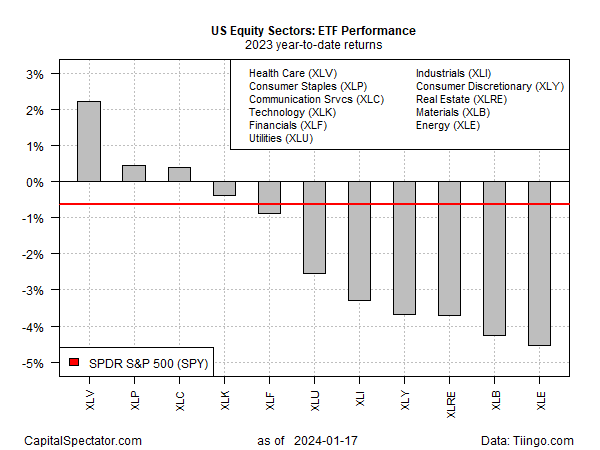

After a modest loss in 2023, shares in the healthcare sector (NYSE:XLV) are enjoying a market-leading rebound so far in the new year.

No one knows if it will last, but the early results certainly look encouraging after this slice of the market has pulled ahead of the rest of the field year to date, based on a set of sector ETFs through yesterday’s close (Jan. 17).

Health Care Select Sector ETF XLV has climbed 2.2% so far in January.

That’s a solid gain relative to the broad market (SPY), which has ticked down 0.6% in 2024’s opening run. Even more impressive, healthcare is outperforming all the other sectors, in some cases by wide margins.

Energy stocks are currently the worst performer among US sectors. Following a modest loss in 2023 for Energy Select Sector SPDR® Fund (NYSE:XLE), the weakness has spilled over into 2024 with a year-to-date decline of 4.5%.

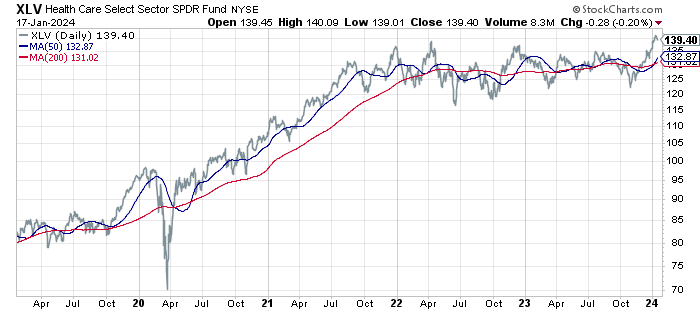

The technical profile for several health stocks looks attractive, advises Renaissance Macro’s Jeff DeGraaf, who points to the return of the so-called golden cross: 50-day moving average rising above its 200-day counterpart.

“Several healthcare names are exhibiting golden crosses, and we continue to believe the prospects for the sector are attractive for 2024,” he tells MarketWatch.

By that reasoning, XLV also looks attractive in the wake of its 50-day average again rising above its 200-day average.

Skeptics will note that we’ve seen this indicator issue several false signals in recent years while the fund has remained in a trading range.

What’s different this time, which investors in healthcare shares hope may signal an enduring bull run: XLV has finally broken out of its trading range on the upside this month (after several failed attempts in recent years).

Does it all add up to a favorable trend signal for healthcare shares in 2024? The odds appear to be leaning a bit more in that direction so far this month.