- The GBP/USD pair has surged above 1.32, reaching its highest level since March 2022.

- Key macro readings this week will influence future Fed rate cut expectations and impact the pair.

- US dollar weakness, BoE's relatively hawkish stance could fuel more gains for the GBP/USD pair.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

After Jerome Powell's dovish boost at Jackson Hole last Friday, the US dollar weakened further. This decline is evident in the GBP/USD currency pair, which recently climbed above the 1.32 mark, reaching its highest level since March 2022.

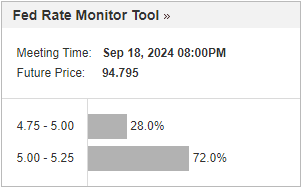

Currently, the market anticipates a 25 basis point rate cut, though a 50 basis point cut remains a possibility with a less than 30% chance.

Looking ahead, investors expect the Fed to implement a total of 100 basis points in rate cuts by year-end, potentially reaching 200 basis points next year if macroeconomic data align with the Fed’s expectations.

Upcoming Macro Readings to Influence the Scale of Fed Rate Cuts

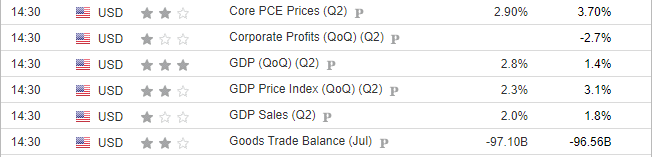

The upcoming days will be crucial as the Fed approaches its September meeting. On Thursday, we’ll see GDP growth data, which has gained importance following the market’s reaction in early August.

The consensus forecast expects an annualized growth rate of 2.8% quarter-over-quarter. A negative surprise could push the Fed toward a 50 basis point rate cut.

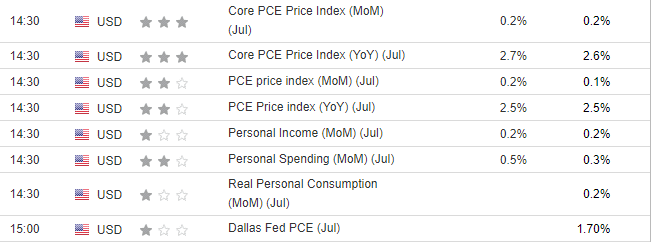

Later in the week, the Fed’s preferred PCE inflation measure will be released on Friday, with forecasts indicating a slight rise to 2.7% year-over-year.

However, upcoming labor market data ahead of the September meeting remains a key focus. Neutral readings above expectations could become critical in shaping monetary policy.

On the Other Side of the Pond, Bank of England Maintains 'Wait and Watch' Approach

At the Jackson Hole conference, Bank of England Governor Andrew Bailey also spoke on the UK’s monetary policy. He noted that inflation is falling faster than anticipated, which raised hopes for quicker rate cuts among borrowers.

Yet, Bailey tempered this dovish outlook by emphasizing the need for caution. He stressed that restrictive policies would continue until inflation trends toward the target in the medium term.

This stance presents a more hawkish position compared to the Fed, likely maintaining upward pressure on the GBP/USD pair.

GBP/USD Technical View: What's Next After New Highs Since 2022?

The GBP/USD currency pair, buoyed by a weakening US dollar and further supported by Friday’s speech from the Fed Chairman, is experiencing strong upward momentum.

The pair has recently climbed above the 1.32 mark, reaching its highest levels since March 2022.

The primary scenario suggests continued upward movement, though shallow corrections may occur within the 1.3140 to 1.3040 range. A move below this level could lead to a test of the upward trend line.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.