This article was written exclusively for Investing.com

We’ve all seen a lot of things change over the last two-and-a-half years since the first time we heard about COVID-19. Some changes such as restrictions on going out in public, stimulus checks and the stock market’s crash then boom, seem to have come and gone. But other changes like the widespread use of online meetings and shifts to remote work may have much more lasting impacts. It seems two big changes that will stay with us are remote work and the growth in freelancing and “gig work” online.

With a strong competitive position, growing adoption from both buyers and sellers, and stock prices that took a beating in the recent sell-off, Fiverr International (NYSE:FVRR) and Upwork (NASDAQ:UPWK) could make great investments today.

The first thing to consider when thinking about Fiverr and Upwork is the value of being part of a marketplace. If you’re an experienced professional with an existing client base and a way to meet new clients, you can probably just market your services and start billing clients directly. But if you’re either just getting started in your field or you want to reach a wider audience, you need some way to market yourself. To do that, you can buy ads, try to meet people on your own, create content that will attract attention or pursue any number of other strategies. The business person should see these as 'costs' in terms of either dollars (in the case of ads), time (in the case of meeting people) or effort (for creating content). So to that end, a freelancer should be willing to give up something in order to meet new clients. That’s where Fiverr and Upwork come in.

Much in the same way that eBay (NASDAQ:EBAY) became valuable for people reselling goods, by bringing the most buyers and the most sellers together in one place, Fiverr and Upwork bring freelancers into contact with far more potential clients or customers than these people could have possibly reached on their own.

Being this preferred marketplace for buyers and sellers creates a 'network effect' which becomes a growing competitive advantage over time. More professionals come to these websites because they’re more likely to meet good clients, and more clients come because the odds of meeting a great professional are higher and higher.

If you go to Fiverr.com and look up something you’re interested in, and then go to Upwork.com to check out a professional interest you’ll see service providers with a wide variety of levels of skills and experience offering something at many different price points.

The professional quotes you a price (by the job, by the hour, or some other agreed metric), and the client pays that price plus applicable taxes. At that point, the websites take a fee from the provider, called a 'take rate.' Up to now, I’ve described the two companies together. I think the different take rates charged by Upwork and Fiverr make it clear how the two are different.

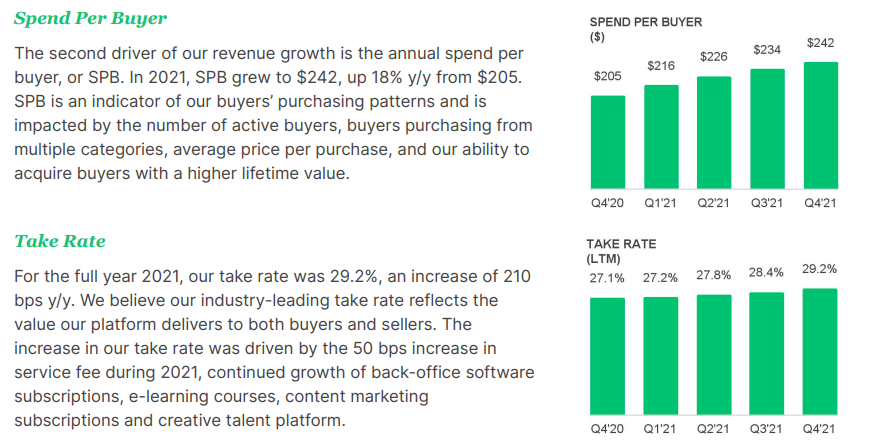

As you can see from Fiverr’s recent investor presentation, the average customer spent over $200 and the company’s take rate is in the high 20s:

Source: Fiverr

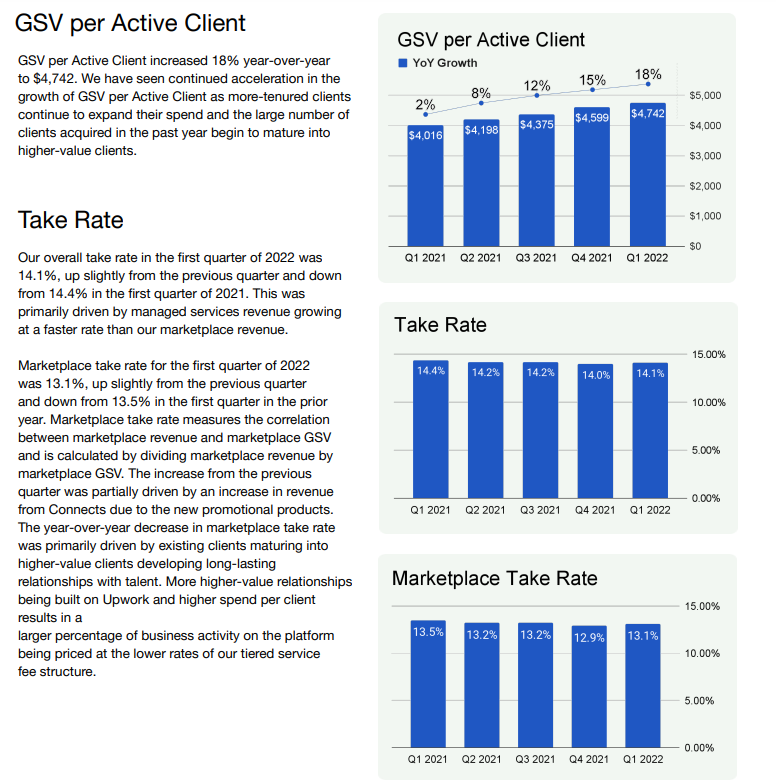

Upwork’s investor letter on the other hand takes a much smaller cut (take rate in the mid-teens) of much larger transactions (gross services value or GSV of well over $4,000):

Source: Upwork

The takeaway should be that these two companies are not competitors but rather they have different kinds of markets: Upwork is geared towards professional services, and Fiverr customers may tend to prefer personal services or things related to amusements, hobbies and interests (but their offerings for professional business are growing).

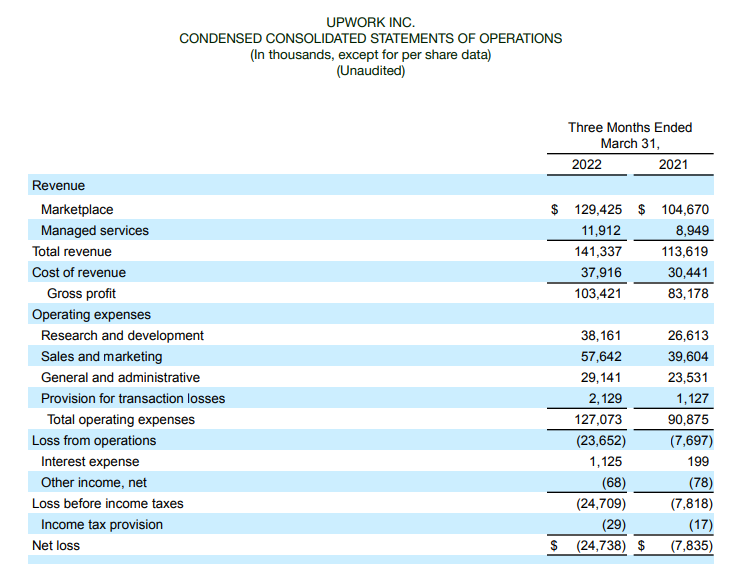

Neither Upwork nor Fiverr are profitable today on a net income basis but it is worth looking 'under the hood' to see how these companies are thinking strategically. Take a look at the income statement from Upwork’s most recent quarterly shareholder letter:

Total revenue in the most recent quarter was $141 million, gross profit was $103 million, but operating expenses were $127 million. Compared to one year ago, revenues were up by $28 million and gross profits were up by $20 million, but operating expenses were up by almost $37 million. Normally seeing operating expenses increase faster than revenue would be concerning, but in the case of a business with real growth and a long runway, it looks like a strategic decision on the part of the company.

That is to say that Upwork probably could have spent a lot less on R&D and Sales and Marketing, but they wouldn’t grow as much. At least some portion of new customers acquired last quarter may continue spending money with Upwork for years to come, so it makes sense to be willing to overspend income today in order to earn more tomorrow.

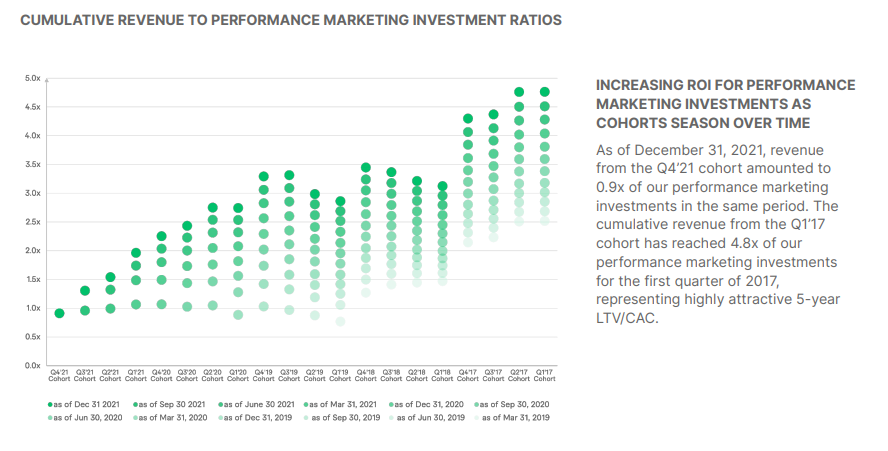

Fiverr has similar financial results and a similar strategic outlook to Upwork with respect to marketing and R&D spending. Fiverr explains how valuable this marketing spending can be by publishing one of my favorite charts in any investor presentation:

Source: Fiverr

In this chart, the company shows that its customers come to spend more and more money over time, so Fiverr continues earning a return on the money spent marketing to them years before. All those 'losses' from marketing in earlier years turned into really valuable relationships after all!

All that is to say that it’s a mistake to value Fiverr or Upwork based on their recent profitability. Instead, examine how the businesses can grow over time and what they might be worth when they don’t have to spend as high a proportion of their sales on R&D and marketing.

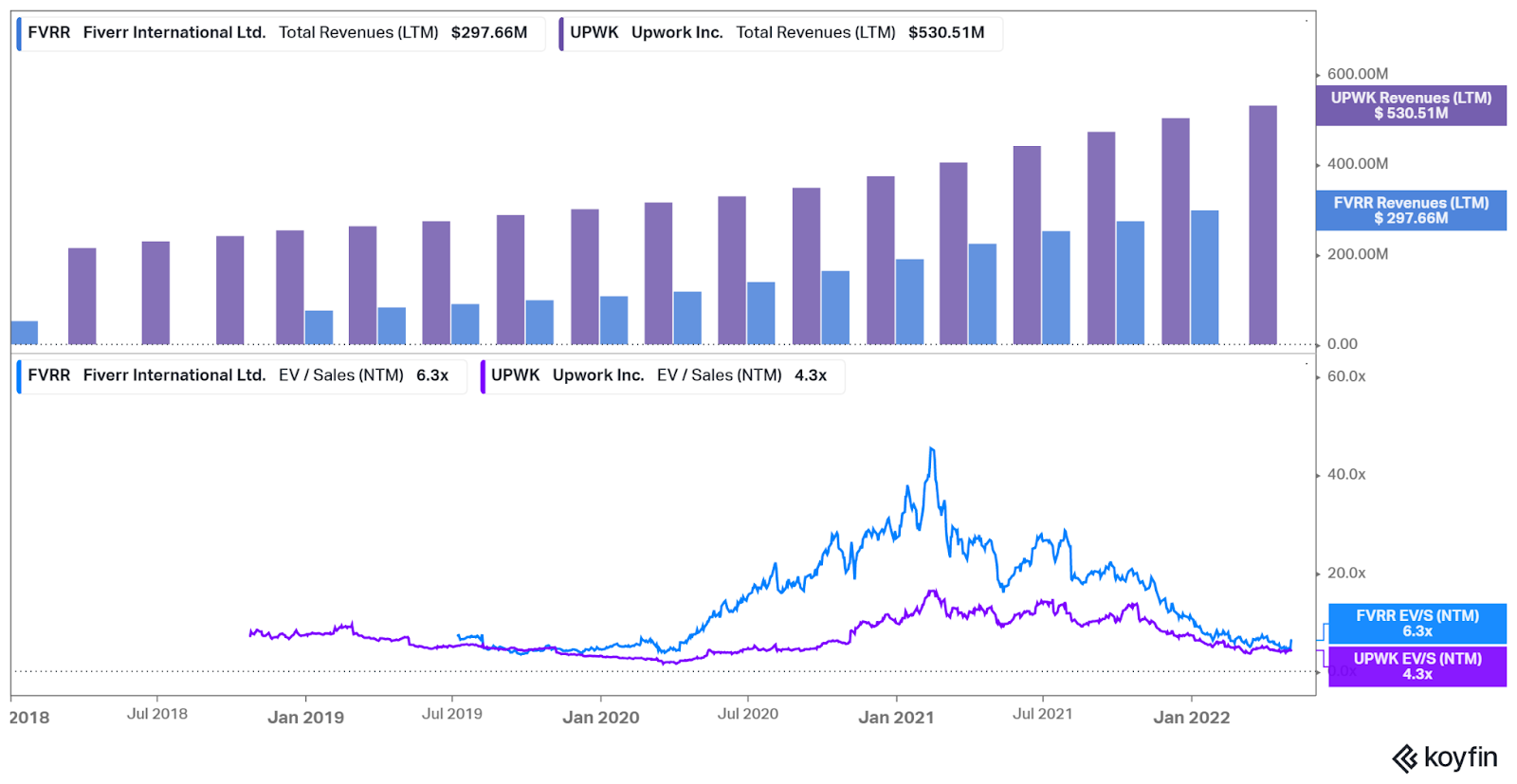

Both companies have growing revenues but their stock prices are trading at lower valuations (I’ve used Enterprise Value/Sales) than almost any other time: I’m happy buying shares in both companies (I already own Fiverr, and I’ll consider buying Upwork this week) at these low multiples of sales because even if nothing else happens to the stock price, but sales grow, they’ll 'grow into these valuations' quickly.

I’m happy buying shares in both companies (I already own Fiverr, and I’ll consider buying Upwork this week) at these low multiples of sales because even if nothing else happens to the stock price, but sales grow, they’ll 'grow into these valuations' quickly.

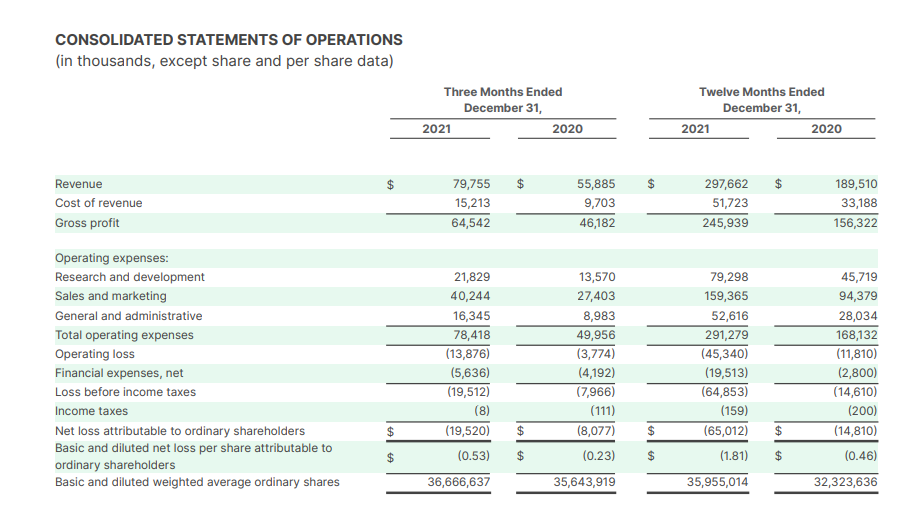

Fiverr’s income statement up to the fourth quarter:

Source: Fiverr

It seems clear to me that Fiverr and Upwork will see their old customers buy more over time and continue acquiring new customers. So I anticipate some time in the medium-term future (i.e., 1-3 years from now) in which gross profits exceed operating expenses and the company earns substantial and growing net profits.

These stocks are worth buying at today’s prices, and I wouldn’t consider selling them unless they either stopped growing or if the share prices appreciated 50% or more in a short period of time.

The biggest risk to my investment thesis is probably competition from an established player in a related field such as Microsoft's LinkedIn (NASDAQ:MSFT) or Facebook Marketplace (NASDAQ:FB), or perhaps a payments company like PayPal (NASDAQ:PYPL) or a business services provider such as Wix (NASDAQ:WIX).

However, dual trends of moving to remote work as well as a large and increasing number of people adding a 'side hustle' or making freelancing and gig work into their full-time endeavor, mean growth is not likely to subside anytime soon.