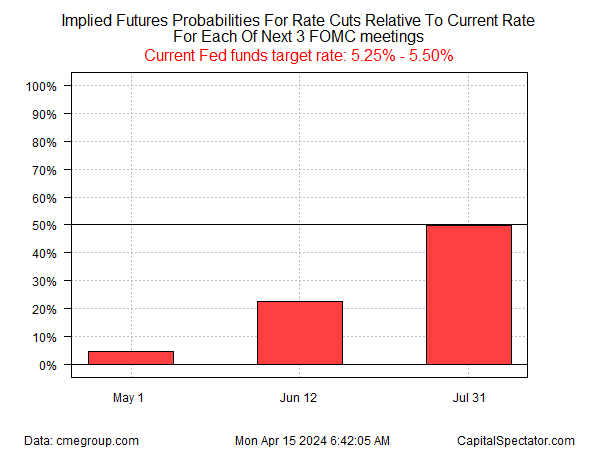

In the wake of last week’s hotter-than-expected consumer inflation data for March, the implied forecast via Fed funds futures indicates that interest-rate cuts are unlikely in the months ahead.

Using early-Monday-morning prices as a guide, the implied probability is heavily skewed toward no rate cuts for the next two FOMC meetings in May and June. For the September policy meeting the current forecast is too close to call and is a coin toss in terms of guesstimating.

The current outlook marks a conspicuous change from just a week ago (Mar. 8), when futures were pricing in a moderate probability of a cut by September.

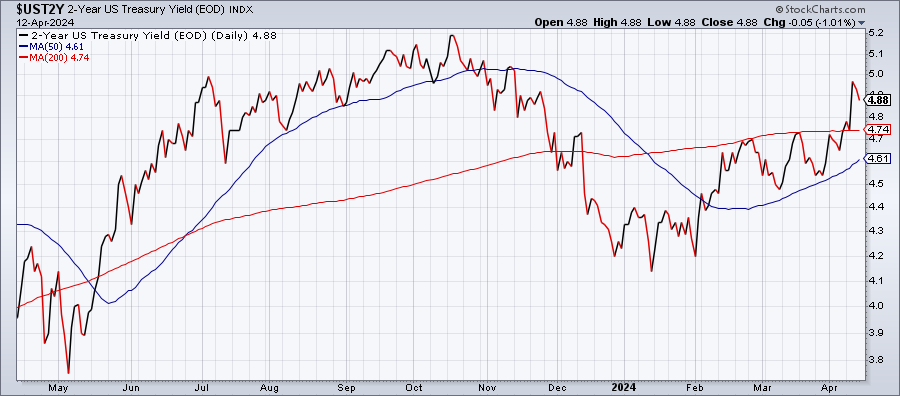

The policy-sensitive US 2-year Treasury yield has also downgraded prospects for a near-term rate cut. This key yield for evaluating the policy outlook jumped sharply last week, closing at 4.88% on Friday (Apr. 12), close to a five-month high.

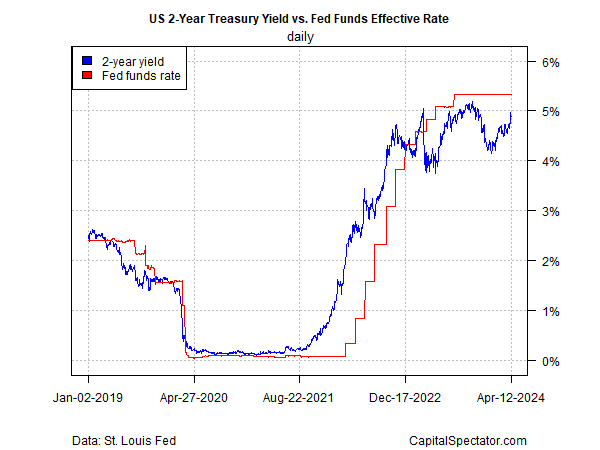

Traders are closely watching the spread between the 2-year yield and effective Fed funds rate for insight into how the outlook for policy evolves. Notably, the gap between these rates has recently narrowed significantly after the 2-year yield rebounded – a sign that the market is downgrading the odds for a near-term rate cut.

Two key questions hang over the outlook for rate-cuts. First, is the hawkish reaction to last week’s consumer inflation data for April excessive?

Meanwhile, how does the Iranian missile attack on Israel alter the calculus?

If the attack marks the start of a wider Middle East war, will it trigger a run for safety in global markets that lifts demand for Treasuries (and reduce yields), if only temporarily?

For the moment, the world is closely monitoring how and when Israel will react. “Israel can’t allow such a large attack over Israel without some kind of response, be it small or large,” an Israeli official in the prime minister’s office tells NBC News. “It’s up to the war Cabinet to decide now.”