Does gold have a chance to sprint toward $1,800 or even $1,900 before the year ends?

It depends pretty much on how the yellow metal reacts to Friday’s inflation data reflected by the Consumer Price Index.

Gold had an opportunity to reclaim the $1,900 mantle a week ago when it got to as high as $1,853 ounce in New York’s COMEX trading.

Settling above the $1,800 level has been a test of sorts for the front month contract on COMEX.

On Friday, COMEX’s spot gold contract peaked at just below $1,777 ahead of the release of the CPI for November.

The Federal Reserve is closely watching numbers on US inflation and employment, among others, to determine the timing for the first post-pandemic rate hike. The central bank kept rates unchanged at between zero and 0.25% since the COVID-19 outbreak in March 2020.

A rate hike will be negative in principle for gold prices.

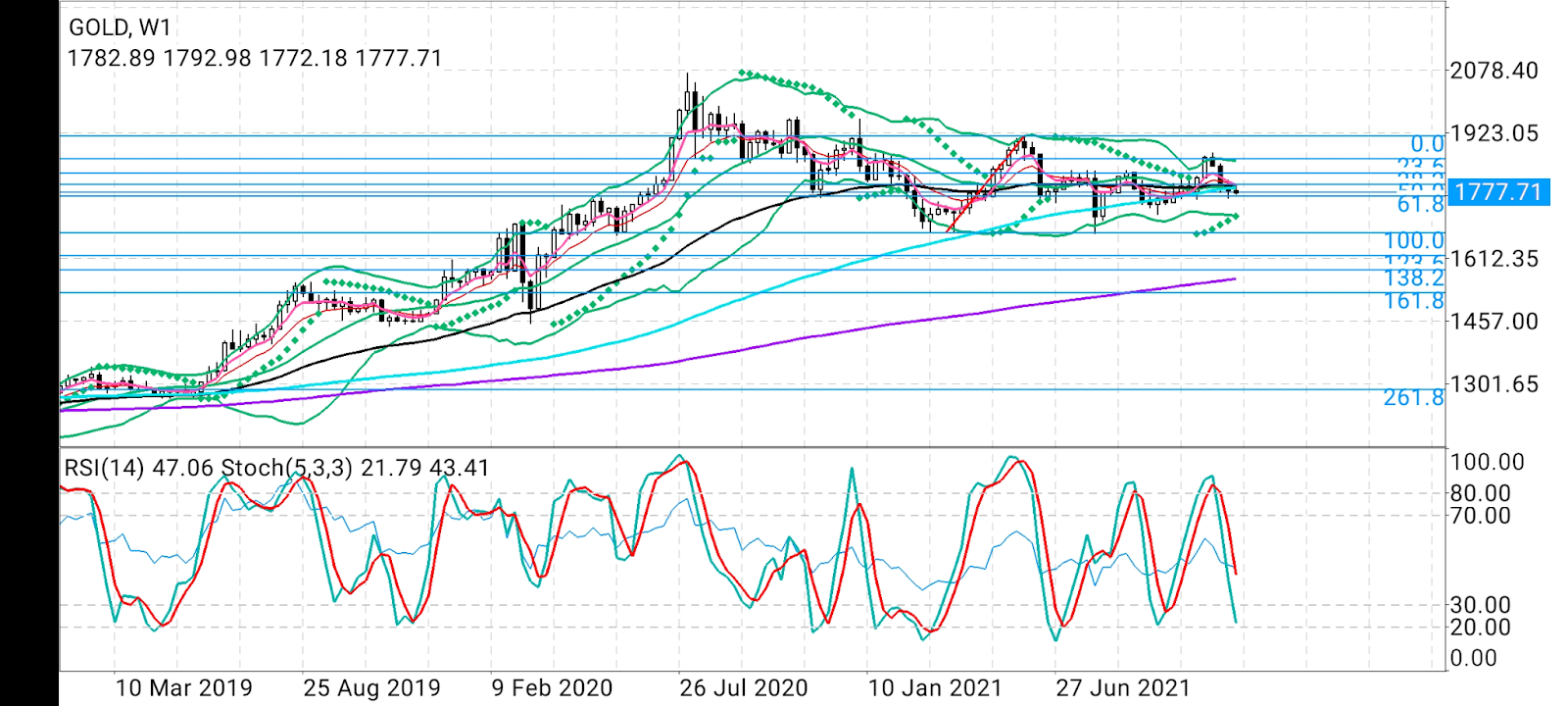

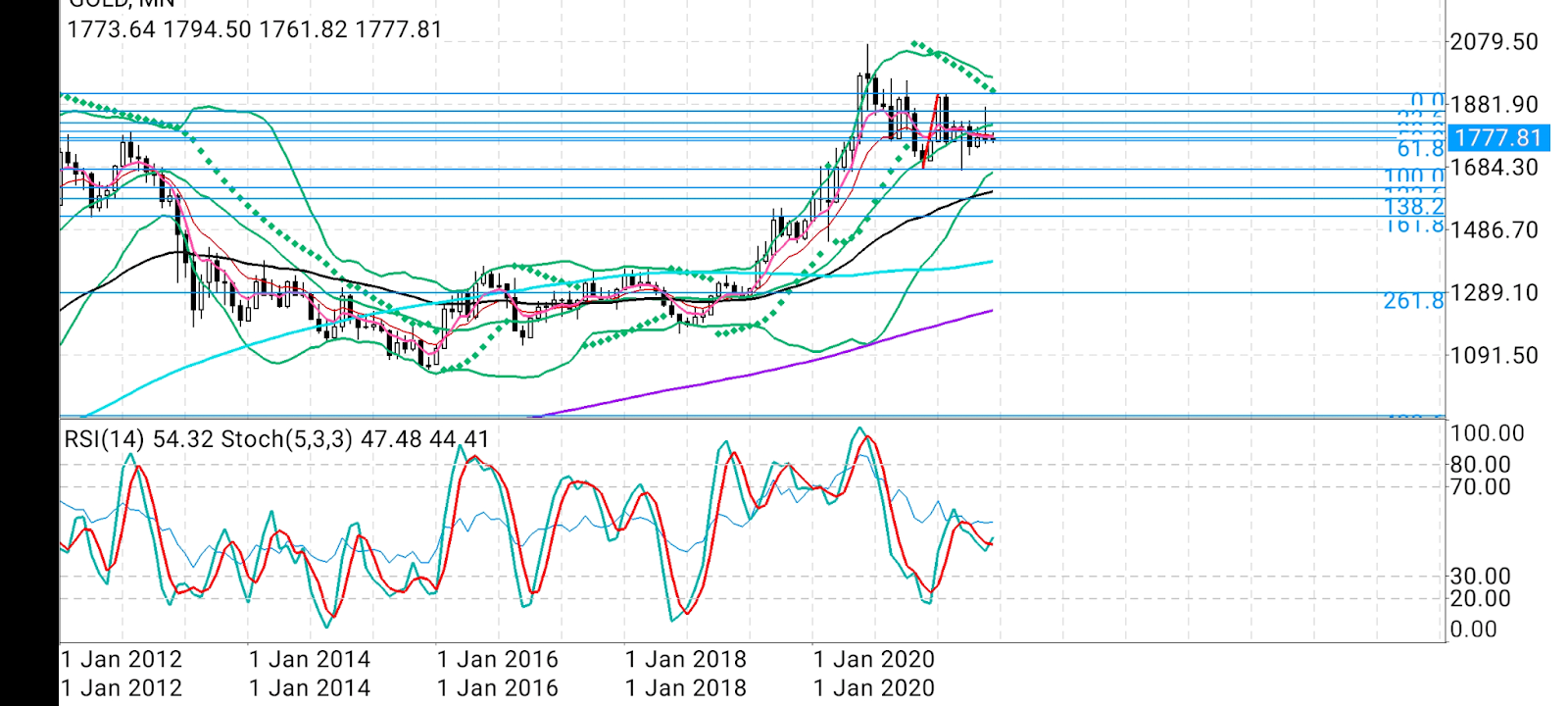

All charts courtesy of skcharting.com

“Persistent selling pressure continues to haunt gold for the fourth week in a row,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

Dixit said the upside for gold appears capped at the 50% Fibonacci retracement level of the latest high of $,1797. Adding:

“The stochastic RSI has taken negative overlap in the daily and weekly charts but the monthly chart stochastic has made positive overlap hinting at last ditch recovery to retest middle Bollinger Band of $1,818 and 38.2% fibonacci level $1,825.”

Whether gold scales above the $1,800 boundary and reclaims the $1,825-$1,860 or plunges to $1,720 broadly depends on the trend key levels of $1,797 and $1,761, said gold blogger Dhwani Mehta said in a post on FX Street.

“Gold is back in the red, looking to test the critical $1,760 support area, with all eyes on the US inflation numbers,” said Mehta.

“Only a daily closing above the key $1,792 confluence will open doors for further recovery, with the next immediate hurdle seen at 50-DMA, now at $1,796. The bulls will then target the $1,800 figure.”

Mehta said on the flip side, immediate support for COMEX gold was seen at the previous day’s low of $1,773. The Nov. 3 low at $1,766 could then be on buyers’ radars, she said.

Gold bulls remain hopeful while the horizontal trendline support pegged at $1,760, she noted.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.