With the Federal Reserve expected to raise interest rates for the third time this year, the U.S. dollar is hovering near multi-year and, in the case of USD/JPY, multi-decade highs. The greenback retreated slightly on the eve of FOMC, but don’t be mistaken, the Federal Reserve will be very hawkish on Wednesday. A half-point increase has been completely discounted and, in the last 24 hours, expectations for a 75bp hike soared to 96%, according to the CME’s Fed Watch tool.

Is Inflation Alarming Enough To Risk Recession?

A 75bp hike would be a technically and psychologically big move – the largest one-time hike since 1994. How the U.S. dollar reacts will depend entirely on whether the central bank opts for a 50bp or 75bp move. For the Fed, the question is whether inflation conditions are alarming enough for a drastic move that would inevitably crush the equity markets and heighten the risk of recession next year.

The short answer is yes.

Consumer prices hit a 40-year high in May, and the pain will continue as producer prices rise 10.8% year over year. Short- and long-term inflation expectations continued to climb, according to the June University of Michigan consumer sentiment index. Both the Federal Reserve and U.S. President Joe Biden have made fighting inflation a top priority. To put this into perspective, according to Moody’s Analytics, the typical U.S. household is spending about $460 more each month on the same basket of goods and services compared with last year. With oil prices hitting a three-month high today, there are no signs of price pressures letting up. The Fed could get away with raising rates by 75bp tomorrow because the labor market remains strong with the unemployment rate hovering near its lowest rate since the 1960s.

The problem is that rising prices and rising interest rates means a rising risk of recession. According to a Financial Times poll taken last week (before expectations for 75bp rate hike surged) 70% of leading economists expect the U.S. economy to fall into recession in 2023. Their concern is that the speed and velocity of the Federal Reserve’s rate hikes would lead to a deeper contraction in spending and growth. Retail sales are due for release tomorrow, and a soft release would be a daunting reminder of the risks ahead. The recent drop in the personal savings rate to its lowest level since 2008 tells us that Americans are already dipping into their savings to cope with rising prices. Unfortunately, according to 40% of the economists surveyed, 2.8% rates this year (which would be 50bp hikes in June, July and September) would not be enough to bring prices down. Traders are getting ahead of the game by pricing in 4% rates by the middle of next year.

How To Trade FOMC

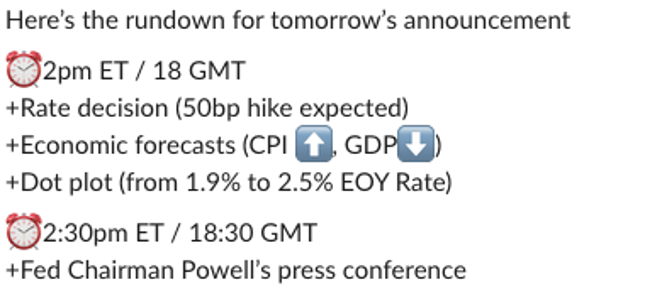

Aside from the Federal Reserve’s decision on interest rates, economic projections and their dot plot will be released tomorrow. We are looking for an increase in their CPI forecast along with a decrease in their GDP projections. Minimally, the dot plot should show their Federal funds rate projection rising from 1.9% in 2022 to at least 2.6%. The 2023 forecast should rise from 2.8% to at least 3.5%.

For Wednesday’s FOMC announcement, there are two catalysts for big moves in currencies, equities and Treasuries. The first being the 2 p.m. rate decision, which will be accompanied by the economic forecasts and dot plot. The dot plot will provide some guidance on future policy path, but the extent of the Federal Reserve’s hawkishness may not truly be known until Fed Chairman Jerome Powell delivers his press conference 30 minutes later.

When it comes to trading FOMC, there is usually a knee-jerk reaction to the announcement, and this month the reaction will be significant. Then there is usually a retracement followed by consolidation about 10 to 15 minutes after the initial move before a real more durable move, about 15 minutes after Powell delivers his prepared comments. For the U.S. dollar and USD/JPY in particular, 150 is a far target but an achievable one if the Fed raises by 75bp and suggests 50bp of tightening at the next two to three meetings. However, if it only raise rates by 50bp instead of 75bp, even if it intends to continue tightening consistently over the next few months, the U.S. dollar should sell off in disappointment, with the better trade being long EUR/USD than short USD/JPY. However, with a clear aggressive path of tightening still ahead, the U.S. dollar’s pullback will be short-lived.