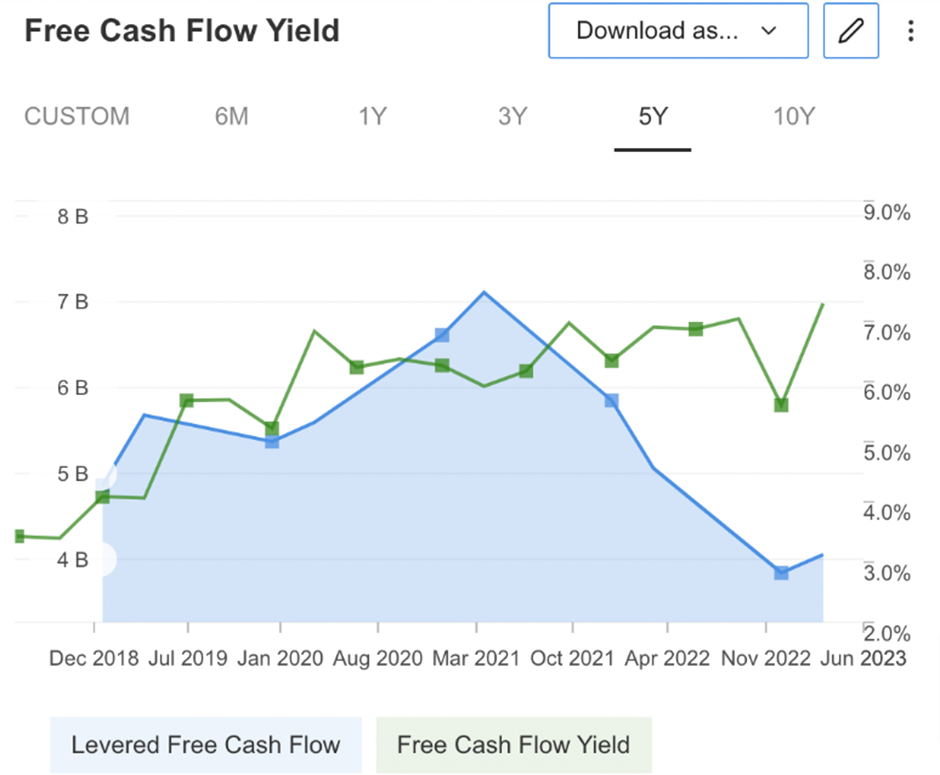

Additionally, 3M’s free cash flow yield continued to grow, while cash flow leverage stayed impressively low.

Source: InvestingPro

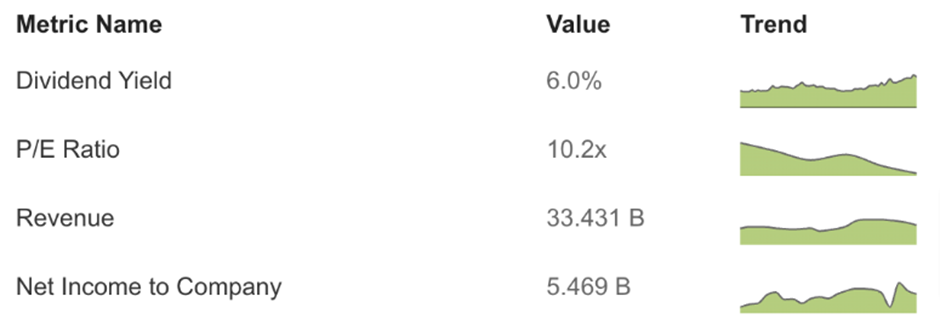

Despite the negative headlines, 3M appeared financially solid, boasting a 10.2 P/E ratio with robust profitability by October 2022—just as FV highlighted its deep-value potential.

Caption: P/E as of late 2023

Fair Value’s call turned out to be prescient. At the close of 2023, 3M’s stock began a remarkable comeback, rallying to deliver an impressive 52.68% return by August 2024.

The recovery proved that beneath the legal storms, 3M’s financial foundation remained resilient, ultimately rewarding those who saw value where others saw risk.

2. General Motors – Top Performing Auto Stock That Left Rivals in the Dust

The auto industry is transforming fast, driven by electric vehicles, autonomous tech, and vehicle-as-a-service models.

Amid a challenging year, General Motors (NYSE:GM) has surged ahead, posting a 51% return in 2024—outpacing rivals like Tesla (NASDAQ:TSLA), up 29%, and Ford (NYSE:F), which has faced losses alongside Stellantis (NYSE:STLA), down 41% YTD.

How did GM pull this off? The company has kept strong margins and boosted revenue, fueling its stock’s impressive climb.

Investors who used InvestingPro’s Fair Value tool got an early advantage: the tool identified GM as a potential bargain, spotting a 45% discount on November 11, 2023, just before the rally began.

Not only was the stock able to fulfill the Fair Value potential of 45% by August 7, 2024, it went beyond, exceeding the FV target by 6.5%, returning 51.40% in total.

The stock outperformed the broader market by far, as the S&P 500 returned 18% in the same period.

Bottom Line

In an era where market rallies can make even cautious investors eager to jump in, spotting undervalued gems becomes crucial—and tools like InvestingPro’s Fair Value have proven invaluable.

3M and GM’s impressive rebounds exemplify how smart insights, powered by data, can uncover opportunities that others might miss.

As market optimism grows, now could be the time to add undervalued stocks to your portfolio with confidence.

With InvestingPro’s Fair Value tool, you’ll gain access to deep insights, helping you make informed decisions even when the market seems at its peak.

Don’t miss out on today’s opportunities—equip yourself with InvestingPro and take advantage of our Black Friday offer to stay ahead.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.