In this Helium (HNT) price prediction 2024, 2025-2030, we will analyze the price patterns of HNT by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

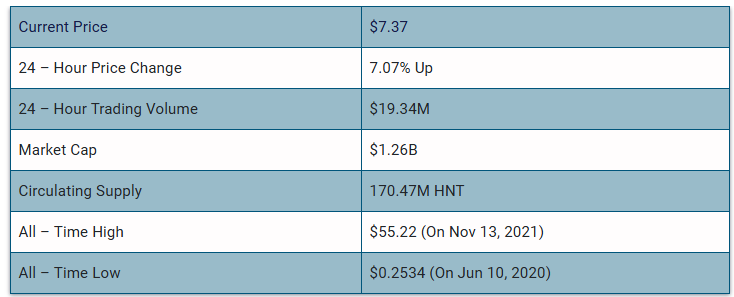

Helium (HNT) Current Market Status

What is Helium (HNT)

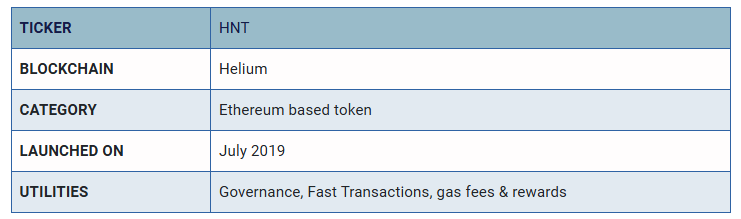

Helium (HNT) is the native utility token of Helium, a decentralized wireless Internet-of-things (IoT) network. HNT was launched in 2019. The token was created based on a burn-and-mint equilibrium (BME) model. HNT are burnt and converted to Data Credits (DCs) that users hold to access and use the network.

Helium operates on a proof-of-coverage (PoC) consensus algorithm. PoC relies on Honey Badger Byzantine Fault Tolerant (HBBFT). With this algorithm, the transactions are encrypted by a shared public key and can only be decrypted by an elected consensus group.

HNT tokens can be mined through ‘hotspots’, wireless devices that use radio waves. Miners mine HNT and create network coverage for IoT devices. Also, the network aims to achieve decentralized IoT communication

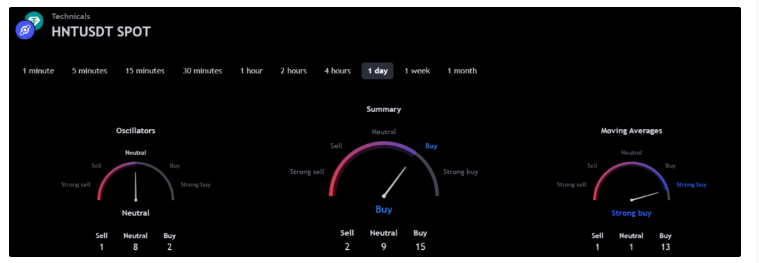

Helium 24H Technicals

Helium (HNT) Price Prediction 2024

Helium (HNT) ranks 60th on CoinMarketCap in terms of its market capitalization. The Helium price prediction for 2024 is explained below with a daily time frame.

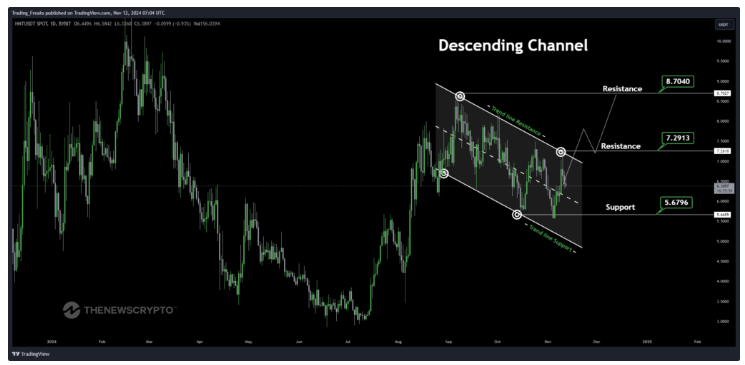

In the above chart, Helium (HNT) laid out a descending channel pattern. A descending channel, also known as a falling channel, is a bearish technical analysis pattern formed by two parallel downward-sloping trendlines. The upper trendline connects a series of high points, indicating resistance where the price struggles to rise above, while the lower trendline connects the lower points, acting as support.

This pattern suggests that sellers are in control, with the price consistently making lower highs and lower lows. Traders often look to sell near the upper trendline and buy near the lower trendline, as the price typically oscillates within this defined range. Overall, the descending channel helps traders identify potential shorting opportunities and assess market sentiment.

At the time of analysis, the price of Helium (HNT) was recorded at $6.10. If the pattern trend continues, then the price of HNT might reach the resistance level of $7.2913 and $8.7040. If the trend reverses, then the price of HNT may fall to the support of $5.679.

Helium (HNT) Resistance and Support Levels

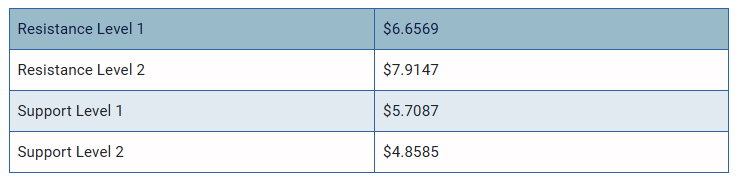

The chart below elucidates Helium’s possible resistance and support levels (HNT) in 2024.

From the above chart, we can analyze and identify the following as resistance and support levels of Helium (HNT) for 2024.

Helium (HNT) Price Prediction 2024 — RVOL, MA, and RSI

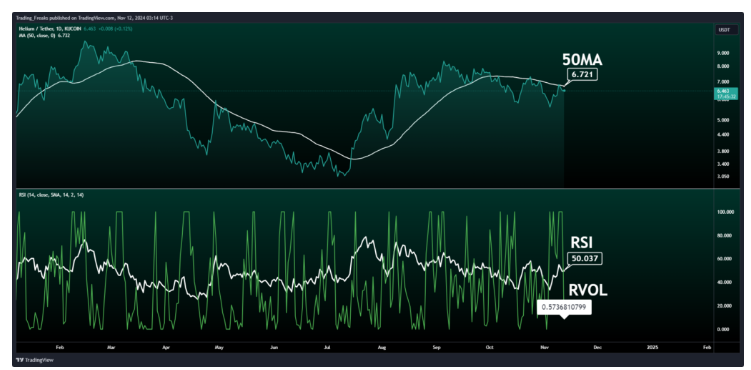

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Helium (HNT) are shown in the chart below.

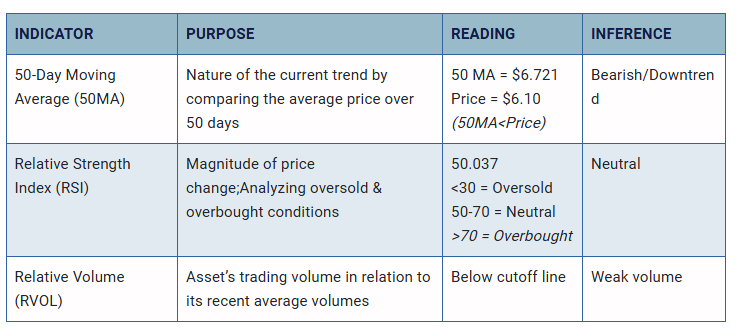

From the readings on the chart above, we can make the following inferences regarding the current Helium (HNT) market in 2024.

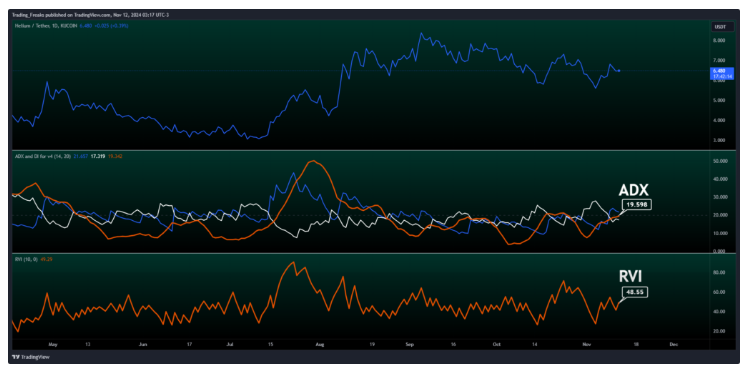

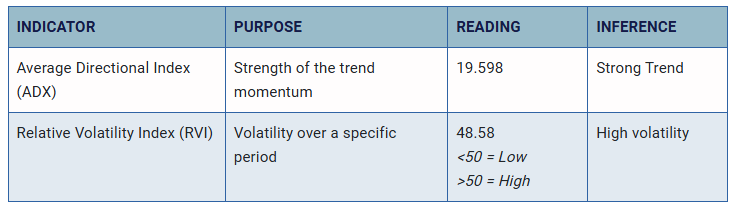

Helium (HNT) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Helium (HNT) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Helium (HNT).

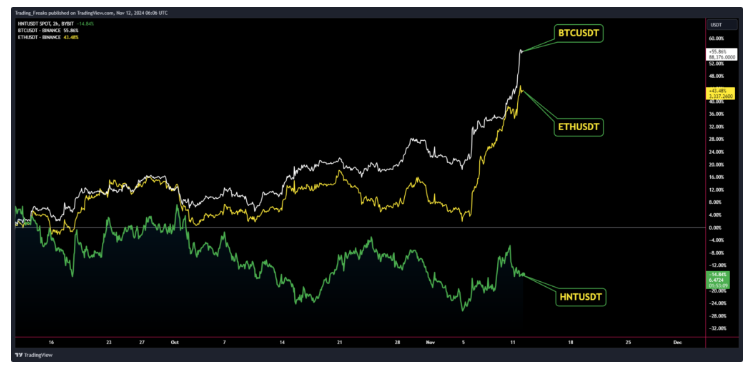

Comparison of HNT with BTC, ETH

Let us now compare the price movements of Helium (HNT) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of HNT is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of HNT also increases or decreases respectively.

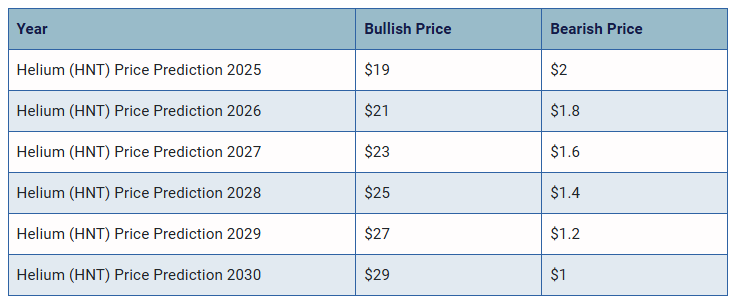

Helium (HNT) Price Prediction 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Helium (HNT) between 2025, 2026, 2027, 2028, 2029, and 2030.

Conclusion

If Helium (HNT) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish Helium (HNT) price prediction for 2024 is $15.725. Comparatively, if unfavorable sentiment is triggered, the bearish Helium (HNT) price prediction for 2024 is $3.058.

If the market momentum and investors’ sentiment positively elevate, then Helium (HNT) might hit $17. Furthermore, with future upgrades and advancements in the Helium ecosystem, HNT might surpass its current all-time high (ATH) of $55.22 and mark its new ATH.

This content was originally published by our partners at The News Crypto.